Beruflich Dokumente

Kultur Dokumente

Valuation

Hochgeladen von

Mehak JainOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Valuation

Hochgeladen von

Mehak JainCopyright:

Verfügbare Formate

`

Valuation is the process of estimating the market value of a financial asset and liability. Valuation is device to assess the worth of enterprise. Valuation of both the company is must for fixing the consideration amount to be paid in form of cash and share in M&A process. Valuations of both the companies help to safe guard the interest of the share holders in M&A process .

Valuation of business depends upon` Assets it carries ` Equity share price ` Projects in hand ` Risk profile of different classes of business it carries ` Intangible asset it possess

` `

Assets based valuation method Valuation Relative to industry average methods

Dividend yield method Return on capital employed Earning yield method Price earning method

` `

DCF valuation methods Theoretical valuation models

` ` ` ` ` `

All tangible and intangible assets are to be taken into account. All fictitious assets are to be ignored Present value of goodwill to be include in net asset. but value given in b/s is to be ignored. all outside liabilities to be taken on the value payable on the date of valuation. Any arrear of dividend, provision of tax and provision of doubtful debt should be considered. From the amount of the net asset the claim of the preference share holder to be deducted to get the net amount of asset available to equity share holders.

Asset base valuation method is good where the business is easily expressed in terms of its assets. EX Banks, mining companies etc. But this method is not good for companies where the primary assets are intangible assets like brand value and coy right etc. Major drawback in this method is that it does not value the items like skilled manpower, investment in marketing and research & development cost etc.

Value per share= market price of publically traded company Value of company=market price of equity share * no of equity share out standing OR Equity value + market value of debt+ minority interest + pension provision+ other interests

Intrinsic value of equity share= ` net asset available to equity share holders number of equity share

Value per share= company dividend per share Industrys nominal rate per share Value of business = value per equity share X total no of equity share

Method is based upon the assumption that the dividend policy will remain constant, in practice companies can or do change their dividend policy. This methods gives different valuation for listed or unlisted companies because their dividend policies are different.

To compare listed and unlisted companies instead of dividend yield method earning yield method is used. Calculation of an earning yield value involve three stepPredict the future maintainable profit (annual) Identify the required earning yield with reference of similar companies. Value of business= com. Exp. future maintainable profit Industries normal earning yield

Calculation of return on capital employed involve three stepPredict the future maintainable profit (annual) Identify the acceptable normal rate of return on capital invested with reference of similar companies. Value of business= com. Exp. future maintainable profit Industries normal rate of return on capital employed

Value of company= com. Exp. future maintainable profit X Industrys average P/E ratio Value of share= companys expected earning per share X Industrys average P/E ratio

Fair value of share = ( intrinsic value per share + value per share from earning yield method )/2 Fair value of company = (value of company under asset based valuation method+ value of company from earning yield method )/2

` ` `

Capitalization of earnings focuses on the debt of the company that's being merged or acquired. It's a measurement of the ratio between the company's capital structure and its debts = The company's long-term debt . The shareholder's equity plus the company's long-term debt. Long term debt includes things like bank loans and mortgages; it's what the company uses to finance, or pay for, its operations. Shareholder equity is the company's total assets minus total liabilities, that is, the amount that the shareholders can claim after all debts and liabilities are paid. For valuation purposes, the ratio indicates how much debt the company uses to finance its assets. Generally, if the company has low debt and high equity, it's financially sound, and so its sale price will be higher than if it has high debt and low equity.

Das könnte Ihnen auch gefallen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Legprof CasesDokument104 SeitenLegprof CasesJemaica SebolinoNoch keine Bewertungen

- Internship Ahsan AkhterDokument42 SeitenInternship Ahsan Akhterinzamamalam515Noch keine Bewertungen

- Web3 Summit Oracle HackerNode AgendaDokument8 SeitenWeb3 Summit Oracle HackerNode AgendaChainlink100% (1)

- Facts:: Cemco Holdings V. National Life Insurance Company of Philippines, GR NO. 171815, 2007-08-07Dokument2 SeitenFacts:: Cemco Holdings V. National Life Insurance Company of Philippines, GR NO. 171815, 2007-08-07Carl Marx FernandezNoch keine Bewertungen

- Wedding Planner Magazine Volume 1, Issue 5Dokument40 SeitenWedding Planner Magazine Volume 1, Issue 5SigmarNoch keine Bewertungen

- Solomon Chukwuemeka Ugbaja GUI ProfileDokument6 SeitenSolomon Chukwuemeka Ugbaja GUI ProfileGlobal Unification InternationalNoch keine Bewertungen

- Kase Fund Letter To Investors-Q1 14Dokument4 SeitenKase Fund Letter To Investors-Q1 14CanadianValue100% (1)

- 2017/eur/pdf/DEVNET 2023 PDFDokument45 Seiten2017/eur/pdf/DEVNET 2023 PDFSayaOtanashiNoch keine Bewertungen

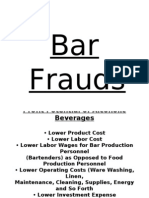

- Bar Frauds & FormsDokument41 SeitenBar Frauds & FormsOm Singh100% (6)

- 1-The Usage of Accounting Information Systems For Effective Internal Controls in The HotelsDokument3 Seiten1-The Usage of Accounting Information Systems For Effective Internal Controls in The HotelsrinaawahyuniNoch keine Bewertungen

- The Kennedy Tree 2014Dokument9 SeitenThe Kennedy Tree 2014shaggypuppNoch keine Bewertungen

- Business Names For Sale Business Name Generator WLRTX PDFDokument2 SeitenBusiness Names For Sale Business Name Generator WLRTX PDFisraelbongo7Noch keine Bewertungen

- Catchment AreaDokument3 SeitenCatchment AreaBaala MuraliNoch keine Bewertungen

- 1q13 BP MM Global Sales PlaybookDokument22 Seiten1q13 BP MM Global Sales Playbookouss860Noch keine Bewertungen

- Deviation Powers 07.12.16 BCC - BR - 108 - 587Dokument11 SeitenDeviation Powers 07.12.16 BCC - BR - 108 - 587RAJANoch keine Bewertungen

- Ecommerce SrsDokument14 SeitenEcommerce SrsVikram ShekhawatNoch keine Bewertungen

- Strategies For Improving Capsule Filling EfficiencyDokument4 SeitenStrategies For Improving Capsule Filling EfficiencySangram KendreNoch keine Bewertungen

- Mobil Annual Report 2016 FinalDokument204 SeitenMobil Annual Report 2016 FinalDebashish NiloyNoch keine Bewertungen

- Case 6Dokument3 SeitenCase 6Cristine Sanchez50% (4)

- SCC/AQPC Webinar: SCOR Benchmarking & SCC Member Benefits: Webinar Joseph Francis - CTO Supply Chain CouncilDokument23 SeitenSCC/AQPC Webinar: SCOR Benchmarking & SCC Member Benefits: Webinar Joseph Francis - CTO Supply Chain CouncilDenny SheatsNoch keine Bewertungen

- Price Determination For AutomobilesDokument11 SeitenPrice Determination For AutomobilesAbubakarNoch keine Bewertungen

- Gacp Application TemplateDokument8 SeitenGacp Application TemplatejackedddaNoch keine Bewertungen

- Sig Ar 0405Dokument84 SeitenSig Ar 0405kapoorvikrantNoch keine Bewertungen

- Kellogs Case StudyDokument22 SeitenKellogs Case StudyAshish Kumar Banka100% (1)

- Preparing Financial StatementsDokument14 SeitenPreparing Financial StatementsAUDITOR97Noch keine Bewertungen

- Yuksel (2001) The Expectancy Disconfirmation ParadigmDokument26 SeitenYuksel (2001) The Expectancy Disconfirmation ParadigmMariana NunezNoch keine Bewertungen

- Intro To Accounting Ch. 2Dokument5 SeitenIntro To Accounting Ch. 2Bambang HasmaraningtyasNoch keine Bewertungen

- Accounting Information SystemDokument79 SeitenAccounting Information Systemrecca123100% (3)

- Kudos - 4 21 14Dokument1 SeiteKudos - 4 21 14Stephanie Rose GliddenNoch keine Bewertungen

- What Is A Hot Work Permit PDFDokument3 SeitenWhat Is A Hot Work Permit PDFmridul lagachuNoch keine Bewertungen