Beruflich Dokumente

Kultur Dokumente

Topic No.14

Hochgeladen von

Neil Villas0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

31 Ansichten12 Seiten1) Debt management refers to an unofficial agreement with unsecured creditors to repay debts over a fixed period of time, helping debtors clear debts at a lower monthly payment.

2) The Philippine government is mandated to allocate most of its budget to education but allocates one of the lowest amounts among ASEAN countries. This causes problems in financing public schools.

3) To address financing problems, the Department of Education is focusing on improving education quality rather than increasing access by building more schools and hiring more teachers. It emphasizes resources like textbooks and teacher training.

Originalbeschreibung:

Originaltitel

topic no.14.pptx

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden1) Debt management refers to an unofficial agreement with unsecured creditors to repay debts over a fixed period of time, helping debtors clear debts at a lower monthly payment.

2) The Philippine government is mandated to allocate most of its budget to education but allocates one of the lowest amounts among ASEAN countries. This causes problems in financing public schools.

3) To address financing problems, the Department of Education is focusing on improving education quality rather than increasing access by building more schools and hiring more teachers. It emphasizes resources like textbooks and teacher training.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

31 Ansichten12 SeitenTopic No.14

Hochgeladen von

Neil Villas1) Debt management refers to an unofficial agreement with unsecured creditors to repay debts over a fixed period of time, helping debtors clear debts at a lower monthly payment.

2) The Philippine government is mandated to allocate most of its budget to education but allocates one of the lowest amounts among ASEAN countries. This causes problems in financing public schools.

3) To address financing problems, the Department of Education is focusing on improving education quality rather than increasing access by building more schools and hiring more teachers. It emphasizes resources like textbooks and teacher training.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 12

Debt Management

*Problems in financing public

education by the national

government

*How to get out of debt

HAZEL R. DIMARANAN

Debt Management

refers to an unofficial agreement with unsecured creditors for

repayment of debts over a specific time period, generally

extending the amount of time over which the debt will be paid

back.

The basic aim of debt management is, therefore, to help you

clear your debts at a compact level over a fixed time period

thus helping you make a new start with your finances.

Who can use debt management?

are facing a short term cash flow problem and believe

that their financial position will change in the near

future

are not able or do not want to take out any additional

loans or use their equity in their home

want to do away with the pressure from creditors

want to pay off all their debts but are struggling with

their present repayment schedule

Financing Public Education

1. Funding Sources

1.1.State and Local Funding. State governments provide a

national average of around 49 percent of their education

budgets using a combination of income taxes, corporate taxes,

sales taxes and fees. Local or county governments contribute

on average about 43 percent, typically using revenue from

local taxes from residential and commercial properties.

Financing Public Education

1.2.Federal Funding. The federal government contributes

the remaining 8 percent of the public education budget, a

percentage that has increased since 1990. This amounts to

$70 billion annually, which is equal to 3 percent of the total

federal budget. Much of this funding is discretionary, which

means that Congress sets the amount annually through the

appropriations process.

Distribution of Funds

Generally, funding formulas have two distinct parts that are used

exclusively or combined in some way: foundation funding ensures a

minimum amount per pupil, and categorical funding finances specific

tasks, facilities, and special programs. The formulas consider any

combination of factors, including median family income levels,

property values, teacher allocation, total student enrollment,

inflation and additional weighting for students with extra need,

like low-income, special education, English language learners or

low-performing students.

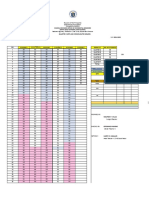

EDUCATION-PHILIPPINES:

Problems to Finance Public Schools

The Philippine Constitution has mandated the government

to allocate the highest proportion of its budget to

education. But, in reality, Philippines still has one of the

lowest budget allocations to education among the

ASEAN countries.

The education department admits it needs to build 21,000

classrooms and hire 10,000 teachers for public schools across

the country to fill the current shortfall, but the problem is

finding the money to fund this.

The Department of Education is also not only considering how to

increase access to education; it is concentrating more in improving the

quality of education, shifting further away from proposing additional

school buildings or new teachers and emphasizing instead more critical

inputs for education: textbooks, trainings, and better deployment.

The Commission on Higher Education is a Department of Education

component that has taken advantage of the new budget system. Last

year, in weeding out underperforming programs in state colleges, the

Commission cancelled 90 courses in 86 private and government state

colleges where the percentage of graduates passing exams for a license

was less than 3 percent.

“Although public elementary education is free, school-

related expenses like transportation fare, snacks, lunch,

school supplies and other learning materials are beyond the

financial capabilities of poor parents,” UNESCO said.

Out of every 100 Filipino schoolchildren enrolled every

year, 66 will complete elementary education, 42 will finish

high school but only 14 will earn a college degree, says the

Centre for Asia- Pacific Studies

How to Get Out of Debt

Step 1: Use this tool to find out how much debt you REALLY

have

Step 2: Choose your “plan of attack” for paying off

debt

Step 3: Freeze your credit card debt — literally — to

stop it from growing

Step 4: Ask for lower interest rates on your credit cards

— and negotiate other bills.

Step 5: Earn more money

Thank You

Das könnte Ihnen auch gefallen

- Toring J. Final ExamDokument5 SeitenToring J. Final ExamJessa Dela Rosa ToringNoch keine Bewertungen

- No Child Left Behind PolicyDokument19 SeitenNo Child Left Behind PolicyDeuterNoch keine Bewertungen

- CCPA - Eliminating Tuition and Compulsory Fees For Post-Secondary EducationDokument7 SeitenCCPA - Eliminating Tuition and Compulsory Fees For Post-Secondary EducationRBeaudryCCLENoch keine Bewertungen

- 11.20.2013 AQE 2014 Legislative Priorites EmbargoedDokument6 Seiten11.20.2013 AQE 2014 Legislative Priorites EmbargoedJon CampbellNoch keine Bewertungen

- Proposal A PaperDokument8 SeitenProposal A Paperapi-463713984Noch keine Bewertungen

- Toward Market Education: Are Vouchers or Tax Credits The Better Path?, Cato Policy Analysis No. 392Dokument18 SeitenToward Market Education: Are Vouchers or Tax Credits The Better Path?, Cato Policy Analysis No. 392Cato InstituteNoch keine Bewertungen

- Disadvantage AnswersDokument1 SeiteDisadvantage AnswersPriyanka SikkaNoch keine Bewertungen

- Innovative Options For Parents of Children in The Lowest Performing SchoolsDokument7 SeitenInnovative Options For Parents of Children in The Lowest Performing SchoolsCREWNoch keine Bewertungen

- Strat 244 EssayDokument5 SeitenStrat 244 EssayamyPolinarNoch keine Bewertungen

- E-HRD Unit-2Dokument54 SeitenE-HRD Unit-2Joshan ThomasNoch keine Bewertungen

- 10 Point Agenda of Sec Briones FinalDokument5 Seiten10 Point Agenda of Sec Briones FinalTodd BurgoiseNoch keine Bewertungen

- Description: Tags: ProposalDokument31 SeitenDescription: Tags: Proposalanon-694361Noch keine Bewertungen

- Chapter Six Financing EducationDokument8 SeitenChapter Six Financing EducationKaren May UrlandaNoch keine Bewertungen

- Chapter Six Financing EducationDokument8 SeitenChapter Six Financing EducationKaren May UrlandaNoch keine Bewertungen

- Education System Ass 3 EvaDokument3 SeitenEducation System Ass 3 EvaSamuel EveNoch keine Bewertungen

- Un Partenariat Public Prive Pour Reformer Leducation Aux PhilippinesDokument4 SeitenUn Partenariat Public Prive Pour Reformer Leducation Aux PhilippinesJessica Gonce AlcabazaNoch keine Bewertungen

- Superintendent Hicks: Letter To Governor CuomoDokument2 SeitenSuperintendent Hicks: Letter To Governor CuomoAlan BedenkoNoch keine Bewertungen

- Dinapoli Audit PDFDokument18 SeitenDinapoli Audit PDFChris BraggNoch keine Bewertungen

- Policy Brief: Early Childhood EducationDokument7 SeitenPolicy Brief: Early Childhood EducationRyan WestNoch keine Bewertungen

- Lecturer: Dr. Ruth Thinguri Email: OR Semester: January, May, Septemebr.2016 Venue: Virtual CampusDokument46 SeitenLecturer: Dr. Ruth Thinguri Email: OR Semester: January, May, Septemebr.2016 Venue: Virtual CampusBILASIO KOKONYA NAKAOYANoch keine Bewertungen

- EngDokument5 SeitenEngMary Shane DecenaNoch keine Bewertungen

- Financing Public EducationDokument11 SeitenFinancing Public EducationSan Eustacio Elementary SchoolNoch keine Bewertungen

- Oxford University Press - Pupil Premium Report - Making It WorkDokument20 SeitenOxford University Press - Pupil Premium Report - Making It WorkMatt GrantNoch keine Bewertungen

- Old Policies, New Ways To Fund PreschoolDokument5 SeitenOld Policies, New Ways To Fund Preschoolanilpandey_04Noch keine Bewertungen

- 2006 Assessment ReportDokument9 Seiten2006 Assessment ReportKrisnaff Connor QuitorianoNoch keine Bewertungen

- Sect1 2Dokument3 SeitenSect1 2losangelesNoch keine Bewertungen

- Economics in Education: Presented byDokument13 SeitenEconomics in Education: Presented byArul SamyNoch keine Bewertungen

- An Analysis On The Implementation of TheDokument11 SeitenAn Analysis On The Implementation of TheMaryJoylene De Arca ItangNoch keine Bewertungen

- Financing Education in Croatia: Ivana Batarelo, Željka Podrug, and Tome ApostoloskiDokument23 SeitenFinancing Education in Croatia: Ivana Batarelo, Željka Podrug, and Tome Apostoloskiivabat17Noch keine Bewertungen

- How State Funding Models Can Cause Educational InequalityDokument5 SeitenHow State Funding Models Can Cause Educational InequalityIjahss JournalNoch keine Bewertungen

- Rmmose - Lesson 5Dokument2 SeitenRmmose - Lesson 5Sherry MoseNoch keine Bewertungen

- For References CheckingDokument46 SeitenFor References CheckingSandra Pogoy AñascoNoch keine Bewertungen

- For References Checking - AngcoDokument43 SeitenFor References Checking - AngcoSandra Pogoy AñascoNoch keine Bewertungen

- A Fresh Look at School FundingDokument9 SeitenA Fresh Look at School FundingCenter for American ProgressNoch keine Bewertungen

- Department of Education: Since 2001, The AdministrationDokument5 SeitenDepartment of Education: Since 2001, The AdministrationlosangelesNoch keine Bewertungen

- Description: Tags: IntroductionDokument10 SeitenDescription: Tags: Introductionanon-748118Noch keine Bewertungen

- ISIP, Katrina Mae P. - Article Review (Chapter 1-5)Dokument5 SeitenISIP, Katrina Mae P. - Article Review (Chapter 1-5)katykat101001Noch keine Bewertungen

- Budget Pressures - Productivity - 3 Mar 11Dokument11 SeitenBudget Pressures - Productivity - 3 Mar 11GothamSchools.orgNoch keine Bewertungen

- Trump Higher Education ActDokument5 SeitenTrump Higher Education ActErin LaviolaNoch keine Bewertungen

- For References CheckingDokument46 SeitenFor References CheckingSandra Pogoy AñascoNoch keine Bewertungen

- Fighting Back Against Rising Tuition 1Dokument7 SeitenFighting Back Against Rising Tuition 1api-345124344Noch keine Bewertungen

- Budget Analysis and TrackingDokument32 SeitenBudget Analysis and TrackingNazish TariqNoch keine Bewertungen

- Chapter 2 4psDokument11 SeitenChapter 2 4psfatima b. coronel100% (1)

- Education LoanDokument56 SeitenEducation LoanSunil Kumar YadavNoch keine Bewertungen

- Financing Schools: Analysis and RecommendationsDokument20 SeitenFinancing Schools: Analysis and RecommendationsAmjad IbrahimNoch keine Bewertungen

- Susana Martinez'S Plan To Reform Education: "A Bold Agenda For Education in New Mexico"Dokument6 SeitenSusana Martinez'S Plan To Reform Education: "A Bold Agenda For Education in New Mexico"katenashreporterNoch keine Bewertungen

- On Right To EducationDokument17 SeitenOn Right To EducationH Janardan PrabhuNoch keine Bewertungen

- Financing Philippine EducationDokument34 SeitenFinancing Philippine EducationSARAH JANE NABORANoch keine Bewertungen

- Education LoanDokument29 SeitenEducation LoanPravesh Kumar Singh100% (2)

- Unit 4 Financial Management: ObjectivesDokument7 SeitenUnit 4 Financial Management: ObjectivesJeorgette GarroteNoch keine Bewertungen

- Description: Tags: Budget08-FactsheetDokument5 SeitenDescription: Tags: Budget08-Factsheetanon-203274Noch keine Bewertungen

- Description: Tags: 0126Dokument6 SeitenDescription: Tags: 0126anon-370062Noch keine Bewertungen

- Rmmose Lesson3Dokument2 SeitenRmmose Lesson3Sherry MoseNoch keine Bewertungen

- Finals Lesson6 Evaluate GradoDokument1 SeiteFinals Lesson6 Evaluate Gradolaicaely3Noch keine Bewertungen

- Chan King Fung UID: 2010152162 ECON0104TERM-PAPERSDokument7 SeitenChan King Fung UID: 2010152162 ECON0104TERM-PAPERSckf1022Noch keine Bewertungen

- Forecasting Mainstream School Funding: School Financial Success Guides, #5Von EverandForecasting Mainstream School Funding: School Financial Success Guides, #5Noch keine Bewertungen

- I. Executive SummaryDokument30 SeitenI. Executive SummarySteel HeartNoch keine Bewertungen

- Reflection On No Collection PolicyDokument4 SeitenReflection On No Collection PolicyJun Cueva Comeros67% (9)

- 828 Assignment 1Dokument19 Seiten828 Assignment 1Naem AhmadNoch keine Bewertungen

- WHLP Week67 Cluster BDokument5 SeitenWHLP Week67 Cluster BNeil VillasNoch keine Bewertungen

- Mps q2 Research2Dokument5 SeitenMps q2 Research2Neil VillasNoch keine Bewertungen

- DP For English Report TemplateDokument2 SeitenDP For English Report TemplateNeil VillasNoch keine Bewertungen

- Theoretical Models of Career Decision MakingDokument2 SeitenTheoretical Models of Career Decision Makingdeons neutronNoch keine Bewertungen

- Cluster B: No. of StudentsDokument5 SeitenCluster B: No. of StudentsNeil VillasNoch keine Bewertungen

- Mps q1 Research2Dokument5 SeitenMps q1 Research2Neil VillasNoch keine Bewertungen

- Theoretical Models of Career Decision MakingDokument2 SeitenTheoretical Models of Career Decision Makingdeons neutronNoch keine Bewertungen

- Mps q1 Research2Dokument5 SeitenMps q1 Research2Neil VillasNoch keine Bewertungen

- 02 - Team Roles For Activity (For Both Days)Dokument9 Seiten02 - Team Roles For Activity (For Both Days)Neil VillasNoch keine Bewertungen

- 05 - PBL Workshop - Day 2 (8am To 5pm) - SlidesDokument79 Seiten05 - PBL Workshop - Day 2 (8am To 5pm) - SlidesNeil VillasNoch keine Bewertungen

- Mps FG InqinvimmDokument5 SeitenMps FG InqinvimmNeil VillasNoch keine Bewertungen

- Mps q2 Research2Dokument5 SeitenMps q2 Research2Neil VillasNoch keine Bewertungen

- HG G12 Q1 Mod1 RTPDokument10 SeitenHG G12 Q1 Mod1 RTPAlysza Ashley M. Daep80% (5)

- 01 - PBL Workshop - Day 1 (1pm To 5pm) - SlidesDokument36 Seiten01 - PBL Workshop - Day 1 (1pm To 5pm) - SlidesNeil VillasNoch keine Bewertungen

- Population and Sampling Methods: Quarter 4 - Module 7Dokument1 SeitePopulation and Sampling Methods: Quarter 4 - Module 7Neil VillasNoch keine Bewertungen

- Day and Time Learning Area Learning Competencies Learning Tasks Mode of DeliveryDokument2 SeitenDay and Time Learning Area Learning Competencies Learning Tasks Mode of DeliveryNeil VillasNoch keine Bewertungen

- HG-G12 Module 2 RTPDokument10 SeitenHG-G12 Module 2 RTPelisa oliva78% (9)

- Homeroom Guidance: Quarter 2 - Module 4Dokument10 SeitenHomeroom Guidance: Quarter 2 - Module 4Eric Sapio67% (3)

- Homeroom Guidance: Quarter 1 - Module 3: Thinking Aloud My DecisionsDokument11 SeitenHomeroom Guidance: Quarter 1 - Module 3: Thinking Aloud My DecisionsDianne Joy Mina92% (13)

- Blic of The Philippines Department of Education Region IV-MIMAROPA Division of Occidental Mindoro Sta. Cruz, Occidental MindoroDokument1 SeiteBlic of The Philippines Department of Education Region IV-MIMAROPA Division of Occidental Mindoro Sta. Cruz, Occidental MindoroNeil VillasNoch keine Bewertungen

- Ldm2 Teachers Lac Session 1 Guide LAC Components Activity Suggested PeriodDokument2 SeitenLdm2 Teachers Lac Session 1 Guide LAC Components Activity Suggested Periodjhanie lapid100% (2)

- Sta - Cruz National High School: Republic of The PhilippinesDokument1 SeiteSta - Cruz National High School: Republic of The PhilippinesNeil VillasNoch keine Bewertungen

- LDM2 Module 1 - Course OrientationDokument9 SeitenLDM2 Module 1 - Course OrientationChelsea Macalia Yumul83% (36)

- Pertaskq2 Template 4Dokument3 SeitenPertaskq2 Template 4Neil VillasNoch keine Bewertungen

- Practical Research II PERFORMANCE TASK (50% of Your Grade) Computed and RecordedDokument2 SeitenPractical Research II PERFORMANCE TASK (50% of Your Grade) Computed and RecordedNeil VillasNoch keine Bewertungen

- Study Notebook Brief PDFDokument1 SeiteStudy Notebook Brief PDFJennylyn De Luna AlegreNoch keine Bewertungen

- Practical Research II PERFORMANCE TASK (50% of Your Grade) Computed and RecordedDokument2 SeitenPractical Research II PERFORMANCE TASK (50% of Your Grade) Computed and RecordedNeil VillasNoch keine Bewertungen

- Related Lit/Study #1 Related Lit/Study #2 Related Lit/Study #3Dokument2 SeitenRelated Lit/Study #1 Related Lit/Study #2 Related Lit/Study #3Neil VillasNoch keine Bewertungen

- Table of Specification Item Location: (Type Here)Dokument1 SeiteTable of Specification Item Location: (Type Here)Neil VillasNoch keine Bewertungen

- TOS - PR2 - Q2 - Summative Test 4Dokument2 SeitenTOS - PR2 - Q2 - Summative Test 4Neil VillasNoch keine Bewertungen

- Learning Packet (CAE19) BSA 3Dokument36 SeitenLearning Packet (CAE19) BSA 3Judy Anne RamirezNoch keine Bewertungen

- Europass CV Lokesh NandreDokument5 SeitenEuropass CV Lokesh NandreAbhishek Ajay DeshpandeNoch keine Bewertungen

- NCM 103 Lec Week 1 Midterm What Is NursingDokument10 SeitenNCM 103 Lec Week 1 Midterm What Is NursingKhream Harvie OcampoNoch keine Bewertungen

- 0408 - s23 - QP - 22 - World LiteratureDokument4 Seiten0408 - s23 - QP - 22 - World LiteratureAzrin AzNoch keine Bewertungen

- Bohol Mil q3 PLP Wk2Dokument7 SeitenBohol Mil q3 PLP Wk2Nelia AbuevaNoch keine Bewertungen

- Nico Krisch (Eds) - Entangled Legalities Beyond The StateDokument522 SeitenNico Krisch (Eds) - Entangled Legalities Beyond The StateRoddy89Noch keine Bewertungen

- Policy and Procedure Manual: (A Unit of Hindustan Group of Institutions)Dokument77 SeitenPolicy and Procedure Manual: (A Unit of Hindustan Group of Institutions)Sairam SaiNoch keine Bewertungen

- MCRJVolume23No.32017 ConstructionprocurementsystemsDokument18 SeitenMCRJVolume23No.32017 ConstructionprocurementsystemsLew ClementNoch keine Bewertungen

- Consti 2 Equal ProtectionDokument8 SeitenConsti 2 Equal ProtectionKim Jan Navata BatecanNoch keine Bewertungen

- Brett ResumeDokument3 SeitenBrett Resumeapi-333058526Noch keine Bewertungen

- ZGE 4301 CSAH - M10 Activity No. 1 FT Climate ChangeDokument10 SeitenZGE 4301 CSAH - M10 Activity No. 1 FT Climate ChangeMark Joshua PasicolanNoch keine Bewertungen

- NOIDADokument7 SeitenNOIDAMlivia DcruzeNoch keine Bewertungen

- Worksheet No. 4.1A Detailed Lesson Plan in Eim T. V. L.: I. ObjectivesDokument3 SeitenWorksheet No. 4.1A Detailed Lesson Plan in Eim T. V. L.: I. Objectivesramel gedorNoch keine Bewertungen

- Correct Answer: RA 7160Dokument5 SeitenCorrect Answer: RA 7160Tom CuencaNoch keine Bewertungen

- Accredited Medical Provider: BATCH 2025Dokument3 SeitenAccredited Medical Provider: BATCH 2025CharlesNoch keine Bewertungen

- BSI ISO 50001 Case Study Sheffield Hallam University UK EN PDFDokument2 SeitenBSI ISO 50001 Case Study Sheffield Hallam University UK EN PDFfacundoNoch keine Bewertungen

- 016 - Task 1 - My IELTS Classroom Writing Answer SheetDokument2 Seiten016 - Task 1 - My IELTS Classroom Writing Answer Sheetfakeusername2022Noch keine Bewertungen

- Law Case Study AnalysisDokument3 SeitenLaw Case Study Analysisapi-323713948Noch keine Bewertungen

- Chapter 2 Taking Charge of Your Health: Lesson 1 Building Health SkillsDokument2 SeitenChapter 2 Taking Charge of Your Health: Lesson 1 Building Health SkillsEthan DennisonNoch keine Bewertungen

- MUHAMMAD AFFAN BASHIR (SR Reliability Engineer)Dokument2 SeitenMUHAMMAD AFFAN BASHIR (SR Reliability Engineer)darff45Noch keine Bewertungen

- 8 класс планDokument2 Seiten8 класс планmukhtar6103Noch keine Bewertungen

- Lopena RPH Page 1 25 ReviewerDokument2 SeitenLopena RPH Page 1 25 ReviewerchingchongNoch keine Bewertungen

- All PDF Class 11Dokument27 SeitenAll PDF Class 11ngiri071067Noch keine Bewertungen

- Engineeringstandards 150416152325 Conversion Gate01Dokument42 SeitenEngineeringstandards 150416152325 Conversion Gate01Dauødhårø Deivis100% (2)

- 071 Firouzeh SepehrianazarDokument6 Seiten071 Firouzeh SepehrianazarТеодора ДелићNoch keine Bewertungen

- Ia 1Dokument8 SeitenIa 1Tushar SinghviNoch keine Bewertungen

- Human Rights Chap 6-9Dokument14 SeitenHuman Rights Chap 6-9Lucky VastardNoch keine Bewertungen

- Answer Keys: Division of City Schools-Manila Gen. Emilio Aguinaldo Integrated School Punta, Sta. AnaDokument6 SeitenAnswer Keys: Division of City Schools-Manila Gen. Emilio Aguinaldo Integrated School Punta, Sta. AnaJennina Bordeos MazoNoch keine Bewertungen

- Course Syllabus - Cooking Theory Sept09Dokument20 SeitenCourse Syllabus - Cooking Theory Sept09jermsemail0204Noch keine Bewertungen

- Job Description Associate Attorney 2019Dokument5 SeitenJob Description Associate Attorney 2019SAI SUVEDHYA RNoch keine Bewertungen