Beruflich Dokumente

Kultur Dokumente

Approaches and Techniques in Budgeting: The Philippine Experience

Hochgeladen von

Ma'am Lea0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

354 Ansichten63 SeitenThe document discusses different approaches and techniques used in budgeting in the Philippine government experience, including line-item budgeting, performance budgeting, and planning, programming, and budgeting systems (PPBS). It provides definitions and orientations of budgeting, emphasizing control, management, and planning. It describes the importance of budgeting in enabling the government to plan, prioritize, and implement programs and projects. It then examines each approach in more detail, outlining their advantages and disadvantages when used in the Philippine context.

Originalbeschreibung:

Originaltitel

Theory of the Budget.pptx

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe document discusses different approaches and techniques used in budgeting in the Philippine government experience, including line-item budgeting, performance budgeting, and planning, programming, and budgeting systems (PPBS). It provides definitions and orientations of budgeting, emphasizing control, management, and planning. It describes the importance of budgeting in enabling the government to plan, prioritize, and implement programs and projects. It then examines each approach in more detail, outlining their advantages and disadvantages when used in the Philippine context.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

354 Ansichten63 SeitenApproaches and Techniques in Budgeting: The Philippine Experience

Hochgeladen von

Ma'am LeaThe document discusses different approaches and techniques used in budgeting in the Philippine government experience, including line-item budgeting, performance budgeting, and planning, programming, and budgeting systems (PPBS). It provides definitions and orientations of budgeting, emphasizing control, management, and planning. It describes the importance of budgeting in enabling the government to plan, prioritize, and implement programs and projects. It then examines each approach in more detail, outlining their advantages and disadvantages when used in the Philippine context.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 63

Approaches and Techniques in

Budgeting: The Philippine

Experience

Ms. Lea S. Aceron

Discussant

Definition and Orientations

Is the process of allocating financial resources for intended programs,

projects, services, and activities to empower the organization to carry

out stated goals and objectives (Briones, 1996)

Entails the management of government expenditures that will create

impact from the production and deliver of goods and services while

supporting a healthy fiscal position.

Three orientations

Control, Management and Planning

Importance

It enables the government to plan and manage its financial resources

to support the implementation of various programs and projects that

best promotes the development of the country.

Government can prioritize and put into action its plans, programs and

policies within the constraint of its financial capability as dictated by

economic conditions.

Orientation in Budgeting

A. Control Orientation in budgeting is the process of enforcing

limitations and conditions set in the budget and in appropriations, and

of securing compliance with spending restrictions imposed by central

authorities. If the budget details the allowances for items of expense,

central budgeters will be required or at least motivated to monitor

agency actions in order to enforce the limits.

Orientation in Budgeting

B. Management Orientation involves the use of budgetary authority at

both agency and central levels to ensure the efficient use of staff and

other resources in the conduct of authorized activities. In

management-oriented budgeting, the focus is on agency outputs –

what is being done and produced and at what cost and how does

performance compare with the budgeted goal? This orientation is best

illustrated in a performance budget. It is more concerned with the

operations and results rather than control, with efficiency rather than

the legality of expenditures.

Orientation in Budgeting

C. Planning Orientation refers to the process of determining public

objectives and the evaluation of alternative programs. To use the

budget for planning, central authorities must have information

concerning the purposes and effectiveness of programs. They must also

be informed of multi-year spending plans and of the linkage between

planning, spending, and public benefits.

According to Schick, three important developments

influenced the evolution from a management to a

planning orientation in the sixties:

1. Economic Analysis – the emergence of macro and micro analysis

has had an increasing part in the shaping of fiscal and budgetary

policy;

2. The development of new information and decision technologies has

enlarged the applicability of objective analysis to policymaking; and

3. There has been a gradual convergence of planning and budgetary

processes.

Approaches Used Since 1937

Line Item Budgeting (LIB)

Performance Budgeting (PB)

Planning, Programming and Budgeting System (PPBS)

Zero Based Budgeting (ZBB)

Line-item Budget Approach

“Item of Expenditure Approach”

Manifestation of process budgetary, “incremental,fragmented, non

programmatic and sequential.”

During its Legislation or authorization Phase, the legislature wielded

so much influence on agencies of their choice.

The lawmakers were able to pinpoint “objects of future choice”

especially those referring to new positions.

Advantages of Line-item Budget Approach

Offers simplicity: easily budget for the agency based on historical

expenditures required in previous years.

Easy to justify the expenditures.

Straightforward, simple to administer, and readily understood.

On the basis of the United States’ long experience in

utilizing the line-item budget approach, Allen Schick was

able to lay down ten advantages:

1. It enables central authorities to control inputs; that is, to control

the cost of inputs before the expenditure is made or obligated.

2. It provides external control by legislators and central monitors who

are not beholden to a particular agency.

3. Line-item control is especially effective for salaries and purchases,

which together account for the bulk of state government spending,

perhaps 90 percent or more in some instances.

On the basis of the United States’ long experience in

utilizing the line-item budget approach, Allen Schick was

able to lay down ten advantages:

4. Control is uniform. Each agency is governed by the same accounts

and standards.

5. Control is comprehensive. No item escapes control surveillance.

6. Control is exact. It can be imposed with pinpoint precision on the

class of actions or expenditures that central officials want to control.

7. Control is routine. The records upon which control is built are

required in the ordinary course of activity: purchase specifications,

personnel actions, voucher approvals, travel authorizations, etc.

On the basis of the United States’ long experience in

utilizing the line-item budget approach, Allen Schick was

able to lay down ten advantages:

8. There are multiple opportunities for control. Central authority can be

exercised at many points in the expenditure process and throughout

the fiscal year.

9. Both aggregate and detailed control are promoted. Line-item

supervision ensures that the expenditure ceilings established by law or

administrative fiat will not be breached, but it also permits control to

extend down to particular items.

10. Line-item controls established the basis for budget cutting. To bring

the budget into a desired relationship with income, central controllers

are able to delete or reduce items until the target is reached.

Performance Budgeting

“Activity” or “functional” budgeting.

Objects of expenditures are deemed as significant factors in relation

to what they used for and not in relation to their specific character.

The Budget, accounting and auditing modernization project was

launched in July 1954 in collaboration with US management;

introduced as part of package reforms.

Budgetary improvements represented an attempt in initiate requisite

changes in an area relatively neglected in the past.

Reforms to help government cope with social, economic and political

problems.

Advantages of Performance Budgeting

Gives comprehensive and reliable information.

Helps individual legislature to understand what the government is doing

and what the costs are.

Improves legislative examination of budgetary requirements and enables

the legislative financial committee to decide more easily on the basic

expenditure issues.

Makes possible the submission and consideration of budget for a shorter

length of time.

Enables administrators to place responsibility upon subordinate officials

for the clear execution of the provisions made by the legislative body.

Permits effective performance in reporting on budgeting and

management.

Disadvantages of Performance Budgeting

Executive agencies pointed out that there’s indifference in the

execution of programs, and lack of understanding on the part of key

operation officials.

Lack or absence of performance measures, personnel processing

technical skills and competencies.

Streamlining the government’s organizational structure impeded the

success of PB. Only 1/50 plans presented in the Congress in 1955 was

approved.

Lack of Congressional support leading to RA No. 992 changed to

downright hostility on the part of the Congress.

A performance budget is one which states:

a) The short term and long term goals in the major functional areas

for which funds are requested;

b) The programmes in each function and activities or projects in each

programme proposed for the accomplishment of the goals in the

various functional areas;

c) The cost of the programs and activities or projects proposed;

d) The qualitative and quantitative data for the program and activities

proposed

A performance budget is one which states:

e) The organization units responsible for carrying out the programmes;

f) The sources and amount of all money receipts and expenditures; and

g) The units of work measurement which measure the results of

programs, projects and activities

Components of Performance Budgeting

Systems:

1. Functional and Activity Classifications

2. Performance Measurements

3. Performance Reports

Planning, Programming and Budgeting System

Answer to the need for an economic allocation of resources and the

undertaking of government policy, program analysis, and cost utility

analysis to improve the policy decision process of government.

The scheme requires agency managers to identify program

objectives, develop measuring program output, calculate total

program costs over the long-run, prepare detailed multi-year program

and financial plans, and analyze the costs and benefits of alternative

program designs.

The system provides a strong linkage between planning and

budgeting.

Planning, Programming and Budgeting System

Martial Law in September 1972, PD No. 1 – reorganization of the

entire government system – formulate short term and long term

development plans and to monitor.

Creation of NEDA (National Economic and Development Authority)

Navy attempted to workout the said Model for the entire National

Defense in 1976

PAGBA (Philippine Association of Government Budget Administration)

and CESDP (Career Executive Service Development Program) devoted

several conferences to discuss its merits

Advantages of Planning, Programming and

Budgeting System

Provides clear linkage between planning and budgeting.

Officers techniques which might help solve the problem of resource

allocation and setting of positions.

Offers logical, objective approach to planning and budgeting.

Allows administrators to evaluate anticipated results of proposed

programs and systems alternatives and to compare results from

different proposals.

Disadvantages of Planning, Programming and

Budgeting System

Brought a damaging gap between publicity and performance.

Only a tool and never makes decision

Zero-Base Budgeting Approach

An operating, planning, and budgeting method which requires every

agency manager to justify its entire budget-systems in detail and

transfers the burden of proof to each manager why he should spend

any money.

It underscores the analysis of all budgetary expenditures to answer

effectiveness in achieving organizational goals.

Yearly analysis, evaluation, and justification of each activity, program

or project starting from a “zero” performance level.

A budget based on need not want.

Basic ZBB Terms

A Decision Unit is a major activity, group of related activities, cost

center or organizational unit which requires significant managerial

decisions on performance and funding levels.

The Decision Level is the level of the organization responsible for

analyzing, reviewing, ranking, and grouping activity justification

document. Each division, regional office, and bureau are required to

analyze and rank activities.

Basic ZBB Terms

The Levels of Performance and Funding

a) Current Level (CL) – level of performance and funding that is required to

carry on the current year’s service or output level without major policy

changes; also referred to as “business as entusual” level.

b) Minimum Level (ML) – level of performance and funding below which an

activity is not feasible to operate because it cannot make a constructive

contribution towards fulfilling an objective.

c) Enhancement Level (EL) – the level of performance and funding above

the current level wherein increased output and service will warrant the

serious review of higher management; the enhancement level may be

divided into EL (1) and EL (2) where EL (2) is higher than EL (1) and is

closer to attaining completely the objective of an activity.

Basic ZBB Terms

The Activity Justification Document (AJD) Decision package is a

document that identifies and describes a specific operation in a

manner that enables management to evaluate and rank it against other

operations competing for limited resources and to decide whether to

approve or disapprove it.

An AJD contains all three levels of performance funding besides the

following information: objectives, description of activity, alternative

methods considered, and output performance measurement.

Ranking is the process by which higher level managers evaluate an

array activity levels in descending order of priority.

Zero Base Budgeting

Introduced in 1977 during the preparation of Calendar year 1978

National Budget

Section 8 of PD 1177 (Budget Reform Decree) – Legal Basis

Established benchmark for outlays category: (Personal Services,

Maintenance and Operating Expenses and Equipment

Justified its used due to lack of managerial involvement in budgeting,

limited priority setting of projects and activities, lack of performance

measurements and cost benefit analysis, unnecessary spending, weak

planning and budget linkage, inadequate probing organization and

methods of operation and ineffective allocation of resources.

Eight Steps Necessary to Establish in an

Agency

1. Development and issuance of agency planning assumption and policy

guidelines;

2. Identification of decision units;

3. Identification of objectives for each decision unit;

4. Identification and evaluation of alternative methods of accomplishing

objectives;

5. Analysis of different levels of performance and funding;

6. Preparation of activity justification documents of decision packages;

7. Ranking of activities at various performance and funding levels; and

8. Consolidation of activity justification documents and accomplishment of

standard budget preparation forms.

Advantage of Zero Base Budgeting

The most important programs and projects are allocated, enough

funding rather than distribute the resources thinly among the many

activities and achieve nothing in the end.

Disadvantages of Zero Base Budgeting

Support from Top Management

Translation of Concepts

Management System

Insufficient training of agency personnel

Lack of guidance in its implementation

Insufficient central staff

Emphasis on forms or too much paperwork

Difficulty in translating concepts to more comprehensive concrete

terms which are digestible and palatable to end users

Budgeting in the Philippines

2009 Profile

Budgeting in the Philippines – 2009 Profile

General overview of the Philippine System of Budgeting

Divided into two parts:

1. Budget Formulation Process

2. Role of Congress in Approving the Budget

Special Characteristics

1. A commitment to fiscal discipline

2. Tax compliance and corruption

3. Subsidies: government-owned and controlled corporations

4. The Development Budget Coordinating Committee

5. The national planning function

6. Unprogrammed funds and special purpose funds

Arroyo Administration

Major turning point for budget policy

Restoring fiscal discipline and sustainability a key priority

Averted fiscal crisis by severe expenditure restraint

Primary expenditure declined by two percentage points of GDP

Marked by political/governance challenges

Declared that the country was on the verge of a “fiscal crisis” and

identified the budget deficit as the “most urgent problem”

“Sometimes stamping out deficits can show

growth. But ignoring them can kill the

economy.”

Public Expenditure Management

“The programme of restoring fiscal strength is premised on the

painful fact that the government could, very soon, no longer afford to

subsist on borrowed funds”.

Promotes 3 Outcomes

1. Aggregate Fiscal Discipline – Spending with means

2. Allocative Efficiency – Spending on the right priorities

3. Operational Efficiency – Spending with value for money

Medium-term Expenditure Framework

Known as “activity” or “functional” budgeting, the Hoover

Commission succeeded in creating a feeling of novelty and

excitement for the post-war generation of public administrators.

6-year fiscal plan of projected revenues and deficit targets

“forward estimates” – to show the baseline cost of continuing

existing policies.

1999 then reintroduced in 2006 as analytical tool.

Several Changes in Implementation of MTEF

Significant share of the budget in accounted for by capital projects, which

are by their nature one-off.

There is a systematic issue with revenue forecasting, which inflates the

MTEF in terms of fiscal space for new expenditures.

High degree of flexibility is permitted in the implementation of the budget,

both to “claw back” expenditures in view of actual revenue receipts and

because of extensive in-year reallocations.

Great efforts is needed to keep the MTEF up-to-date throughout the year.

Great importance is thus placed being integrated into the same units that

deal with the annual budgeting, rather than being placed in a special unit.

Paper on Budget Strategy

New initiative Originated in 2006

Internal document used as a basis for discussion within the

Development Budget Coordinating Committee (DBCC) for deciding on

priority sectors for the use of new resources

Three priority sectors have been consistently identified: education,

health and infrastructure development. In 2008, agriculture and

welfare were added because of the global rice crisis

Arroyo Administration

Achieved impressive fiscal outcomes including governance challenges

and most recently the effects of the global financial crisis.

Central and long-standing fiscal problem in the Philippines has to do

with revenue mobilization, both in terms of broadening the tax bases

and increasing tax rates and tax collection.

Philippines suffers from rampant tax evasion and complicit corruption

in the revenue collection agencies.

Must be emphasized that the impressive fiscal outcome and

implementation of modern budgeting reforms have been

accomplished within the most challenging environment.

Arroyo Administration

The Congress has a very active and vocal role in the budget process in

the Philippines. Majority of members of both the House and the

Senate are also members of their respective chamber’s budget

committee is most noteworthy.

The budget approval process is often tense between the House of

Representatives and the Senate and within the Bicameral Conference

Committee.

The Constitution gives the President extraordinary power vis-à-vis the

Congress in budgetary matters, which has served to counteract the

effects of these practices.

Budgeting in the Philippines

DBM

Department of Budget and Management

Aquino Administration

“Daang Matuwid” – Ituloy ang Paggugol na Matuwid

A Budget for Inclusive Development

Passed the budget on time for six consecutive years

Budget reaffirms the belief that no one should be left behind as the

country progresses

To link budgets to agency performance through Performance-

Informed Budgeting and enable citizens to hold agencies accountable

for delivering their targets through the use of their budgets

Budget Transparency

Agencies are required to publish key budget information and reports

through their respective websites

Transparency Seals

Open Data Initiative

People’s Budget

Performance-Informed Budgeting

Publication of performance in the budget documents submitted to

Congress

Strengthens the accountability of government for spending with

measurable results

A set output and outcome indicators and targets are presented in the

NEP and GAA for each MFO

Advantages of Performance-Informed

Budgeting

Adoption of the PIB has made the budget more understandable to

the layman because it simplified budget presentation.

Easier to gauge the performance of an Agency. Compared to the

traditional line-item based budgeting, it links funding to results.

Strengthens the direct relationship between planning, budgeting, and

outcomes, and enhances transparency and accountability in the

allocation of limited resources.

Bottom-Up Budgeting

A demand-driven budget-planning process.

Institutionalizes people’s participation in the budget process to gain a

better understanding of their needs and requirements and ensure

that these are met.

Open Government Partnership in 2015 has recognized the BuB

program as one of three Best Practices in Fiscal Transparency from

around the world.

Advantages of Bottom-Up Budgeting

Fiscal Output to be produced by the Local Communities Produced by

Local Poverty Action Team per municipality/city composed of equal

representation from LGUs and CSOs.

LPRAP will come from budgets of participating agencies

Summary

Reforms were essential for restoring a cynical public’s trust in

government.

Budget addressed hiccups in the budget implementation.

Empowered people through tighter prioritization of their needs,

faster delivery of results and more open budget process

Emphasized that the government exists to serve Filipinos

It lays foundation for inclusive development and sustains the

momentum of reform.

Duterte Administration

“The thought that dominated my being was to make good on my

promise to the people to bring change in government, not a change

that is passing, but a change that can survive the test of time”.

PRRD SONA 2017

“Budget for Real Change”

A budget for and by the people, the 2017 Budget invests in programs

and projects that will help realize the collective aspirations of

Filipinos.

Supporting the Philippine Development Plan 2017-2022

Duterte Administration – Key Principles

1. Credible and Disciplined Fiscal policy

2. Fiscal space focused on equitable and social order

3. Budget reflecting our policies

4. Strengthening transparency, participation and accountability

5. Enhancing partnerships with local governments to ensure

sustainable development

Duterte Administration – Key Expenditure

Priorities

1. Promoting and enabling and Supportive Economic

2. Reducing Inequality in Economic Development Opportunities

“Pagbabago”

3. Increasing potential for Growth “Kaunlaran”

4. Enhancing the Social Fabric “Malasakit”

5. Foundations for Inclusive and Sustainable Development

Program Convergence Budgeting

An approach to facilitate and incentivize coordination between

agencies on priority inter-Agency programs.

National Budget Memorandum No. 114 in 2012 sets out guidelines

for building and sustaining cooperation in the development and

implementation of priority programs.

The lead Agency for each program has the responsibility to ensure

collaboration and coordination among all the agencies participating in

the program.

Program Expenditure Classification (PREXC)

Evolved from the Organizational Performance Indicator Framework

(OPIF) being approach to expenditure management that directs

resources towards results and accounts for performance by

identifying Major Final Outputs.

Logical continuation of Performance-Informed Budgeting (PIB).

Reflects in the budget link between strategies, budgets and results

and facilitates the monitoring and evaluation of programs with the

performance indicators attached to each program.

Restructures an agency’s budget to group all recurring activities as

well as projects under appropriate programs or key strategies.

Advantages of Program Expenditure

Classification

Strengthens the link between planning and budgeting by clearly

articulating how government’s strategies and investments under each

program are linked to the attainment of desired sectoral and socio-

economic results.

Enables various stakeholders to better manage the public expenditure

management process through programs and sub-programs of the agencies.

Does not replace the line-item budget structure. Rather, it groups the line

items more coherently under programs and sub-programs; and adds

performance information which should enable program managers,

legislators, and the general public to better understand the purpose of

expenditure and who should benefit from it.

Objectives of Program Expenditure

Classification

NEDA and DBM – better understand how programs and strategies

implemented by individual agencies lead to the achievement of

desired societal goals; and, based on this, more strategically allocate

resources to successful programs.

PREXC is consistent with, and supports the Planning Tool submitted

by Cabinet Secretaries

Implementing Agencies – better manage and ensure that agency

operations and expenditures are clearly linked to the delivery of

agency mandates, facilitating the evaluation of the effectiveness and

efficiency of programs; and, based on this, appropriately hold

respective managers and units accountable for overall performance.

Objectives of Program Expenditure

Classification

Congress – analyzes and appropriates each agency’s budget based on

better appreciation of agency objectives, strategies, and performance

in the past years; and, based on that, better performs its

congressional oversight role.

Citizens and civil society organizations- better monitor performance

of key agency programs and make evidence-based recommendations

to government; and, based on this, hold agencies accountable for

performance.

Program Expenditure Classification

From To

Outcome indicators at the organizational level Outcome Performance Indicators at a lower level of

Programs to show how programs and strategies

contribute to achieving an agency’s objectives

Agency-level outcome (i.e. organizational outcome) Outcomes and output targets assigned at the Program

and output (i.e. major final output or MFO) targets level to facilitate the measurement of the

effectiveness of Programs

“Line Items” defined as Programs, Activities, and Line Items, whether recurring activities or projects,

Projects (PAPs) grouped under each MFO grouped by program

Program Expenditure Classification

Other Tools

Unified Accounts Code Structure (UACS)

Government-wide harmonized classification system for financial transactions

which is used by the Commission on Audit (COA), Bureau of the Treasury

(BTr), Department of Finance (DOF), and DBM

Enables orderly and transparent budgeting, accounting, and auditing of each

budget item

Allows timely, accurate reporting of actual receipts and expenditures against

budgeted, programmed revenues and expenditures; and secures the integrity

of the Budget as enacted by Congress

Other Tools

Tier Budget Approach

Allows for the use of the performance information-both financial and

non-financial accomplishments – in assessing new spending proposals

of agencies

Streamlines the budget process by separating the discussion and

deliberations of the requirements of ongoing policies with the new

spending proposals

Other Tools

GAA as Release Document (GAARD)

And the creation of Full-Time Delivery Units (FDUs) have facilitated

the swift and efficient implementation of the Administration’s

expenditure program

It allows agencies to enter into contracts, complete the procurement

process and kick-start the implementation of programs/projects on

the very first working day of the fiscal year, because the disaggregated

budget items in the GAA are already considered released to their

respective agencies.

Forward Estimates (FEs)

Concepts was first introduced around 2007 as part of the

implementation of the MTEF

It has now been given a more important role in the annual budget

process through the introduction of the 2TBA process

Estimates of the future costs of on-going policies, programs and

projects of the Government for the next three years

Das könnte Ihnen auch gefallen

- Approaches and Techniques in BudgetingDokument8 SeitenApproaches and Techniques in Budgetinghijkayelmnop89% (9)

- Theory of The BudgetDokument30 SeitenTheory of The Budgetivymarie reblora83% (12)

- Theories, Concepts and Practices of Accounting and Auditing in The Philippines - Jirah Rose FloresDokument30 SeitenTheories, Concepts and Practices of Accounting and Auditing in The Philippines - Jirah Rose Floresjirah rose flores0% (1)

- III. The Nature of People and OrganizationDokument16 SeitenIII. The Nature of People and OrganizationKhristina Anne Ama67% (3)

- Financing Higher Education Services and Their Legal BasesDokument8 SeitenFinancing Higher Education Services and Their Legal BasesKenneth Delos SantosNoch keine Bewertungen

- Monitoring and Evaluation Training Narrative Report, Sierra Leone (May, 2011)Dokument24 SeitenMonitoring and Evaluation Training Narrative Report, Sierra Leone (May, 2011)wacsi100% (1)

- 5 Components of Human Resource ManagementDokument7 Seiten5 Components of Human Resource ManagementClifford Jay Calihat100% (1)

- Budgeting in A Public Sector Power PointDokument40 SeitenBudgeting in A Public Sector Power Pointmutisa100% (20)

- Financial Accountability at Schools Challenges and ImplicationsDokument22 SeitenFinancial Accountability at Schools Challenges and Implicationsmurti51Noch keine Bewertungen

- Fiscal Management: and The Role of The School Head As Fiscal ManagerDokument314 SeitenFiscal Management: and The Role of The School Head As Fiscal ManagerC.j. TenorioNoch keine Bewertungen

- Masters Degree Thesis For Educational ManagementDokument39 SeitenMasters Degree Thesis For Educational ManagementJohn Bryan Aldovino100% (2)

- Definition of ValueDokument2 SeitenDefinition of ValueLia ArianNoch keine Bewertungen

- Chapter III: Managerial Approach To Government BudgetingDokument58 SeitenChapter III: Managerial Approach To Government BudgetingkNoch keine Bewertungen

- Financing Philippine Local GovernmentDokument37 SeitenFinancing Philippine Local GovernmentJaycee TualaNoch keine Bewertungen

- Budgeting The Educ. Plan-MagtubaDokument13 SeitenBudgeting The Educ. Plan-MagtubaLani BellezaNoch keine Bewertungen

- Planning at The National LevelDokument2 SeitenPlanning at The National LevelALI SHER HaidriNoch keine Bewertungen

- Planning Programming Budgeting System (PPBS)Dokument16 SeitenPlanning Programming Budgeting System (PPBS)Central University100% (1)

- DPE 405 - School Finance MattersDokument48 SeitenDPE 405 - School Finance MattersKaren Veronica GerminoNoch keine Bewertungen

- 4 Socioeconomic Impact AnalysisDokument13 Seiten4 Socioeconomic Impact AnalysisAnabel Marinda TulihNoch keine Bewertungen

- Presenter Dr. Samuel M. Gumbe: Sgumbe@commerce - Uz.ac - ZWDokument51 SeitenPresenter Dr. Samuel M. Gumbe: Sgumbe@commerce - Uz.ac - ZWKeithNoch keine Bewertungen

- Budgeting and PlanningDokument32 SeitenBudgeting and PlanningNguyen Thi Thu HuongNoch keine Bewertungen

- Prepared By: Nichol Kim S.Caňa MEM StudentDokument24 SeitenPrepared By: Nichol Kim S.Caňa MEM StudentNichol KimNoch keine Bewertungen

- 24th GRADUATION TasksDokument6 Seiten24th GRADUATION TasksMaria Erica Cuartero100% (1)

- NBC-No.568 National Budget Circular 2017Dokument11 SeitenNBC-No.568 National Budget Circular 2017Deped Tambayan100% (14)

- Education Process in The PhilippinesDokument12 SeitenEducation Process in The PhilippinesLe@H97% (35)

- Accounting Systems of Local GovernmentDokument5 SeitenAccounting Systems of Local GovernmentWasLiana JafarNoch keine Bewertungen

- Content Analysis The Economic Impact of Area F To Private SchoolsDokument10 SeitenContent Analysis The Economic Impact of Area F To Private SchoolsMartin Ceazar HermocillaNoch keine Bewertungen

- 2023 Project Proposal Water TankDokument2 Seiten2023 Project Proposal Water TankGrace GaraldeNoch keine Bewertungen

- Trends and Issues in Personnel ManagementDokument29 SeitenTrends and Issues in Personnel ManagementIsip DavidNoch keine Bewertungen

- Saint Columban CollegeDokument3 SeitenSaint Columban CollegeAbegail PanangNoch keine Bewertungen

- Planning, Organizing, Staffin, Directing, and Controlling From General Management and Project Management PerspectiveDokument11 SeitenPlanning, Organizing, Staffin, Directing, and Controlling From General Management and Project Management Perspectiveblaxani100% (1)

- BudgetingpptDokument38 SeitenBudgetingpptdivyakyNoch keine Bewertungen

- Budget As An Instrument of ControlDokument8 SeitenBudget As An Instrument of Controlgoyalvikas86Noch keine Bewertungen

- Determining The Effects of Planning, Programing and Budgeting System (PBBS) Implementation in The PhilippinesDokument11 SeitenDetermining The Effects of Planning, Programing and Budgeting System (PBBS) Implementation in The PhilippinesChong Bianz50% (2)

- The Budget ProcessDokument2 SeitenThe Budget Processshyne joonNoch keine Bewertungen

- Lecture Non Teaching StaffDokument2 SeitenLecture Non Teaching StaffJoyce Ann RamirezNoch keine Bewertungen

- Accounting of School FundDokument14 SeitenAccounting of School FundQuel MadrigalNoch keine Bewertungen

- Fiscal ManagementDokument36 SeitenFiscal ManagementDorie Mina100% (2)

- Theory of The BudgetDokument23 SeitenTheory of The BudgetClemen John TualaNoch keine Bewertungen

- Performance Informed Budgeting - BrochureDokument12 SeitenPerformance Informed Budgeting - BrochureraineydaysNoch keine Bewertungen

- Chapter 5 Final-NewDokument52 SeitenChapter 5 Final-NewChristian Joni Salamante GregorioNoch keine Bewertungen

- Module Review Practicum in Educational AdministrationDokument7 SeitenModule Review Practicum in Educational AdministrationHECTOR RODRIGUEZ100% (2)

- 2011 Annual Report DepEd Lanao Del NorteDokument29 Seiten2011 Annual Report DepEd Lanao Del Nortejosejardiniano100% (1)

- Strategic Planning in Education, Some Concepts and MethodsDokument14 SeitenStrategic Planning in Education, Some Concepts and MethodsZackNoch keine Bewertungen

- Budget Legislation: Alternatively Called The "Budget Authorization Phase,"Dokument13 SeitenBudget Legislation: Alternatively Called The "Budget Authorization Phase,"Nikki Ever JuanNoch keine Bewertungen

- School Based Management Contextualized Self Assessment and Validation Tool Region 3Dokument29 SeitenSchool Based Management Contextualized Self Assessment and Validation Tool Region 3Felisa AndamonNoch keine Bewertungen

- Sample Training Design - Financial ManagementDokument6 SeitenSample Training Design - Financial Managementrey ulysses l. dimaanoNoch keine Bewertungen

- INSET Learning Application PlanDokument2 SeitenINSET Learning Application PlanJanelkris PlazaNoch keine Bewertungen

- Management Theories and PracticeDokument175 SeitenManagement Theories and PracticeKidistMollaNoch keine Bewertungen

- Effects of Out-Of-Field TeachingDokument85 SeitenEffects of Out-Of-Field TeachingFeinrirNoch keine Bewertungen

- Curriculum Design and Technology IntegrationDokument3 SeitenCurriculum Design and Technology IntegrationmunirjssipgkperlisgmNoch keine Bewertungen

- Global Trends in Service ExcellenceDokument3 SeitenGlobal Trends in Service ExcellenceShiela Mae Mapalo-Rapista100% (1)

- Financial Aspect of Educational PlanningDokument21 SeitenFinancial Aspect of Educational PlanningKRISNA MAE ARTITCHEA100% (2)

- HRM Work Life BalanceDokument17 SeitenHRM Work Life BalanceAnnaliseNoch keine Bewertungen

- Chapter No # 01 Managing Human Resources: Management: What Is HRM?Dokument6 SeitenChapter No # 01 Managing Human Resources: Management: What Is HRM?hira naz100% (1)

- HBO Report GROUP 4 - ORGANIZATION AND ITS EFFECTSDokument12 SeitenHBO Report GROUP 4 - ORGANIZATION AND ITS EFFECTSPat M. VergaNoch keine Bewertungen

- Score Sheet For Teacher - (Deped Order 66, S. 2007)Dokument8 SeitenScore Sheet For Teacher - (Deped Order 66, S. 2007)Charmie LouNoch keine Bewertungen

- Action Plan For Pupils at Risk FinalDokument3 SeitenAction Plan For Pupils at Risk FinalMae Jumao-asNoch keine Bewertungen

- Chapter 1 - Introduction To ManagementDokument27 SeitenChapter 1 - Introduction To ManagementNur Hidayah Bustam100% (3)

- Personnel Administration..Dokument14 SeitenPersonnel Administration..Carmina DongcayanNoch keine Bewertungen

- Techniques and Approaches in BudgetingDokument9 SeitenTechniques and Approaches in BudgetingCamilla Reyes100% (1)

- Performance Budgeting - Module 5Dokument25 SeitenPerformance Budgeting - Module 5bermazerNoch keine Bewertungen

- MRS. Erlinda M. Ko, RN, BSNDokument5 SeitenMRS. Erlinda M. Ko, RN, BSNPrince MonNoch keine Bewertungen

- Contrastive and Error AnalysisDokument22 SeitenContrastive and Error AnalysisAan SafwandiNoch keine Bewertungen

- Organization and Its EnvironmentDokument20 SeitenOrganization and Its EnvironmentPrasanga PriyankaranNoch keine Bewertungen

- MoodleTMB 2019-20 Seminar 4 Relative GroundsDokument36 SeitenMoodleTMB 2019-20 Seminar 4 Relative GroundsJohn SheldonNoch keine Bewertungen

- Karte Za Crnu Goru (Eurocode)Dokument19 SeitenKarte Za Crnu Goru (Eurocode)Vahid100% (1)

- Module 4 Fit Me RightDokument55 SeitenModule 4 Fit Me RightMaria Theresa Deluna Macairan75% (4)

- k12 QuestionnaireDokument3 Seitenk12 QuestionnaireGiancarla Maria Lorenzo Dingle75% (4)

- Enem Enem Enem: Me Deu Um Beijo e Virou PoesiaDokument34 SeitenEnem Enem Enem: Me Deu Um Beijo e Virou PoesiaMaristella GalvãoNoch keine Bewertungen

- Socio-Anhtro Assessment 2Dokument2 SeitenSocio-Anhtro Assessment 2Adrienne GamaNoch keine Bewertungen

- Chapter 12 Quiz 1Dokument4 SeitenChapter 12 Quiz 1joyceNoch keine Bewertungen

- ACC802 - Assignment 1Dokument9 SeitenACC802 - Assignment 1Lippy TeatuNoch keine Bewertungen

- Rules and Violations in Playing VolleyballDokument8 SeitenRules and Violations in Playing Volleyballish p.Noch keine Bewertungen

- IELTS Reading Recent Actual Test 12 With AnswerDokument13 SeitenIELTS Reading Recent Actual Test 12 With AnswerNhung NguyễnNoch keine Bewertungen

- Intelligence Test: Three YearsDokument4 SeitenIntelligence Test: Three YearsAnshuman TewaryNoch keine Bewertungen

- Boeing Case StudyDokument4 SeitenBoeing Case Studyapi-541922465Noch keine Bewertungen

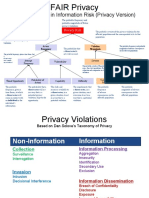

- Factor Analysis in Information Risk (Privacy Version)Dokument8 SeitenFactor Analysis in Information Risk (Privacy Version)Otgonbayar TsengelNoch keine Bewertungen

- Workshop Guide: The Design ProcessDokument29 SeitenWorkshop Guide: The Design ProcessLuisana MartínNoch keine Bewertungen

- Exam Prep Guide Priya Rao: Taking Stock: 2 Weeks Before Study LeaveDokument2 SeitenExam Prep Guide Priya Rao: Taking Stock: 2 Weeks Before Study LeavePriya RaoNoch keine Bewertungen

- PPIC Training ResumeDokument2 SeitenPPIC Training Resumenana arya sumardjaNoch keine Bewertungen

- RSN Referral FormDokument1 SeiteRSN Referral Formapi-315905321Noch keine Bewertungen

- POEADokument2 SeitenPOEAJaimie Paz AngNoch keine Bewertungen

- Bcsc009: Software Engineering: No. Content Teaching HoursDokument1 SeiteBcsc009: Software Engineering: No. Content Teaching HoursAKSHIT VERMANoch keine Bewertungen

- 2.1 Understanding REACH: How Does REACH Work?Dokument3 Seiten2.1 Understanding REACH: How Does REACH Work?xixixoxoNoch keine Bewertungen

- The Componential Theory of CreativityDokument2 SeitenThe Componential Theory of CreativityMuhammad SaadNoch keine Bewertungen

- Website Planning Template ForDokument10 SeitenWebsite Planning Template ForDeepak Veer100% (2)

- Technology and Livelihood Education (TLE) 6Dokument10 SeitenTechnology and Livelihood Education (TLE) 6Louie EscuderoNoch keine Bewertungen

- IBS - ITC Group FinalDokument21 SeitenIBS - ITC Group FinalUTKARSH AGARWALNoch keine Bewertungen

- Community Health Nursing Notes (Second Year)Dokument6 SeitenCommunity Health Nursing Notes (Second Year)anette katrinNoch keine Bewertungen