Beruflich Dokumente

Kultur Dokumente

Local Media193168800

Hochgeladen von

Kyeien0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

33 Ansichten62 SeitenOriginaltitel

local_media193168800.pptx

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

33 Ansichten62 SeitenLocal Media193168800

Hochgeladen von

KyeienCopyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 62

Cash Flows (Returns)

-the value of any asset depends on the

cash flow(s) it is expected to provide over the

ownership period.

- an asset does not have to provide an

annual cash flow

Personal Finance Example 6.4

Celia Sargent wishes to eliminate the value of three

assets she is considering investing in the following:

Stock in Michaels Enterprises Expect to

receive cash dividends of $300 per year indefinitely.

Oil Well Expect to receive cash flow of $2,000

at the end of year 1, and $4,000 at the end of year

2, and 10,000 at the end of year 4, when the well is

to be sold.

Original Painting Expect to be able to sell the

painting in 5 years for 85,000.

Timing

- in addition to making cash flow

estimates, we must know the timing of the cash

flow.

- the combination of the cash flow and its

timing fully defines the return expected from

the asset.

Risk and Required Return

- the level of risk associated with a given

cash flow can significantly affect its value.

- the greater the risk of (or the less certain)

a cash flow, the lower its value.

-greater risk can be incorporated into a

valuation analysis by using a higher required

return or discount rate.

- the higher the risk, the greater the

required return, and the lower the risk, the less

the required return.

Personal Finance Example 6.5

Celia Sargent’s task of placing a value on the original

painting and consider two scenarios.

Scenario 1: Certainty A major art gallery has

contracted to buy the painting for $85,000 at the end of 5

years. Because this contract is considered a certain risk-free

rate of 3% as the required return when calculating the value

of the painting.

Scenario 2: High Risk The values of original paintings

by his artist have fluctuated widely over the past 10 years.

Although Celia expects to be able to sell the painting for

$85,000, she realizes that its sale price in 5 years could

range between $30,000 and $140,000. Because of the high

uncertainty surrounding the painting’s value, Celia believes

that a %15 required return is appropriate.

Personal Finance Example 6.6

Celia Sargent uses the Equation 6.4 to calculate

the value of each asset. She values Michaels

Enterprises stock using Equation 5.7, which says

that the present value of a perpetuity equals

the annual payment divided by the required

return. In the case of Michaels stock, the annual

cash flow is $300, and Celia decides that a 12%

discount rate is appropriate for this investment.

Therefore, her estimate of the value of Michaels

Enterprises stock is

$300 ÷ 0.12 = $2.500

(con.)

Next, Celia values the oil well investment, which

she believes is the most risky of the three

investments. Using a 20% required return, Celia

estimates the oil well’s value to be

$2,000 $4,000 $10,000

+ 2 + = $9,266.98

(1+0.20) (1+0.20) (1+0.20)⁴

Finally, Celia estimates the value of the

painting by discounting the expected $85,000

lump sum payment in 5 years at 15%:

$85,000 ÷ (1+0.15)⁵ = $42,260.02

4-5. Give 2 factors that will affect the

equilibrium interest rate?

Das könnte Ihnen auch gefallen

- Philippine Culture: What Makes The Filipinos Different From The Rest of The WorldDokument10 SeitenPhilippine Culture: What Makes The Filipinos Different From The Rest of The WorldKyeienNoch keine Bewertungen

- To Be PreyntDokument2 SeitenTo Be PreyntKyeienNoch keine Bewertungen

- Application Letter RiezelDokument2 SeitenApplication Letter RiezelKyeienNoch keine Bewertungen

- Objective of The StudyDokument3 SeitenObjective of The StudyKyeienNoch keine Bewertungen

- Parental Consent FormDokument1 SeiteParental Consent FormKyeienNoch keine Bewertungen

- PhilippinePopularCulture Assgnmnt#1Dokument2 SeitenPhilippinePopularCulture Assgnmnt#1KyeienNoch keine Bewertungen

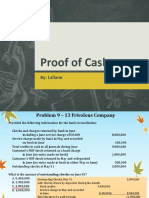

- Proof of Cash: By: LailaneDokument19 SeitenProof of Cash: By: LailaneGianJoshuaDayrit100% (1)

- Solicitation LetterDokument3 SeitenSolicitation LetterKyeienNoch keine Bewertungen

- 15 - 16 Accounting Concepts and PrinciplesDokument39 Seiten15 - 16 Accounting Concepts and PrinciplesKyeien100% (1)

- A Step by Step Process On How To Open A Passbook Savings AccountDokument1 SeiteA Step by Step Process On How To Open A Passbook Savings AccountKyeienNoch keine Bewertungen

- Part IiDokument63 SeitenPart IiKyeienNoch keine Bewertungen

- Stories With Values For KidsDokument19 SeitenStories With Values For KidsKyeienNoch keine Bewertungen

- A QUALITATIVE INVESTAGATION OF RELIGION Reaserch TitleDokument5 SeitenA QUALITATIVE INVESTAGATION OF RELIGION Reaserch TitleKyeienNoch keine Bewertungen

- I Went To A CooperativeDokument1 SeiteI Went To A CooperativeKyeienNoch keine Bewertungen

- Art Is An Objec-WPS OfficeDokument3 SeitenArt Is An Objec-WPS OfficeKyeienNoch keine Bewertungen

- I Went To A CooperativeDokument1 SeiteI Went To A CooperativeKyeienNoch keine Bewertungen

- Lesson 5Dokument15 SeitenLesson 5KyeienNoch keine Bewertungen

- Chapter 3 Key Points On Process CostingDokument4 SeitenChapter 3 Key Points On Process CostingKyeienNoch keine Bewertungen

- ArtsDokument1 SeiteArtsKyeienNoch keine Bewertungen

- Ratio Analysis-WPS OfficeDokument4 SeitenRatio Analysis-WPS OfficeKyeienNoch keine Bewertungen

- What Are Financial Ratios?: Uses and Users of Financial Ratio AnalysisDokument5 SeitenWhat Are Financial Ratios?: Uses and Users of Financial Ratio AnalysisGultayaz khanNoch keine Bewertungen

- Reflective Essay On Art AppreciationDokument4 SeitenReflective Essay On Art AppreciationKyeien50% (2)

- Financial RatioDokument1 SeiteFinancial RatioRizza CiriacoNoch keine Bewertungen

- Ratio Analysis-WPS OfficeDokument4 SeitenRatio Analysis-WPS OfficeKyeienNoch keine Bewertungen

- c01 PDFDokument26 Seitenc01 PDFHaneef AzeemiNoch keine Bewertungen

- On Human Acts2ndsem2019-2 PDFDokument23 SeitenOn Human Acts2ndsem2019-2 PDFJennifer GomezNoch keine Bewertungen

- ArtsDokument1 SeiteArtsKyeienNoch keine Bewertungen

- A Perfect Chris-WPS OfficeDokument5 SeitenA Perfect Chris-WPS OfficeKyeienNoch keine Bewertungen

- Mao Na NiDokument1 SeiteMao Na NiKyeienNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Commodity TradingDokument0 SeitenCommodity TradingNIKNISHNoch keine Bewertungen

- Ch05 Mini CaseDokument8 SeitenCh05 Mini CaseTia1977Noch keine Bewertungen

- Economics Letters: Haejung Na, Soonho KimDokument7 SeitenEconomics Letters: Haejung Na, Soonho KimHeni AgustianiNoch keine Bewertungen

- Gallagher 5e.c4Dokument27 SeitenGallagher 5e.c4Stacy LanierNoch keine Bewertungen

- Financial Management Model Question PaperDokument2 SeitenFinancial Management Model Question PaperdvraoNoch keine Bewertungen

- Company Profile: SOSS Shield o SGER Sumber BRPT Barito P BBSS Bumi BeDokument6 SeitenCompany Profile: SOSS Shield o SGER Sumber BRPT Barito P BBSS Bumi BeJemzkatigaNoch keine Bewertungen

- Systematic Investment Plan: Returns CalculatorDokument11 SeitenSystematic Investment Plan: Returns CalculatorMayank GandhiNoch keine Bewertungen

- Ufr Quiz 4Dokument4 SeitenUfr Quiz 4sam barrientosNoch keine Bewertungen

- PLM Midterm Exam - Docx 2.0Dokument11 SeitenPLM Midterm Exam - Docx 2.0primoNoch keine Bewertungen

- Financial Statement Analysis: Charles H. GibsonDokument26 SeitenFinancial Statement Analysis: Charles H. GibsonGud BooyNoch keine Bewertungen

- Banking Chapter NineDokument46 SeitenBanking Chapter NinefikremariamNoch keine Bewertungen

- Module 1Dokument52 SeitenModule 1dileepsuNoch keine Bewertungen

- Trade Journal V2Dokument48 SeitenTrade Journal V2MaxNoch keine Bewertungen

- Additional Performance MeasuresDokument11 SeitenAdditional Performance MeasuresNabila Banon SunhalooNoch keine Bewertungen

- Reaction Paper No 5 (Role of Business To Shareholders)Dokument1 SeiteReaction Paper No 5 (Role of Business To Shareholders)ANGELINE LABBUTANNoch keine Bewertungen

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDDokument1 SeiteCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856Noch keine Bewertungen

- Balance Sheet StartUpDokument1 SeiteBalance Sheet StartUpHercule P OirotNoch keine Bewertungen

- Cougars+Deutsch HBS Case SolutionDokument16 SeitenCougars+Deutsch HBS Case Solutionnicco.carduNoch keine Bewertungen

- Gujarat Technological UniversityDokument1 SeiteGujarat Technological UniversityShyamsunder SinghNoch keine Bewertungen

- Market MicroStructure - IntroductionDokument8 SeitenMarket MicroStructure - IntroductionDenis GachokaNoch keine Bewertungen

- Long Put Calendar SpreadDokument3 SeitenLong Put Calendar SpreadpkkothariNoch keine Bewertungen

- Company Research Highlights: Plug Power IncDokument4 SeitenCompany Research Highlights: Plug Power Incapi-109061352Noch keine Bewertungen

- Korean Government Bond Relative Value Report: Rates RV AnalyticsDokument12 SeitenKorean Government Bond Relative Value Report: Rates RV AnalyticsTinNoch keine Bewertungen

- CA Related Syllabus For 2024 - 2025Dokument4 SeitenCA Related Syllabus For 2024 - 2025loganathanNoch keine Bewertungen

- Autoloan Form Application IndividualDokument2 SeitenAutoloan Form Application IndividualEumell Alexis PaleNoch keine Bewertungen

- Exchange Rates in Thailand & DeterminantsDokument14 SeitenExchange Rates in Thailand & DeterminantsJehanzaibNoch keine Bewertungen

- SK2 PT Angkasa AksesoriDokument50 SeitenSK2 PT Angkasa AksesoriballqiisssNoch keine Bewertungen

- Sheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalanceDokument4 SeitenSheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalancePrince Frederic Mangambu100% (1)

- Mba Vtu 3 Sem SyullabusDokument8 SeitenMba Vtu 3 Sem SyullabusShiva KumarNoch keine Bewertungen

- 401 Epm QP NDDokument2 Seiten401 Epm QP NDvipul rathodNoch keine Bewertungen