Beruflich Dokumente

Kultur Dokumente

Chapter 8 Accounting For Franchise Operations - Franchisor: Learning Competencies

Hochgeladen von

Rey Joyce Abuel0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

443 Ansichten21 Seitenaa

Originaltitel

FRANCHISE

Copyright

© © All Rights Reserved

Verfügbare Formate

PPTX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenaa

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

443 Ansichten21 SeitenChapter 8 Accounting For Franchise Operations - Franchisor: Learning Competencies

Hochgeladen von

Rey Joyce Abuelaa

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPTX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 21

Chapter 8 Accounting for Franchise

Operations – Franchisor

Related standard: PFRS 15 Revenue from Contracts

with Customers

Learning Competencies

• Define a franchise contract.

• Apply the general and specific principles of

PFRS 15 in recognizing revenue from franchise

contracts.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Applicability of PFRS 15

• An entity shall apply the principles set forth under PFRS

15 Revenue from Contracts with Customers in

accounting for revenues from contracts with customers,

regardless of the nature of the contract entered into with

a customer.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Core principle

• An entity recognizes revenue to depict the

transfer of promised goods or services to

customers in an amount that reflects the

consideration to which the entity expects to be

entitled in exchange for those goods or services.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Steps in the recognition of revenue

PFRS 15 requires the following steps in recognizing revenue:

• Step 1: Identify the contract with the customer

• Step 2: Identify the performance obligations in the contract

• Step 3: Determine the transaction price

• Step 4: Allocate the transaction price to the performance

obligations in the contract

• Step 5: Recognize revenue when (or as) the entity satisfies a

performance obligation

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Step 1: Identify the contract with the customer

Requirements before a contract with a customer is accounted for under

PFRS 15:

a. The contract must be approved and the contracting parties are

committed to it;

b. rights and payment terms are identifiable;

c. The contract has commercial substance; and

d. The consideration is probable of collection.

No revenue is recognized if the contract does not meet the criteria

above. Any consideration received is recognized as liability.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Step 2: Identify the performance obligations in the contract

Each promise in a contract to transfer a distinct

good or service is treated as a separate

performance obligation.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Identifying distinct goods or services

A good or service is distinct if:

(a) the customer can benefit from it, either on its own or together

with other resources that are readily available to the customer

(e.g., the good or service is regularly sold separately); and

(b) the good or service is separately identifiable (i.e., not an input

to a combined output, does not significantly modify the other

promises, or not highly interrelated with the other promises).

A good or service that is not distinct shall be combined with the other

promises in the contract. Combined promises are treated as a single

performance obligation.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

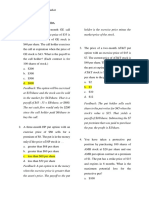

Specific principles

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Specific principles - continuation

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Specific principles - continuation

• Regardless of the previous requirements (i.e., not distinct vs.

distinct, right to access vs. right to use), an entity shall recognize

revenue from sales-based or usage-based royalties when (or as)

those sales or usage occur.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Step 3: Determine the transaction price

• The entity shall determine the transaction price because this is

the amount at which revenue will be measured.

• Transaction price is “the amount of consideration to which an

entity expects to be entitled in exchange for transferring promised

goods or services to a customer, excluding amounts collected on

behalf of third parties (e.g., some sales taxes).” The consideration

may include fixed amounts, variable amounts, or both.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Step 4: Allocate the transaction price to the performance obligations

• The transaction price shall be allocated to each performance

obligation identified in a contract based on the relative stand-

alone prices of the distinct goods or services promised to be

transferred.

• The stand-alone selling price is the price at which a promised good

or service can be sold separately to a customer.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Step 5: Recognize revenue when (or as) the entity satisfies a

performance obligation

• If the performance obligation in the contract is satisfied over

time, revenue is recognized over time as the entity progresses

towards the complete satisfaction of the obligation.

• If the performance obligation in the contract is satisfied at a

point in time, the entity recognizes revenue when the

performance obligation is satisfied.

• Revenue is measured at the amount of the transaction price

allocated to the satisfied performance obligation.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Measuring progress towards complete satisfaction of a performance

obligation

• For each performance obligation satisfied over time, an entity shall

recognize revenue over time by measuring the progress towards

complete satisfaction of that performance obligation.

• Examples of acceptable measurement methods:

1. Output methods (e.g., surveys of work performed)

2. Input methods (e.g., relationship between costs incurred to date

and total expected costs)

If efforts or inputs are expended evenly throughout the performance

period, revenue may be recognized on a straight-line basis.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Contract costs

Contract costs include the following:

(a) Incremental costs of obtaining a contract – recognized as asset if

they are recoverable and avoidable. As a practical expedient, the

costs are recognized as expense if their expected amortization

period is 1 year or less.

(b) Costs to fulfill a contract –if within the scope of PFRS 15, they are

recognized as asset if they are: (a) directly related to a contract, (b)

generate or enhance resources, and (c) recoverable.

(OPTIONAL APPLICATION: PROBLEM 38-6: # 9)

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Presentation

A contract where either party has performed is presented in the statement

of financial position as a contract liability, contract asset or receivable.

• Contract liability – is an entity’s obligation to transfer goods or

services to a customer for which the entity has received consideration (or

the amount is due) from the customer.

• Contract asset – is an entity’s right to consideration in exchange for

goods or services that the entity has transferred to a customer when that

right is conditioned on something other than the passage of time.

• Receivable – is an entity’s right to consideration that is unconditional.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

ADDITIONAL CONCEPTS

Concepts related to Step 2 (Identifying the performance

obligations)

• Non-refundable upfront fee (i.e., initial franchise fee that covers

the provision of the ‘know-how’ and initial services to set up the

contract) is a performance obligation only if it relates to the transfer of

goods or services. It is not a performance obligation if it relates to

administrative tasks to set up a contract. In the latter case, the non-

refundable upfront fee is treated as a prepayment and recognized as

revenue only when the related goods or services are transferred to the

customer.

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

ADDITIONAL CONCEPTS

Concepts related to Step 3 (Determining the transaction

price) - continuation

• If the timing of agreed payments provides the customer or the entity

with a significant benefit of financing, the revenue recognized

shall reflect the cash selling price of the goods or services.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

APPLICATION OF CONCEPTS

ANSWER PRACTICE SET # 8

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

OPEN FORUM

QUESTIONS????

REACTIONS!!!!!

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

END

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

Das könnte Ihnen auch gefallen

- Chapter 8 Accounting For Franchise Operations Franchisor Chapter 8 Accounting For Franchise Operations FranchisorDokument55 SeitenChapter 8 Accounting For Franchise Operations Franchisor Chapter 8 Accounting For Franchise Operations FranchisorQueeny Mae Cantre Reuta100% (1)

- Caltech Ventures Performance AgreementDokument3 SeitenCaltech Ventures Performance AgreementAnita WilliamsNoch keine Bewertungen

- Quiz - Act 07A: I. Theories: ProblemsDokument2 SeitenQuiz - Act 07A: I. Theories: ProblemsShawn Organo0% (1)

- p3 Acc 110 ReviewerDokument12 Seitenp3 Acc 110 ReviewerRona Amor MundaNoch keine Bewertungen

- Accounting For Special TransactionsDokument3 SeitenAccounting For Special TransactionsnovyNoch keine Bewertungen

- AFAR Answer KeyDokument9 SeitenAFAR Answer KeyFery AnnNoch keine Bewertungen

- Accounting For Special Transactions:: Corporate LiquidationDokument28 SeitenAccounting For Special Transactions:: Corporate LiquidationKim EllaNoch keine Bewertungen

- Chapter 2 Nca Held For Sale and Discontinued OperationsDokument14 SeitenChapter 2 Nca Held For Sale and Discontinued Operationslady gwaeyngNoch keine Bewertungen

- Petron CorporationDokument3 SeitenPetron CorporationXander BancaleNoch keine Bewertungen

- Consolidation at Acquisition DateDokument29 SeitenConsolidation at Acquisition DateLee DokyeomNoch keine Bewertungen

- Mas Drills Weeks 1 5Dokument28 SeitenMas Drills Weeks 1 5Hermz ComzNoch keine Bewertungen

- Consignment Accounting EntriesDokument9 SeitenConsignment Accounting EntriesAnjo Amiel SantosNoch keine Bewertungen

- Quiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2Dokument31 SeitenQuiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2marie aniceteNoch keine Bewertungen

- Unit Iii Assessment ProblemsDokument8 SeitenUnit Iii Assessment ProblemsChin Figura100% (1)

- MAS 2017 01 Management Accounting Concepts Techniques For Planning and ControlDokument5 SeitenMAS 2017 01 Management Accounting Concepts Techniques For Planning and ControlMitch Delgado EmataNoch keine Bewertungen

- Chapter 16 Summary: Accounting for Non-Profit OrganizationsDokument27 SeitenChapter 16 Summary: Accounting for Non-Profit OrganizationsEllen MNoch keine Bewertungen

- Compute P/E ratios, dividend yields, and book-to-market ratiosDokument2 SeitenCompute P/E ratios, dividend yields, and book-to-market ratiosJaneth NavalesNoch keine Bewertungen

- Chapter 3 Liquidation ValueDokument11 SeitenChapter 3 Liquidation ValueJIL Masapang Victoria ChapterNoch keine Bewertungen

- 05 Activity 1 BALADokument3 Seiten05 Activity 1 BALAPola PolzNoch keine Bewertungen

- Chapter 16 AnsDokument7 SeitenChapter 16 AnsDave Manalo100% (5)

- Arts Cpa Review: BatchDokument5 SeitenArts Cpa Review: BatchKristel Sumabat0% (1)

- Dolores' Music Emporium estimated liabilities for warranties and premiumsDokument2 SeitenDolores' Music Emporium estimated liabilities for warranties and premiumsMark Michael LegaspiNoch keine Bewertungen

- Module 8 AgricultureDokument9 SeitenModule 8 AgricultureTrine De LeonNoch keine Bewertungen

- Audit Theory Chapter 7 Overview of FS Audit ProcessDokument13 SeitenAudit Theory Chapter 7 Overview of FS Audit ProcessAdam SmithNoch keine Bewertungen

- FINANCE LEASE-lecture and ExercisesDokument10 SeitenFINANCE LEASE-lecture and ExercisesJamie CantubaNoch keine Bewertungen

- Installment SalesDokument6 SeitenInstallment SalesMarivic C. VelascoNoch keine Bewertungen

- Sol Man Sec 6 SQ1 PDFDokument4 SeitenSol Man Sec 6 SQ1 PDFHope Trinity EnriquezNoch keine Bewertungen

- Consolidated Financial FormulasDokument3 SeitenConsolidated Financial FormulasNiña Rica PunzalanNoch keine Bewertungen

- Advanced Accounting Part 2 Dayag 2015 Chapter 4 (2022)Dokument68 SeitenAdvanced Accounting Part 2 Dayag 2015 Chapter 4 (2022)Mazikeen DeckerNoch keine Bewertungen

- Practical Accounting 1 ReviewerDokument13 SeitenPractical Accounting 1 ReviewerKimberly RamosNoch keine Bewertungen

- Mas 1 QuizDokument7 SeitenMas 1 Quizsean justin EspinaNoch keine Bewertungen

- Psa 550 FNDokument1 SeitePsa 550 FNkristel-marie-pitogo-4419Noch keine Bewertungen

- Exercises and Problems on Prepaid Expenses and InsuranceDokument5 SeitenExercises and Problems on Prepaid Expenses and InsuranceKathleenCusipagNoch keine Bewertungen

- Ia3 IsDokument3 SeitenIa3 IsMary Joy CabilNoch keine Bewertungen

- Jun Zen Ralph Yap BSA - 3 Year Let's CheckDokument2 SeitenJun Zen Ralph Yap BSA - 3 Year Let's CheckJunzen Ralph YapNoch keine Bewertungen

- Finma Group 5 Capital Budgeting - Part 1-12-14Dokument4 SeitenFinma Group 5 Capital Budgeting - Part 1-12-14jovibonNoch keine Bewertungen

- AE120 - Final Activity 1Dokument1 SeiteAE120 - Final Activity 1Krystal shaneNoch keine Bewertungen

- Management Science Chapter 10Dokument44 SeitenManagement Science Chapter 10Myuran SivarajahNoch keine Bewertungen

- Chapter 1-Business Combination (Part 1)Dokument9 SeitenChapter 1-Business Combination (Part 1)May JennNoch keine Bewertungen

- Accounting controls for special transactionsDokument12 SeitenAccounting controls for special transactionsRNoch keine Bewertungen

- Accounting for Business CombinationsDokument52 SeitenAccounting for Business CombinationsXavier AresNoch keine Bewertungen

- Chapter 35 - AnswerDokument8 SeitenChapter 35 - AnswerJonathan Tumamao FernandezNoch keine Bewertungen

- Accounting for Warranties and PremiumsDokument2 SeitenAccounting for Warranties and PremiumsMa Teresa B. CerezoNoch keine Bewertungen

- Cost Accounting Quiz 5 Joint Products & By-Products CostingDokument7 SeitenCost Accounting Quiz 5 Joint Products & By-Products CostingshengNoch keine Bewertungen

- COMPARING CAFÉS AND TEA HOUSES IN SAN JOSEDokument15 SeitenCOMPARING CAFÉS AND TEA HOUSES IN SAN JOSEAngel Venus GuerreroNoch keine Bewertungen

- Seatwork - Advacc1Dokument2 SeitenSeatwork - Advacc1David DavidNoch keine Bewertungen

- Final Exam Questions on Financial ManagementDokument3 SeitenFinal Exam Questions on Financial ManagementAnaSolitoNoch keine Bewertungen

- Don Honorio Ventura State University Graduate School Strategy EvaluationDokument29 SeitenDon Honorio Ventura State University Graduate School Strategy EvaluationShelly Mae SiguaNoch keine Bewertungen

- PFRS 12 Disclosure RequirementsDokument26 SeitenPFRS 12 Disclosure RequirementsMeiNoch keine Bewertungen

- FAR 4320 Book Value Per Share Earnings Per Share PDFDokument3 SeitenFAR 4320 Book Value Per Share Earnings Per Share PDFAnjolina BautistaNoch keine Bewertungen

- Fundamentals of Assurance Services - Docx'Dokument8 SeitenFundamentals of Assurance Services - Docx'jhell dela cruzNoch keine Bewertungen

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDokument5 SeitenColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNoch keine Bewertungen

- Chapter 09Dokument16 SeitenChapter 09FireBNoch keine Bewertungen

- Chapter 11 Intagible AssetsDokument5 SeitenChapter 11 Intagible Assetsmaria isabellaNoch keine Bewertungen

- Auditing Theory Audit Report Key Audit ConceptsDokument13 SeitenAuditing Theory Audit Report Key Audit ConceptsMay RamosNoch keine Bewertungen

- ULO A Analyze Act1Dokument5 SeitenULO A Analyze Act1Marian B TersonaNoch keine Bewertungen

- Goodwill and acquisition accounting problemsDokument13 SeitenGoodwill and acquisition accounting problemsChincel G. ANINoch keine Bewertungen

- Acco 30013 Accounting For Special Transactions 2019Dokument8 SeitenAcco 30013 Accounting For Special Transactions 2019Azel Ann AlibinNoch keine Bewertungen

- Toa Quizzer 1: Multiple ChoiceDokument18 SeitenToa Quizzer 1: Multiple ChoiceRukia KuchikiNoch keine Bewertungen

- Chapter 6 Accounting For Franchise Operations - Franchisor-PROFE01Dokument7 SeitenChapter 6 Accounting For Franchise Operations - Franchisor-PROFE01Steffany RoqueNoch keine Bewertungen

- Memo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesDokument3 SeitenMemo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesRey Joyce AbuelNoch keine Bewertungen

- AC Actual SP SC/unit: AQ Used AQ Per UnitDokument18 SeitenAC Actual SP SC/unit: AQ Used AQ Per UnitRey Joyce AbuelNoch keine Bewertungen

- PsychDokument6 SeitenPsychRey Joyce AbuelNoch keine Bewertungen

- AC Actual SP SC/unit: AQ Used AQ Per UnitDokument18 SeitenAC Actual SP SC/unit: AQ Used AQ Per UnitRey Joyce AbuelNoch keine Bewertungen

- DL FinalDokument1 SeiteDL FinalRey Joyce AbuelNoch keine Bewertungen

- ReflectionDokument1 SeiteReflectionRey Joyce AbuelNoch keine Bewertungen

- Chapter 7 Cash & Cash Equivalents: PayableDokument2 SeitenChapter 7 Cash & Cash Equivalents: PayableRey Joyce AbuelNoch keine Bewertungen

- Chapter 8 Accounting For Franchise Operations - Franchisor: Learning CompetenciesDokument21 SeitenChapter 8 Accounting For Franchise Operations - Franchisor: Learning CompetenciesRey Joyce AbuelNoch keine Bewertungen

- Gothic ArchitectureDokument2 SeitenGothic ArchitectureRey Joyce AbuelNoch keine Bewertungen

- Use The Following Information For The Next Two Questions:: Practice Set # 6: Joint ArrangementsDokument4 SeitenUse The Following Information For The Next Two Questions:: Practice Set # 6: Joint ArrangementsRey Joyce Abuel0% (1)

- Factory Overhead: AssumptionsDokument6 SeitenFactory Overhead: AssumptionsRey Joyce AbuelNoch keine Bewertungen

- Virtue Ethics ReflectionDokument3 SeitenVirtue Ethics ReflectionRifa Farhad67% (12)

- Explain The Rights TheoryDokument8 SeitenExplain The Rights TheoryDanelle VillanuevaNoch keine Bewertungen

- COA guidelines for preventing irregular expendituresDokument71 SeitenCOA guidelines for preventing irregular expendituresleah santosNoch keine Bewertungen

- Ethics MoralityDokument14 SeitenEthics MoralityUsama Javed100% (1)

- RostowsDokument2 SeitenRostowsRey Joyce AbuelNoch keine Bewertungen

- Chapter 8 - Teacher's Manual - Afar Part 1Dokument7 SeitenChapter 8 - Teacher's Manual - Afar Part 1Angelic100% (3)

- Architectural Designs Near HomeDokument1 SeiteArchitectural Designs Near HomeRey Joyce AbuelNoch keine Bewertungen

- Exemplar Company Statement of Financial Position As of December 31, 2017Dokument3 SeitenExemplar Company Statement of Financial Position As of December 31, 2017Rey Joyce AbuelNoch keine Bewertungen

- Activity On Architectural Designs:: Rubric For Grading: PPT Video RubricDokument1 SeiteActivity On Architectural Designs:: Rubric For Grading: PPT Video RubricRey Joyce AbuelNoch keine Bewertungen

- PS Pink Ni Nga Cartolina Kim, Dakoa Imong Agi Hehehe Tanxx MONOPOLISTIC COMPETITION - Is A Type of Imperfect Competition Such That Competing Producers SellDokument2 SeitenPS Pink Ni Nga Cartolina Kim, Dakoa Imong Agi Hehehe Tanxx MONOPOLISTIC COMPETITION - Is A Type of Imperfect Competition Such That Competing Producers SellRey Joyce AbuelNoch keine Bewertungen

- BSP evaluates savings bank loansDokument2 SeitenBSP evaluates savings bank loansRey Joyce AbuelNoch keine Bewertungen

- Structural Change ApproachDokument3 SeitenStructural Change ApproachRey Joyce AbuelNoch keine Bewertungen

- 3-15 Free Cash Flow: Rey Joyce B. Abuel July 10, 2018 Aec 13-AcbDokument3 Seiten3-15 Free Cash Flow: Rey Joyce B. Abuel July 10, 2018 Aec 13-AcbRey Joyce AbuelNoch keine Bewertungen

- FV PV (1+i) FV $ 100 (1+0.10) FVDokument6 SeitenFV PV (1+i) FV $ 100 (1+0.10) FVRey Joyce Abuel100% (2)

- Financial Markets Essential For Economic GrowthDokument2 SeitenFinancial Markets Essential For Economic GrowthRey Joyce AbuelNoch keine Bewertungen

- ContextDokument2 SeitenContextRey Joyce AbuelNoch keine Bewertungen

- Rey Joyce BDokument2 SeitenRey Joyce BRey Joyce AbuelNoch keine Bewertungen

- My Company Unadjusted Trial Balance December 31, 2018 Debit CreditDokument9 SeitenMy Company Unadjusted Trial Balance December 31, 2018 Debit CreditRey Joyce AbuelNoch keine Bewertungen

- Chapter 10: Eucharist: Basic Description of The EucharistDokument1 SeiteChapter 10: Eucharist: Basic Description of The EucharistRey Joyce AbuelNoch keine Bewertungen

- Synopsis Puma AdidasDokument12 SeitenSynopsis Puma AdidasArvind Sanu Misra100% (3)

- The Tech Marketer's Guide To B2B VideoDokument23 SeitenThe Tech Marketer's Guide To B2B Videoanon_154309434Noch keine Bewertungen

- Final Asian Paints SCMDokument25 SeitenFinal Asian Paints SCMsanju0789Noch keine Bewertungen

- Accounting For Branch Operations SolutionsDokument62 SeitenAccounting For Branch Operations SolutionsMUNIKA SULISTIAWATINoch keine Bewertungen

- Doing Business With BelizeDokument21 SeitenDoing Business With BelizeOffice of Trade Negotiations (OTN), CARICOM SecretariatNoch keine Bewertungen

- A Study On Customer Satisfaction With Reference To Amazon Online ShoppingDokument20 SeitenA Study On Customer Satisfaction With Reference To Amazon Online Shoppingjeel rabadiya60% (5)

- De Beers ReportDokument6 SeitenDe Beers Reportjyoti singhalNoch keine Bewertungen

- Additional Topics in Variance Analysis: Solutions To Review QuestionsDokument36 SeitenAdditional Topics in Variance Analysis: Solutions To Review QuestionskrrrNoch keine Bewertungen

- CXC Principles of Business Exam GuideDokument25 SeitenCXC Principles of Business Exam GuideMaryann Maxwell67% (3)

- Prasad HTC InvoiceDokument2 SeitenPrasad HTC InvoicekrishnaavNoch keine Bewertungen

- Case Study: The Global Pharmaceutical IndustryDokument23 SeitenCase Study: The Global Pharmaceutical IndustryRasool AsifNoch keine Bewertungen

- Tapal TeaDokument8 SeitenTapal TeaMajid Hussain100% (1)

- Tribunal Decision on Cenvat Credit Unsettles Settled PositionDokument97 SeitenTribunal Decision on Cenvat Credit Unsettles Settled PositionshantX100% (1)

- Business Communication Assignment SummaryDokument2 SeitenBusiness Communication Assignment SummarySharif Jan67% (3)

- AIS Packing Slip/ Bill of LadingDokument4 SeitenAIS Packing Slip/ Bill of LadingLyka Liwanag NonogNoch keine Bewertungen

- Vending Machine - Piso Wifi For BusinessDokument17 SeitenVending Machine - Piso Wifi For BusinessNoli Canlas100% (3)

- Chapter020 Solutions Manuall 2 PDFDokument29 SeitenChapter020 Solutions Manuall 2 PDFleoyay50% (2)

- Panlilio vs. VictorioDokument8 SeitenPanlilio vs. VictoriojeiromeNoch keine Bewertungen

- The Multichannel Challenge at Natura in Beauty and Personal CareDokument18 SeitenThe Multichannel Challenge at Natura in Beauty and Personal CareJonathan RosalesNoch keine Bewertungen

- Country Branding & PakistanDokument65 SeitenCountry Branding & Pakistanmurtaza_khambatiNoch keine Bewertungen

- Solman SOAL 1 Asis CHP 15 Options MarketDokument4 SeitenSolman SOAL 1 Asis CHP 15 Options MarketfauziyahNoch keine Bewertungen

- Lect 19 Slides 01-Bosmeny-Sales MarketingDokument15 SeitenLect 19 Slides 01-Bosmeny-Sales Marketingdonmd98Noch keine Bewertungen

- Lecture Notes 2Dokument15 SeitenLecture Notes 2Asghar AsgharmaneshNoch keine Bewertungen

- Questionnaire On Sales Force Analysis/DiagnosisDokument3 SeitenQuestionnaire On Sales Force Analysis/DiagnosisKaushal67% (3)

- Yuvraj Beej BhandarDokument1 SeiteYuvraj Beej Bhandarakhil0% (1)

- CorePlus Learning Solutions MapDokument1 SeiteCorePlus Learning Solutions MapSwarnalata SatapathyNoch keine Bewertungen

- Cebu Winland Development Corporation v. Ong Siao HuaDokument3 SeitenCebu Winland Development Corporation v. Ong Siao HuaIldefonso HernaezNoch keine Bewertungen

- Bhatia Traders - ERP Implementation - Case StudyDokument2 SeitenBhatia Traders - ERP Implementation - Case StudyCEM Business SolutionsNoch keine Bewertungen

- Ahold: The Biggest Supermarket Retailer You Would Have Never Heard ofDokument25 SeitenAhold: The Biggest Supermarket Retailer You Would Have Never Heard ofGaurav Kumar50% (2)

- Final Report On LifebuoyDokument41 SeitenFinal Report On LifebuoyNawaz TanvirNoch keine Bewertungen