Beruflich Dokumente

Kultur Dokumente

Chapter 10: Accounting Cycle of A Merchandising Business (FAR By: Millan)

Hochgeladen von

Gennelyn Lairise Rivera0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

780 Ansichten16 SeitenOriginaltitel

ACCOUNTING CYCLE OF A MERCHANDISING BUSINESS.pptx

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

780 Ansichten16 SeitenChapter 10: Accounting Cycle of A Merchandising Business (FAR By: Millan)

Hochgeladen von

Gennelyn Lairise RiveraCopyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 16

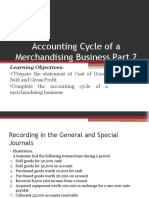

Chapter 10: Accounting Cycle of a

Merchandising Business (FAR by: Millan)

Chapter 10

Accounting Cycle of a Merchandising

Business

Learning Objectives

1. Prepare the Statement of Cost of Goods Sold

and Gross Profit.

2. Complete the accounting cycle of a

merchandising business

Chapter 10: Accounting Cycle of a

Merchandising Business (FAR by: Millan)

Merchandising Business

• A merchandising business is one that buys

and sells goods, in their original form and

without any further processing. Those goods

are referred to as merchandise inventory (or

simply, inventory).

Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan)

Inventory Systems

a. Perpetual inventory system – under this system,

the “Inventory” account is updated each time a

purchase or sale is made. Thus, the “Inventory”

account shows a continuing or running balance of

the goods on hand.

b. Periodic inventory system – under this system, the

“Inventory” account is updated only when a

physical count is performed. Thus, the amounts of

inventory and cost of goods sold are determined

only periodically.

Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan)

Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan)

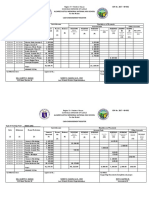

Accounts used under Periodic System

• Purchases – the account used to record purchases

of inventory under the periodic system.

• Freight-in (Transportation-in) – the account used

to record the shipping costs incurred on

purchases of inventory under the periodic system.

• Purchase returns – the account used to record

returns of purchased goods to the supplier.

• Purchase discounts – the account used to record

cash discounts availed of on the purchased goods.

Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan)

Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan)

Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan)

Gross Profit

Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan)

Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan)

Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan)

• Sales – include both cash sales and credit

sales.

• Sales returns – the account used to goods

sold but were returned by customers.

• Sales discounts – the account used to record

cash discounts given to and taken by

customers.

Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan)

Statement of Cost of Goods Sold and Gross Profit

Chapter 10: Accounting Cycle of a Merchandising Business (FAR by: Millan)

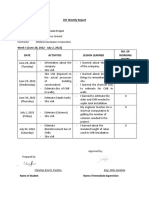

TERMS OF TRANSACTIONS

• Cash Discounts-discount for prompt payment

“2/10” ,n/30

– Sales Discount

– Purchase Discount

• Trade Discount

– Computed first before reflecting the cash discount

computation

Chapter 10: Accounting Cycle of a

Merchandising Business (FAR by: Millan)

OPEN FORUM

QUESTIONS????

REACTIONS!!!!!

Chapter 10: Accounting Cycle of a

Merchandising Business (FAR by: Millan)

END

Chapter 10: Accounting Cycle of a

Merchandising Business (FAR by: Millan)

Das könnte Ihnen auch gefallen

- Statement of Cash FlowDokument24 SeitenStatement of Cash FlowMylene Santiago100% (1)

- Cfas Chapter 2Dokument55 SeitenCfas Chapter 2Lance Lenard Divinagracia Calimpos100% (1)

- Accounting For Merchandising BusinessDokument27 SeitenAccounting For Merchandising Businessarnel barawedNoch keine Bewertungen

- Chapter 8 Adjusting EntriesDokument11 SeitenChapter 8 Adjusting EntriesBLANKNoch keine Bewertungen

- BSA 1101 Fundamentals of Accounting 1 and 2 Prelim PDFDokument14 SeitenBSA 1101 Fundamentals of Accounting 1 and 2 Prelim PDFAnn Santos100% (1)

- Accounting Adjusting EntryDokument20 SeitenAccounting Adjusting EntryClemencia Masiba100% (1)

- Accounting For Merchandising Business PDFDokument38 SeitenAccounting For Merchandising Business PDFFariha Lynn Safwan86% (7)

- Solution Manual For Human Resource Management 16th Edition Gary Dessler 2Dokument36 SeitenSolution Manual For Human Resource Management 16th Edition Gary Dessler 2torosityacardiacj26v100% (48)

- Adjusting EntriesDokument2 SeitenAdjusting Entriesitsayuhthing100% (1)

- Acctg Introduction To Merchandising BusinessDokument39 SeitenAcctg Introduction To Merchandising BusinessDaisy Marie A. RoselNoch keine Bewertungen

- Chapter 12 - Partnership OperationsDokument8 SeitenChapter 12 - Partnership Operationsgeyb awayNoch keine Bewertungen

- Chapter 13 - Partnership DissolutionDokument13 SeitenChapter 13 - Partnership DissolutionVillanueva, Jane G.Noch keine Bewertungen

- 46 Types of Office Equipment & Supplies (Items Checklist) - Home StratosphereDokument51 Seiten46 Types of Office Equipment & Supplies (Items Checklist) - Home StratospheremaheshNoch keine Bewertungen

- Conceptual Framework: & Accounting Standards Lecture AidDokument19 SeitenConceptual Framework: & Accounting Standards Lecture AidFuentes, Ferdelyn F.Noch keine Bewertungen

- 5.4 Merchandising Answer Key PDFDokument7 Seiten5.4 Merchandising Answer Key PDFamichuNoch keine Bewertungen

- 2 Statement of Comprehensive IncomeDokument27 Seiten2 Statement of Comprehensive IncomeMichael Lalim Jr.Noch keine Bewertungen

- Statement of Comprehensive IncomeDokument30 SeitenStatement of Comprehensive IncomeSheilaMarieAnnMagcalas100% (4)

- Basic Accounting Level 1 Quiz Instructions: Started: Dec 26 at 5:20amDokument24 SeitenBasic Accounting Level 1 Quiz Instructions: Started: Dec 26 at 5:20amVhia Rashelle GalzoteNoch keine Bewertungen

- 8 ACCT 1A&B MerchandisingDokument13 Seiten8 ACCT 1A&B MerchandisingShannon MojicaNoch keine Bewertungen

- Chapter 6: Business Transcations & Their Analysis (FAR By: Millan)Dokument9 SeitenChapter 6: Business Transcations & Their Analysis (FAR By: Millan)Ella Montefalco50% (2)

- Acctg1 Answer Key 1Dokument3 SeitenAcctg1 Answer Key 1Coman Nocat Eam100% (1)

- Accounting Cycle of A Merchandising Business-FinalsDokument47 SeitenAccounting Cycle of A Merchandising Business-FinalsAprile Margareth HidalgoNoch keine Bewertungen

- Santa Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesDokument19 SeitenSanta Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesareumNoch keine Bewertungen

- Process Map For EPC Construction ContractorDokument2 SeitenProcess Map For EPC Construction Contractorrahul nandananNoch keine Bewertungen

- Koman Catalogue (Hose) PDFDokument19 SeitenKoman Catalogue (Hose) PDFNguyen Quoc KhanhNoch keine Bewertungen

- 0 Chapter 14 Partnership Liquidation 1279697122Dokument10 Seiten0 Chapter 14 Partnership Liquidation 1279697122Ian RanilopaNoch keine Bewertungen

- CosmetisDokument27 SeitenCosmetisHimani Khandelwal100% (2)

- Quiz 9 Completing The Accounting Cycle Worksheet and Reversing Entries Without AnswerDokument4 SeitenQuiz 9 Completing The Accounting Cycle Worksheet and Reversing Entries Without AnswerJazzy Mercado40% (5)

- Chapter 7 Posting To The LedgerDokument11 SeitenChapter 7 Posting To The LedgerMa. Concepcion Desepeda100% (2)

- Tmobile Receipt enDokument1 SeiteTmobile Receipt enTerrance LeeNoch keine Bewertungen

- Accounting Cycle of A Merchandising BusinessDokument31 SeitenAccounting Cycle of A Merchandising BusinessAresta, Novie Mae100% (1)

- Chapter 1: Introduction To Accounting (FAR By: Millan)Dokument28 SeitenChapter 1: Introduction To Accounting (FAR By: Millan)Ella MontefalcoNoch keine Bewertungen

- Chapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)Dokument15 SeitenChapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)Ella MontefalcoNoch keine Bewertungen

- Handouts Acctg 1 - MerchandisingDokument13 SeitenHandouts Acctg 1 - MerchandisingJoannah Marie OliverosNoch keine Bewertungen

- Cfas Quiz 1 2 3 4Dokument47 SeitenCfas Quiz 1 2 3 4JONATHAN LANCE JOBLENoch keine Bewertungen

- CH 8 - Merchandising OperationsDokument70 SeitenCH 8 - Merchandising OperationsJem BobilesNoch keine Bewertungen

- Accounting For A Merchandising BusinessDokument3 SeitenAccounting For A Merchandising BusinessAngelique Faye CalucinNoch keine Bewertungen

- Far Quiz Nov. 20, 2020Dokument7 SeitenFar Quiz Nov. 20, 2020Yanna AlquisolaNoch keine Bewertungen

- Accounting For Merchandising Operations LongDokument2 SeitenAccounting For Merchandising Operations Longgk concepcionNoch keine Bewertungen

- Fabm 1 Reviewer Q1Dokument8 SeitenFabm 1 Reviewer Q1raydel dimaanoNoch keine Bewertungen

- Accounting 101 MerchandisingDokument7 SeitenAccounting 101 Merchandisingchristian talosig100% (2)

- Adjusting Entries ExerciseDokument2 SeitenAdjusting Entries ExerciseMarc Eric RedondoNoch keine Bewertungen

- Accounting For Merchandising OperationsDokument5 SeitenAccounting For Merchandising OperationsatoydequitNoch keine Bewertungen

- Chapter 1 - Financial StatementsDokument14 SeitenChapter 1 - Financial StatementsRey OñateNoch keine Bewertungen

- Accounting For Merchandising Operations LongDokument32 SeitenAccounting For Merchandising Operations Longgk concepcionNoch keine Bewertungen

- BA991 Activity Guide Chapter 3Dokument12 SeitenBA991 Activity Guide Chapter 3vanessaNoch keine Bewertungen

- Chapter 6 - Business Transactions Their AnalysisDokument10 SeitenChapter 6 - Business Transactions Their Analysisgeyb awayNoch keine Bewertungen

- Chapter 9 - Accounting Cycle of A Service BusinessDokument15 SeitenChapter 9 - Accounting Cycle of A Service Businessgeyb away0% (1)

- Recording Merchandising TransactionsDokument4 SeitenRecording Merchandising Transactionsacidreign50% (2)

- Accounting Cycle of A Merchandising BusinessDokument2 SeitenAccounting Cycle of A Merchandising BusinessAnne Alag100% (1)

- Problems Problem 1: True or FalseDokument11 SeitenProblems Problem 1: True or FalseSarah SantosNoch keine Bewertungen

- Chapter 6 Completing The Accounting Cycle For A Service ProviderDokument5 SeitenChapter 6 Completing The Accounting Cycle For A Service ProviderPaw VerdilloNoch keine Bewertungen

- Merchandising AccountingDokument4 SeitenMerchandising AccountingJuby BelandresNoch keine Bewertungen

- Manual Accounting Practice SetDokument13 SeitenManual Accounting Practice SetNguyen Thien Anh Tran100% (2)

- Journalizing To Adjusting Entries QuizDokument3 SeitenJournalizing To Adjusting Entries QuizNemar Jay Capitania100% (1)

- AccountingDokument5 SeitenAccountingAbe Loran PelandianaNoch keine Bewertungen

- Chapter 3 - The Accounting EquationDokument10 SeitenChapter 3 - The Accounting Equationgeyb away100% (1)

- Accounting Cycle of A Merchandising Business Part 2Dokument7 SeitenAccounting Cycle of A Merchandising Business Part 2Amie Jane MirandaNoch keine Bewertungen

- Module 1b - Bank ReconDokument37 SeitenModule 1b - Bank ReconChen HaoNoch keine Bewertungen

- Chapter 2: Accounting Concepts and Principles (FAR By: Millan)Dokument7 SeitenChapter 2: Accounting Concepts and Principles (FAR By: Millan)Ella MontefalcoNoch keine Bewertungen

- Xy95lywmi - Midterm Exam FarDokument12 SeitenXy95lywmi - Midterm Exam FarLyra Mae De BotonNoch keine Bewertungen

- Topic 4 - Quiz Types of Major Accounts PDFDokument4 SeitenTopic 4 - Quiz Types of Major Accounts PDFSarah Santos33% (3)

- Chapter 3: The Accounting Equation (FAR By: Millan)Dokument9 SeitenChapter 3: The Accounting Equation (FAR By: Millan)Ella Montefalco67% (3)

- Q2euxhyim - Activity - Chapter 10 - Acctg Cycle of A Merchandising BusinessDokument8 SeitenQ2euxhyim - Activity - Chapter 10 - Acctg Cycle of A Merchandising BusinessLyra Mae De BotonNoch keine Bewertungen

- Accounting Cycle of A Merchandising BusinessDokument16 SeitenAccounting Cycle of A Merchandising BusinessGennelyn Lairise RiveraNoch keine Bewertungen

- Chapter 10 - Accounting Cycle of A Merchandising BusinessDokument16 SeitenChapter 10 - Accounting Cycle of A Merchandising BusinessEsther Grace PreNoch keine Bewertungen

- Group Specific Values: Presented By: Palomar, Alvarado, PesimoDokument21 SeitenGroup Specific Values: Presented By: Palomar, Alvarado, PesimoGennelyn Lairise RiveraNoch keine Bewertungen

- Republic Act - No. 9163: National Service Training Program Act of 2001Dokument23 SeitenRepublic Act - No. 9163: National Service Training Program Act of 2001Gennelyn Lairise RiveraNoch keine Bewertungen

- Intrinsic ValueDokument18 SeitenIntrinsic ValueGennelyn Lairise RiveraNoch keine Bewertungen

- Managerial Economics IntroDokument28 SeitenManagerial Economics IntroGennelyn Lairise RiveraNoch keine Bewertungen

- C. Castro Company-Cdc 2018Dokument42 SeitenC. Castro Company-Cdc 2018Gennelyn Lairise Rivera100% (1)

- Coping With The Challenges of Intercultural CommunicationDokument11 SeitenCoping With The Challenges of Intercultural CommunicationGennelyn Lairise Rivera100% (1)

- Accounting Cycle of A Merchandising BusinessDokument16 SeitenAccounting Cycle of A Merchandising BusinessGennelyn Lairise RiveraNoch keine Bewertungen

- CASE STUDY 1 Global WarmingDokument4 SeitenCASE STUDY 1 Global WarmingGennelyn Lairise RiveraNoch keine Bewertungen

- MANAGERIAL ECONOMICS Lesson 1Dokument7 SeitenMANAGERIAL ECONOMICS Lesson 1Gennelyn Lairise RiveraNoch keine Bewertungen

- Freedom, Reason and ImpartialityDokument9 SeitenFreedom, Reason and ImpartialityGennelyn Lairise Rivera100% (2)

- Schools Division of Iloilo: Alcarde Gustilo Memorial National High SchoolDokument6 SeitenSchools Division of Iloilo: Alcarde Gustilo Memorial National High SchoolLOUEDA MAY Z. CARADONoch keine Bewertungen

- List of Brokers - IRDAIDokument27 SeitenList of Brokers - IRDAIharsh.mohanNoch keine Bewertungen

- Sample Test Method and Value EngineeringDokument4 SeitenSample Test Method and Value EngineeringbahreabdellaNoch keine Bewertungen

- Accounting For Corporations: Mcgraw-Hill/Irwin1 © The Mcgraw-Hill Companies, Inc., 2006Dokument67 SeitenAccounting For Corporations: Mcgraw-Hill/Irwin1 © The Mcgraw-Hill Companies, Inc., 2006Analou LopezNoch keine Bewertungen

- RQ 2110054Dokument2 SeitenRQ 2110054ofiNoch keine Bewertungen

- Observations:: Submitted by Divya Sree Chamarthi, MBA - ADokument1 SeiteObservations:: Submitted by Divya Sree Chamarthi, MBA - AManoj NagNoch keine Bewertungen

- Heidelberg Cement India LTD Vs Commissioner of Cenq140293COM838303Dokument9 SeitenHeidelberg Cement India LTD Vs Commissioner of Cenq140293COM838303Rıtesha DasNoch keine Bewertungen

- Kaizen Sheet - Tamil & EngDokument6 SeitenKaizen Sheet - Tamil & EngkrixotNoch keine Bewertungen

- LECTURA 1 Energy For A Developed World - Arto Et AlDokument13 SeitenLECTURA 1 Energy For A Developed World - Arto Et AlPEDRO MIGUEL SOLORZANO PICONNoch keine Bewertungen

- Fixerr: Let's Help Each Other Repair!Dokument13 SeitenFixerr: Let's Help Each Other Repair!rameen kamranNoch keine Bewertungen

- TTM Squeeze - Daily Chart, Technical Analysis ScannerDokument2 SeitenTTM Squeeze - Daily Chart, Technical Analysis ScannerRON 70% (1)

- Juran's Quality TrilogyDokument6 SeitenJuran's Quality Trilogychandu veeraNoch keine Bewertungen

- Updated-PdpDokument540 SeitenUpdated-Pdpapi-648810768Noch keine Bewertungen

- MU - Project Proposal Group 13 December 2016 V3Dokument21 SeitenMU - Project Proposal Group 13 December 2016 V3mihiret lemmaNoch keine Bewertungen

- Ortega I PDFDokument147 SeitenOrtega I PDFdenny josephNoch keine Bewertungen

- OJT Weekly Report: Project Name: GEELY Showroom ProjectDokument9 SeitenOJT Weekly Report: Project Name: GEELY Showroom ProjectGintokiNoch keine Bewertungen

- Mess Management SystemDokument11 SeitenMess Management Systembaigz_9175% (4)

- Topic 11 - Open-Economy Macroeconomics - Basic Concepts.Dokument36 SeitenTopic 11 - Open-Economy Macroeconomics - Basic Concepts.Trung Hai TrieuNoch keine Bewertungen

- Amazon Fulfillment ProcessDokument1 SeiteAmazon Fulfillment ProcessRAHUL RNAIRNoch keine Bewertungen

- Q-ON-20-X-493-PT. Prastiwahyu (Rittal 1016600)Dokument1 SeiteQ-ON-20-X-493-PT. Prastiwahyu (Rittal 1016600)BowoNoch keine Bewertungen

- Statements of Cash Flows Three ExamplesDokument7 SeitenStatements of Cash Flows Three Examplesmohamed arbi taifNoch keine Bewertungen

- Cordage Institute International Standard - The Cordage InstituteDokument4 SeitenCordage Institute International Standard - The Cordage InstituteOscar CassoNoch keine Bewertungen

- Year of IncomeDokument64 SeitenYear of IncomeBISEKONoch keine Bewertungen

- BT Toyota Forklift Collections Repair Manual Training ManualDokument15 SeitenBT Toyota Forklift Collections Repair Manual Training Manualanthonystafford030799oct100% (70)