Beruflich Dokumente

Kultur Dokumente

Beyond NPV & IRR: Touching On Intangibles: Economic Evaluation of Upstream Technology

Hochgeladen von

Biswarup BandyopadhyayOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Beyond NPV & IRR: Touching On Intangibles: Economic Evaluation of Upstream Technology

Hochgeladen von

Biswarup BandyopadhyayCopyright:

Verfügbare Formate

Economic Evaluation of Upstream Technology

Beyond NPV & IRR: touching on intangibles

Massimo Antonelli Paolo Boi

Alberto F. Marsala Dean Cecil Bahr

Nicola De Blasio Lorenzo Dondi

Giorgio Vicini Andrea Mastropietro

Vincenzo Di Giulio Edoardo Patriarca

Budi Permana

Kokok Prihandoko

Ramin Soltani

Yermek Zhakashev

Eni Corporate University Scuola Mattei

Beyond NPV & IRR

1. Alternative indicators for tangibles

2. Intangible benefits

3. Conclusions

Eni Corporate University Scuola Mattei

Beyond NPV & IRR

1. Other indicators for tangibles

2. Intangible benefits

3. Conclusions

Eni Corporate University Scuola Mattei

1. Other indicators for tangibles

COST SAVING

• incremental NPV / R&D costs

• average incremental NPV per application / average application costs

• potential cost saving per application / R&D costs

• potential cost saving per application / application costs

PRODUCTION INCREASE

• value of average incremental production per application / R&D cost

• value of average incremental production per application / application costs

EXPECTED LIFE OF THE TECHNOLOGY

• R&D costs / expected life of the technology

• expected life of the technology / years of R&D

Eni Corporate University Scuola Mattei

Other indicators for tangibles

LOW PRICE SCENARIO - 18 $/bbl

MULTIPHASE MULTIPHASE

CROSSWELL EXPANDABLE

BOOSTING BOOSTING

SEISMIC TECHNOLOGIES

COST SAVING OFFSHORE ONSHORE

incremental NPV

incremental NPV/ R&D

/ R&D costs

costs 19,14 8,20 0,20 0,07

avrg incremental NPV per appl. / avrg appl. costs 59,44 n.a. 0,94 1,54

potential cost saving per appl. / R&D costs 0,49 0,03 0,31 0,00

potential cost saving per appl. / appl. costs 1,52 n.a. 1,47 0,00

MULTIPHASE MULTIPHASE

CROSSWELL EXPANDABLE

BOOSTING BOOSTING

SEISMIC TECHNOLOGIES

PRODUCTION INCREASE OFFSHORE ONSHORE

value ofavrg

value of avrgdelta

delta production

production perper appl.

appl. / R&D

/ R&D costscosts 13,08 39,00 0,26 0,21

value of avrg delta production per appl. / application costs 40,64 n.a. 1,25 4,75

MULTIPHASE MULTIPHASE

CROSSWELL EXPANDABLE

BOOSTING BOOSTING

SEISMIC TECHNOLOGIES

EXPECTED LIFE OF THE TECHNOLOGY OFFSHORE ONSHORE

R&D costs/ /expected

R&D costs expected lifelife

of of

thethe technology

technology [k€/anno]

[k€/anno] 103,32 48,72 2,79 1,63

expected life of the technology / years of R&D 5 10 0,79 0,79

Eni Corporate University Scuola Mattei

Beyond NPV & IRR: intangible assessment

1. Other indicators for tangibles

2. Intangible benefits

3. Conclusions

Eni Corporate University Scuola Mattei

How to Measure Intangibles

Market Capitalization

Return on Invested Capital

Scorecards

Direct Measure of Intellectual Capital

Brand Valuation

Eni Corporate University Scuola Mattei

How to Evaluate Intangibles

Market Capitalization

Measure of the difference between a company’s market

capitalization and book value

at Corporate level

Return on Invested Capital

Scorecards

Direct Measure of Intellectual Capital

Brand Valuation

Eni Corporate University Scuola Mattei

How to Evaluate Intangibles

Market Capitalization

Return on Invested Capital

Comparison berween the ROIC of the firm and an industry

reference index. The spread gives the value creation capabilities

of Intangible assets of the firm

at Corporate level

Scorecards

Direct Measure of Intellectual Capital

Brand Valuation

Eni Corporate University Scuola Mattei

How to Evaluate Intangibles

Market Capitalization

Return on Invested Capital

Scorecards

It allows to define a rating of Intangible assets on the basis of a set

of key parameters (indicators) set for a specific asset

Specific to Single Asset

Direct Measure of Intellectual Capital

Brand Valuation

Eni Corporate University Scuola Mattei

How to Evaluate Intangibles

Market Capitalization

Return on Invested Capital

Scorecards

Direct Measure of Intellectual Capital

Tries to identify the whole cash flows connected with a specific

intangible asset

Specific to Single Asset

Brand Valuation

Eni Corporate University Scuola Mattei

How to Evaluate Intangibles

Market Capitalization

Return on Invested Capital

Scorecards

Direct Measure of Intellectual Capital

Brand Valuation

Focused on a single intangible asset: the Brand (Company image)

at Company level

Eni Corporate University Scuola Mattei

Beyond NPV & IRR: intangible assessment

1. Other indicators for tangibles

2. Intangible benefits

3. Conclusions

Eni Corporate University Scuola Mattei

2. Intangible benefits

Rating system for intangible ASSESSMENT DELLE RICADUTE "INTANGIBLES" DEI PROGETTI DI RICERCA E SVILUPPO

benefits CROSSWELL SEISMIC VALUTAZIONE GLOBALE 1-5 4,45

1 IMPORTANZA STRATEGICA DELLA TECNOLOGIA 4,60

1.1 RILEVANZA NEL PIANO STRATEGICO

Intangible assessment - La tecnologia in questione è parte integrante del piano di business aziendale?

- Lo sviluppo della tecnologia rientra in piani di sviluppo più ampi?

- I risultati attesi della R&D potrebbero causare anche cambiamenti organizzativi (ex. nuove divisioni…)?

- L’azienda mira ad acquisire una posizione di leadership in questa tecnologia?

VALUTAZIONE 1-5 MEDIA PESATA

A qualitative valuation of

4,0 0,80

1.2 RILEVANZA SUL BUSINESS ATTUALE

intangible benefits for different - Esistono problemi che la compagnia può risolvere solo con questa tecnologia?

- Il mancato sviluppo della tecnologia potrebbe provocare un gap competitivo per la azienda?

technologies based on an - La tecnologia rafforza la posizione aziendale in un’area tecnica in cui era carente?

- La tecnologia sotto studio permetterà di:

Affacciarsi su nuovi mercati, in nuovi ambiti competitivi?

assessment methodology. Fornire nuovi servizi/prodotti?

Far crescere il business attuale?

Collaborare in partnership strategiche?

This methodology allows us to VALUTAZIONE 1-5 MEDIA PESATA

rank technologies based on 5,0

1.3 RILEVANZA SUL BUSINESS POTENZIALE

1,50

their relative contribution to - Quante applicazioni della tecnologia sono previste in futuro?

- Per quale arco di tempo si pensa di ottenere benefici dalla tecnologia?

total corporate intangible value. - Esiste una tecnologia equivalente all’esterno? E’possibile acquistarla?

- Sarà possibile in seguito vendere la tecnologia?

VALUTAZIONE 1-5 MEDIA PESATA

5,0 1,50

Eni Corporate University Scuola Mattei

Intangible assessment

Strategic relevance of the technology (strategy)

• Relevance in strategic plan

• Relevance in current business

• Relevance on potential business

• Synergy effects on overall portfolio

Visibility, reputation, partnership (external)

• Partnership

• Visibility

• HSE & Social

• Excellence level

Corporate know-how improvement (internal)

• Level of technology innovation

• Information sharing

• Ownership - IP

Eni Corporate University Scuola Mattei

Intangible assessment

GLOBAL

4,45 EVALUATION

1 STRATEGIC RELEVANCE OF THE TECHNOLOGY EVALUATION 1-5 0,33

0,33 4,60

1.1 RELEVANCE IN STRATEGIC PLAN 4,0 micro peso 0,20

1.2 RELEVANCE IN CURRENT BUSINESS 5,0 micro peso 0,30

1.3 RELEVANCE ON POTENTIAL BUSINESS 5,0 micro peso 0,30

1.4 SYNERGY EFFECTS ON OVERALL PORTFOLIO 4,0 micro peso 0,20

2 VISIBILITY, REPUTATION, PARTNERSHIP 0,33 4,25

2.1 PARTNERSHIP 4,0 micro peso 0,35

2.2 VISIBILITY 5,0 micro peso 0,35

2.3 SOCIAL REPUTATION 1,0 micro peso 0,10 WEIGHTS

2.4 EXCELLENCE LEVEL 5,0 micro peso 0,20

3 CORPORATE KNOW-HOW IMPROVEMENT 0,33 4,50

3.1 LEVEL OF TECHNOLOGY INFORMATION 5,0 micro peso 0,50

3.2 INFORMATION SHARING 4,0 micro peso 0,25

3.3 CHANGES IN INTERNAL STRUCTURE 4,0 micro peso 0,25

Eni Corporate University Scuola Mattei

Intangible assessment

Strategic relevance

4

CROSSWELL SEISMIC

(4,45)

3

EXPANDABLE 2

TECHNOLOGIES

(3,65) MULTIPHASE

1 BOOSTING

(1,77)

Know-how improvement Visibility, reputation, partnership

Eni Corporate University Scuola Mattei

How to quantify intangibles

After generating a ranking of the technology, we estimated the

contribution of each technology to the total intangible value of the portfolio

But… what is the whole intangible value of the technology portfolio?

We assumed 3 different values for overall intangibles

- R&D expenses (100 mln € per year, structure costs included)

- 3 % of E&P revenues

- 5 % of E&P revenues

Eni Corporate University Scuola Mattei

How to quantify intangibles

By means of the rating obtained under the “Intangible Assessment”

procedure, we can try to distribute intangible value of R&D over the

three technologies considered

Intangible Values (million €)

Technology 5% E&P Income 3% E&P income 100 million €

Crosswell Seismic 330 198 43

Multiphase Boosting 128 77 17

Expandable Technologies 269 161 35

Eni Corporate University Scuola Mattei

Putting it all together – total value of technology

Crosswell Seismic - Scenario 1C

19500

14500

9500

4500

-500

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

Flussi economici [k€] Valore intangibile Crossw ell S. [k€]

Tangibles only With intangibles

IRR 460% IRR 735%

NPV 58 mill € NPV 101 mill €

Eni Corporate University Scuola Mattei

Beyond NPV & IRR: intangible assessment

1. Other indicators for tangibles

2. Intangible benefits

3. Conclusions

Eni Corporate University Scuola Mattei

3. Conclusions

It is challenging to find a simple method to assess the value of an R&D

project taking into account intangible and tangible values

It is useful taking into account a combination of different assessment

methodologies in order to estimate the overall value of a technology.

NPV

INDICATORS

IRR

INTANGIBLE

ASSESSMENT

Eni Corporate University Scuola Mattei

Thank you for your attention

Eni Corporate University Scuola Mattei

Das könnte Ihnen auch gefallen

- BlueOceanStrategy - v1.0 - 2021-ShareDokument49 SeitenBlueOceanStrategy - v1.0 - 2021-ShareAdithya MNoch keine Bewertungen

- Lean Management in Apparel ManufacturingDokument7 SeitenLean Management in Apparel Manufacturingabineshm1310Noch keine Bewertungen

- R&D Lorenzo-Siciliano ENIDokument11 SeitenR&D Lorenzo-Siciliano ENIinterponNoch keine Bewertungen

- Champions Trophy: Industry 4.0Dokument13 SeitenChampions Trophy: Industry 4.0Uday SharmaNoch keine Bewertungen

- BIRL BroschureDokument2 SeitenBIRL Broschurepraveendj2011Noch keine Bewertungen

- Advance Equity Research and ValuationDokument4 SeitenAdvance Equity Research and ValuationELO OPSNoch keine Bewertungen

- Chapter 1 NotesDokument8 SeitenChapter 1 NotesZakariya PkNoch keine Bewertungen

- Production Function - EcoDokument44 SeitenProduction Function - Ecodeepsonu15685Noch keine Bewertungen

- RPCPPE ICT EquipmentDokument1 SeiteRPCPPE ICT Equipmentjasmin Catong50% (2)

- Qua Sep 2022 QM0922Dokument55 SeitenQua Sep 2022 QM0922Ismal AdrianNoch keine Bewertungen

- DPR1Dokument35 SeitenDPR1muthum44499335Noch keine Bewertungen

- Ikm Besut: Business PlanDokument17 SeitenIkm Besut: Business PlanAriq Ariq DariusNoch keine Bewertungen

- TBA320 - Rob Akershoek - Traceability Is The New SuperpowerDokument25 SeitenTBA320 - Rob Akershoek - Traceability Is The New SuperpowerMostafa MirbabaieNoch keine Bewertungen

- 10 BPDokument13 Seiten10 BPDewi AnggraeniNoch keine Bewertungen

- Accelerate The Vehicle Development ProcessDokument41 SeitenAccelerate The Vehicle Development ProcesselectronarutoNoch keine Bewertungen

- ICEF 2020 Keynote Prith BanerjeeDokument23 SeitenICEF 2020 Keynote Prith BanerjeeSai Santhosh ManepallyNoch keine Bewertungen

- qr2 DavidrainfordDokument27 Seitenqr2 DavidrainfordDavinder MankuNoch keine Bewertungen

- 1574823975divya Jadi Booti Supplement 3Dokument16 Seiten1574823975divya Jadi Booti Supplement 3Kumar SwamyNoch keine Bewertungen

- Center of Excellence (CoEs)Dokument16 SeitenCenter of Excellence (CoEs)Eswaramoorthy K VNoch keine Bewertungen

- International Financial Management: Presented To: Prof - ParshuramanDokument27 SeitenInternational Financial Management: Presented To: Prof - ParshuramanNiveet SrivastavaNoch keine Bewertungen

- Theory of CostDokument5 SeitenTheory of CostPyanka RajputNoch keine Bewertungen

- Blackberry - Scenario AnalysisDokument28 SeitenBlackberry - Scenario AnalysisMuraliNoch keine Bewertungen

- Sharing - Session - Petroleum Economic - 1 Page Back To BackDokument34 SeitenSharing - Session - Petroleum Economic - 1 Page Back To BacksidNoch keine Bewertungen

- BAJA RestraintDokument2 SeitenBAJA Restraintadharb21Noch keine Bewertungen

- Aai Summit 03-InardDokument16 SeitenAai Summit 03-InardBeben TangkilNoch keine Bewertungen

- World Class ManufacturingDokument32 SeitenWorld Class ManufacturingUng Kok Aik100% (1)

- Submitted By: Himanshu Rawat Submitted To:Dr. Pallavi DawraDokument16 SeitenSubmitted By: Himanshu Rawat Submitted To:Dr. Pallavi DawraHIMANSHU RAWATNoch keine Bewertungen

- R&D Expense As A Percentage of Total Revenue: Sample Content & Da TADokument4 SeitenR&D Expense As A Percentage of Total Revenue: Sample Content & Da TAGabriel FreitasNoch keine Bewertungen

- Parallel Session 8 IRF Zev ArnoldDokument6 SeitenParallel Session 8 IRF Zev ArnoldasdasdNoch keine Bewertungen

- Project Report: Detective EyeDokument10 SeitenProject Report: Detective EyeFarooqChaudharyNoch keine Bewertungen

- Audit Background: National Fire Service College, Nagpur-2019Dokument165 SeitenAudit Background: National Fire Service College, Nagpur-2019Mohit DeshmukhNoch keine Bewertungen

- Presentation - Battery & ChargerDokument91 SeitenPresentation - Battery & ChargerArun das100% (1)

- Maintenance Reliability Industry 4.0 SKFDokument21 SeitenMaintenance Reliability Industry 4.0 SKFJoão Miguel ViegasNoch keine Bewertungen

- Dokumen - Tips - k3 Cost Benefit Analysis RevDokument35 SeitenDokumen - Tips - k3 Cost Benefit Analysis RevBagas Nawastu AlviantoNoch keine Bewertungen

- SuperTech CatalogueDokument6 SeitenSuperTech Cataloguetutorgurjeetdhillon90Noch keine Bewertungen

- New Engagement Models For Next Generation Technology Nodes: Critical Factors For SuccessDokument16 SeitenNew Engagement Models For Next Generation Technology Nodes: Critical Factors For SuccessdenghueiNoch keine Bewertungen

- Cost Evaluation StudyDokument29 SeitenCost Evaluation StudyMo ZeroNoch keine Bewertungen

- Strategy MappingDokument6 SeitenStrategy MappingLuis Carlos RodriguezNoch keine Bewertungen

- Biz Plan (KAIGO)Dokument6 SeitenBiz Plan (KAIGO)gau shresNoch keine Bewertungen

- Idle Capacity and Management: BE PresentationDokument15 SeitenIdle Capacity and Management: BE PresentationBhawna GosainNoch keine Bewertungen

- Maf Seminar Slide SyafDokument19 SeitenMaf Seminar Slide SyafNur SyafiqahNoch keine Bewertungen

- Market PotentialDokument41 SeitenMarket Potentialnadjib62Noch keine Bewertungen

- 1 2 Overview WP EcuadorDokument10 Seiten1 2 Overview WP EcuadorLuis RamirezNoch keine Bewertungen

- Silicon Valley PortfolioDokument2 SeitenSilicon Valley PortfolioAzif K MohammedNoch keine Bewertungen

- Rubric 2 - Industry Supervisor - Presentation Evaluation FormDokument4 SeitenRubric 2 - Industry Supervisor - Presentation Evaluation FormwanNoch keine Bewertungen

- Telemanagement Forum (TMF) Ngoss and EtomDokument25 SeitenTelemanagement Forum (TMF) Ngoss and EtomkuvvetliNoch keine Bewertungen

- CostDokument4 SeitenCostMoayad EhabNoch keine Bewertungen

- Quality 4.0 Digital Transformation of Quality ManagementDokument50 SeitenQuality 4.0 Digital Transformation of Quality ManagementAYOUB DAOUIMNoch keine Bewertungen

- Swami Generation and Screening of IdeaDokument38 SeitenSwami Generation and Screening of IdeaShifali AgrawalNoch keine Bewertungen

- How To Reduce Cost of Quality With Industry 4.0 - DeckDokument20 SeitenHow To Reduce Cost of Quality With Industry 4.0 - DeckSalvador DiazNoch keine Bewertungen

- Futsal Brazil by Altaf JahangirDokument11 SeitenFutsal Brazil by Altaf JahangirAltaf JahangirNoch keine Bewertungen

- TruEarth Case AnalysisDokument53 SeitenTruEarth Case Analysisneeraj_ghs679Noch keine Bewertungen

- Rooms Division and Facility ManagementDokument24 SeitenRooms Division and Facility ManagementSnehasis MondalNoch keine Bewertungen

- ABradic Product Development FIDokument12 SeitenABradic Product Development FIFounder InstituteNoch keine Bewertungen

- The Tryton Holdings Compressed 1Dokument55 SeitenThe Tryton Holdings Compressed 1api-701733288Noch keine Bewertungen

- The Road To Zero PrototypesDokument33 SeitenThe Road To Zero PrototypesProvocateur SamaraNoch keine Bewertungen

- Technical Proposal For Priority 1 Metering Points Site SurveyDokument11 SeitenTechnical Proposal For Priority 1 Metering Points Site SurveyMOSES EDWINNoch keine Bewertungen

- Different Type of Costs.Dokument21 SeitenDifferent Type of Costs.Syed Tauseef RazaNoch keine Bewertungen

- Formal Verification: An Essential Toolkit for Modern VLSI DesignVon EverandFormal Verification: An Essential Toolkit for Modern VLSI DesignNoch keine Bewertungen

- Practical Test Design: Selection of traditional and automated test design techniquesVon EverandPractical Test Design: Selection of traditional and automated test design techniquesNoch keine Bewertungen

- Emhart Inspection Defect GuideDokument1 SeiteEmhart Inspection Defect GuideBryan Nadimpally75% (4)

- G95me c10 5Dokument4 SeitenG95me c10 5KyinaNoch keine Bewertungen

- NAA Standard For The Storage of Archival RecordsDokument17 SeitenNAA Standard For The Storage of Archival RecordsickoNoch keine Bewertungen

- Linear Algebra 2: Final Test Exam (Sample) : T: V V A Linear TransformationDokument3 SeitenLinear Algebra 2: Final Test Exam (Sample) : T: V V A Linear TransformationDavidNoch keine Bewertungen

- Elektor Electronics 1998-10Dokument54 SeitenElektor Electronics 1998-10Adrian_Andrei_4433Noch keine Bewertungen

- A510 Instruction Manual PDFDokument459 SeitenA510 Instruction Manual PDFPhops FrealNoch keine Bewertungen

- CAAM-Drone Requirement 2020Dokument6 SeitenCAAM-Drone Requirement 2020nasser4858Noch keine Bewertungen

- Polytec Vibrometer Controller OFV-5000Dokument121 SeitenPolytec Vibrometer Controller OFV-5000vnetawzNoch keine Bewertungen

- Leak Off Test: - Procedure - Maasp - Maximum Allowable Mud WeightDokument5 SeitenLeak Off Test: - Procedure - Maasp - Maximum Allowable Mud Weighteng20072007Noch keine Bewertungen

- Soil Classification and Crop Recommendation SystemDokument4 SeitenSoil Classification and Crop Recommendation SystemInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Supply Chain ManagementDokument16 SeitenSupply Chain ManagementHaider AyyNoch keine Bewertungen

- Ibs Kota Bharu 1 30/06/22Dokument7 SeitenIbs Kota Bharu 1 30/06/22Nik Suraya IbrahimNoch keine Bewertungen

- Discrete Mathematics - Propositional LogicDokument8 SeitenDiscrete Mathematics - Propositional LogicAldrich PanioNoch keine Bewertungen

- SBxx-1SP-US-40-IA-xx-16 Instruct ManDokument224 SeitenSBxx-1SP-US-40-IA-xx-16 Instruct ManSmellyDog360Noch keine Bewertungen

- TÜV Rheinland Academy: 2021 Professional Training Schedule - Virtual ClassroomDokument3 SeitenTÜV Rheinland Academy: 2021 Professional Training Schedule - Virtual ClassroomAaron ValdezNoch keine Bewertungen

- Purposive Communication AssignmentDokument2 SeitenPurposive Communication AssignmentJohn Warren MestiolaNoch keine Bewertungen

- Oracle Audit Vault and Database FirewallDokument16 SeitenOracle Audit Vault and Database FirewallRofiq AhmedNoch keine Bewertungen

- C1 Unit 2Dokument4 SeitenC1 Unit 2Omar AlfaroNoch keine Bewertungen

- Carrier AggregationDokument40 SeitenCarrier Aggregationmonel_24671Noch keine Bewertungen

- Avamar-4.1-Technical-Addendum. Avamar Commandspdf PDFDokument537 SeitenAvamar-4.1-Technical-Addendum. Avamar Commandspdf PDFdanilaix50% (2)

- General Purpose Relay: TA, TR Series Part Number DescriptionDokument17 SeitenGeneral Purpose Relay: TA, TR Series Part Number DescriptionMIKENoch keine Bewertungen

- Cama BajaDokument32 SeitenCama BajaCarlosSilvaYruretaNoch keine Bewertungen

- BargeboardsDokument1 SeiteBargeboardsDavid O'MearaNoch keine Bewertungen

- PD2083-EL-HAZ-A1-004.pdf HAZARDOUS AREA CLASSIFICATION SV STATION-3Dokument1 SeitePD2083-EL-HAZ-A1-004.pdf HAZARDOUS AREA CLASSIFICATION SV STATION-3Alla Naveen KumarNoch keine Bewertungen

- Virtual Museums A Survey and Some IssuesDokument9 SeitenVirtual Museums A Survey and Some IssuesCeaser SaidNoch keine Bewertungen

- Selection of Competencies Requiring Ict IntegrationDokument27 SeitenSelection of Competencies Requiring Ict IntegrationMarShel Vlogs100% (1)

- Lecture-3 (Design Methods)Dokument26 SeitenLecture-3 (Design Methods)Mohsin IqbalNoch keine Bewertungen

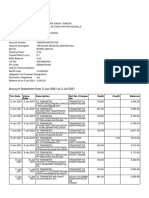

- Account Statement From 3 Jan 2021 To 3 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument8 SeitenAccount Statement From 3 Jan 2021 To 3 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSanatan ThakurNoch keine Bewertungen

- Running IDokument3 SeitenRunning IQuality Design & ConstructionNoch keine Bewertungen

- 4150 70-37-3 Requirement AnalysisDokument71 Seiten4150 70-37-3 Requirement AnalysisSreenath SreeNoch keine Bewertungen