Beruflich Dokumente

Kultur Dokumente

Market Commentary 21feb11

Hochgeladen von

AndysTechnicalsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Market Commentary 21feb11

Hochgeladen von

AndysTechnicalsCopyright:

Verfügbare Formate

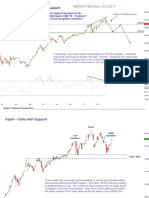

Apple ~ Daily (Log) with Support REPRINTED from 1/23/2011

Last week saw the “greatest company and stock in the history of mankind,”

Apple, blow out all earnings and revenues estimates for the quarter. The

stock promptly traded down for the rest of the week.

Apple is quite likely the most “over-owned” stock amongst hedge funds and retail investors.

Therefore, it will be the most vulnerable to elevator moves down. People who are “long”

AAPL stock should pay close attention to the 320-322 zone. That’s the area of the 23.6%

retracement of the most recent advance as well as classic chart support. A daily close below

320 would suggest a move down $279/share, the next most obvious area of chart support.

Andy’s Technical Commentary__________________________________________________________________________________________________

Apple ~ Daily with RSI and Support

The reason why we occasionally think about Apple is because it is the Maybe a H&S forming here?

“vanguard” of the large corrective move that began in Mar ‘09. “Everyone”

is long Apple and the company has 100% Brand recgonition--nobody is

unfamiliar with the Apple “story.”

A month ago, we pointed out the critical support at 320-322 for Apple. It held that

area nicely and produced another new high. However, it triggered very sharp Daily

RSI divergence in doing so and is now on short term support at 348. A break of

348 should cause AAPL to trade down to 326, the next level of support.

Andy’s Technical Commentary__________________________________________________________________________________________________

Apple ~ Weekly with Fibonacci Support

This is a much bigger picture look at AAPL. That $326/share support price

coincides nicely with the first (small) level of Fibonacci support at $324 (14.6%).

$298/share, the 23.6% retrace matches up with an important inflection point in

November 2010.

Two week ago, we pointed out the critical support at 320-322 for

Apple. It held that area nicely and produced another new high.

However, it triggered very sharp Daily RSI divergence in doing so

and is now on short term support at 348. A break of 348 should

cause AAPL to trade down to 326, the next level of support.

So, to summarize, the message of the previous slide and this

one: There is minor support at 348; medium term support

lies in the $323-$326 zone; critical longer term support

comes in at $298. Longs/Bulls should pay close attention to

these levels and adjust “stop loss” strategies accordingly.

Andy’s Technical Commentary__________________________________________________________________________________________________

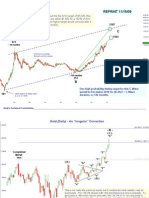

S&P 500 ~ Daily non-Log Scale

(B)

“y”

The pattern up from the 1040 has now become very difficult to determine. We’ve been pointing out

the lack of clear “impulsions” higher, which means we’re dealing with some sort of corrective g?

pattern higher. I’m suggesting a “diametric” labelling here, but there is little conviction in this

counting. e

c f

b

REPRINTED from 2/13/2011

“w” a

d

d

b

a

1040

e

c

“x”

If this happens to be the correct larger degree counting, the “x” wave corrected exactly

23.6% of the “w” wave. One possible target for the “y” wave would be 61.8% of “w” at 1339.

That level would also be 38.2% of “w” measure up from the top of “w.” So, we will stand

back and observe how the market behaves into 1339….

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily non-Log Scale

(B)

“y”

This market continues to grind out the bears by relentlessly moving higher without any appreciable

correction of any kind. The pattern up from 1040 is best described as a “corrective” move of some g?

kind, which is why we prefer the “diametric” labelling. It will be difficult to know exactly where this

type of pattern will conclude. It will take a correction larger than what we saw on Nov. 2010, the

e

blue dashed box, before can call an “end” to this pattern.

c f

b

“w” a

d

d

Alt: “w” b

a

1040

c

e

“x”

Last week, we suggested that 1339 might be an area of

resistance given this wave count. While we did not see

any evidence of peaking action into this zone, the market

did “slow down” into this area at the end of the week.

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily w/RSI

These converging trendlines on the Spot price and RSI were highlighted last week. It’s

worth reinforcing the “picture” here once again as the heavy blue lines seem very important.

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily with Weekly Support and Resistance

We’re not even worrying about “resistance” points on this week’s update,

because that’s not what we’re watching for. We’re waiting on this market to

break key support or show some sort of “peaking pattern.” The S1 and S2

for this week are 1325 and 1275. We’ll sell 20% of a Max Short on a

break of the blue uptrend line highlighted here.

Andy’s Technical Commentary__________________________________________________________________________________________________

Gold (Feb11 Futures) Daily

Head

Left Right

REPRINTED from 1/23/2011 Shoulder Shoulder

Left

Shoulder Right

Shoulder

I heard some people on CNBC talking about this insipient head and shoulder top on

Gold--which means that we’re likely not see it develop the way we “think” it should

develop. Outlined here would be something “textbook.”

We said last week that gold looked like it wanted to trade lower. It’s not disappointing

as our R1 from last week held perfectly at $1,379. New shorts should consider

lowering their stops to $1357 now. The $1,320’s should create support for gold. If it

doesn’t, then gold would be on a “glide path” to $1,265/oz.

Andy’s Technical Commentary__________________________________________________________________________________________________

Gold (Feb11 Futures) Daily

Right

Left Head

Shoulder

Shoulder Right

Shoulder

??

Left

Shoulder

A month ago, we highlighted the possibility of this Head and Shoulder pattern, suggesting

that 1320’s would provide support. Gold closed at $1,318.40 on 1/27/11 and then

produced a richochet rally. The move down from the first “Right Shoulder” was “corrective”

in nature, which is why we thought there was a good chance of seeing a bounce to create

the second “Right Shoulder.” At this point, the bounce we’re seeing is more robust than we

would have predicted and any “ideas” about a “Head and Shoulder Top” or “Rounded Top”

are about to get tossed in the trash can. Bears need a reversal immediately to maintain the

“look” of a longer term peaking pattern.

A break of $1,425/oz would like quite bullish for the near term. Weekly support for

APRIL Gold Futures comes in at $1,385 and $1,369--new bulls should consider those

levels for “stop loss” strategies.

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

Das könnte Ihnen auch gefallen

- Advanced C++ Interview Questions You'll Most Likely Be AskedVon EverandAdvanced C++ Interview Questions You'll Most Likely Be AskedNoch keine Bewertungen

- Nse's Certification in Financial Markets - Options Trading StrategiesDokument60 SeitenNse's Certification in Financial Markets - Options Trading Strategiessachindravid100% (1)

- NCFM - Derivatives, NCDEXDokument212 SeitenNCFM - Derivatives, NCDEXDipali VoraNoch keine Bewertungen

- JPM CDS PrimerDokument11 SeitenJPM CDS PrimerJorge AraujoNoch keine Bewertungen

- (STUDENT) (2023 1) Handout - Describing Charts Graphs DiagramsDokument12 Seiten(STUDENT) (2023 1) Handout - Describing Charts Graphs DiagramsPitta Pitchaya0% (1)

- NEoWave S&PDokument1 SeiteNEoWave S&PshobhaNoch keine Bewertungen

- Market Commentary 5aug12Dokument7 SeitenMarket Commentary 5aug12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 5aug12Dokument7 SeitenMarket Commentary 5aug12AndysTechnicalsNoch keine Bewertungen

- Car Insurance PolicyDokument1 SeiteCar Insurance PolicyVignesh VikiNoch keine Bewertungen

- Case Write Up Sample 2Dokument4 SeitenCase Write Up Sample 2veda20Noch keine Bewertungen

- Risk Management: Exchange RateDokument25 SeitenRisk Management: Exchange RateAjay Kumar TakiarNoch keine Bewertungen

- VUL Mock ExamDokument5 SeitenVUL Mock ExamMillet Plaza Abrigo93% (14)

- Market Discussion 5 Dec 10Dokument9 SeitenMarket Discussion 5 Dec 10AndysTechnicalsNoch keine Bewertungen

- S& P 500 Update 2 May 10Dokument9 SeitenS& P 500 Update 2 May 10AndysTechnicalsNoch keine Bewertungen

- Market Commentary 1JUL12Dokument8 SeitenMarket Commentary 1JUL12AndysTechnicalsNoch keine Bewertungen

- S&P 500 Update 4 Apr 10Dokument10 SeitenS&P 500 Update 4 Apr 10AndysTechnicalsNoch keine Bewertungen

- S&P 500 Update 20 Dec 09Dokument10 SeitenS&P 500 Update 20 Dec 09AndysTechnicalsNoch keine Bewertungen

- Market Commentary 11mar12Dokument7 SeitenMarket Commentary 11mar12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 13mar11Dokument8 SeitenMarket Commentary 13mar11AndysTechnicalsNoch keine Bewertungen

- Sp500 Update 5sep11Dokument7 SeitenSp500 Update 5sep11AndysTechnicalsNoch keine Bewertungen

- Morning View 26jan2010Dokument8 SeitenMorning View 26jan2010AndysTechnicalsNoch keine Bewertungen

- Market Discussion 12 Dec 10Dokument9 SeitenMarket Discussion 12 Dec 10AndysTechnicalsNoch keine Bewertungen

- Market Commentary 10apr11Dokument12 SeitenMarket Commentary 10apr11AndysTechnicalsNoch keine Bewertungen

- Morning View 27jan2010Dokument6 SeitenMorning View 27jan2010AndysTechnicals100% (1)

- This Study Resource WasDokument2 SeitenThis Study Resource WasDANIEL LEONARDO DE LA CRUZ GOMEZNoch keine Bewertungen

- Gold Report 29 Nov 2009Dokument11 SeitenGold Report 29 Nov 2009AndysTechnicalsNoch keine Bewertungen

- Market Update 21 Nov 10Dokument10 SeitenMarket Update 21 Nov 10AndysTechnicalsNoch keine Bewertungen

- Market Commentary 27mar11Dokument10 SeitenMarket Commentary 27mar11AndysTechnicalsNoch keine Bewertungen

- Market Commentary 25SEP11Dokument8 SeitenMarket Commentary 25SEP11AndysTechnicalsNoch keine Bewertungen

- Market Commentary 27feb11Dokument12 SeitenMarket Commentary 27feb11AndysTechnicalsNoch keine Bewertungen

- Market Commentary 30OCT11Dokument6 SeitenMarket Commentary 30OCT11AndysTechnicalsNoch keine Bewertungen

- S&P 500 Update 2 Jan 10Dokument8 SeitenS&P 500 Update 2 Jan 10AndysTechnicalsNoch keine Bewertungen

- S&P 500 Update 25 Apr 10Dokument7 SeitenS&P 500 Update 25 Apr 10AndysTechnicalsNoch keine Bewertungen

- Morning View 24 Feb 10Dokument4 SeitenMorning View 24 Feb 10AndysTechnicalsNoch keine Bewertungen

- Copper Commentary 2OCT11Dokument8 SeitenCopper Commentary 2OCT11AndysTechnicalsNoch keine Bewertungen

- S&P 500 Update 30 Nov 09Dokument8 SeitenS&P 500 Update 30 Nov 09AndysTechnicalsNoch keine Bewertungen

- Market Commentary 6NOVT11Dokument4 SeitenMarket Commentary 6NOVT11AndysTechnicalsNoch keine Bewertungen

- Market Commentary 19DEC11Dokument9 SeitenMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 20NOV11Dokument7 SeitenMarket Commentary 20NOV11AndysTechnicalsNoch keine Bewertungen

- Market Outlook 10 03 2022Dokument4 SeitenMarket Outlook 10 03 2022Mohamad Rais RashidNoch keine Bewertungen

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDokument8 SeitenREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsNoch keine Bewertungen

- Market Discussion 19 Dec 10Dokument6 SeitenMarket Discussion 19 Dec 10AndysTechnicalsNoch keine Bewertungen

- Gold Report 15 Nov 2009Dokument11 SeitenGold Report 15 Nov 2009AndysTechnicalsNoch keine Bewertungen

- Market Commentary 27NOV11Dokument5 SeitenMarket Commentary 27NOV11AndysTechnicalsNoch keine Bewertungen

- Morning View 21jan2010Dokument6 SeitenMorning View 21jan2010AndysTechnicalsNoch keine Bewertungen

- Excel Practice Toolkit - 2007Dokument22 SeitenExcel Practice Toolkit - 2007pgdm mhoNoch keine Bewertungen

- Copper Report 31 Jan 2010Dokument8 SeitenCopper Report 31 Jan 2010AndysTechnicalsNoch keine Bewertungen

- NEoWave Apr 5 2020 MSNPDokument1 SeiteNEoWave Apr 5 2020 MSNPsemih kartalNoch keine Bewertungen

- Market Commentary 18mar12Dokument8 SeitenMarket Commentary 18mar12AndysTechnicalsNoch keine Bewertungen

- Task 1: Describing TrendsDokument8 SeitenTask 1: Describing Trendsdanggiahan310806Noch keine Bewertungen

- Market Commentary 22JUL12Dokument6 SeitenMarket Commentary 22JUL12AndysTechnicalsNoch keine Bewertungen

- This Study Resource Was: Other Long-Term InvestmentsDokument3 SeitenThis Study Resource Was: Other Long-Term InvestmentsMs VampireNoch keine Bewertungen

- Database Design Tutorial - Week7 Functional DependenciesDokument2 SeitenDatabase Design Tutorial - Week7 Functional DependenciesSean WittakerNoch keine Bewertungen

- Waterfall Charts (Chapter 12) : Cial Modelling. The Section On Waterfall Charts On Pages 391-394 Explain inDokument8 SeitenWaterfall Charts (Chapter 12) : Cial Modelling. The Section On Waterfall Charts On Pages 391-394 Explain inGlen YNoch keine Bewertungen

- Good Luck!: Midterm ExamDokument5 SeitenGood Luck!: Midterm ExamGjNoch keine Bewertungen

- MSQ 1801 Introduction PDFDokument4 SeitenMSQ 1801 Introduction PDFmia uyNoch keine Bewertungen

- Copper Commentary 11dec11Dokument6 SeitenCopper Commentary 11dec11AndysTechnicalsNoch keine Bewertungen

- Midterm1 2017 FormADokument11 SeitenMidterm1 2017 FormAJaures AyumbaNoch keine Bewertungen

- Study Guides Ascend Math LessonsDokument68 SeitenStudy Guides Ascend Math Lessonsapi-467445171Noch keine Bewertungen

- Morning View 20jan2010Dokument8 SeitenMorning View 20jan2010AndysTechnicalsNoch keine Bewertungen

- Morning View 29jan2010Dokument5 SeitenMorning View 29jan2010AndysTechnicalsNoch keine Bewertungen

- Morning Update 3 Mar 10Dokument5 SeitenMorning Update 3 Mar 10AndysTechnicalsNoch keine Bewertungen

- Sample: Diploma in International Business Diploma in Banking and FinanceDokument15 SeitenSample: Diploma in International Business Diploma in Banking and FinanceMay JingNoch keine Bewertungen

- Econ - Practice Exam 2Dokument8 SeitenEcon - Practice Exam 2John DoeNoch keine Bewertungen

- Marcoeconomics 11e Arnold HW Chapter 10 Attempt 4Dokument5 SeitenMarcoeconomics 11e Arnold HW Chapter 10 Attempt 4PatNoch keine Bewertungen

- Advanced Options Trading Strategies Advanced Options Trading StrategiesDokument29 SeitenAdvanced Options Trading Strategies Advanced Options Trading StrategiesJoysurya SahaNoch keine Bewertungen

- 6 Week 3. Fama-French and The Cross Section of Stock Returns - Detailed NotesDokument37 Seiten6 Week 3. Fama-French and The Cross Section of Stock Returns - Detailed NotesdmavodoNoch keine Bewertungen

- Summer Sports Tournament Presentation Green VariantDokument26 SeitenSummer Sports Tournament Presentation Green Variantyelianis rodriguezNoch keine Bewertungen

- Market Commentary 22JUL12Dokument6 SeitenMarket Commentary 22JUL12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 17JUN12Dokument7 SeitenMarket Commentary 17JUN12AndysTechnicalsNoch keine Bewertungen

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDokument6 SeitenS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 10JUN12Dokument7 SeitenMarket Commentary 10JUN12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 20may12Dokument7 SeitenMarket Commentary 20may12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 29apr12Dokument6 SeitenMarket Commentary 29apr12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 25mar12Dokument8 SeitenMarket Commentary 25mar12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 11mar12Dokument7 SeitenMarket Commentary 11mar12AndysTechnicalsNoch keine Bewertungen

- S&P500 Report 22apr12Dokument12 SeitenS&P500 Report 22apr12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 18mar12Dokument8 SeitenMarket Commentary 18mar12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 1apr12Dokument8 SeitenMarket Commentary 1apr12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 26feb12Dokument6 SeitenMarket Commentary 26feb12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 8jan12Dokument8 SeitenMarket Commentary 8jan12AndysTechnicalsNoch keine Bewertungen

- Dollar Index (DXY) Daily ContinuationDokument6 SeitenDollar Index (DXY) Daily ContinuationAndysTechnicalsNoch keine Bewertungen

- S&P 500 Commentary 12feb12Dokument6 SeitenS&P 500 Commentary 12feb12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 29jan12Dokument6 SeitenMarket Commentary 29jan12AndysTechnicalsNoch keine Bewertungen

- Copper Commentary 11dec11Dokument6 SeitenCopper Commentary 11dec11AndysTechnicalsNoch keine Bewertungen

- S& P 500 Commentary 20feb12Dokument9 SeitenS& P 500 Commentary 20feb12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 22jan12Dokument8 SeitenMarket Commentary 22jan12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 2jan12Dokument7 SeitenMarket Commentary 2jan12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 16jan12Dokument7 SeitenMarket Commentary 16jan12AndysTechnicalsNoch keine Bewertungen

- Market Commentary 19DEC11Dokument9 SeitenMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 6NOVT11Dokument4 SeitenMarket Commentary 6NOVT11AndysTechnicalsNoch keine Bewertungen

- Sp500 Update 23oct11Dokument7 SeitenSp500 Update 23oct11AndysTechnicalsNoch keine Bewertungen

- Market Commentary 20NOV11Dokument7 SeitenMarket Commentary 20NOV11AndysTechnicalsNoch keine Bewertungen

- Market Commentary 27NOV11Dokument5 SeitenMarket Commentary 27NOV11AndysTechnicalsNoch keine Bewertungen

- Market Commentary 30OCT11Dokument6 SeitenMarket Commentary 30OCT11AndysTechnicalsNoch keine Bewertungen

- Copper Commentary 2OCT11Dokument8 SeitenCopper Commentary 2OCT11AndysTechnicalsNoch keine Bewertungen

- A Discrete Question (Divs)Dokument2 SeitenA Discrete Question (Divs)Veeken ChaglassianNoch keine Bewertungen

- Sea Risk Basel III To Basel Iv2Dokument1 SeiteSea Risk Basel III To Basel Iv2abcNoch keine Bewertungen

- Summer Intership Programme PresentationDokument7 SeitenSummer Intership Programme PresentationMɽ HʋŋteɽNoch keine Bewertungen

- Assignment 1Dokument6 SeitenAssignment 1Uroona MalikNoch keine Bewertungen

- Clearing and Settlement PPT: Financial DerivativesDokument24 SeitenClearing and Settlement PPT: Financial DerivativesAnkush SheeNoch keine Bewertungen

- HDFC Life SanchayDokument2 SeitenHDFC Life SanchaySantoshKumarNoch keine Bewertungen

- Transit of Planets On Thy Birth ChartDokument2 SeitenTransit of Planets On Thy Birth Chartanshi0% (1)

- Insurance Act, 2010: Submitted To: Golam RamijDokument10 SeitenInsurance Act, 2010: Submitted To: Golam RamijAshraful IslamNoch keine Bewertungen

- Chapter 4: Option Pricing Models: The Binomial Model: The Journal of DerivativesDokument59 SeitenChapter 4: Option Pricing Models: The Binomial Model: The Journal of DerivativesTrúc NguyễnNoch keine Bewertungen

- Edelweiss Tokio Life - Income Builder - : OverviewDokument2 SeitenEdelweiss Tokio Life - Income Builder - : OverviewarunNoch keine Bewertungen

- Notice: Health Insurance Portability and Accountability Act of 1996 Implementation: Expatriation Individuals Losing United States Citizenship Quarterly ListingDokument3 SeitenNotice: Health Insurance Portability and Accountability Act of 1996 Implementation: Expatriation Individuals Losing United States Citizenship Quarterly ListingJustia.comNoch keine Bewertungen

- Call Ratio Back SpreadDokument4 SeitenCall Ratio Back SpreadsidNoch keine Bewertungen

- Sheet1: WUSERINFO-login 2000077 - Password abc123/nQUIT/n Account NumberDokument3 SeitenSheet1: WUSERINFO-login 2000077 - Password abc123/nQUIT/n Account NumberPham VietNoch keine Bewertungen

- Insurance Vocabulary - Lesson 1Dokument4 SeitenInsurance Vocabulary - Lesson 1santa RefaelNoch keine Bewertungen

- FRM Mcq'sDokument69 SeitenFRM Mcq'sAakash Kathuria0% (3)

- Assessment Formal AssessmentDokument8 SeitenAssessment Formal Assessmentashish100% (1)

- 2020 Registered Insurance Intermediaries As at 19th October 2020-MergedDokument202 Seiten2020 Registered Insurance Intermediaries As at 19th October 2020-MergedericmNoch keine Bewertungen

- SMP 20 Years 1 LAKHDokument3 SeitenSMP 20 Years 1 LAKHTamil Vanan NNoch keine Bewertungen

- GMC QCR - Sapocom Technologies PVT LTDDokument1 SeiteGMC QCR - Sapocom Technologies PVT LTDShubham GargNoch keine Bewertungen

- CDO Powerpoint SubPrime PrimerDokument45 SeitenCDO Powerpoint SubPrime PrimerFred Fry100% (39)

- Milliman - Solvency II NutshellDokument9 SeitenMilliman - Solvency II NutshellJean-eudes TomawaNoch keine Bewertungen

- 1 Aviation Insurances The History of Aviation Insurance Is - CompressDokument12 Seiten1 Aviation Insurances The History of Aviation Insurance Is - CompressMunni ChukkaNoch keine Bewertungen

- Reshop Your Car Insurance: FundamentalsDokument3 SeitenReshop Your Car Insurance: FundamentalsAlejandra RoseroNoch keine Bewertungen