Beruflich Dokumente

Kultur Dokumente

Retail Banking: Harsh Dave (09119) Randhir Padheriya (09117) Mayank Vachhani (09121) Jitandra Virpura (0955)

Hochgeladen von

Jitendrasinh Virpura0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

31 Ansichten39 SeitenRetail Lending SchemesFeatures Offers high yield, Quick return Low incidents of NPAs Monitoring is easier Products Housing Finance Consumer Durable Finance Vehicle (2-wheeler and 4-wheeler) Finance Personal Loan Advance against future lease rentals Mortgage Loans Pension Loan etc.

Originalbeschreibung:

Originaltitel

ne&im

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenRetail Lending SchemesFeatures Offers high yield, Quick return Low incidents of NPAs Monitoring is easier Products Housing Finance Consumer Durable Finance Vehicle (2-wheeler and 4-wheeler) Finance Personal Loan Advance against future lease rentals Mortgage Loans Pension Loan etc.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

31 Ansichten39 SeitenRetail Banking: Harsh Dave (09119) Randhir Padheriya (09117) Mayank Vachhani (09121) Jitandra Virpura (0955)

Hochgeladen von

Jitendrasinh VirpuraRetail Lending SchemesFeatures Offers high yield, Quick return Low incidents of NPAs Monitoring is easier Products Housing Finance Consumer Durable Finance Vehicle (2-wheeler and 4-wheeler) Finance Personal Loan Advance against future lease rentals Mortgage Loans Pension Loan etc.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 39

Retail Banking

Harsh Dave (09119)

Randhir Padheriya (09117)

Mayank Vachhani(09121)

Jitandra Virpura (0955)

Retail Banking Channels

• Premises Banking/ Banking at Doorstep

• Automated Teller Machine

• Debit & Credit Cards

• Telephone Banking

• Internet Banking

• Mobile Banking

• Electronic Funds Transfer/ Electronic Clearing

System Debit

Retail Lending Schemes- Features

• Offers high yield, Quick return

• Low incidents of NPAs

• Monitoring is easier

• Products

▫ Housing Finance

▫ Consumer Durable Finance

▫ Vehicle (2-wheeler & 4- wheeler) Finance

▫ Personal Loan

▫ Advance against future lease rentals

▫ Mortgage Loans

▫ Pension Loan etc.

Retail Lending Schemes- Key

Terms

• Margin

▫ Contribution bought in by the borrower

▫ Differ according to type of finance & bank

• Interest

▫ De-Regulated by apex monetary authority

▫ Differs from bank to bank

Composition of Retail Lending

Housing Rs. 34654 Crores 50%

Consumer Durables Rs. 6904 Crores 10%

Loans to Individuals agt Rs. 1762 Crores 5%

Shares etc

Other priority sector/ Rs. 26089 Crores 35%

Personal Loans

TOTAL Rs. 69409 Crores 100%

Source: RBI’ report on Trend & Progress of Banks 2002-03

Liability Focused Segment

(Deposit Accounts)

Saving Fund Account/ Savings Bank

Account

• Opened by anyone properly introduced

▫ Individually

▫ Jointly

▫ Minors of 10 yrs & above

▫ Minor under legal guardianship

• Can not be opened in name of Business Concern-

▫ Proprietary

▫ Company

▫ Partnership or

▫ Association

Saving Fund Account/ Savings Bank

Account- Can’t be opened in Name of

• Government Departments

• Municipal Corporation

• Panchayat Samities

• State Housing Boards

• Industrial Development Authorities

• State Electricity Boards

Saving Fund Account/ Savings Bank

Account- Can’t be opened in Name of

• State Text Book Publishing Corp.

• Metropolitan Development Authority

• Housing Corporation/ Societies

• Any bank including Land Development Banks

• Industrial Development Authorities

• State Electricity Boards

• Water/ Sewerage & Drainage Boards

Saving Fund Account/ Savings Bank

Account- Can be opened in Name of

• Companies Licensed under Sec 25 of Companies

Act 1956, not having “Limited”

• Societies Registered under Societies Regulation

Act 1860

• Primary Co-operative credit society financed by

bank

• Any Govt. dept. in respect of grants released for

implementation of Schemes sponsored by

▫ Central Government

Saving Fund Account/ Savings Bank

Account- Can be opened in Name of

• Any trust whose income is exempt from payment of

Income Tax

• Institution permitted by RBI on application by Bank

• SF a/c in name of HUF, if not engaged in business

activity

• Development of children & women in rural areas

• Self Help Group

• Farmers Club

• Of State Govt dept. in respect of grants for

implementation of State Govt. plans

Minimum Balance/ Account Opening

Requirements

• Minimum Balance varies from bank to bank

▫ De-regulated by RBI

• Most banks do not insist on minimum balance

maintenance by

▫ Bank Staff

▫ Pensioners

▫ Students

▫ Salaried Accounts

Interest

• Calculated on Minimum Balance basis

▫ Interest will be calculated on the amount of Daily

Balance in the account

▫ Minimum Re 1/- per a/c to be paid in Interest

▫ Rate of interest is decided by the RBI

▫ Currently prevailing rate is 3.5% p.a. on Half

yearly basis

Withdrawal

• During half year not more than 50 withdrawals

are permitted

▫ By Cheque or otherwise

▫ However individual banks may allow more than

50 withdrawals

Transfer of Accounts

• May be transferred from one branch to another

of the same bank

▫ Generally Free of charge

▫ On written request of the depositor

Premature Closure of Account

• Account closed within a year

▫ Banks may levy certain charges, as per internal

guidelines

• No charges on closure on account of death of

account holder

Joint Accounts

• Account opened in Name of 2 or more persons

▫ All must sign the account opening form &

▫ Affix Photograph

• Joint accounts with either or survivor

▫ If any depositor is dead, the balance will get

transferred to the survivor

Minor Accounts

• Saving account in the name of minor of 10 yrs or

above

• May be opened in his/her own Name

▫ Post obtaining proof of age

▫ Cheque book may or may not be issued

• Minor below 10 years

▫ Account can be opened under guardianship

▫ Photograph of guardian should be affixed

• When minor attains majority

▫ Fresh account should be opened

Blind Customers’ Accounts

• May open Savings account jointly or singly

• Besides introduction a witness is required

• Number & details of multiple identification marks of

Blind person is noted

▫ In Account opening form &

▫ Specimen Signature Slip

• A stamp indicating the account holder is blind is

affixed on

▫ Account Opening Form

▫ Specimen Signature Slip

▫ Ledger Folio &

▫ Pass book

Withdrawal by the Illiterate

• For withdrawal

▫ Will personally call bank with passbook

▫ Thumb impression will be taken on the

withdrawal slip

In presence of passing official

▫ Before making payment Bank official will ensure

reference of illiterates

Photograph

Passbook

Identification mark

▫ Will also assertian the exact amount of withdrawal

Withdrawal by the Illiterate- Standing

Instructions

• Accepted for payments like

▫ Insurance Premium

▫ Taxes

▫ Rentals etc

• Intimation of compliance is sent to the customer

• If instruction not carried out for any reason

▫ Account holder is informed

• No charges levied, for transfer within the

accounts maintained in the same branch

Current Account

Current Accounts

• Is a running account

• Customers are free to make any number of

transactions

• Minimum Balance must be maintained in the

account

• Target group Business Segment

Current Accounts

• Opened by

▫ Individuals- Singly or jointly

▫ Partnership Firm

▫ Company

▫ Association

▫ Institution

▫ Trust

▫ Society etc.

• Illiterate/ Blind person can not open this account

• Minor in his/ her own name can not open the

account

Code of Conduct (KYC norms)

• Banks must attain the following declaration from

customers

▫ “That I/We/am/are not enjoying any credit facility

with any bank/ any other branch of your bank &

I/we undertake to inform you, in writing as soon

as credit facility is availed of by me/us from any

other bank/ any other branch of your bank”

• OR

▫ “That I/We/am/are enjoying any credit facility

with other banks(s)/ other branch of your bank as

per details given in the enclosed sheet”

Code of Conduct (KYC Norms)

• If account holder is enjoying credit facility from

any other bank

▫ Concerned bank should be duly informed

• Bank branches can not open bank accounts of

entities with credit facilities from banks without

▫ No-objection certificate from leading Banks

• Banks can open current account in case no reply

is received within a fortnight

Current Account

• Withdrawal

▫ No Restriction on number

▫ Below an amount cheques should not be drawn

On non compliance bank may impose penalty as per

internal norms

• Interest

▫ No interest paid

▫ Banks may levy certain charges for services

rendered

Current Account

• Penal Charges

▫ Minimum balance as per banks norms must be

maintained

On non-compliance charges may be slapped

Term Deposit

• Deposits made with bank for specific period

• Vary from min 7 days to max 10 years

▫ For more than 10 yrs in case of courts order

• Min in case of NRE 1 year

• Differential rates for term deposits above Rs. 15 Lacs

• Uniform rates for deposits below Rs. 15 Lacs

• On domestic deposits floating rate can be given on

an anchor rate

• Banks have to pay interest on Sundays/ Holidays/

non-business working days

Interest in Deposit of Decreased

Depositor

• In case of death before maturity

▫ Interest paid till maturity&

▫ From maturity till date of payment

Simple Interest from maturity to date of payment

• In case of death after maturity

▫ Interest paid at Saving rate applicable on Maturity

date

From Maturity till payment date of payment

Recurring Deposit

• Can be opened by

▫ Individual

▫ Minor of 10 years or above in own name or

guardianship

▫ HUF

▫ Firm/ Club/ Association

▫ Educational Institution

▫ Municipality/ Panchayat/ Society/ Trust

Recurring Deposit

• It can be opened for an installment of Rs. 100 &

more

▫ For a period ranging from 6months to 120 months in

multiples of 3 months

• Interest is deregulated by RBI

• Installments are deposited by the holder on or

before the last working day of month

• If no stipulation of payment is given than

▫ On or before last working day of the month

• In case of non payment on time bank levies penalty

Recurring Deposit

• Deposit shall mature 30 days after payment of

last installment or

▫ On due date, whichever is late

• Banks also provide loans against reccuring

deposit

RBI Model Policy on Bank Deposits

• RBI is empowered to issue directives on

▫ Interest rate on deposits

▫ Other aspects regarding conduct of deposit

accounts

• With de-regulation banks are now allowed to

formulate deposit products but

▫ Within the broad guidelines issued by RBI

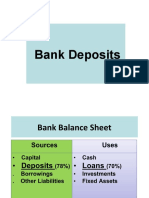

Types of Deposit Accounts

• Demand Deposits

▫ Deposit withdraw-able on demand

• Savings Deposits

▫ Restrictions on number & amount of withdrawal

• Term Deposit

▫ Deposit made for specific period

▫ Withdraw-able only after expiry of period

▫ It includes

Recurring/ Double Benefit Deposits

Short Deposits/ Fixed Deposits

Monthly Income Certificate/ Quarterly Income Certificate

Types of Deposit Accounts

• Notice Deposit

▫ Term deposit for specified period

▫ Withdraw-able on giving at least 1 days notice

• Current Account

▫ Withdrawal allowed any number of time

Account Opening & Operation of

Deposit Account

• Deposit account can be opened by individual in own

name or jointly

• Operation of Joint Account

▫ Can be operated by 1 individual or more jointly

▫ Operating mandate can be changed with consent of all

the holders

• Standing instructions can be given regarding closure

or further renewal of deposit Term Deposit

▫ In case no instruction is there

▫ Bank will seek instructions by sending intimation

15days prior to maturity date

Interest Payable on Term Deposit

Decreased Accounts

• Death before maturity

▫ Amount claimed after maturity

Bank has to pay interest at contracted rate till

maturity date

From date of maturity till payment date

Bank will pay Simple Interest

• Death after date of maturity

▫ Bank will pay saving deposit interest rate from

date of maturity to date of payment

Das könnte Ihnen auch gefallen

- All You Need to Know About Payday LoansVon EverandAll You Need to Know About Payday LoansBewertung: 5 von 5 Sternen5/5 (1)

- PPB Module 3Dokument42 SeitenPPB Module 3RAJNoch keine Bewertungen

- UNITIIDokument66 SeitenUNITIIlokesh palNoch keine Bewertungen

- Chapter 3 Deposit MobilizationDokument28 SeitenChapter 3 Deposit MobilizationdhitalkhushiNoch keine Bewertungen

- Opening and Operating Bank AccountsDokument25 SeitenOpening and Operating Bank Accountssagarg94gmailcom100% (1)

- Banking and Cash SummaryDokument5 SeitenBanking and Cash SummaryLiam Ting WeiNoch keine Bewertungen

- 3-Banker Customer RelationshipDokument32 Seiten3-Banker Customer RelationshipMonika MalikNoch keine Bewertungen

- Retail BankingDokument71 SeitenRetail Bankingswati_rathourNoch keine Bewertungen

- Types of Accounts in A BankDokument25 SeitenTypes of Accounts in A Bankje-ann montejoNoch keine Bewertungen

- Retail Banking: Vivek Saxena Asst. Prof. LSB, LPU Reference: Introduction To Banking by Vijayaragvan IyengarDokument16 SeitenRetail Banking: Vivek Saxena Asst. Prof. LSB, LPU Reference: Introduction To Banking by Vijayaragvan IyengarninalakhotraNoch keine Bewertungen

- Saving Account Salary Account Current AccountDokument32 SeitenSaving Account Salary Account Current AccountSamdarshi KumarNoch keine Bewertungen

- 1627995259-Lecture - 3 TYPES OF ACCOUNTS & FINANCIAL INCLUSIONDokument4 Seiten1627995259-Lecture - 3 TYPES OF ACCOUNTS & FINANCIAL INCLUSIONKhushraj SinghNoch keine Bewertungen

- Types of DepOSIT 15-18-21-22Dokument94 SeitenTypes of DepOSIT 15-18-21-22Saurab JainNoch keine Bewertungen

- Current AccountDokument21 SeitenCurrent AccountSan Awale33% (3)

- Introduction To Banking: Mishu Tripathi Assistant Professor-FinanceDokument93 SeitenIntroduction To Banking: Mishu Tripathi Assistant Professor-FinanceSindru BarbiNoch keine Bewertungen

- Kisan Vikas PatraDokument16 SeitenKisan Vikas PatraAnonymous aAMqLLNoch keine Bewertungen

- Deposits 13514337657761 Phpapp01 121028091831 Phpapp01Dokument18 SeitenDeposits 13514337657761 Phpapp01 121028091831 Phpapp01Jithin Clashes ZcsNoch keine Bewertungen

- Types of Customers and Nature of AccountsDokument18 SeitenTypes of Customers and Nature of Accountssagarg94gmailcomNoch keine Bewertungen

- Opening and Operation of Accounts-SBDokument41 SeitenOpening and Operation of Accounts-SBnurul000Noch keine Bewertungen

- BIM - Unit-III: Unit-3 Management of Deposit and Advances. Opening of ADokument22 SeitenBIM - Unit-III: Unit-3 Management of Deposit and Advances. Opening of AMehak ShineNoch keine Bewertungen

- CP Associates Bullet PointsDokument13 SeitenCP Associates Bullet PointsvikashvacNoch keine Bewertungen

- Types of Accounts in A Bank: BY Abdul Qadir BhamaniDokument23 SeitenTypes of Accounts in A Bank: BY Abdul Qadir Bhamaniafzaal khanNoch keine Bewertungen

- Presentation of Commercial Bank Operations On The Chapter "Deposit MobilizationDokument46 SeitenPresentation of Commercial Bank Operations On The Chapter "Deposit MobilizationSaurav PantaNoch keine Bewertungen

- RB Chapter 3 - Savings BankDokument10 SeitenRB Chapter 3 - Savings BankHarish YadavNoch keine Bewertungen

- Deposit SchemesDokument7 SeitenDeposit SchemesTarun GargNoch keine Bewertungen

- Financial InclusionDokument425 SeitenFinancial InclusionNishad ThakurNoch keine Bewertungen

- Banking - Special Type Sof CustomersDokument29 SeitenBanking - Special Type Sof CustomersRevathi VadakkedamNoch keine Bewertungen

- MCB Bank ReportDokument30 SeitenMCB Bank ReportdadagfazalNoch keine Bewertungen

- Banking Law and ProceduresDokument114 SeitenBanking Law and ProceduresmonaeNoch keine Bewertungen

- ICICI Personal LoanDokument11 SeitenICICI Personal LoanAjit SamalNoch keine Bewertungen

- SAPMDokument45 SeitenSAPMswamyNoch keine Bewertungen

- Legal Aspects: Canara Bank Officers' AssociationDokument20 SeitenLegal Aspects: Canara Bank Officers' Associationmail2me.preet1801Noch keine Bewertungen

- BankingDokument32 SeitenBankingapi-173610472Noch keine Bewertungen

- Procedure of Account OpeningDokument11 SeitenProcedure of Account OpeningSky WalkerNoch keine Bewertungen

- 5 6226516373657356654Dokument230 Seiten5 6226516373657356654Sangeeta HatwalNoch keine Bewertungen

- Axis Bank Product: Term DepositDokument35 SeitenAxis Bank Product: Term DepositSaroj Kumar PandaNoch keine Bewertungen

- Type of DepositDokument12 SeitenType of DepositgaganngulatiiNoch keine Bewertungen

- Entrepreneurship Loan and SchemesDokument10 SeitenEntrepreneurship Loan and SchemesSriniketh SridharNoch keine Bewertungen

- FM Current Account 1Dokument9 SeitenFM Current Account 1varinder_saroaNoch keine Bewertungen

- General InfoDokument15 SeitenGeneral Infodhuni143Noch keine Bewertungen

- Features of Fixed DepositsDokument4 SeitenFeatures of Fixed DepositsBeula Heidy19 071Noch keine Bewertungen

- Customer Satisfaction On Housing Loan in SBI BankDokument23 SeitenCustomer Satisfaction On Housing Loan in SBI BankDebjyoti Rakshit100% (2)

- Functions of Banking Institution: by Resham Raj RegmiDokument49 SeitenFunctions of Banking Institution: by Resham Raj Regmibibek bNoch keine Bewertungen

- English For Banking and FinanceDokument28 SeitenEnglish For Banking and FinancefathiyarizkiNoch keine Bewertungen

- Non-Marketable Financial Assets: Bank DepositsDokument8 SeitenNon-Marketable Financial Assets: Bank DepositsDhruv MishraNoch keine Bewertungen

- Steps 4 Opening A.CDokument20 SeitenSteps 4 Opening A.CBipinNoch keine Bewertungen

- Opening & Operation of Accounts IBPDokument136 SeitenOpening & Operation of Accounts IBPasifafaiz100% (4)

- DepositsDokument37 SeitenDepositsHarshita SahiNoch keine Bewertungen

- Banking: Presented by Mukundan SDokument31 SeitenBanking: Presented by Mukundan SRajalingam100% (1)

- Provisional Tax Saving Fixed Deposit Confirmation AdviceDokument3 SeitenProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshNoch keine Bewertungen

- Calculator: Terms & Conditions - Insta Jumbo LoanDokument3 SeitenCalculator: Terms & Conditions - Insta Jumbo LoanANUDEEP CommunityNoch keine Bewertungen

- Session 17-18 Consumer and Wholesale Banking (Autosaved)Dokument61 SeitenSession 17-18 Consumer and Wholesale Banking (Autosaved)Haritika ChhatwalNoch keine Bewertungen

- Types of Accounts in A BankDokument25 SeitenTypes of Accounts in A BankchthakorNoch keine Bewertungen

- Procedures Undertaken Before Granting Bank Finance & Banking ServicesDokument24 SeitenProcedures Undertaken Before Granting Bank Finance & Banking ServicesNikhil RanjanNoch keine Bewertungen

- Idbi Bank: Casa Study Presented byDokument21 SeitenIdbi Bank: Casa Study Presented byIndal KhannaNoch keine Bewertungen

- Type of DepositDokument12 SeitenType of DepositgaganngulatiiNoch keine Bewertungen

- Presentation Of: Allied Bank LimitedDokument21 SeitenPresentation Of: Allied Bank LimitedRiaz MirzaNoch keine Bewertungen

- Types of Accounts in MCB: Internship Report On Muslim Commercial Bank Page2Dokument23 SeitenTypes of Accounts in MCB: Internship Report On Muslim Commercial Bank Page2nishazaidiNoch keine Bewertungen

- PulpectomyDokument3 SeitenPulpectomyWafa Nabilah Kamal100% (1)

- B1 Pendent SprinklerDokument2 SeitenB1 Pendent SprinklerDave BrownNoch keine Bewertungen

- A.8. Dweck (2007) - The Secret To Raising Smart KidsDokument8 SeitenA.8. Dweck (2007) - The Secret To Raising Smart KidsPina AgustinNoch keine Bewertungen

- Astm B633Dokument5 SeitenAstm B633nisha_khan100% (1)

- Hamraki Rag April 2010 IssueDokument20 SeitenHamraki Rag April 2010 IssueHamraki RagNoch keine Bewertungen

- Biology Q PDFDokument9 SeitenBiology Q PDFsumon chowdhuryNoch keine Bewertungen

- 4EVC800802-LFEN DCwallbox 5 19Dokument2 Seiten4EVC800802-LFEN DCwallbox 5 19michael esoNoch keine Bewertungen

- Complaint: Employment Sexual Harassment Discrimination Against Omnicom & DDB NYDokument38 SeitenComplaint: Employment Sexual Harassment Discrimination Against Omnicom & DDB NYscl1116953Noch keine Bewertungen

- G.R. No. 178741Dokument1 SeiteG.R. No. 178741Jefferson BagadiongNoch keine Bewertungen

- NTJN, Full Conference Program - FINALDokument60 SeitenNTJN, Full Conference Program - FINALtjprogramsNoch keine Bewertungen

- Atlas of Feline Anatomy For VeterinariansDokument275 SeitenAtlas of Feline Anatomy For VeterinariansДибензол Ксазепин100% (4)

- Marketing Study of Mango JuiceDokument18 SeitenMarketing Study of Mango JuiceVijay ArapathNoch keine Bewertungen

- People of The Philippines V. Crispin Payopay GR No. 141140 2003/07/2001 FactsDokument5 SeitenPeople of The Philippines V. Crispin Payopay GR No. 141140 2003/07/2001 FactsAb CastilNoch keine Bewertungen

- NURTURE Module-V 11 1 en PDFDokument4 SeitenNURTURE Module-V 11 1 en PDFJorge SingNoch keine Bewertungen

- Careerride Com Electrical Engineering Interview Questions AsDokument21 SeitenCareerride Com Electrical Engineering Interview Questions AsAbhayRajSinghNoch keine Bewertungen

- Unknown Facts About Physicians Email List - AverickMediaDokument13 SeitenUnknown Facts About Physicians Email List - AverickMediaJames AndersonNoch keine Bewertungen

- Rigging: GuideDokument244 SeitenRigging: Guideyusry72100% (11)

- Cis MSCMDokument15 SeitenCis MSCMOliver DimailigNoch keine Bewertungen

- 10.1.polendo (Additional Patent)Dokument11 Seiten10.1.polendo (Additional Patent)Rima AmaliaNoch keine Bewertungen

- 2015 12 17 - Parenting in America - FINALDokument105 Seiten2015 12 17 - Parenting in America - FINALKeaneNoch keine Bewertungen

- 3 Ways To Take Isabgol - WikiHowDokument6 Seiten3 Ways To Take Isabgol - WikiHownasirNoch keine Bewertungen

- Ra Concrete Chipping 7514Dokument5 SeitenRa Concrete Chipping 7514Charles DoriaNoch keine Bewertungen

- Tractor Price and Speci Cations: Tractors in IndiaDokument4 SeitenTractor Price and Speci Cations: Tractors in Indiatrupti kadamNoch keine Bewertungen

- Glycolysis Krebscycle Practice Questions SCDokument2 SeitenGlycolysis Krebscycle Practice Questions SCapi-323720899Noch keine Bewertungen

- Impression TakingDokument12 SeitenImpression TakingMaha SelawiNoch keine Bewertungen

- Standerdised Tools of EducationDokument25 SeitenStanderdised Tools of Educationeskays30100% (11)

- Form 28 Attendence RegisterDokument1 SeiteForm 28 Attendence RegisterSanjeet SinghNoch keine Bewertungen

- Pressure Classes: Ductile Iron PipeDokument4 SeitenPressure Classes: Ductile Iron PipesmithNoch keine Bewertungen

- BS 65-1981Dokument27 SeitenBS 65-1981jasonNoch keine Bewertungen

- UgpeDokument3 SeitenUgpeOlety Subrahmanya SastryNoch keine Bewertungen