Beruflich Dokumente

Kultur Dokumente

6.MAF 603 CH 10 - Mergers, Acquisitions and Divestitures

Hochgeladen von

Sullivan LyaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

6.MAF 603 CH 10 - Mergers, Acquisitions and Divestitures

Hochgeladen von

Sullivan LyaCopyright:

Verfügbare Formate

Chapter 10- Mergers and Acquisition 1

1. Merger or Consolidation

i. Absorption of one firm by another.

ii. Acquirer acquires all of the assets & liabilities of

the target firm.

iii. After the merger, the target firm ceased to exist.

iv. In consolidation, an entirely new firm is created.

Both the target and acquirer terminate their

previous existence and become part of the new

firm

Chapter 10- Mergers and Acquisition 2

Advantages Disadvantages

1. Legally 1. Must be approved by a

straightforward vote of the shareholders of

2. Avoid the necessity to each firm (usually votes of

transfer title of each the owners of 2/3 of the

individual asset of the shares)

acquired firm to the 2. Often occur disagreement

acquiring firm. as to the fair value, which

3. Cost less may result in an expensive

legal proceeding.

Chapter 10- Mergers and Acquisition 3

2. Acquisition of Stocks

1. purchase firm’s voting stock in exchange for

cash or shares of stock or other securities

2. start as a private offer from management of one

firm to another.

3. offer is taken directly to the selling firm’s

stockholders through tender offer. Tender offer

is a public offer to buy shares of a target

firm.

4. often unfriendly

5. may have minority shareholders.

Chapter 10- Mergers and Acquisition 4

3. Acquisition of Assets

1. buy all of firm’s assets

2. require a formal vote of the shareholders of

the selling firm.

3. costly.

4. involve transfer of titles to assets.

5. avoid the potential problem of having

minority shareholders .

Chapter 10- Mergers and Acquisition 5

Public offer to buy shares of a target firm

Offer made by one firm directly to the shareholders

of another firm

Communicated to target firm’s shareholders by

public announcement

Chapter 10- Mergers and Acquisition 6

1. No vote is required in acquisition of stock. If the

shareholders of target firm do not like the offer, they are

not required to accept it and will not tender their shares.

2. Bidding firm can deal directly with shareholders’ of

target firm.

3. Often unfriendly. Resistance by target firm’s

management often makes the cost of acquisition more

than the cost of merger.

4. Target firm may not be completely absorbed if minority

shareholders hold out in a tender offer.

Chapter 10- Mergers and Acquisition 7

1. Horizontal Acquisition- Involve firm in the same

industry. The firm is competing with each other in

their product market. Eg: Hyundai merging with

Proton

2. Vertical Acquisition – Involve firms at different

steps of the production process. E.g.: MAS taking

over all travel agencies.

3. Conglomerate Acquisition – The acquiring and

the acquired firm are not related to each other. E.g.:

Computer firm acquiring Nagoya Textile.

Chapter 10- Mergers and Acquisition 8

Merger or Consolidation

Acquisitions Acquisition of stocks

Acquisitions of assets

A group of shareholders attempts

Proxy Contest to gain controlling seats in the

BOD by voting new directors

Takeover

All equity shares of a public firm

Going Private

are purchased by a small group of

investors. The shares of the firm

are delisted from stock exchanges

and no longer be purchased in the

open market

Chapter 10- Mergers and Acquisition 9

Most acquisitions fail to create value for the acquirer

(bidder).

Synergy occurs if the value of the combined firm after the

merger is greater than the sum of the value of the acquiring

firm and the value of the target firm as separate entities

The main reason why they do not create value lies in

failures to integrate two companies after a merger.

1. Intellectual capital often walks out the door when

acquisitions aren't handled carefully.

2. Traditionally, acquisitions deliver value when they allow

for scale economies or market power, better products and

services in the market, or learning from the new firms.

Chapter 10- Mergers and Acquisition 10

Suppose firm A is contemplating acquiring firm B.

The synergy from the acquisition is

Synergy = VAB – (VA + VB)

The synergy of an acquisition can be determined from the

usual discounted cash flow model: Incremental CF from

merger at date t discounted at the risk adjusted discount

rate.

T

CFt

Synergy = (1 + r)t

t=1

where

ΔD CFt = Δ Revt – Δ Costst – ΔTaxest – ΔCapital Requirementst

Chapter 10- Mergers and Acquisition 11

Δ CFt = Δ Revt – ΔCostst – ΔTaxest – ΔCapital Requirementst

1.Revenue Enhancement

2.Costs Reduction

3.Lower Taxes

4.Lower Cost of Capital

Chapter 10- Mergers and Acquisition 12

Increased revenues may come from:

1. Marketing Gains

Improvements can be made in the following:

Previously ineffective media programming and

advertising efforts

A weak existing distribution network

An unbalanced product mix

Chapter 10- Mergers and Acquisition 13

2. Strategic Benefits

Opportunity to take advantage of the competitive

environment if certain situations materialized. E.g. 1: A

sewing machine company acquiring a computer company

which might produce a computer-driven sewing machine.

E.g. 2: Procter & Gamble acquired Charmin Paper Co. to

develop highly interrelated cluster of paper products such

as disposable diapers, paper towels, bathroom tissues and

feminine hygiene products.

3. Market or Monopoly Power.

Reduce competition as to achieve monopoly profits.

Empirical evidence does not suggest that increased

market power is a reason for mergers.

Chapter 10- Mergers and Acquisition 14

Combined firm may operate more efficiently than 2 separate

firms.

1. Economies of Scale (EOS)

- Spreading overhead – sharing of central facilities such as

corporate head quarters, top management and a large main

frame computer

- average cost drops as levels of production increases.

- Diseconomies of scale occur after it reaches optimal

point.

2. Economies of Vertical Integration

- to make coordination of closely related activities

easier

- E.g. 1: Forest product firms that cut timber also own

sawmills and hauling equipment.

Chapter 10- Mergers and Acquisition 15

- to transfer technology (e.g. automobile company

acquiring aircraft company)

- E.g.: Airline companies – own airplanes, hotels, car rental

companies

3. Complementary Resources

- to make better use of existing resources

- to provide the missing ingredient for success

- E.g.: ski equipment store acquire tennis equipment store

to produce more sales for summer and winter.

4. Elimination of Inefficient Management

- changing technology or market condition that require a

restructuring of the corporation because incumbent

managers do not understand changing condition and have

trouble abandoning strategies and styles that they have

formulated.

Chapter 10- Mergers and Acquisition 16

Possible tax gain that can come from

acquisition:

1. Use of tax losses from net operating losses

2. Use of unused debt capacity

3. Use of surplus funds

Chapter 10- Mergers and Acquisition 17

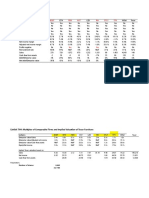

If two firms

merge, for

example, firm A Before Merger After Merger

and B, they will A B AB

pay lower taxes State State State State State 1 State 2

than if they 1 2 1 2

remain separate

Taxabl 200 -100 -100 200 100 100

Example: e

Income

Without merger, Tax 68 0 0 68 34 34

they can not

take advantage Net 132 -100 -100 132 66 66

income

of potential tax

losses.

Chapter 10- Mergers and Acquisition 18

1. When firms merge, diversification will occur. The

cost of financial distress is likely to be less for the

combined firm than is the sum of these present

values of the 2 separate firms.

2. The acquiring firm might be able to increase its

debt-equity ratio after a merger creating additional

tax benefits and additional value.

Chapter 10- Mergers and Acquisition 19

1. Refers to cash flows available after payment of all

taxes and after all positive NPV projects have been

provided for.

2. Firm might make acquisition with its excess funds

3. In a merger, no taxes are paid on dividends remitted

from the acquired firm-resulting in tax savings.

Chapter 10- Mergers and Acquisition 20

1. COC can be reduced when two firms merge

because the cost of issuing securities are

subjected to EOS.

2. Cost of issuing both debt and equity are

much lower for large issues than for smaller

issues.

Chapter 10- Mergers and Acquisition 21

Avoiding Mistakes

1. Do not Ignore Market Values

Use market price of comparable opportunities to

estimate present value of benefits.

2. Estimate only Incremental Cash Flows

Only incremental cash flow from an acquisition add

value to the acquiring firm.

3. Use the Correct Discount Rate

The discount rate should reflect the risk associated

with the use of funds

4. Consider Transactions Costs such as fees to investment

bankers, legal fees, disclosure requirements.

Chapter 10- Mergers and Acquisition 22

The Base Case

- If two all-equity firms merge, there is no transfer of

synergies to bondholders

- Stockholders of both firms are indifferent to the merger

- One Firm has Debt

- The value of the levered shareholder’s call option falls.

- Bondholders gain the coinsurance effect (mutual

guarantee) and the stockholders lose.

- Bondholders will usually be helped by mergers.

- The less risky the combined firm is, the greater the gains to

the bondholders.

- Stockholders of the acquiring firm will be hurt by the

amount that the bondholders gain

Chapter 10- Mergers and Acquisition 23

2 all equity firms merge.

State 1 State 2 State 3 Market

Value

(RM) (RM) (RM) (RM)

Before Merger:

A 80 50 25 60

B 50 40 15 40

Probability 0.5 0.3 0.2

After Merger:

AB 130 90 40 100

Stockholders of A and B are indifferent to the proposed

merger

Chapter 10- Mergers and Acquisition 24

Firm A has debt while Firm B is an all-equity firm

Before Merger

Probability 0.5 0.3 0.2

Firm A RM80 RM50 RM25 RM60

Debt RM40 RM40 RM25 RM37

Equity RM40 RM10 RM0 RM23

Firm B RM50 RM40 RM15 RM40

After Merger

Probability 0.5 0.3 0.2

Firm AB RM130 RM90 RM40 RM100

Debt RM40 RM40 RM40 RM40

Equity RM90 RM50 RM0 RM60

Chapter 10- Mergers and Acquisition 25

From the above table, we can see:

◦ Firm A cannot pay the debt claim in full since the NPV = RM25

whereas the value of the debt = RM40. (Under State 3)

◦ Therefore, Debt = (RM40 x 0.50) + (RM40 x 0.30) + (RM25x 0.2)

= RM37

◦ When A and B are separate, B cannot guarantee A’s debt. But after

merger, the bondholders can draw on the cash flows from Firm AB.

Hence, bondholders gain RM3 (RM40 – RM37) from the merger.

◦ This mutual guarantee is called the “coinsurance effect”.

◦ The existing shareholders of A lose RM3 (RM20 – RM23) from merger.

Equity value of A after merger: Equity value of A before

(RM60 – RM40) merger:

(RM60 – RM37)

Equity value of AB Equity value of B

Chapter 10- Mergers and Acquisition 26

1. Retire debt pre-merger and reissue an equal

amount of debt after merger.

Retire at the low, pre-merger price

2. Issue more debt after merger.

Two effects:

(1) interest deduction from new debt increase

firm’s value

(2) Probability of financial distress increase thus

reduce bondholders’ gain from coinsurance

effect.

Chapter 10- Mergers and Acquisition 27

1. Earnings Growth

◦ Acquisition can create the appearance of earnings growth.

Example: Selamat acquires Sentosa . The merger creates no value.

Selamat Sentosa Selamat Bhd after Merger

before before The Market The Market

merger merger is “Smart” is “Fooled”

Earnings per share RM1.00 RM1.00 RM1.43 RM1.43

Price per share RM25 RM10 RM25 RM35.71

Price-earnings 25 10 17.5 25

ratio

Number of shares 100 100 140 140

Total Earnings RM100 RM100 RM200 RM200

Total Value RM2,500 RM1,000 RM3,500 RM5,000

Chapter 10- Mergers and Acquisition 28

If market is smart: Since the stock price of Selamat after

merger = before merger, they recognize that the P/E ratio

must fall (from 25 to 17.5)

If market is fooled: The acquisition of Sentosa increases

Selamat EPS from RM1 to RM1.43. They might think

that the 43% increase is a true growth in the company.

Suppose the P/E of Selamat remains at 25, therefore, total

value of the combined firm increases to RM5,000 (25 x

200). Stock price per share will increase to RM35.71

(RM5,000 /140). This may work only for a while, but in

the long run, the efficient market will force the value

down.

Chapter 10- Mergers and Acquisition 29

2. Diversification

◦ Shareholders who wish to diversify can

accomplish this at much lower cost with one

phone call to their broker than can management

with a takeover.

Acquiring firm can gain from diversification in 2

conditions: (1) if diversification decreases the

unsystematic variability at lower cost than

investors.

(2) if diversification reduces risk and increases

debt capacity.

Chapter 10- Mergers and Acquisition 30

1. Typically, a firm would use NPV analysis when

making acquisitions.

2. The analysis is straightforward with a cash offer,

but gets complicated when the consideration is

stock.

3. NPV analysis is used to quantify the synergy

necessary to justify mergers.

4. Research has discovered that mergers produce little

or no benefits to the acquiring firm. This may

indicate that the merger takes place for reasons

other than synergy or there could be some

weaknesses in the research methodology used.

Chapter 10- Mergers and Acquisition 31

NPV of merger to acquirer = Synergy – Premium

Synergy = VAB – (VA + VB)

Premium = Price paid for B – VB

NPV of merger to acquirer = Synergy – Premium

= [VAB – (VA + VB)] – [Price paid for B – VB]

= VAB – (VA + VB) – Price paid for B + VB

= VAB – VA – Price paid for B

Chapter 10- Mergers and Acquisition 32

NPV of merger to acquirer = VB after merger – Cost paid

VB after merger = VB before merger + Synergy

Chapter 10- Mergers and Acquisition 33

The analysis gets muddied up because we need to consider the

post-merger value of those shares we’re giving away.

Target firm payout N ew firm value

New shares issued

Old shares New shares issued

α = proportion of the shares in the combined firm that firm

B’s shareholders own.

Chapter 10- Mergers and Acquisition 34

1. Overvaluation

◦ If the target firm shares are too expensive to buy with

cash, then go with stock.

◦ If the shares of the acquirer are overvalued, pay by

shares.

2. Taxes

◦ Cash acquisitions usually trigger taxes.

◦ Stock acquisitions are usually tax-free.

3. Sharing Gains from the Merger

◦ With a cash transaction, the target firm shareholders are

not entitled to any downstream synergies.

Chapter 10- Mergers and Acquisition 35

1. In a friendly merger, both companies’ management are

receptive.

2. In a hostile merger, the acquiring firm attempts to gain

control of the target without their approval. Strategies to

gain control in a hostile merger:

a) Tender offer – an offer made directly to the stockholders to buy

shares at a premium above the current market price.

b) Street Sweep – acquirer may continue to buy more shares in the open

market until control is achieved.

c) Proxy fight – a procedure involving corporate voting as an attempt to

win a majority of seats on the BOD to force merger.

Chapter 10- Mergers and Acquisition 36

1. Target-firm managers frequently resist takeover attempts.

2. It can start with press releases and mailings to shareholders

that present management’s viewpoint and escalate to legal

action.

3. Management resistance may represent the pursuit of self

interest at the expense of shareholders.

4. Resistance may benefit shareholders in the end if it results in

a higher offer premium from the bidding firm or another

bidder.

Chapter 10- Mergers and Acquisition 37

1. The Corporate Charter

i. Refers to articles of incorporation and corporate by laws

to govern the firm.

ii. Amend charter to make takeover more difficult such as

instead of 2/3 approval, management require 80%

approval(super-majority amendment)

iii.Stagger the election of the BOD, which increases

difficulty of electing a new BOD quickly.

The adoption of anti-takeover amendments related to corporate

charter has no adverse effects to stock price.

Chapter 10- Mergers and Acquisition 38

2. Golden Parachutes:

◦ Provide compensation to top level management if

takeover occurs. This will make management become

more interested in stockholders’ welfare. Alternatively,

the payment can be seen as an attempt to enrich

management at the stockholders’ expense.

3. Poison Pill:

◦ A right granted to target firm’s stockholders to buy

shares in the merged firm at a bargain price. The right

dilutes the stock that the bidding firm loses money on its

shares. Thus the wealth is transferred from the bidder to

the target.

Chapter 10- Mergers and Acquisition 39

1. Greenmail and Standstill Agreements

◦ In a targeted repurchase the firm buys back its own

stock from a potential acquirer, often at a premium, with

the provision that the seller promises not to acquire the

company for a specified period. This is known as

greenmail

2. Standstill agreements are contracts where acquirer, for a

fee, agrees to limit its holdings in the target. These usually

leads to cessation of takeover attempts. Announcements to

such agreements had a negative effect on stock price.

Chapter 10- Mergers and Acquisition 40

3. White Knight and White Squire:

a) White Knight : A friendly suitor who are arranged to

acquire the target firm in a hostile acquisition. The

white knight is willing to pay a higher purchase price or

it might promise not to lay off employees, fire managers

or sell off divisions.

b) White Squire: If management wishes to avoid any

acquisition, a third party might be invited to make a

significant investment in the firm, under the condition

that it votes with management. The squire is generally

offered shares at a favorable price.

Chapter 10- Mergers and Acquisition 41

4. Recapitalization and Repurchases:

Target management will often issue debt to pay out

a dividend (leveraged recapitalization) This will

fend off takeover in 2 ways:

◦ The stock price will rise which makes acquisition

less attractive to bidder

◦ As part of recapitalization, management may

issue new shares that give management greater

voting control.

Chapter 10- Mergers and Acquisition 42

5. Exclusionary Self-Tenders: a firm makes a tender offers

for a given amount of its stocks while excluding targeted

stockholders

6. Assets Restructurings: Firms may sell off existing assets

(crown jewels) or buy new ones to avoid takeover

7. Going private and leveraged buyouts(LBO): When

publicly owned stock in a firm is purchased by a private

group, (existing management), the stock is taken off the

market (delisted) If the purchase is financed by debt, the

transaction is called leveraged buy-out.

Chapter 10- Mergers and Acquisition 43

1. Shark repellent

Any corporate activity that is undertaken to discourage a

hostile takeover, such as a golden parachute, scorched

earth policy or poison pill.

2. Bear hug

A hostile takeover attempt predicated on making an offer at

a premium large enough to ensure shareholder support

even in the face of resistance from the target's board of

directors. The directors are bound by an obligation to the

shareholders.

Chapter 10- Mergers and Acquisition 44

1. In the long run, the shareholders of acquiring firms

experience below average returns.

2. Cash-financed mergers are different than stock-financed

mergers.

3. Acquirers can be friendly or hostile. The shares of hostile

cash acquirers outperformed those of friendly cash

acquirers. One explanation is that unfriendly cash bidders

are more likely to replace poor management.

Chapter 10- Mergers and Acquisition 45

Das könnte Ihnen auch gefallen

- INVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESVon EverandINVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESNoch keine Bewertungen

- Merger & AcquisitionDokument26 SeitenMerger & AcquisitionAi Amoxy Na100% (1)

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItVon EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItBewertung: 5 von 5 Sternen5/5 (1)

- Notes For Mergers and Acquistions - CourseDokument9 SeitenNotes For Mergers and Acquistions - CourseharjasNoch keine Bewertungen

- Mergers and AcqDokument24 SeitenMergers and AcqMaverick CardsNoch keine Bewertungen

- Book AccountingDokument220 SeitenBook Accountingcunbg vubNoch keine Bewertungen

- 2021 - 2022 Mergers and AquisitionsDokument29 Seiten2021 - 2022 Mergers and AquisitionsDafrosa HonorNoch keine Bewertungen

- 2021 - 2022 Mergers and AquisitionsDokument29 Seiten2021 - 2022 Mergers and AquisitionsDafrosa HonorNoch keine Bewertungen

- Tutorial 12Dokument3 SeitenTutorial 12charlie simo100% (1)

- Mergers and Acquisitions-Atty EspedidoDokument9 SeitenMergers and Acquisitions-Atty EspedidoKvyn Honoridez100% (1)

- Acct For BussCombiDokument37 SeitenAcct For BussCombiVeta AkkountNoch keine Bewertungen

- Strategic Fit in Mergers & Acquisitions - An ImperativeDokument22 SeitenStrategic Fit in Mergers & Acquisitions - An ImperativeAnil Sahu100% (1)

- Corporate RestructingDokument69 SeitenCorporate RestructingNguyen NhanNoch keine Bewertungen

- Business CombinationDokument3 SeitenBusiness CombinationJane Layug CabacunganNoch keine Bewertungen

- Mergers Are Capital Budgeting Problems, ButDokument19 SeitenMergers Are Capital Budgeting Problems, ButakashdeepimeNoch keine Bewertungen

- Merger and AcquisitionDokument4 SeitenMerger and Acquisitionshady emadNoch keine Bewertungen

- Financial Management Part I Quiz - 1 Name: - ScoreDokument3 SeitenFinancial Management Part I Quiz - 1 Name: - Scorejeric rotasNoch keine Bewertungen

- Lecture 1Dokument94 SeitenLecture 1NeceiaNoch keine Bewertungen

- CHAPTER 30 - AnswerDokument3 SeitenCHAPTER 30 - Answernash100% (1)

- MODULE 11 Accounting For Business Combination PART 1Dokument43 SeitenMODULE 11 Accounting For Business Combination PART 121-39693Noch keine Bewertungen

- Ma GimDokument5 SeitenMa GimfabriNoch keine Bewertungen

- Manajemen Keuangan - Merger and Acquisition PDFDokument36 SeitenManajemen Keuangan - Merger and Acquisition PDFvrieskaNoch keine Bewertungen

- Topic 10Dokument5 SeitenTopic 10黄芷琦Noch keine Bewertungen

- Chapter 1 Business Combination Part 1 PDFDokument20 SeitenChapter 1 Business Combination Part 1 PDFShane CharmedNoch keine Bewertungen

- Advance IiDokument110 SeitenAdvance Iitemedebere100% (3)

- RossFCF10ce SM ch23 FINALDokument11 SeitenRossFCF10ce SM ch23 FINALyash sindhiNoch keine Bewertungen

- SFM NotesDokument58 SeitenSFM NotesNabinSundar NayakNoch keine Bewertungen

- Topic 5. Mergers & Acquisitions: Corporate Finance: Cfi 311Dokument14 SeitenTopic 5. Mergers & Acquisitions: Corporate Finance: Cfi 311Veneranda vedastusNoch keine Bewertungen

- Different Types of MergersDokument25 SeitenDifferent Types of Mergerskawaljitsingh23Noch keine Bewertungen

- Valuation & Analysis of M&AsDokument31 SeitenValuation & Analysis of M&AsSHIHASNoch keine Bewertungen

- Mergers and AquisitionsDokument26 SeitenMergers and AquisitionscleophacerevivalNoch keine Bewertungen

- CA Final Course Paper 2 Strategic Financial Management Chapter 13 CA. Biharilal DeoraDokument79 SeitenCA Final Course Paper 2 Strategic Financial Management Chapter 13 CA. Biharilal DeoraPiyush KulkarniNoch keine Bewertungen

- Presentation On Mergers & Acquisition: Prepared byDokument31 SeitenPresentation On Mergers & Acquisition: Prepared byAdarsh JainNoch keine Bewertungen

- 21578sm SFM Finalnewvol2 Cp13Dokument95 Seiten21578sm SFM Finalnewvol2 Cp13subhradeep sinhaNoch keine Bewertungen

- CMA B5.1 Corporate RestructuringDokument16 SeitenCMA B5.1 Corporate RestructuringZeinabNoch keine Bewertungen

- Sarwanti Purwandari Conceptual QuestionsDokument5 SeitenSarwanti Purwandari Conceptual QuestionsSarwanti PurwandariNoch keine Bewertungen

- Merger & AcquisitionDokument48 SeitenMerger & AcquisitionAshfaque Ul Haque100% (1)

- Conceptual QuestionsDokument5 SeitenConceptual QuestionsSarwanti PurwandariNoch keine Bewertungen

- Summary Chapter 8 - 504115Dokument2 SeitenSummary Chapter 8 - 504115Atik Selvi AnggraeniNoch keine Bewertungen

- Ajmer Institute of TechnologyDokument8 SeitenAjmer Institute of Technologyshubhendra119370Noch keine Bewertungen

- Merger and AcquisitionDokument29 SeitenMerger and Acquisitionrashmi k murthyNoch keine Bewertungen

- Merger & AcquisitionDokument48 SeitenMerger & AcquisitionAshfaque Ul HaqueNoch keine Bewertungen

- Chapter 5 DivestitureDokument12 SeitenChapter 5 Divestituremansisharma8301Noch keine Bewertungen

- Summary M&aDokument29 SeitenSummary M&aLê Thanh TrúcNoch keine Bewertungen

- Solution Manual For Core Concepts of Accounting Raiborn 2nd EditionDokument18 SeitenSolution Manual For Core Concepts of Accounting Raiborn 2nd EditionJacquelineFrancisfpgs100% (36)

- Introduction To Business Combinations and The Conceptual FrameworkDokument15 SeitenIntroduction To Business Combinations and The Conceptual FrameworkAhmed FahmyNoch keine Bewertungen

- BBMF 2093CF: Tutorial 10 Business Merger 1. Why Does Corporation Carry Out Merger? What Are The Benefits of Merger?Dokument5 SeitenBBMF 2093CF: Tutorial 10 Business Merger 1. Why Does Corporation Carry Out Merger? What Are The Benefits of Merger?WONG ZI QINGNoch keine Bewertungen

- Unit V-1Dokument9 SeitenUnit V-1Archi VarshneyNoch keine Bewertungen

- Takeover & AcquisitionsDokument18 SeitenTakeover & AcquisitionssambitacharyaNoch keine Bewertungen

- Business Combination Handout RRDokument19 SeitenBusiness Combination Handout RRMulugeta NiguseNoch keine Bewertungen

- Merger, Acquisition & Restructuring: Basic Concepts and FormulaeDokument56 SeitenMerger, Acquisition & Restructuring: Basic Concepts and Formulaemegha balajiNoch keine Bewertungen

- Adv Act NotesDokument77 SeitenAdv Act Notesmzvette234100% (1)

- Mergers and AcquisitionDokument13 SeitenMergers and AcquisitionUzair KamranNoch keine Bewertungen

- Corporate Restructuring Ch.23Dokument13 SeitenCorporate Restructuring Ch.23Elizabeth StephanieNoch keine Bewertungen

- (FS11) Mergers and AcquisitionsDokument30 Seiten(FS11) Mergers and AcquisitionsRicha GuptaNoch keine Bewertungen

- Unit-1: Mergers & AcquisitionsDokument38 SeitenUnit-1: Mergers & AcquisitionsSri VaishnaviNoch keine Bewertungen

- Advanced Accounting 10th Edition Hoyle Solutions ManualDokument25 SeitenAdvanced Accounting 10th Edition Hoyle Solutions ManualErikKeithnwmp100% (48)

- Business Com Part 1Dokument39 SeitenBusiness Com Part 1Peter GonzagaNoch keine Bewertungen

- DiversificationDokument88 SeitenDiversificationabhilashaNoch keine Bewertungen

- The Battle For Endesa - Case AnalysisDokument3 SeitenThe Battle For Endesa - Case Analysislorren4jeanNoch keine Bewertungen

- Psa522 5.budgetary Control Mac2015Dokument21 SeitenPsa522 5.budgetary Control Mac2015Sullivan LyaNoch keine Bewertungen

- Types of Budgeting Techniques: Topic 4Dokument59 SeitenTypes of Budgeting Techniques: Topic 4Sullivan LyaNoch keine Bewertungen

- Psa522 - Odl Lesson Plan N New AssessmentDokument6 SeitenPsa522 - Odl Lesson Plan N New AssessmentSullivan LyaNoch keine Bewertungen

- 7.Ch 11 - International Finance New SyllabusDokument85 Seiten7.Ch 11 - International Finance New SyllabusSullivan LyaNoch keine Bewertungen

- October 2020 Printable Calendar PDFDokument1 SeiteOctober 2020 Printable Calendar PDFSullivan LyaNoch keine Bewertungen

- Homework Notes Unit 1 MBA 615Dokument10 SeitenHomework Notes Unit 1 MBA 615Kevin NyasogoNoch keine Bewertungen

- Business Management Paper 2 SL MarkschemeDokument25 SeitenBusiness Management Paper 2 SL MarkschemeNur AzianNoch keine Bewertungen

- Debenhams Analyst ReportDokument108 SeitenDebenhams Analyst ReportFisher Black75% (4)

- Bennington CompanyDokument4 SeitenBennington CompanyKhoa VoNoch keine Bewertungen

- SPI-Property VALUATION UPDATE-VB Real Estate Services GmbH-Timisoara-74687m - 191112-FINA L PDFDokument39 SeitenSPI-Property VALUATION UPDATE-VB Real Estate Services GmbH-Timisoara-74687m - 191112-FINA L PDFPopescu GeorgeNoch keine Bewertungen

- Pamper Me Salon Inc S General Ledger at April 30 2015Dokument1 SeitePamper Me Salon Inc S General Ledger at April 30 2015Miroslav GegoskiNoch keine Bewertungen

- WowDokument253 SeitenWowadam kulnovskiNoch keine Bewertungen

- Free Wood Pellet Manufacturer Business PlanDokument19 SeitenFree Wood Pellet Manufacturer Business PlanFurqon Hidayatulloh75% (4)

- Success Through Excess: How Property and Casualty Insurers Are Boosting Profits by Entering The Excess and Surplus MarketDokument32 SeitenSuccess Through Excess: How Property and Casualty Insurers Are Boosting Profits by Entering The Excess and Surplus MarketNauman NoorNoch keine Bewertungen

- Global Ice Cream - Data MonitorDokument44 SeitenGlobal Ice Cream - Data MonitorPrathibha Prabakaran100% (1)

- Analysis of Mutual Funds in IndiaDokument78 SeitenAnalysis of Mutual Funds in Indiadpk1234Noch keine Bewertungen

- Garden Sillk MillDokument132 SeitenGarden Sillk MillYogesh JasoliyaNoch keine Bewertungen

- Castilian Seigniorage and Coinage in The Reign of Philip IIDokument25 SeitenCastilian Seigniorage and Coinage in The Reign of Philip IIdnalor88Noch keine Bewertungen

- Teuer B DataDokument41 SeitenTeuer B DataAishwary Gupta100% (1)

- MITI 021 Unit 3Dokument16 SeitenMITI 021 Unit 3Nidhy KhajuriaNoch keine Bewertungen

- Mjunction Services Limited: Final Settlement PayslipDokument1 SeiteMjunction Services Limited: Final Settlement PayslipNur IslamNoch keine Bewertungen

- Q3 - PPE and Government Grant Problem Solving: SolutionDokument8 SeitenQ3 - PPE and Government Grant Problem Solving: SolutionLyka Nicole DoradoNoch keine Bewertungen

- Paper 4 Taxation Nov 14 PDFDokument16 SeitenPaper 4 Taxation Nov 14 PDFghsjgjNoch keine Bewertungen

- GMAT Practice Set 13 - VerbalDokument73 SeitenGMAT Practice Set 13 - VerbalKaplanGMATNoch keine Bewertungen

- Report - Solar Power Plant - Financial Modeling PrimerDokument48 SeitenReport - Solar Power Plant - Financial Modeling Primeranimeshsaxena83100% (3)

- ENG 5 Academic Paper: Republic Act No. 10963 Tax Reform For Acceleration and Inclusion (TRAIN) To Sustainable Near-Term GrowthDokument4 SeitenENG 5 Academic Paper: Republic Act No. 10963 Tax Reform For Acceleration and Inclusion (TRAIN) To Sustainable Near-Term GrowthRey Joyce AbuelNoch keine Bewertungen

- Economic Survey 2009-10 MaharashtraDokument240 SeitenEconomic Survey 2009-10 MaharashtrasurendragiriaNoch keine Bewertungen

- 04-01-17 EditionDokument32 Seiten04-01-17 EditionSan Mateo Daily JournalNoch keine Bewertungen

- CA ProjectDokument21 SeitenCA Projectkalaswami100% (1)

- PDFDokument189 SeitenPDFPrakashNoch keine Bewertungen

- Generally Accepted Accounting Principles (GAAP)Dokument7 SeitenGenerally Accepted Accounting Principles (GAAP)Laxmi GurungNoch keine Bewertungen

- Dew Right CompanyDokument11 SeitenDew Right CompanyGaurav KumarNoch keine Bewertungen

- Bir RR 15-2010Dokument3 SeitenBir RR 15-2010Anonymous OzIYtbjZNoch keine Bewertungen

- Ch3.2 - HomeworkDokument2 SeitenCh3.2 - HomeworkArcherDash Love GeometrydashNoch keine Bewertungen

- Upfcl ProjectttttDokument95 SeitenUpfcl ProjectttttgoswamiphotostatNoch keine Bewertungen