Beruflich Dokumente

Kultur Dokumente

Bank Final Flex

Hochgeladen von

Archana VishwakarmaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bank Final Flex

Hochgeladen von

Archana VishwakarmaCopyright:

Verfügbare Formate

INTER-COLLEGIATE AVISHKAR RESEARCH CONVENTION 2018-19

Code No:

Category : 02 LEVEL : UG

INTRODUCTION Abstract

Banking frauds constitute conscious Banks are the engine that drive operations in the financial sector. With the

misrepresentation obtaining possession money rapidly growth of banking industry, frauds in banks are also increasing very fast,

or other property which is owned or held by a and fraudsters have started using innovative ideas. Internal audit professionals

financial institution or depositors by using those

should pay an integral role in there organizations fraud fighting efforts. This

means which are against the law.

Bank fraud keeps the management of banks research studies the causes and impact of frauds from the perspective of

alert and cause them to waste resources and banking industry. It also recommends the measures to prevent the frauds.

energies on fraud prevention and detection

RBI has been circulating to banks, the details

frauds of an ingenious nature not reported Research Methodology Recommendations

Research design: The research design employed in this study was a

earlier so that banks could introduce necessary

descriptive research in form of a survey, interview and questionnaire Account holders review

safeguards by way of appropriate procedure Sample size: the sample size will be focused on 20 respondents within the Proper verification of document

and internal check given area multi-layer security structure

Data collection methods: the data is collected by interview and Strict supervision of RBI

questionnaire

Data analysis: data analysis was carried out in order to inspect, clean,

RBI guidelines:

Objectives of the study transform and model data with the aim of identifying and highlighting useful

To study the cause and impact of information that can used to support the decision making process

The CMD/CEOs of banks must provide

frauds on banking sector focus on the fraud prevention and

To recommend preventive measures management functions to enable

CAUSE

to control the frauds in the banking Fraudulent documentation involves altering, changing or effective investigation of frauds

sector modifying a document to deceive the bank. The fraud risk management fraud

r monitoring and fraud investigation

Advanced related fraud like diversion of funds, overvaluation function must be owned by banks

or absence of requisite co-laterals. CEOs

Bank with approval of their respective

SUGGESTION

Technological related fraud involve hacking ,phishing, board shall frame internal policy for

pharming and smishing. fraud risk management and fraud

Eternal vigilance of the bank as well as The frauds and for Forgery involve professional workers who are investigation based on the

customer thoroughly conversant with the banking systems and governance standard

procedures and who seeks to enlist the support and

cooperation of the dishonest member of the bank staff.

References:

Monetary system and RBI Should be out of EFFECTS

the political pressure Erodes public confidence Slideshare.

banking systems net/urvi

There is proper functioning of bank internal Diminishing the Academia. Articlesng.

profitability of bank and edu com

of verification of document at the time of thus reduces firm value.

approving loan bank should follow strict

guideline of RBI before disbursing loan Depletion of stakeholder

and bank capital base Metro.co.u Grossarchi

k ve.com

Bank security level must be improved for Dismissal and Myproject.

net banking like ATM, debit and credit card retrenchment of staff com.ng

Das könnte Ihnen auch gefallen

- Analyzing Banking Risk (Fourth Edition): A Framework for Assessing Corporate Governance and Risk ManagementVon EverandAnalyzing Banking Risk (Fourth Edition): A Framework for Assessing Corporate Governance and Risk ManagementBewertung: 5 von 5 Sternen5/5 (5)

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Von EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Noch keine Bewertungen

- Bank Final FlexDokument1 SeiteBank Final FlexArchana VishwakarmaNoch keine Bewertungen

- Study of Fraud and It's Prevention in ReferenceDokument8 SeitenStudy of Fraud and It's Prevention in ReferenceArchana VishwakarmaNoch keine Bewertungen

- p1sgp 2018 Marjun ADokument13 Seitenp1sgp 2018 Marjun AAyesha KhanNoch keine Bewertungen

- Basic Principle SupervisionDokument9 SeitenBasic Principle SupervisionDhena SinayangNoch keine Bewertungen

- Synergy MFI PPT ScamDokument34 SeitenSynergy MFI PPT ScamArafat SipuNoch keine Bewertungen

- Concurrent Audit PDFDokument98 SeitenConcurrent Audit PDFDekrouf SysNoch keine Bewertungen

- Due Deligency GidelineDokument19 SeitenDue Deligency GidelinetesfayeNoch keine Bewertungen

- Due Deligency GidelineDokument143 SeitenDue Deligency GidelinemokeNoch keine Bewertungen

- MICROFINANCE-LENDING - Mozambique (Faith)Dokument5 SeitenMICROFINANCE-LENDING - Mozambique (Faith)Yey PahmateeNoch keine Bewertungen

- Bank yDokument30 SeitenBank yTatotNoch keine Bewertungen

- (Revised) Barings Bank CaseDokument12 Seiten(Revised) Barings Bank CaseMansi ParmarNoch keine Bewertungen

- Banking FraudsDokument17 SeitenBanking FraudsVandana gupta100% (1)

- Risk ManagementDokument10 SeitenRisk ManagementarakazajeandavidNoch keine Bewertungen

- RakhiDokument5 SeitenRakhiJinesh BabuNoch keine Bewertungen

- GRC in BanksDokument19 SeitenGRC in BanksNilesh RoyNoch keine Bewertungen

- ICICI Bank Group 5Dokument7 SeitenICICI Bank Group 5Sayee prasad KompellaNoch keine Bewertungen

- 15 - Audit of BanksDokument21 Seiten15 - Audit of BanksBelgium PropertiesNoch keine Bewertungen

- SynopsisDokument6 SeitenSynopsisShabreen SultanaNoch keine Bewertungen

- Risk Based SupervisionDokument22 SeitenRisk Based Supervisionsakshi819863200Noch keine Bewertungen

- BLP Module3 Paper 9 1Dokument634 SeitenBLP Module3 Paper 9 1elliot fernandes100% (1)

- Private & Public BankDokument2 SeitenPrivate & Public BankAnvesh Pulishetty -BNoch keine Bewertungen

- Cbs Audit 2020 - ShareDokument136 SeitenCbs Audit 2020 - ShareAmarnath OjhaNoch keine Bewertungen

- Risk Based Internal Audit in BanksDokument10 SeitenRisk Based Internal Audit in Banksnadim.rashid9849Noch keine Bewertungen

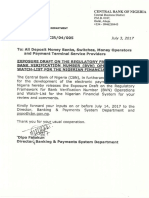

- Circular and Exposure Draft On The Framework For BVN Operations and WatchlistDokument16 SeitenCircular and Exposure Draft On The Framework For BVN Operations and WatchlistFrancis OkonkwoNoch keine Bewertungen

- India Banking Fraud Survey: Edition IIDokument36 SeitenIndia Banking Fraud Survey: Edition IIAkash SahuNoch keine Bewertungen

- Bank Management 1Dokument42 SeitenBank Management 1Saifur Rahman JoyNoch keine Bewertungen

- Chapter 12 Audit of BanksDokument37 SeitenChapter 12 Audit of Banksvinay sainiNoch keine Bewertungen

- SSRN Id2632911Dokument21 SeitenSSRN Id2632911KUNAL GUPTANoch keine Bewertungen

- Developing EQDokument16 SeitenDeveloping EQArpita SrivastavaNoch keine Bewertungen

- OCC S New Fair Lending Guide May Portend Broader Changes 1675948989Dokument3 SeitenOCC S New Fair Lending Guide May Portend Broader Changes 1675948989Stanford A. Stanford Sr.Noch keine Bewertungen

- PDF 20230228 110243 0000Dokument11 SeitenPDF 20230228 110243 0000Kshitij SinghNoch keine Bewertungen

- Bank Frauds and Role of RBI - Taxguru - inDokument3 SeitenBank Frauds and Role of RBI - Taxguru - inSamarth jhunjhunwalaNoch keine Bewertungen

- Assignment 2 Dealing With Frauds in Banking IndustryDokument5 SeitenAssignment 2 Dealing With Frauds in Banking IndustryMovie MasterNoch keine Bewertungen

- Corporate Governance in Indian Banking SectorDokument11 SeitenCorporate Governance in Indian Banking SectorFàrhàt HossainNoch keine Bewertungen

- Project of IciciDokument4 SeitenProject of IciciAshwini SawantNoch keine Bewertungen

- Frauds in BankingDokument60 SeitenFrauds in BankingRobin Singh Arora83% (6)

- Avnibathla 80012301167 EthicsDokument6 SeitenAvnibathla 80012301167 Ethicskanikabhateja7Noch keine Bewertungen

- Sanket PDFDokument15 SeitenSanket PDFSnehalNoch keine Bewertungen

- AI Use CasesDokument18 SeitenAI Use CasesErick Ivan Barcenas Martinez100% (1)

- BVN CorrectedDokument14 SeitenBVN CorrectedRasheed Onabanjo DamilolaNoch keine Bewertungen

- Review of A Sample of All New Loans IssuedDokument6 SeitenReview of A Sample of All New Loans IssuedkamranimamNoch keine Bewertungen

- kiểm toán nội bộDokument23 Seitenkiểm toán nội bộĐặng Khánh LinhNoch keine Bewertungen

- Presentation On: A Comparative Analysis of Islamic Banking Between Bangladesh & IranDokument12 SeitenPresentation On: A Comparative Analysis of Islamic Banking Between Bangladesh & IranMd. Riyajul IslamNoch keine Bewertungen

- Implementing Risk Based Internal Audit in Indian Banks: An Assessment of Organizational PreparednessDokument19 SeitenImplementing Risk Based Internal Audit in Indian Banks: An Assessment of Organizational Preparednessnasir_m68Noch keine Bewertungen

- Ijulianto, 84-105Dokument22 SeitenIjulianto, 84-105HeRlambang AjiNoch keine Bewertungen

- Wa0015 PDFDokument60 SeitenWa0015 PDFAjay RajbharNoch keine Bewertungen

- 11 4.3 Risk ManagementDokument5 Seiten11 4.3 Risk Managementambarish.brbnmplNoch keine Bewertungen

- 42 P1-2017-Marjun-ADokument12 Seiten42 P1-2017-Marjun-AAmeena FatimaNoch keine Bewertungen

- Data Mining Techniques For Fraud Detection in Banking SectorDokument5 SeitenData Mining Techniques For Fraud Detection in Banking SectorZen LawrenceNoch keine Bewertungen

- Fraud and Scams in Banking SectorDokument92 SeitenFraud and Scams in Banking SectorTasmay EnterprisesNoch keine Bewertungen

- Di Early Warning Signal Ews Campaign BrochureDokument12 SeitenDi Early Warning Signal Ews Campaign Brochureanuradha jagarlapudiNoch keine Bewertungen

- CBPTM - Course OutlineDokument3 SeitenCBPTM - Course OutlineAru RanjanNoch keine Bewertungen

- Basel II Accord and Its ImplicationsDokument5 SeitenBasel II Accord and Its ImplicationsAjit Kumar SahooNoch keine Bewertungen

- Digital Banking An Regulatry ComplianceDokument23 SeitenDigital Banking An Regulatry Compliancesathyanandaprabhu2786Noch keine Bewertungen

- Bank Frauds: Concept and DimensionsDokument8 SeitenBank Frauds: Concept and DimensionsDanish AlamNoch keine Bewertungen

- Icici Bank ProjectDokument82 SeitenIcici Bank ProjectiamdarshandNoch keine Bewertungen

- 205 - F - Icici-A Study On Credit Appraisal System at Icici BankDokument71 Seiten205 - F - Icici-A Study On Credit Appraisal System at Icici BankPeacock Live Projects0% (1)

- Dr. Ram Manohar Lohiya National LAW University, Lucknow.: Final Project ONDokument19 SeitenDr. Ram Manohar Lohiya National LAW University, Lucknow.: Final Project ONGulafshaNoch keine Bewertungen

- DRT'S A. E, Kalsekar Degree Coolege: Customer Relationship Management in Insurance Sector With Reference To MumbraDokument61 SeitenDRT'S A. E, Kalsekar Degree Coolege: Customer Relationship Management in Insurance Sector With Reference To MumbraArchana VishwakarmaNoch keine Bewertungen

- History of Mutual FundDokument10 SeitenHistory of Mutual FundArchana VishwakarmaNoch keine Bewertungen

- Presented by ... : Mr. Mir Riyajul Haque Asst. Prof. ICLE's MJ College, VashiDokument1 SeitePresented by ... : Mr. Mir Riyajul Haque Asst. Prof. ICLE's MJ College, VashiArchana VishwakarmaNoch keine Bewertungen

- DRT'S A. E, Kalsekar Degree Coolege: Customer Relationship Management in Insurance Sector With Reference To MumbraDokument60 SeitenDRT'S A. E, Kalsekar Degree Coolege: Customer Relationship Management in Insurance Sector With Reference To MumbraArchana VishwakarmaNoch keine Bewertungen

- Bank Final FlexDokument1 SeiteBank Final FlexArchana VishwakarmaNoch keine Bewertungen

- Archana RESUMEDokument1 SeiteArchana RESUMEArchana VishwakarmaNoch keine Bewertungen

- ResumeDokument2 SeitenResumeArchana VishwakarmaNoch keine Bewertungen

- ResumeDokument2 SeitenResumeArchana VishwakarmaNoch keine Bewertungen

- 14 AppendixDokument5 Seiten14 AppendixJohn CarpenterNoch keine Bewertungen

- History of Mutual FundDokument10 SeitenHistory of Mutual FundArchana VishwakarmaNoch keine Bewertungen

- Mutual FundDokument28 SeitenMutual FundArchana Vishwakarma100% (1)

- ResumeDokument2 SeitenResumeArchana VishwakarmaNoch keine Bewertungen

- History of Mutual FundDokument10 SeitenHistory of Mutual FundArchana VishwakarmaNoch keine Bewertungen

- History of Mutual FundDokument2 SeitenHistory of Mutual FundArchana VishwakarmaNoch keine Bewertungen

- Bank Final FlexDokument1 SeiteBank Final FlexArchana VishwakarmaNoch keine Bewertungen

- 2 6 250 508 PDFDokument4 Seiten2 6 250 508 PDFArchana VishwakarmaNoch keine Bewertungen

- Bank Final FlexDokument1 SeiteBank Final FlexArchana VishwakarmaNoch keine Bewertungen

- Mutual FundDokument31 SeitenMutual FundAmbrish (gYpr.in)Noch keine Bewertungen

- Tecplot 360 2013 Scripting ManualDokument306 SeitenTecplot 360 2013 Scripting ManualThomas KinseyNoch keine Bewertungen

- Financial StatementDokument8 SeitenFinancial StatementDarwin Dionisio ClementeNoch keine Bewertungen

- Catalogue of The Herbert Allen Collection of English PorcelainDokument298 SeitenCatalogue of The Herbert Allen Collection of English PorcelainPuiu Vasile ChiojdoiuNoch keine Bewertungen

- Common OPCRF Contents For 2021 2022 FINALE 2Dokument21 SeitenCommon OPCRF Contents For 2021 2022 FINALE 2JENNIFER FONTANILLA100% (30)

- CNS Manual Vol III Version 2.0Dokument54 SeitenCNS Manual Vol III Version 2.0rono9796Noch keine Bewertungen

- GSMDokument11 SeitenGSMLinduxNoch keine Bewertungen

- Gogte Institute of Technology: Karnatak Law Society'SDokument33 SeitenGogte Institute of Technology: Karnatak Law Society'SjagaenatorNoch keine Bewertungen

- 2 and 3 Hinged Arch ReportDokument10 Seiten2 and 3 Hinged Arch ReportelhammeNoch keine Bewertungen

- Incoterms 2010 PresentationDokument47 SeitenIncoterms 2010 PresentationBiswajit DuttaNoch keine Bewertungen

- How Can You Achieve Safety and Profitability ?Dokument32 SeitenHow Can You Achieve Safety and Profitability ?Mohamed OmarNoch keine Bewertungen

- Common Base AmplifierDokument6 SeitenCommon Base AmplifierMuhammad SohailNoch keine Bewertungen

- Colibri - DEMSU P01 PDFDokument15 SeitenColibri - DEMSU P01 PDFRahul Solanki100% (4)

- Musings On A Rodin CoilDokument2 SeitenMusings On A Rodin CoilWFSCAO100% (1)

- QuestionDokument7 SeitenQuestionNgọc LuânNoch keine Bewertungen

- MPPWD 2014 SOR CH 1 To 5 in ExcelDokument66 SeitenMPPWD 2014 SOR CH 1 To 5 in ExcelElvis GrayNoch keine Bewertungen

- U2 - Week1 PDFDokument7 SeitenU2 - Week1 PDFJUANITO MARINONoch keine Bewertungen

- Payment Plan 3-C-3Dokument2 SeitenPayment Plan 3-C-3Zeeshan RasoolNoch keine Bewertungen

- SEBI Circular Dated 22.08.2011 (Cirmirsd162011)Dokument3 SeitenSEBI Circular Dated 22.08.2011 (Cirmirsd162011)anantNoch keine Bewertungen

- Software Testing Notes Prepared by Mrs. R. Swetha M.E Unit I - Introduction at The End of This Unit, The Student Will Be Able ToDokument30 SeitenSoftware Testing Notes Prepared by Mrs. R. Swetha M.E Unit I - Introduction at The End of This Unit, The Student Will Be Able ToKabilan NarashimhanNoch keine Bewertungen

- E OfficeDokument3 SeitenE Officeஊக்கமது கைவிடேல்Noch keine Bewertungen

- Elb v2 ApiDokument180 SeitenElb v2 ApikhalandharNoch keine Bewertungen

- Bs en 1991-1-5 2003 + 2009 Thermal Actions (Unsecured)Dokument52 SeitenBs en 1991-1-5 2003 + 2009 Thermal Actions (Unsecured)Tan Gui SongNoch keine Bewertungen

- Qa-St User and Service ManualDokument46 SeitenQa-St User and Service ManualNelson Hurtado LopezNoch keine Bewertungen

- Chap 06 Ans Part 2Dokument18 SeitenChap 06 Ans Part 2Janelle Joyce MuhiNoch keine Bewertungen

- Manulife Health Flex Cancer Plus Benefit IllustrationDokument2 SeitenManulife Health Flex Cancer Plus Benefit Illustrationroschi dayritNoch keine Bewertungen

- CORDLESS PLUNGE SAW PTS 20-Li A1 PDFDokument68 SeitenCORDLESS PLUNGE SAW PTS 20-Li A1 PDFΑλεξης ΝεοφυτουNoch keine Bewertungen

- Company Law Handout 3Dokument10 SeitenCompany Law Handout 3nicoleclleeNoch keine Bewertungen

- Seminar Report of Automatic Street Light: Presented byDokument14 SeitenSeminar Report of Automatic Street Light: Presented byTeri Maa Ki100% (2)

- Finaniial AsceptsDokument280 SeitenFinaniial AsceptsKshipra PrakashNoch keine Bewertungen

- Solutions To Questions - Chapter 6 Mortgages: Additional Concepts, Analysis, and Applications Question 6-1Dokument16 SeitenSolutions To Questions - Chapter 6 Mortgages: Additional Concepts, Analysis, and Applications Question 6-1--bolabolaNoch keine Bewertungen