Beruflich Dokumente

Kultur Dokumente

Accounting Process Cycle

Hochgeladen von

chandra sekhar Tippreddy100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

27 Ansichten12 Seitenfollw above link

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenfollw above link

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

27 Ansichten12 SeitenAccounting Process Cycle

Hochgeladen von

chandra sekhar Tippreddyfollw above link

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 12

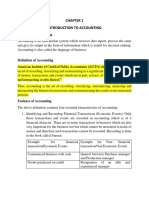

Accounting Process Cycle.

There Are 9 steps to be followed

1.Identifying and Analyzing

Business Transactions

The accounting process starts with identifying and

analyzing business transactions and events.

Not all transactions and events are entered into the

accounting system. Only those that included to the

business environment are included in the process.

For example, a personal loan made by the owner that

does not have anything to do with the business is not

accounted for.

2. Recording in the Journals.

Journals are also known as Books of Original

Entry.

A journal is a book – paper or Computer in

which transactions are recorded.

Business transactions are recorded using the

double-entry bookkeeping system.

3. Posting to the Ledger.

Also known as Books of Final Entry, the ledger

is a collection of accounts that shows the

changes made to each account as a result of

past transactions, and their current balances.

After the posting all transactions to the ledger,

the balances of each account can be

determined.

4. Unadjusted Trial Balance.

A trial balance is prepared to test the equality

of the debits and credits.

All account balances are extracted from the

ledger and arranged in one report.

Afterwards, all debit balances are added. All

credit balances are also added. Total debits

should be equal to total credits.

5. Adjusting Entries.

Adjusting entries are prepared as an

application of the accrual basis of accounting.

At the end of the accounting period, some

expenses may have been incurred but not yet

recorded in the journals. Some income may

have been earned but not entered in the

books.

6. Adjusted Trial Balance.

An adjusted trial balance may be prepared

after adjusting entries are made and before

the financial statements are prepared.

This is to test if the debits are equal to credits

after adjusting entries are made.

7. Financial Statements.

When the accounts are already up-

to-date and equality between the debits and

credits have been tested, the financial

statements can now be prepared.

The financial statements are the end-

products of an accounting system.

8. Closing Entries.

Temporary or nominal accounts, income

statement accounts, are closed to prepare the

system for the next accounting period.

Temporary accounts include income, expense,

and withdrawal accounts. These items are

measured periodically.

9. Post-Closing Trial Balance.

In the accounting cycle, the last step is to

prepare a post-closing trial balance.

It is prepared to test the equality of debits

and credits after closing entries are made.

Since temporary accounts are already closed

at this point, the post-closing trial balance

contains real accounts only.

10. Reversing Entries (It Is

Optional Step)

Reversing entries are optional. They are

prepared at the beginning of the new

accounting period to facilitate a smoother and

more consistent recording process.

Das könnte Ihnen auch gefallen

- Entity Level ControlsDokument45 SeitenEntity Level ControlsNiraj AlltimeNoch keine Bewertungen

- COBOL/400 Tutorial: Basics of COBOL/400 ProgrammingDokument208 SeitenCOBOL/400 Tutorial: Basics of COBOL/400 Programmingchandra sekhar TippreddyNoch keine Bewertungen

- The Accounting Cycle: 9-Step Accounting Process InshareDokument3 SeitenThe Accounting Cycle: 9-Step Accounting Process InshareBTS ARMYNoch keine Bewertungen

- Accounting Cycle StepsDokument3 SeitenAccounting Cycle Stepsjewelmir100% (1)

- Accounts 1Dokument14 SeitenAccounts 1Piyush PatelNoch keine Bewertungen

- FINANCIAL ACCOUNTING PART 1: DEFINING, HISTORY & USERSDokument22 SeitenFINANCIAL ACCOUNTING PART 1: DEFINING, HISTORY & USERSJan Paulene RiosaNoch keine Bewertungen

- Introduction to Accounting LectureDokument15 SeitenIntroduction to Accounting LectureMary FolawumiNoch keine Bewertungen

- BBA 1st Sem. FULL SYLLABUS Basic AccountingDokument115 SeitenBBA 1st Sem. FULL SYLLABUS Basic AccountingYash KhattriNoch keine Bewertungen

- Accounts-Cls Notes 1Dokument8 SeitenAccounts-Cls Notes 1AmritMohantyNoch keine Bewertungen

- Unit 1. Introduction To Accounting and Business 1.1Dokument25 SeitenUnit 1. Introduction To Accounting and Business 1.1Qabsoo FiniinsaaNoch keine Bewertungen

- Intro to Accounting FundamentalsDokument14 SeitenIntro to Accounting FundamentalssimmysinghNoch keine Bewertungen

- Accounting and Finance For Managers - Course Material PDFDokument94 SeitenAccounting and Finance For Managers - Course Material PDFbil gossayw100% (1)

- Financial Accounting NotesDokument44 SeitenFinancial Accounting NotesVansh TayalNoch keine Bewertungen

- Unit I MaterialDokument40 SeitenUnit I Materialarun kumarNoch keine Bewertungen

- Accounting Concepts, Conventions & PrinciplesDokument34 SeitenAccounting Concepts, Conventions & PrincipleskaleabNoch keine Bewertungen

- Accounting Principle From 1 To 10Dokument10 SeitenAccounting Principle From 1 To 10trishqNoch keine Bewertungen

- Chap 1-4Dokument20 SeitenChap 1-4Rose Ann Robante TubioNoch keine Bewertungen

- CMBE 2 - Lesson 1 ModuleDokument11 SeitenCMBE 2 - Lesson 1 ModuleEunice AmbrocioNoch keine Bewertungen

- Limitations of Financial AccountingDokument6 SeitenLimitations of Financial Accountingchitra_shresthaNoch keine Bewertungen

- Module 2 - Financial Accounting PrinciplesDokument13 SeitenModule 2 - Financial Accounting PrinciplesVimbai MusangeyaNoch keine Bewertungen

- Session - 2 & 3 - Recording in Primary Books and Posting in Secondary Books - Reading - Material PDFDokument27 SeitenSession - 2 & 3 - Recording in Primary Books and Posting in Secondary Books - Reading - Material PDFShashank Pandey100% (1)

- Concepts, Principles and Convensions - AnoverviewDokument6 SeitenConcepts, Principles and Convensions - AnoverviewA KA SH TickuNoch keine Bewertungen

- Lesson 3 AccountingDokument12 SeitenLesson 3 AccountingDrin BaliteNoch keine Bewertungen

- Accounting ConceptsDokument13 SeitenAccounting ConceptsdeepshrmNoch keine Bewertungen

- Introduction To Accounting: StructureDokument418 SeitenIntroduction To Accounting: StructureRashadNoch keine Bewertungen

- Introduction To Financial AccountingDokument19 SeitenIntroduction To Financial AccountingJashan100% (1)

- Module 1 - AccountsDokument22 SeitenModule 1 - AccountsPrince BharvadNoch keine Bewertungen

- What Are Financial StatementsDokument4 SeitenWhat Are Financial StatementsJustin Era ApeloNoch keine Bewertungen

- Ch. 1-Fundamentals of Accounting IDokument20 SeitenCh. 1-Fundamentals of Accounting IDèřæ Ô MáNoch keine Bewertungen

- Basic Accounting Concepts and ConventionDokument12 SeitenBasic Accounting Concepts and ConventionParul TandanNoch keine Bewertungen

- Nderstand The Difference Between Accounting and BookkeepingDokument2 SeitenNderstand The Difference Between Accounting and BookkeepingManju GuptaNoch keine Bewertungen

- BCOM 1 Financial Accounting 1Dokument63 SeitenBCOM 1 Financial Accounting 1karthikeyan01Noch keine Bewertungen

- Chapter 1: Introduction To AccountingDokument17 SeitenChapter 1: Introduction To AccountingPALADUGU MOUNIKANoch keine Bewertungen

- Chapter 5 Principls and ConceptsDokument10 SeitenChapter 5 Principls and ConceptsawlachewNoch keine Bewertungen

- Chapter 3. The Accounting EquationDokument2 SeitenChapter 3. The Accounting EquationKarysse Arielle Noel JalaoNoch keine Bewertungen

- Notes of Basic AccountingDokument9 SeitenNotes of Basic AccountingAshit BaidNoch keine Bewertungen

- Financial Accounting 123Dokument46 SeitenFinancial Accounting 123shekhar87100% (1)

- CMBE 2 - Lesson 3 ModuleDokument12 SeitenCMBE 2 - Lesson 3 ModuleEunice AmbrocioNoch keine Bewertungen

- Lesson 1Dokument9 SeitenLesson 1Bervette HansNoch keine Bewertungen

- 1 - Understanding AccountingDokument12 Seiten1 - Understanding AccountingNicole DuranteNoch keine Bewertungen

- Financial Acctg Reporting 1 Chapter 1Dokument26 SeitenFinancial Acctg Reporting 1 Chapter 1Charise Jane ZullaNoch keine Bewertungen

- Love Is A FallacyDokument13 SeitenLove Is A FallacyDedi AgustiantoNoch keine Bewertungen

- Setting Up Accounting Ledgers and JournalsDokument18 SeitenSetting Up Accounting Ledgers and JournalsAnimaw YayehNoch keine Bewertungen

- ACCOUNTING CONCEPTS, CONVENTIONS AND PRINCIPLES EXPLAINEDDokument42 SeitenACCOUNTING CONCEPTS, CONVENTIONS AND PRINCIPLES EXPLAINEDSheetal NafdeNoch keine Bewertungen

- Accounting For ManagementDokument21 SeitenAccounting For ManagementSeban KsNoch keine Bewertungen

- Introduction to Accounting FundamentalsDokument18 SeitenIntroduction to Accounting FundamentalsHussain DilawerNoch keine Bewertungen

- Introduction To AccountingDokument9 SeitenIntroduction To AccountingJessicaNoch keine Bewertungen

- Bcfa 1: Fundamentals of Accounting 1Dokument14 SeitenBcfa 1: Fundamentals of Accounting 1Arlene PerlasNoch keine Bewertungen

- Afm Unit 1 Total NotesDokument26 SeitenAfm Unit 1 Total NotesanglrNoch keine Bewertungen

- Parties Interested in Accounting InformationDokument4 SeitenParties Interested in Accounting InformationMizba HameedNoch keine Bewertungen

- Unit-I: SVD & SGL College of Management and Technology: RajahmundryDokument38 SeitenUnit-I: SVD & SGL College of Management and Technology: RajahmundryHappyPrinceNoch keine Bewertungen

- UNIT II Branches of AccountingDokument40 SeitenUNIT II Branches of AccountingJOHN ,MARK LIGPUSANNoch keine Bewertungen

- Accountancy ManualDokument61 SeitenAccountancy ManualAhmad Fauzi MehatNoch keine Bewertungen

- ACT103 - Module 1Dokument13 SeitenACT103 - Module 1Le MinouNoch keine Bewertungen

- Accounting ConceptsDokument16 SeitenAccounting ConceptsEverjoice ChatoraNoch keine Bewertungen

- The Accounting Cycle: 9-Step Accounting ProcessDokument2 SeitenThe Accounting Cycle: 9-Step Accounting Processfazal rahmanNoch keine Bewertungen

- 7 The Accounting CycleDokument3 Seiten7 The Accounting Cycleapi-299265916Noch keine Bewertungen

- The Accounting Cycle: 9-Step Accounting ProcessDokument3 SeitenThe Accounting Cycle: 9-Step Accounting ProcessLala ArdilaNoch keine Bewertungen

- The Accounting CycleDokument3 SeitenThe Accounting Cycleliesly buticNoch keine Bewertungen

- Accounting Cycle in 10 StepsDokument4 SeitenAccounting Cycle in 10 StepsAntiiasmawatiiNoch keine Bewertungen

- The Accounting Cycle: 1. TransactionsDokument2 SeitenThe Accounting Cycle: 1. TransactionsJonalyn MontecalvoNoch keine Bewertungen

- Accounting CycleDokument3 SeitenAccounting CycleMardy DahuyagNoch keine Bewertungen

- Andhra Pradesh Grama - Ward SachivalayamDokument1 SeiteAndhra Pradesh Grama - Ward Sachivalayamchandra sekhar TippreddyNoch keine Bewertungen

- Project ReportDokument193 SeitenProject Reportchandra sekhar TippreddyNoch keine Bewertungen

- ResumeDokument3 SeitenResumechandra sekhar TippreddyNoch keine Bewertungen

- PDF of RecvirmentDokument1 SeitePDF of Recvirmentchandra sekhar TippreddyNoch keine Bewertungen

- Faculty ListDokument3 SeitenFaculty Listchandra sekhar TippreddyNoch keine Bewertungen

- Accounting Process CycleDokument12 SeitenAccounting Process Cyclechandra sekhar Tippreddy100% (1)

- MHRDDokument1 SeiteMHRDchandra sekhar TippreddyNoch keine Bewertungen

- Leaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeDokument6 SeitenLeaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeAnonymous iTNFz0a0Noch keine Bewertungen

- Free Radical TheoryDokument2 SeitenFree Radical TheoryMIA ALVAREZNoch keine Bewertungen

- Planning A Real Estate ProjectDokument81 SeitenPlanning A Real Estate ProjectHaile SilasieNoch keine Bewertungen

- Nursing Care Management of a Client with Multiple Medical ConditionsDokument25 SeitenNursing Care Management of a Client with Multiple Medical ConditionsDeannNoch keine Bewertungen

- Biagioli Did Galileo Copy The TelescopeDokument28 SeitenBiagioli Did Galileo Copy The TelescopeGregory HooNoch keine Bewertungen

- Radio Frequency Transmitter Type 1: System OperationDokument2 SeitenRadio Frequency Transmitter Type 1: System OperationAnonymous qjoKrp0oNoch keine Bewertungen

- Liebert PSP: Quick-Start Guide - 500VA/650VA, 230VDokument2 SeitenLiebert PSP: Quick-Start Guide - 500VA/650VA, 230VsinoNoch keine Bewertungen

- Sewage Pumping StationDokument35 SeitenSewage Pumping StationOrchie DavidNoch keine Bewertungen

- Prof Ram Charan Awards Brochure2020 PDFDokument5 SeitenProf Ram Charan Awards Brochure2020 PDFSubindu HalderNoch keine Bewertungen

- Maverick Brochure SMLDokument16 SeitenMaverick Brochure SMLmalaoui44Noch keine Bewertungen

- 08 Sepam - Understand Sepam Control LogicDokument20 Seiten08 Sepam - Understand Sepam Control LogicThức Võ100% (1)

- Manual Analizador Fluoruro HachDokument92 SeitenManual Analizador Fluoruro HachAitor de IsusiNoch keine Bewertungen

- NewspaperDokument11 SeitenNewspaperКристина ОрёлNoch keine Bewertungen

- Inventory Control Review of LiteratureDokument8 SeitenInventory Control Review of Literatureaehupavkg100% (1)

- Non Circumvention Non Disclosure Agreement (TERENCE) SGDokument7 SeitenNon Circumvention Non Disclosure Agreement (TERENCE) SGLin ChrisNoch keine Bewertungen

- Mission Ac Saad Test - 01 QP FinalDokument12 SeitenMission Ac Saad Test - 01 QP FinalarunNoch keine Bewertungen

- M8-2 - Train The Estimation ModelDokument10 SeitenM8-2 - Train The Estimation ModelJuan MolinaNoch keine Bewertungen

- PROF ED 10-ACTIVITY #1 (Chapter 1)Dokument4 SeitenPROF ED 10-ACTIVITY #1 (Chapter 1)Nizelle Arevalo100% (1)

- House Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Dokument4 SeitenHouse Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Raphael Eyitayor TyNoch keine Bewertungen

- BPL Millipacs 2mm Hardmetrics RarDokument3 SeitenBPL Millipacs 2mm Hardmetrics RarGunter BragaNoch keine Bewertungen

- Catalogoclevite PDFDokument6 SeitenCatalogoclevite PDFDomingo YañezNoch keine Bewertungen

- Artist Biography: Igor Stravinsky Was One of Music's Truly Epochal Innovators No Other Composer of TheDokument2 SeitenArtist Biography: Igor Stravinsky Was One of Music's Truly Epochal Innovators No Other Composer of TheUy YuiNoch keine Bewertungen

- Steam Turbine Theory and Practice by Kearton PDF 35Dokument4 SeitenSteam Turbine Theory and Practice by Kearton PDF 35KKDhNoch keine Bewertungen

- Pre Job Hazard Analysis (PJHADokument2 SeitenPre Job Hazard Analysis (PJHAjumaliNoch keine Bewertungen

- UTP3-SW04-TP60 Datasheet VER2.0Dokument2 SeitenUTP3-SW04-TP60 Datasheet VER2.0Ricardo TitoNoch keine Bewertungen

- Motor Master 20000 SeriesDokument56 SeitenMotor Master 20000 SeriesArnulfo Lavares100% (1)

- KSEB Liable to Pay Compensation for Son's Electrocution: Kerala HC CaseDokument18 SeitenKSEB Liable to Pay Compensation for Son's Electrocution: Kerala HC CaseAkhila.ENoch keine Bewertungen

- John Hay People's Alternative Coalition Vs Lim - 119775 - October 24, 2003 - JDokument12 SeitenJohn Hay People's Alternative Coalition Vs Lim - 119775 - October 24, 2003 - JFrances Ann TevesNoch keine Bewertungen

- Sri S T Kalairaj, Chairman: Income Tax TaxesDokument3 SeitenSri S T Kalairaj, Chairman: Income Tax TaxesvikramkkNoch keine Bewertungen