Beruflich Dokumente

Kultur Dokumente

Financial Instruments: The Building Blocks

Hochgeladen von

Ammara NawazOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Instruments: The Building Blocks

Hochgeladen von

Ammara NawazCopyright:

Verfügbare Formate

Chapter 11

Financial instruments: the building

blocks

Corporate Financial Strategy

Financial instruments: contents

Learning objectives

Risk and return

The risk-averse investor

The speculative investor

The building blocks of financial instruments

Characteristics of debt and equity

Rules for designing a financial instrument

Risk profile determines yield and gain to investor

Caps, floors, and collars

Net flows from swapping floating rate into fixed

Corporate Financial Strategy 2

Learning objectives

1. Explain the fundamental characteristics of debt and equity.

2. Identify and contrast the different risk-reduction mechanisms used by

investors and lenders.

3. Analyse a financial instrument to determine the yield, upside, and risk

reduction mechanisms it adopts.

4. Understand the basics of interest rate management tools.

Corporate Financial Strategy 3

Investors need to make a return on their money.

That return can come from a

− yield

− capital gain

− Both

The amount of return they require depends on the

− level of risk that they perceive they are taking

Within this simple framework there is a vast panoply

of financial instruments that can be created to serve

the different needs of companies and their investors.

Corporate Financial Strategy 4

Risk and Return

Investment in Company

− Debt (Bonds)

− Equity (Shares)

there is huge volatility in the expected return from an

investment in shares

That volatility of anticipated return is the risk we take, and it is

for this that we need to be compensated.

If debt pays us 6%, we will demand a much higher return from

our shares

it is also worth noting that individual investors perceive risk in

different ways, and thus demand different levels of return for

what is technically the same amount of risk.

Corporate Financial Strategy 5

Risk and Return

One of you has a very low risk threshold for personal

investment,

preferring the certainty of a secure retirement to the possible

glory of earning millions on speculative investment.

a venture capitalist may see the risk/return spectrum in an

entirely different way.

Such an investor is really not interested in low-risk

investments,

as their whole raison d’etre (justification for being) is in

making high gains on more speculative investments.

Corporate Financial Strategy 6

Risk and return

Required

return

Perceived risk

Corporate Financial Strategy 7

The risk- averse investor

Risk-averse

investor

Required

return

Market line

Perceived risk

Corporate Financial Strategy 8

The speculative investor

Required

return

Market line

Speculative

investor

Perceived risk

Corporate Financial Strategy 9

THE BUILDING BLOCKS OF A FINANCIAL INSTRUMENT

the return investors require is dependent on their perception

of the risk inherent in their investment.

That return will comprise some combination of yield and the

upside which comes normally from a capital gain.

Thus, the three building blocks are:

−● Risk

−● Yield

−● Upside

Corporate Financial Strategy 10

RISK

In order to reduce the return that the company has to pay,

the risk to the Investor has to be managed down

1. Giving the investor a way out

− one way to reduce investors ’ risk is assure them of a way out, by

• repayment or redemption, or

• conversion into another valuable asset.

2. Providing security :

− The company can provide security to the investor, often referred to

− as a ‘ charge’ on the company’s assets,

− such that if it fails to meet the terms of the agreement, the investor

can protect their downside in some way. (Collaterals, Securities)

Corporate Financial Strategy 11

Types of Securities, Collaterals

Under current UK law, security comes in two flavours

− fixed

− floating

fixed charge is one over specific assets such as buildings or

fixed plant

floating charge is a charge over assets which change on a

daily or weekly basis, such as inventories

In a liquidation,

− the holder of a fixed charge can use the proceeds of selling those

specific assets in order to recover their due debts.

− Holders of floating charges can be repaid from the monies released by

selling these assets, but they have a lower priority to the fixed charge

holders and to various statutory creditors

Corporate Financial Strategy 12

RISK

3. Providing a third party guarantee:

• If the company is unable to provide the assurance, it is possible that

a third party could do so

• For example,

a holding company or a major shareholder might agree to guarantee the loan

as might, for a fee, a bank, or insurance company.

4. Covenants:

• Covenants are conditions in a loan contract which protect the lender

by stating what the borrower may or may not do

• Types of Covenants:

Positive Covenants:

Negative Covenants:

Corporate Financial Strategy 13

RISK

− Positive Covenants:

• Positive covenants are loan conditions which state what the

borrower must do.

• For example,

the borrowing company must deliver management accounts within

a certain period after the month end;

must deliver audited annual accounts within a given timeframe;

must maintain agreed levels of accounting figures and ratios (such

as the level of equity or the working capital ratios).

Corporate Financial Strategy 14

RISK

− Negative Covenants:

• Negative covenants are clauses which prevent the borrower

from undertaking certain actions.

• For example,

negative covenants will prevent directors’ remuneration being increased

above a pre-agreed level, so that the business loan is not immediately

transferred to the directors’ benefit.

there will be covenants preventing large dividends being paid, or setting a

maximum level of pay for other employees.

covenants in place preventing a company from taking further loans, which

may have precedence in repayment, unless the lender gives consent.

Negative covenants will also prevent the company from spending large

amounts on fixed assets that have not been previously agreed with the

bank: this ensures that the monies borrowed are spent on the new factory

rather than the director’s Ferrari!

Corporate Financial Strategy 15

RISK

The main use of covenants is that a breach of the

covenant terms can enable the lender to demand

repayment of the loan, even though its term is not yet

due.

Corporate Financial Strategy 16

YIELD

The yield of a security includes any payment made

to the investors during the period for which the

investment is outstanding, other than payments which

reduce the capital balance.

Examples:

− interest on loans and

− dividends on shares.

Share repurchases or loan redemptions would not be

included in yield, as they are capital items.

Corporate Financial Strategy 17

YIELD

The yield can be a regular payment, such as contracted

quarterly interest, or can be on a more irregular basis, such

as an occasional dividend.

Yields are often linked to an underlying reference point.

For example,

− interest rates on debt may be fixed rate or floating.

− Floating rate loans charge interest based on a premium

over a reference rate such as

• LIBOR (London Inter Bank Offered Rate).

the contracted interest rate might be set at LIBOR plus a

premium of 1%

Corporate Financial Strategy 18

YIELD

If LIBOR is 5%, then the interest rate paid on the loan will

be 6%;

if LIBOR rises to 5.5%, the loan will be charged at 6.5%.

Floating rate interest can reduce risk for the lender, as it

ensures that the lender will always receive ‘ market ’ rates

on the loan.

However, it leaves the borrowing company vulnerable to rises

in market rates

example , were LIBOR to rise to say 15% (which was the

case in the late 1980s), the company would have to pay 16%

Corporate Financial Strategy 19

INTEREST RATE MANAGEMENT TOOLS

Interest rate management tools are used to lower the

financing risk for companies which have borrowed at a

floating rate.

If the reference rate falls, the company will pay less interest.

unexpected increases in market interest rates could lead to

the company having to pay a much larger than anticipated

charge

Reference rate

− In the UK the reference rate most commonly used is LIBOR (London

Inter Bank Offered Rate – the rate at which banks lend to each other

in London).

Corporate Financial Strategy 20

INTEREST RATE MANAGEMENT TOOLS

types of LIBOR,

− representing money being lent for varying periods

• 3 month LIBOR

• 6 month LIBOR

Example:

− As an example, CapCo might borrow say £1 million for 2 years at a rate of 3-month

LIBOR plus 2% (200 basis points). On the first day of the loan, 3-month LIBOR

might be 5%; this means that CapCo will pay interest at 7% (5% + 2%) for 3

months.

− At the end of the 3 months, the new rate for 3-month LIBOR would be used to set

the rate of interest due for the next 3-month period.

− If 6-month LIBOR had been used as the reference rate, CapCo’s interest would

have remained at that level for 6 months

Corporate Financial Strategy 21

CAPS, FLOORS, AND COLLARS

current LIBOR is 5%

Upper Limit of LIBOR is 9%

− Rate is 11% (9%+2%)

at levels above that (9%) there may be problems in meeting interest

payments.

In order to protect its position, the company can buy an interest rate

cap .

This is in effect an insurance policy that prevents the company having to

pay interest at more than a given rate.

The Firm can buy LIBOR cap at 9% by paying some amount

Corporate Financial Strategy 22

CAPS, FLOORS, AND COLLARS

several points to note about buying the cap

− the cap need not be acquired from the Bank, who provided the loan.

• In fact, the Loan providing Bank need not even know about the existence

of the cap

• CapCo has in fact bought it from an other bank, and it is a separate

financial transaction to the loan.

− technically, having a cap does not prevent the company having to pay

high interest rates to its lender

• it just means that it can offset this extra interest by the receipts from the

bank which sold it the cap.

• if LIBOR were to rise to 12%, CapCo would have to pay Landing Bank

interest at 14%, but would receive interest back from ScotWest amounting

to 3%, leaving it paying a net 11%.

Corporate Financial Strategy 23

CAPS, FLOORS, AND COLLARS

several points to note about buying the cap

− although the loan is for £1 million, the cap could be for less than that

amount, or more

• if CapCo wishes to speculate on interest rates.

If LIBOR rises to 12% then interest rate will be 14%

So above the caped LIBOR 3% (12% - 9%) will be compensated

by the other Bank.

Leaving the firm to paying actual interest 11% (9% LIBOR plus

2%) only.

Corporate Financial Strategy 24

CAPS, FLOORS, AND COLLARS

Acquiring the cap will cost CapCo an up-front payment, the level

of which depends on

− the rate capped, and t

− he time for which it is needed

For example,

− if our company wanted to cap LIBOR at 6%, it would be a great deal

more expensive than capping at 9%;

− similarly, a 6-month cap would be cheaper to buy than a 2-year cap.

Corporate Financial Strategy 25

CAPS, FLOORS, AND COLLARS

Should CapCo wish to avoid paying for its cap,

it could enter into a transaction to sell a floor to a bank.

Just as buying a cap means that the company’s interest rate will

never move above a certain amount,

selling a floor means that even if market rates fall the company will

not be able to take full advantage of it.

So CapCo might sell ScotWest (or another bank) a LIBOR oor at

4%.

This would mean that should LIBOR fall to say 3%, CapCo would

be paying Barland interest on its loan at 5% (3% + 2%) but

would also be paying 1% (4% + 3%) to ScotWest which owns

the floor.

Corporate Financial Strategy 26

CAPS, FLOORS, AND COLLARS

The purchase of a cap and a floor together is known as a collar.

Terms can be set such that the amount that the company has to

pay for purchasing the cap can be exactly offset by the amount the

bank is paying it for the floor. This is known as a zero cost collar.

Corporate Financial Strategy 27

Caps, floors, and collars

cap

collar

floor

Corporate Financial Strategy 28

SWAP

Another type of interest rate management tool is

− an interest rate swap.

example,

− a company which has borrowed at a floating rate agrees to swap interest

rate payments with a counter-party which has borrowed at a fixed rate.

There may be several reasons for doing this

− perhaps our company cannot borrow floating rate in the market,

− or perhaps the other company is changing its financing strategy and wants to

move out of fixed interest.

Alternatively, the swap might be done because both parties can

make money on it

− based on comparative advantage.

Corporate Financial Strategy 29

SWAP

Each company wants to borrow £1 million.

SwapCo would like fixed rate funds, and

FixCo would like floating rate funds.

If each of them were to borrow the types of funds they wanted, the

total rate they would pay would be LIBOR plus 9.5%.

However, if SwapCo were to borrow floating rate and FixCo at a

fixed rate, the total they paid would be LIBOR plus 8%. It is thus

worthwhile for them to borrow at the combined lower rate, and

then to swap payments.

Corporate Financial Strategy 30

SWAP

So, SwapCo will borrow £1 million

at a floating rate, paying LIBOR plus 2%.

FixCo will borrow £1 million at 6% fixed.

Then the swap agreement will ensure that SwapCo makes the

payments at 6% fixed, and

FixCo pays at LIBOR plus 2%.

The overall saving of 1.5% can be split between the two, and used

to reduce FixCo’s payment to (at most) the LIBOR plus 1.5% that

it would have paid on its own.

Corporate Financial Strategy 31

Net flows from swapping from floating rate into fixed

Lender

Floating rate interest

payments

Loan &

repayments

Borrower borrows Floating Borrower

Floating rate interest

payments

Fixed rate interest

payments

Borrower swaps into Fixed

Counterparty

Corporate Financial Strategy 32

UPSIDE

The investor obtains an upside from selling the security for an

amount greater than was originally invested in it;

the upside is the capital gain.

The upside can come from various different sources:

1. Sale of the financial instrument to another investor .

2. Redemption of the instrument at a premium by the

investee company, the premium being paid in cash or in

the securities of the investee company.

3. Redemption by the investee company with a premium in

securities of another company or in another asset

Corporate Financial Strategy 33

The building blocks of financial instruments

Risk v Return

Downside protection Yield

Repayment Fixed / Floating / Other

Security Discretionary or by right?

Guarantees Upside

Sale / Redemption /

Covenants

Exchange?

Voting rights

Depends on markets or on

Veto rights the company?

Board representation Guaranteed? Discretionary?

Corporate Financial Strategy 34

Characteristics of debt and equity

Debt Equity

Risk to the investor Low, protected by High

security and

covenants

Yield Interest, normally Dividends, at the

contractually agreed discretion of the

directors

Potential upside to None Very high

the investor

Corporate Financial Strategy 35

Rules for designing a financial instrument

The expected return on a

financial instrument must

be consistent with the

investor’s perceived risk

The return will come

from yield and upside.

Corporate Financial Strategy 36

Risk profiles determine yield and gain to investors

100%

Proportion of

required

return 100% 100%

supplied by yield gain

yield

0%

Perceived risk

Corporate Financial Strategy 37

Das könnte Ihnen auch gefallen

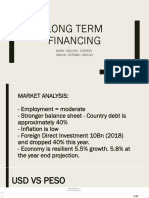

- LONG TERM FINANCING Finma FinalDokument36 SeitenLONG TERM FINANCING Finma FinalJane Baylon100% (2)

- Mutual Funds for Beginners Learning Mutual Funds BasicsVon EverandMutual Funds for Beginners Learning Mutual Funds BasicsNoch keine Bewertungen

- Vce ST01 FMDokument4 SeitenVce ST01 FMSourabh ChiprikarNoch keine Bewertungen

- Finance ManagementDokument12 SeitenFinance ManagementSoumen SahuNoch keine Bewertungen

- DJMD SjdnajkDokument14 SeitenDJMD Sjdnajksuhaib shaikhNoch keine Bewertungen

- Financial ManagementDokument21 SeitenFinancial ManagementsumanNoch keine Bewertungen

- 5418 Assignment # 01Dokument24 Seiten5418 Assignment # 01noorislamkhanNoch keine Bewertungen

- International Finance #13Dokument52 SeitenInternational Finance #13Amir AhmadNoch keine Bewertungen

- Portfolio Management - Return Objectives and Investment ConstraintsDokument2 SeitenPortfolio Management - Return Objectives and Investment ConstraintssauravNoch keine Bewertungen

- Factors Affecting Financial DecisionsDokument4 SeitenFactors Affecting Financial Decisionsshubham_cool1996Noch keine Bewertungen

- 3 - Descriptive Questions With Answers (20) DoneDokument13 Seiten3 - Descriptive Questions With Answers (20) DoneZeeshan SikandarNoch keine Bewertungen

- Financial Management RiskDokument11 SeitenFinancial Management RisknevadNoch keine Bewertungen

- 3.intro To Financial Institution and MarketDokument28 Seiten3.intro To Financial Institution and MarketKimberly FloresNoch keine Bewertungen

- FM Module 4 Capital Structure of A CompanyDokument6 SeitenFM Module 4 Capital Structure of A CompanyJeevan RobinNoch keine Bewertungen

- Leveraged BuyoutsDokument12 SeitenLeveraged BuyoutsLeonardo100% (1)

- Investing Made Easy: Finding the Right Opportunities for YouVon EverandInvesting Made Easy: Finding the Right Opportunities for YouNoch keine Bewertungen

- Icfai Sources - of - Capital - FinanceDokument25 SeitenIcfai Sources - of - Capital - Financeapi-3757629Noch keine Bewertungen

- NIBM ExamDokument9 SeitenNIBM ExamRavi GurungNoch keine Bewertungen

- Raising Funds Through EquityDokument20 SeitenRaising Funds Through Equityapi-3705920Noch keine Bewertungen

- FOF Tutorial 9 AnsDokument6 SeitenFOF Tutorial 9 AnsYasmin Zainuddin100% (1)

- F3 Chapter 3Dokument11 SeitenF3 Chapter 3Ali ShahnawazNoch keine Bewertungen

- Project Rationale:: Mutual FundsDokument26 SeitenProject Rationale:: Mutual FundsMuhammad KashifNoch keine Bewertungen

- Mastering the Art of Investing Using Other People's MoneyVon EverandMastering the Art of Investing Using Other People's MoneyNoch keine Bewertungen

- Chapter 24 Professional and Institutional Money ManagementDokument24 SeitenChapter 24 Professional and Institutional Money Managementsharktale2828100% (1)

- UNIT-4: Financial Inst ItutionsDokument35 SeitenUNIT-4: Financial Inst ItutionskaushalvrindaNoch keine Bewertungen

- Q 1. What Is Financial Planning? Discuses Basic Elements.: BBM 2 Year Part-II Honours 2021Dokument6 SeitenQ 1. What Is Financial Planning? Discuses Basic Elements.: BBM 2 Year Part-II Honours 2021buletkumar035Noch keine Bewertungen

- Paper FMDokument8 SeitenPaper FMmuzzammil ishfaqNoch keine Bewertungen

- FM ExamDokument13 SeitenFM Examtigist abebeNoch keine Bewertungen

- Financial Management PaperDokument11 SeitenFinancial Management PaperSankar RajagopalNoch keine Bewertungen

- Chapter - 9Dokument7 SeitenChapter - 9sonal2901Noch keine Bewertungen

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingVon EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNoch keine Bewertungen

- Chapter 5, Long Term Financing, RevisedDokument9 SeitenChapter 5, Long Term Financing, RevisedAndualem ZenebeNoch keine Bewertungen

- FM - March-April-2021Dokument10 SeitenFM - March-April-2021Towhidul IslamNoch keine Bewertungen

- AIM3Dokument12 SeitenAIM3prachiNoch keine Bewertungen

- Sources of FinanceDokument25 SeitenSources of FinanceAnand Kumar MishraNoch keine Bewertungen

- Securities Analysis and Portfolio Management PDFDokument64 SeitenSecurities Analysis and Portfolio Management PDFShreya s shetty100% (1)

- April Roze L. Nudo Bs-Iv Financial Management 2 Quiz-S Finals 2Dokument4 SeitenApril Roze L. Nudo Bs-Iv Financial Management 2 Quiz-S Finals 2April NudoNoch keine Bewertungen

- Top Private Equity Analyst Interview Questions and Answers Helpful For The BelowDokument7 SeitenTop Private Equity Analyst Interview Questions and Answers Helpful For The BelowTushar NegiNoch keine Bewertungen

- 10 - Chapter 1Dokument22 Seiten10 - Chapter 1Janhavi JadhavNoch keine Bewertungen

- Finance MarketDokument18 SeitenFinance Markettp0603069Noch keine Bewertungen

- Financial Management DPSDokument19 SeitenFinancial Management DPSYashasviNoch keine Bewertungen

- Discuss Following Methods of Evaluating Investment Projects. Pay Back Period MethodDokument5 SeitenDiscuss Following Methods of Evaluating Investment Projects. Pay Back Period MethodNilesh kumarNoch keine Bewertungen

- Financing DecisionsDokument10 SeitenFinancing DecisionsAahana GuptaNoch keine Bewertungen

- MB20202 Corporate Finance Unit IV Study MaterialsDokument21 SeitenMB20202 Corporate Finance Unit IV Study MaterialsSarath kumar CNoch keine Bewertungen

- Capital and The Financing of The CompaniesDokument49 SeitenCapital and The Financing of The CompaniesRAVENAL DELA FUENTENoch keine Bewertungen

- Bonds: Here Are Some Benefits They Can ProvideDokument7 SeitenBonds: Here Are Some Benefits They Can ProvidefaqehaNoch keine Bewertungen

- Sources of FinanceDokument25 SeitenSources of FinanceManish Parashar100% (11)

- Inve, T and Portfolio Management Assin 1Dokument11 SeitenInve, T and Portfolio Management Assin 1Filmona YonasNoch keine Bewertungen

- Finance Exam NotesDokument14 SeitenFinance Exam NotesAneesha100% (1)

- Risk and ReturnsDokument17 SeitenRisk and ReturnsLeica Jayme100% (1)

- Legal AspectDokument49 SeitenLegal AspectRAVENAL DELA FUENTENoch keine Bewertungen

- Bumanglag BES9 Page 267Dokument3 SeitenBumanglag BES9 Page 267Michael Sean BumanglagNoch keine Bewertungen

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementVon EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNoch keine Bewertungen

- Business Finance DefinationsDokument6 SeitenBusiness Finance DefinationsAhmed SaeedNoch keine Bewertungen

- Chapter 9 FINANCIAL MANAGEMENTDokument34 SeitenChapter 9 FINANCIAL MANAGEMENTLatha VarugheseNoch keine Bewertungen

- Portfolio Management - Part 2: Portfolio Management, #2Von EverandPortfolio Management - Part 2: Portfolio Management, #2Bewertung: 5 von 5 Sternen5/5 (9)

- Unit - 3 Dividend PolicyDokument8 SeitenUnit - 3 Dividend Policyetebark h/michaleNoch keine Bewertungen

- Basic Rule For Investing in Mutual FundDokument22 SeitenBasic Rule For Investing in Mutual FundTapan JoshiNoch keine Bewertungen

- Legal Obligations of Directors: Unilever Code of Corporate Governance of PakistanDokument1 SeiteLegal Obligations of Directors: Unilever Code of Corporate Governance of PakistanAmmara NawazNoch keine Bewertungen

- Business Plan Final ReportDokument42 SeitenBusiness Plan Final ReportAmmara NawazNoch keine Bewertungen

- Corporate Governance: An OverviewDokument24 SeitenCorporate Governance: An OverviewAmmara NawazNoch keine Bewertungen

- Financial Instrument: What Are Financial Instruments?Dokument9 SeitenFinancial Instrument: What Are Financial Instruments?Ammara NawazNoch keine Bewertungen

- Formate of Ratio AnalysisDokument13 SeitenFormate of Ratio AnalysisAmmara NawazNoch keine Bewertungen

- Mature Companies: Corporate Financial Strategy 4th Edition DR Ruth BenderDokument13 SeitenMature Companies: Corporate Financial Strategy 4th Edition DR Ruth BenderAmmara NawazNoch keine Bewertungen

- Declining Businesses: A Case For Euthanasia?: Corporate Financial Strategy 4th Edition DR Ruth BenderDokument6 SeitenDeclining Businesses: A Case For Euthanasia?: Corporate Financial Strategy 4th Edition DR Ruth BenderAmmara NawazNoch keine Bewertungen

- What Does The Share Price Tell Us?: Corporate Financial Strategy 4th Edition DR Ruth BenderDokument12 SeitenWhat Does The Share Price Tell Us?: Corporate Financial Strategy 4th Edition DR Ruth BenderAmmara NawazNoch keine Bewertungen

- Government Influence On Exchange RatesDokument65 SeitenGovernment Influence On Exchange RatesAmmara NawazNoch keine Bewertungen

- Growth Companies Marketing Focus: Corporate Financial StrategyDokument15 SeitenGrowth Companies Marketing Focus: Corporate Financial StrategyAmmara NawazNoch keine Bewertungen

- Bargaining Power of SupplierDokument9 SeitenBargaining Power of SupplierAmmara NawazNoch keine Bewertungen

- Pakistan-India Relations: Sabih Kamran BB-4297Dokument7 SeitenPakistan-India Relations: Sabih Kamran BB-4297Ammara NawazNoch keine Bewertungen

- Growth Companies Marketing Focus: Corporate Financial StrategyDokument21 SeitenGrowth Companies Marketing Focus: Corporate Financial StrategyAmmara NawazNoch keine Bewertungen

- Start-Up Businesses and Venture Capital: Corporate Financial StrategyDokument14 SeitenStart-Up Businesses and Venture Capital: Corporate Financial StrategyAmmara NawazNoch keine Bewertungen

- Optimal Decisions Using Marginal Analysi PDFDokument20 SeitenOptimal Decisions Using Marginal Analysi PDFAmmara NawazNoch keine Bewertungen

- Fazal Group Economics - 2Dokument7 SeitenFazal Group Economics - 2Ammara NawazNoch keine Bewertungen

- Foreign Direct Investments and Economic Growth: The Primary DriversDokument14 SeitenForeign Direct Investments and Economic Growth: The Primary DriversAmmara NawazNoch keine Bewertungen

- Pepsi Marketing ReportDokument17 SeitenPepsi Marketing ReportAmmara NawazNoch keine Bewertungen

- Summary Output W T: Multiple R R Square Adjusted R Square Standard Error Observations Anova Regression Residual TotalDokument6 SeitenSummary Output W T: Multiple R R Square Adjusted R Square Standard Error Observations Anova Regression Residual TotalAmmara NawazNoch keine Bewertungen

- Noor Fatima Adeeba Mukhtar Iqra ShafqatDokument3 SeitenNoor Fatima Adeeba Mukhtar Iqra ShafqatAmmara NawazNoch keine Bewertungen

- Analysis of Financial StatementDokument6 SeitenAnalysis of Financial StatementAmmara NawazNoch keine Bewertungen

- International Financial ManagementDokument6 SeitenInternational Financial ManagementAmmara NawazNoch keine Bewertungen

- Mergers & Acquisitions: Master in Management - Investment BankingDokument21 SeitenMergers & Acquisitions: Master in Management - Investment Bankingisaure badreNoch keine Bewertungen

- Investment Houses Securities BrokersDealersDokument35 SeitenInvestment Houses Securities BrokersDealersbessmasanqueNoch keine Bewertungen

- Wage and Tax StatementDokument4 SeitenWage and Tax StatementRich1781Noch keine Bewertungen

- Thesis On MilkDokument80 SeitenThesis On Milkvplou7Noch keine Bewertungen

- Role of Digital MarketingDokument2 SeitenRole of Digital MarketingUrmi ThadaniNoch keine Bewertungen

- Market Plan of Lucky Cement FActoryDokument20 SeitenMarket Plan of Lucky Cement FActoryRehman RehoNoch keine Bewertungen

- Taglish Radio-Broadcasting Script Draft Example by Melbourne PomboDokument10 SeitenTaglish Radio-Broadcasting Script Draft Example by Melbourne PomboEmma Belanigue-PomboNoch keine Bewertungen

- The Wonderful World of Tax SalesDokument9 SeitenThe Wonderful World of Tax Saleslyocco1Noch keine Bewertungen

- Population Pyramid: Pyramid", Is A Graphical Illustration That Shows TheDokument7 SeitenPopulation Pyramid: Pyramid", Is A Graphical Illustration That Shows TheUsmanNoch keine Bewertungen

- Financial DerivativesDokument2 SeitenFinancial Derivativesviveksharma51Noch keine Bewertungen

- ChallanFormDokument1 SeiteChallanFormAman GargNoch keine Bewertungen

- Accounts ManipulationDokument5 SeitenAccounts ManipulationomarahpNoch keine Bewertungen

- 2 Wheeler Automobile IndustryDokument9 Seiten2 Wheeler Automobile IndustryShankeyNoch keine Bewertungen

- Ed Ebreo - High Performance Team Leadership WorkshopDokument5 SeitenEd Ebreo - High Performance Team Leadership WorkshopEdwin EbreoNoch keine Bewertungen

- Marketing Offering & Brand ManagementDokument33 SeitenMarketing Offering & Brand ManagementTom jerryNoch keine Bewertungen

- The Oriental Express Case StudyDokument5 SeitenThe Oriental Express Case Studysehajsomi008Noch keine Bewertungen

- ProposalDokument5 SeitenProposalDeepika KandiNoch keine Bewertungen

- Commercial Bank Management Midsem NotesDokument12 SeitenCommercial Bank Management Midsem NotesWinston WongNoch keine Bewertungen

- Presidential Decree No 772Dokument14 SeitenPresidential Decree No 772Juan Luis LusongNoch keine Bewertungen

- ExamDokument12 SeitenExamAvi SiNoch keine Bewertungen

- Nikita: Thanks For Choosing Swiggy, Nikita! Here Are Your Order Details: Delivery ToDokument2 SeitenNikita: Thanks For Choosing Swiggy, Nikita! Here Are Your Order Details: Delivery ToAkash MadhwaniNoch keine Bewertungen

- Agreement FormatDokument5 SeitenAgreement Formatpurshottam hunsigiNoch keine Bewertungen

- DT 0108 Annual Paye Deductions Return Form v1 2Dokument2 SeitenDT 0108 Annual Paye Deductions Return Form v1 2Kwasi DankwaNoch keine Bewertungen

- What Might Happen in China in 2016Dokument9 SeitenWhat Might Happen in China in 2016Henrique SartoriNoch keine Bewertungen

- Shareholders' EquityDokument16 SeitenShareholders' Equitymaria evangelistaNoch keine Bewertungen

- HP Planning PDFDokument20 SeitenHP Planning PDFMD. Asiqur RahmanNoch keine Bewertungen

- 128电子及家电2Dokument156 Seiten128电子及家电2zhen zengNoch keine Bewertungen

- Project Work On Bisleri.Dokument60 SeitenProject Work On Bisleri.Rizwan Shaikh 44Noch keine Bewertungen

- Kami Export - Microsoft Word - Choose To Save Lesson Plan 2 4 1 - Https - Mail-Attachment Googleusercontent Com-Attachment-U-0Dokument4 SeitenKami Export - Microsoft Word - Choose To Save Lesson Plan 2 4 1 - Https - Mail-Attachment Googleusercontent Com-Attachment-U-0api-296019366Noch keine Bewertungen