Beruflich Dokumente

Kultur Dokumente

Devidend Decision Questions

Hochgeladen von

DishAnt PaTelOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Devidend Decision Questions

Hochgeladen von

DishAnt PaTelCopyright:

Verfügbare Formate

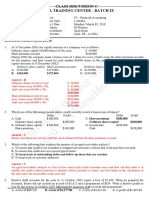

Dividend Decision

Q1. Lee Ann, Inc., has declared $7.50 per share dividend. Suppose

capital gain are not texed, but dividends are taxed at 15%. New

regulations required that taxes be withheld when the dividend is paid.

The company’s stock sells for $93 per share, and is about to go ex-

dividend. What do you think the ex dividend price will be?

Ans:

After-tax Dividend $ 6.38

Ex-dividend price $ 86.63

Q2.The owner's equity account for Hexagon International are shown here:

Particulars Amt.

Common Stock 40000

Capital Surplus 155000

Retained earnings 538400

Total Owners Equity 733400

a. The company's stock currently sells for $39 per share and a 10% stock dividend is declared, how

many shares will be distributed? Show how the equity accounts would change.

b. If the company declared a 25% stock dividend, how would account changes?

a. New shares outstanding 44,000

Ans: New shares issued 4,000

Capital surplus on new shares $ 1,52,000

Common stock $ 44,000

Capital surplus 3,07,000

Retained earnings 3,82,400

$ 7,33,400

b. New shares outstanding 50,000

New shares issued 10,000

Capital surplus on new shares $ 3,80,000

Common stock $ 50,000

Capital surplus 5,35,000

Retained earnings 1,48,400

$ 7,33,400

Q3. For the company in problem 2, show how the equity account will

change if:

a. The company declared a four-for-one stock split, how many shares

outstanding now? what is the new par value per share?

b. The company declared one-for-five reverse stock split. How many

shares are outstanding now? what is the new par value per share?

a. New shares outstanding 1,60,000

Ans: The accounts are unchanged except that

par value is now $ 0.25

b. New shares outstanding 8,000

The accounts are unchanged except that

par value is now $ 5.00

Q4.Roll Corporation currently has 465000 share of stock outstanding

that sell for $73 per share. Determine the number of shares

outstanding. Assuming no market Imperfection or text effects exist,

what will the share price be after.

a. RC has a five-for-three stock split?

b. RC has a 15% stock dividend?

c. RC has a 42.5% stock dividend?

d. RC has a four-for-seven reverse stock split?

Ans: a. Stock split $ 43.80

b. Stock dividend $ 63.48

c. Stock dividend $ 51.23

d. Stock split $ 127.75

a. New shares outstanding 7,75,000

b. New shares outstanding 5,34,750

c. New shares outstanding 6,62,625

d. New shares outstanding 2,65,714

Das könnte Ihnen auch gefallen

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Von EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- BE - Stockholders' Equity ADokument5 SeitenBE - Stockholders' Equity ALuis JoseNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Final Exam Essay QuestionsDokument4 SeitenFinal Exam Essay Questionsapi-408647155Noch keine Bewertungen

- C. Wolken Issued New Common Stock in 2013Dokument4 SeitenC. Wolken Issued New Common Stock in 2013Talha JavedNoch keine Bewertungen

- Ratios AssignmentDokument3 SeitenRatios AssignmentDiana SaidNoch keine Bewertungen

- Session16 DividendDokument7 SeitenSession16 DividenditachiNoch keine Bewertungen

- Business Finance - Tutorial QuestionsDokument2 SeitenBusiness Finance - Tutorial QuestionsButhaina HNoch keine Bewertungen

- Business Finance - Tutorial QuestionsDokument2 SeitenBusiness Finance - Tutorial QuestionsButhaina HNoch keine Bewertungen

- Fin Exam 1Dokument14 SeitenFin Exam 1tahaalkibsiNoch keine Bewertungen

- ParCor QuizDokument4 SeitenParCor QuizJinx Cyrus Rodillo0% (1)

- ch.13 Practice QuestionsDokument4 Seitench.13 Practice QuestionsAshNoch keine Bewertungen

- HW 1-SolnDokument8 SeitenHW 1-SolnZhaohui ChenNoch keine Bewertungen

- Jones Corportion SoluationDokument14 SeitenJones Corportion SoluationShakilNoch keine Bewertungen

- SOAL 1 - Break Even AnalysisDokument3 SeitenSOAL 1 - Break Even AnalysisRifqi RinaldiNoch keine Bewertungen

- Chapter 19 - Introduction To Company AccountingDokument56 SeitenChapter 19 - Introduction To Company AccountingK60 Triệu Thùy LinhNoch keine Bewertungen

- Question - BS and FADokument6 SeitenQuestion - BS and FANguyễn Thùy LinhNoch keine Bewertungen

- Question - FS and FADokument6 SeitenQuestion - FS and FANguyễn Thùy LinhNoch keine Bewertungen

- ACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2Dokument14 SeitenACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2accounts 3 lifeNoch keine Bewertungen

- First Partn - Answer 2Dokument5 SeitenFirst Partn - Answer 2Monique CabreraNoch keine Bewertungen

- Financial Market TextBook (Dragged) 3Dokument1 SeiteFinancial Market TextBook (Dragged) 3Nick OoiNoch keine Bewertungen

- Question - FS and FADokument4 SeitenQuestion - FS and FAPhương NhungNoch keine Bewertungen

- Quizz Advance AccountingDokument7 SeitenQuizz Advance AccountingarifNoch keine Bewertungen

- Sem6 RatioAnalysisLecture 6 JuhiJaiswal 19apr2020Dokument8 SeitenSem6 RatioAnalysisLecture 6 JuhiJaiswal 19apr2020Hanabusa Kawaii IdouNoch keine Bewertungen

- Quiz ReorganizationDokument7 SeitenQuiz ReorganizationJam SurdivillaNoch keine Bewertungen

- Class On Merger and AcquisitionDokument5 SeitenClass On Merger and AcquisitionMuhammad QaiserNoch keine Bewertungen

- Chapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus Issue Practice QuestionsDokument26 SeitenChapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus Issue Practice Questionsnikhil diwan75% (4)

- Answer Jerry Rice and Grain StoresDokument2 SeitenAnswer Jerry Rice and Grain StoresJken OrtizNoch keine Bewertungen

- Homework Chapter 11Dokument8 SeitenHomework Chapter 11Trung Kiên NguyễnNoch keine Bewertungen

- Financial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDDokument10 SeitenFinancial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDLeanne TehNoch keine Bewertungen

- Practice Questions AFS1Dokument12 SeitenPractice Questions AFS1yasirNoch keine Bewertungen

- CPA Question - CHPT 18 Answers-1Dokument27 SeitenCPA Question - CHPT 18 Answers-1rohaanali222Noch keine Bewertungen

- 10 - ReviewDokument14 Seiten10 - ReviewNur Mohammad Yusuf Deljan EscanderNoch keine Bewertungen

- Soal Dan Jawaban Advance 2Dokument6 SeitenSoal Dan Jawaban Advance 2nicholas adityaNoch keine Bewertungen

- Chapter 14 SolutionsDokument11 SeitenChapter 14 Solutionssalsabilla rpNoch keine Bewertungen

- Tutorial 9 - Dividend and Dividend Policy ClassDokument6 SeitenTutorial 9 - Dividend and Dividend Policy ClassAmy LimnaNoch keine Bewertungen

- Shareholder's Equity 2 - PracAccDokument19 SeitenShareholder's Equity 2 - PracAccClyn CFNoch keine Bewertungen

- CH 3 Probset - Analysis of Fin Stmts 15ed - MasterDokument5 SeitenCH 3 Probset - Analysis of Fin Stmts 15ed - MasterCharleene GutierrezNoch keine Bewertungen

- Chapter 7 ParcorDokument10 SeitenChapter 7 Parcornikki syNoch keine Bewertungen

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Dokument6 SeitenChapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Minh HuyyNoch keine Bewertungen

- Dwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingDokument4 SeitenDwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingNeeraj DNoch keine Bewertungen

- Patnership TwoDokument8 SeitenPatnership TwoTapz IbrahimNoch keine Bewertungen

- 317 Midterm 1 Practice Exam SolutionsDokument9 Seiten317 Midterm 1 Practice Exam Solutionskinyuadavid000Noch keine Bewertungen

- Chapter 13 14 Review QuestionsDokument6 SeitenChapter 13 14 Review QuestionsHERSINoch keine Bewertungen

- Activity 3 - Financial RatiosDokument3 SeitenActivity 3 - Financial RatiosNCF- Student Assistants' OrganizationNoch keine Bewertungen

- Midterm 1 991ansDokument12 SeitenMidterm 1 991ansNguyên NguyễnNoch keine Bewertungen

- ACCT 213 Exercise (Chapter 18) STDokument5 SeitenACCT 213 Exercise (Chapter 18) STMohammedNoch keine Bewertungen

- Topic 2 ExercisesDokument6 SeitenTopic 2 ExercisesRaniel Pamatmat0% (1)

- 10 FS Analysis Sample Exam Discussion KEYDokument10 Seiten10 FS Analysis Sample Exam Discussion KEYrav danoNoch keine Bewertungen

- ReSA AP Quiz 2 B43Dokument13 SeitenReSA AP Quiz 2 B43Rafael BautistaNoch keine Bewertungen

- CFASDokument3 SeitenCFASataydeyessaNoch keine Bewertungen

- Corporation ReviewerDokument5 SeitenCorporation ReviewerKara GamerNoch keine Bewertungen

- 5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFDokument5 Seiten5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFUnplanned VideosNoch keine Bewertungen

- Sia 3.compound Financial InstrumentDokument11 SeitenSia 3.compound Financial InstrumentleneNoch keine Bewertungen

- Chapter 1 Case 1 Net Asset AcquisitionDokument4 SeitenChapter 1 Case 1 Net Asset AcquisitionANGELI GRACE GALVANNoch keine Bewertungen

- With Owners of The Business, Such As Share Issues and Dividends. The Statement Making The LinkDokument7 SeitenWith Owners of The Business, Such As Share Issues and Dividends. The Statement Making The LinkHikmət RüstəmovNoch keine Bewertungen

- Basic Finance An Introduction To Financial Institutions Investments and Management 11th Edition Mayo Test BankDokument10 SeitenBasic Finance An Introduction To Financial Institutions Investments and Management 11th Edition Mayo Test Bankjesseschmidtdsgbcqopnj100% (19)

- Problem 32 Retained Earnings ParcorDokument3 SeitenProblem 32 Retained Earnings Parcornikki syNoch keine Bewertungen

- This Study Resource Was: Multiple Choice QuestionsDokument8 SeitenThis Study Resource Was: Multiple Choice QuestionsPamela SantosNoch keine Bewertungen

- Chapter 4 Test Bank Consolidation Techniques and Procedures: Investment Account?Dokument31 SeitenChapter 4 Test Bank Consolidation Techniques and Procedures: Investment Account?AldwinNoch keine Bewertungen

- Proposal - Manju (Formatted) (Final)Dokument16 SeitenProposal - Manju (Formatted) (Final)How to TecH.Noch keine Bewertungen

- Test Bank For An Introduction To Derivative Securities Financial Markets and Risk Management by JarrowDokument17 SeitenTest Bank For An Introduction To Derivative Securities Financial Markets and Risk Management by JarrowMannuNoch keine Bewertungen

- Dmart Finlatics PDF FreeDokument11 SeitenDmart Finlatics PDF Freeashutosh shendgeNoch keine Bewertungen

- Top Large Cap Companies - List of Top Large Cap Companies - Best Blue Chip Stocks in IndiaDokument14 SeitenTop Large Cap Companies - List of Top Large Cap Companies - Best Blue Chip Stocks in IndiasandeepNoch keine Bewertungen

- Capital BudgetingDokument15 SeitenCapital Budgetingkarthik sNoch keine Bewertungen

- Chapter 9 Stocks and Their ValuationDokument24 SeitenChapter 9 Stocks and Their ValuationHammad KamranNoch keine Bewertungen

- KPMG Flash News Hitesh Satishchandra DoshiDokument7 SeitenKPMG Flash News Hitesh Satishchandra DoshiHimanshuNoch keine Bewertungen

- 1 Minute Trend Momentum Scalping StrategyDokument5 Seiten1 Minute Trend Momentum Scalping Strategyoyekanmi agoroNoch keine Bewertungen

- Chapter 3 - Inflation and Escalation 10102016Dokument11 SeitenChapter 3 - Inflation and Escalation 10102016Muhammad NursalamNoch keine Bewertungen

- Virgin Corporate Strategy Case Study FinalDokument9 SeitenVirgin Corporate Strategy Case Study FinalAnkit Bhosale100% (1)

- Requirements For The Replacement of Lost or Destroyed Certificates of Stock PDFDokument1 SeiteRequirements For The Replacement of Lost or Destroyed Certificates of Stock PDFMark PesiganNoch keine Bewertungen

- Edit - 5 Types of Forex Trading Strategies That Work PDFDokument18 SeitenEdit - 5 Types of Forex Trading Strategies That Work PDFDereck Teveraishe100% (1)

- Canvas FabricsDokument17 SeitenCanvas FabricssamsonNoch keine Bewertungen

- PSE Trading Strategies (Handout)Dokument26 SeitenPSE Trading Strategies (Handout)Ysabella May Sarthou CervantesNoch keine Bewertungen

- Piper Jaffray On BAGL 8.14Dokument4 SeitenPiper Jaffray On BAGL 8.14lehighsolutionsNoch keine Bewertungen

- Foreign Exchange Derivative MarketsDokument16 SeitenForeign Exchange Derivative MarketsAIRES VILLASURDANoch keine Bewertungen

- Kertas Kerja Konsolidasi InventoryDokument3 SeitenKertas Kerja Konsolidasi InventoryArriNoch keine Bewertungen

- Basel III Accord - Basel 3 Norms: Contributed byDokument25 SeitenBasel III Accord - Basel 3 Norms: Contributed bysamyumuthuNoch keine Bewertungen

- On The Nature of NeighbourhoodDokument15 SeitenOn The Nature of NeighbourhoodsoydepaloNoch keine Bewertungen

- 0 - Tybms If Sem 6 QBDokument47 Seiten0 - Tybms If Sem 6 QBMangesh GuptaNoch keine Bewertungen

- Management Accounting II 0405Dokument29 SeitenManagement Accounting II 0405api-26541915Noch keine Bewertungen

- Chap 1 - Goals & Governance of FirmDokument41 SeitenChap 1 - Goals & Governance of FirmMuhammad ShaheerNoch keine Bewertungen

- MBA Local Compnay Presentation - Financial - AccountingDokument7 SeitenMBA Local Compnay Presentation - Financial - AccountingAliza RizviNoch keine Bewertungen

- Understanding Compulsory Convertible Debentures PDFDokument10 SeitenUnderstanding Compulsory Convertible Debentures PDFDaksh Jai BajajNoch keine Bewertungen

- Calculation of Stock BetaDokument2 SeitenCalculation of Stock Betamanoranjan838241Noch keine Bewertungen

- Robert Kiyosaki - 7 Levels of InvestorsDokument17 SeitenRobert Kiyosaki - 7 Levels of Investors2read100% (3)

- Demystifying IFRS 17 - Philip JacksonDokument26 SeitenDemystifying IFRS 17 - Philip JacksonWubneh AlemuNoch keine Bewertungen

- Minor Research Paper FINAL 1Dokument30 SeitenMinor Research Paper FINAL 1Deep ChoudharyNoch keine Bewertungen

- CREutomo-Analysis For Project InvestmentDokument52 SeitenCREutomo-Analysis For Project InvestmentdaraNoch keine Bewertungen

- The Big Market DelusionDokument38 SeitenThe Big Market DelusionsarpbNoch keine Bewertungen