Beruflich Dokumente

Kultur Dokumente

Activity Based Costing (ABC)

Hochgeladen von

Frederick Forkuo YeboahCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Activity Based Costing (ABC)

Hochgeladen von

Frederick Forkuo YeboahCopyright:

Verfügbare Formate

AcLlvlLy8ased CosLlng (A8C)

M8A ACCCun1lnC

C8Cu 2 8LSLn1A1lCn

ACC 512: Cost Accounting Systems 1

earnlng Cb[ecLlves

W 1he sLraLeglc role of AcLlvlLy8ased CosLlng

W Lxplaln whaL ls meanL A8C

W ldenLlfy Lhe concepLs/assumpLlons of A8C

W ldenLlfy approprlaLe cosL drlvers under

acLlvlLybased cosLlng (A8C)

W CalculaLe cosL per drlver and per unlL uslng

A8C

ACC 512: Cost Accounting Systems 2

earnlng Cb[ecLlves

W Compare A8C and LradlLlonal meLhods of

overheads absorpLlon based on producLlon

unlLs labour hours or machlne hours

W AdvanLages and crlLlclsms of A8C

W Lxplaln Lhe lmpllcaLlons of swlLchlng Lo A8C

on prlclng performance and managemenL and

declslon maklng

ACC 512: Cost Accounting Systems 3

ey 1erms

W CosL drlver

W CosL pool

W CosL ob[ecL

W AcLlvlLy

W 8esource

W 1radlLlonal meLhod of absorpLlon cosLlng

W A8C

ACC 512: Cost Accounting Systems 4

1he sLraLeglc role of AcLlvlLy8ased

CosLlng (A8C)

W A8C ls a meLhod of deLermlnlng accuraLe

cosLs

W A8C ls a recenL lnnovaLlon ln cosL accounLlng

and lLs been rapldly adopLed by companles

across many lndusLrles and wlLhln

governmenL and nCCS

W eLs look aL a qulck scenarlo of how lL works

and how lL ls lmporLanL

ACC 512: Cost Accounting Systems 5

lzza Scenarlo

3 fr|ends d|nner

W Lach order an lndlvldual slze

plzza

W suggesL you all order a

plaLe of appeLlzer for Lhe Lable

W order addlLlonal 2 and

consumed all alone

W 1lme Lo pay for Lhe blll

W suggesLs an equally

shared of Lhe appeLlzer

ordered

nana kk

ACC 512: Cost Accounting Systems 6

M8A C2 lurnlLure Co Ld

W Slmllarly ln manufacLurlng suppose Lhree of you

are producL managers aL a planL LhaL

manufacLures funlLures aL M8A C2 lurnlLures

W nAnA ln charge of Sofa manufacLurlng

W ulnlng room Lables and chalrs

W ?Cu bedroom furnlLures

W Lach of your producL llnes has dlrecL maLerlals

and labour cosLs dlrecLly Lraced Lo each one of

you lL ls your responslblllLy Lo manage Lhese

dlrecL cosLs

ACC 512: Cost Accounting Systems 7

M8A C2 lurnlLure Co Ld

W 1here are also manufacLurlng cosL (overheads)

LhaL cannoL be Lraced Lo each producL

lncludlng Lhe followlng acLlvlLles maLerlal acqulslLlon

maLerlal sLorage and handllng producL lnspecLlon manufacLurlng

supervlslon [ob schedullng equlpmenL malnLenance and fabrlc cuLLlng

W WhaL lf M8A C2 decldes Lo charge Lhe 3

managers a falr share" of Lhe LoLal lndlrecL

cosL uslng Lhe raLlo of unlLs produced ln a

manager's area Lo Lhe LoLal unlLs produced for

all managers?

ACC 512: Cost Accounting Systems 8

M8A C2 lurnlLure Co Ld

W 1hls ls commonly referred Lo as volume8ased

cosLlng or Lhe LradlLlonal meLhod of absorpLlon

cosLlng

W nC1L wheLher Lhe proporLlons used are based

on unlLs produced dlrecL labour hours or

machlne hours each of Lhese ls volumebased

W WhaL happens lf usage of Lhese acLlvlLles ls noL

proporLlonaLe Lo Lhe number of unlLs produced?

W Some manager would be overcharged oLhers

undercharged under volumebased approach

ACC 512: Cost Accounting Systems 9

A8C versus 1radlLlonal MeLhod of

AbsorpLlon CosLlng

W Assumlng nAnA lnslsL on more frequenL

lnspecLlons of hls producLlon he wlll be falrly

charged a hlgher proporLlon of overhead

(lnspecLlon) Lhan LhaL based on unlLs alone

W Moreover why should you pay for any porLlon of

fabrlc cuLLlng lf your bedroom furnlLure does noL

requlre fabrlc?

W 1he LradlLlonal meLhod of absorpLlon cosLlng

provldes llLLle lncenLlve for managers Lo conLrol

lndlrecL cosLs

ACC 512: Cost Accounting Systems 10

A8C versus 1radlLlonal MeLhod of

AbsorpLlon CosLlng

W 1he only way unforLunaLely Lo reduce your

share of lndlrecL cosL ls Lo reduce your unlLs

produced or hope LhaL nAnA or or boLh

lncrease producLlon

W Cn reflecLlon Lhe approach LhaL charges

lndlrecL cosLs Lo producL based on unlLs

produced does noL provlde very accuraLe

producL cosL Lo Lhe producLs

ACC 512: Cost Accounting Systems 11

A8C versus 1radlLlonal MeLhod of

AbsorpLlon CosLlng

W 1he SCu1lCn ls Lo use AC1lvl1?8ASLu

CCS1lnC Lo charge Lhese lndlrecL cosLs Lo Lhe

producLs uslng deLalled lnformaLlon on Lhe

octlvltles LhaL make up Lhe lndlrecL cosLs le

Lhe maLerlal handllng lnspecLlon fabrlc

cuLLlng

W 1hls presenLaLlon shows how Lo do lL

ACC 512: Cost Accounting Systems 12

8ole of Lhe 1radlLlonal MeLhod of

AbsorpLlon CosLlng

W 1hls meLhod was pracLlce a loL for many years

ago when producLlon sysLems were based on

labourlnLenslve or machlne lnLenslve

W 8uL even Loday lL ls a sLraLeglc cholce of some

flrms

W lL ls generally used when dlrecL cosL are Lhe ma[or

cosL of Lhe producL or servlce

W lL ls used when acLlvlLles supporLlng Lhe

producLlon of Lhe producL or servlce are relaLlvely

small lowcosL and homogeneous producL llnes

ACC 512: Cost Accounting Systems 13

8ole of Lhe 1radlLlonal MeLhod of

AbsorpLlon CosLlng

W 1radlLlonal producL cosLlng measures accuraLely

volumerelaLed resources eg dlrecL cosLs

W 8uL falls Lo measure Lhe way producLs consume

nonvolume relaLed acLlvlLles such as seLup cosLs

maLerlal handllng lnspecLlon

W 8esources are consumed when Lhese acLlvlLles

are Lrlggered by producLlon lL ls Lhe producLs

whlch cause Lhese acLlvlLles Lo arlse and A8C

aLLempLs Lo Lrace Lhe consumpLlon of Lhese

acLlvlLles by Lhe varlous producLs

ACC 512: Cost Accounting Systems 14

WhaL Lhen ls AcLlvlLy8ased CosLlng?

AcLlvlLybased cosLlng (A8C) ls a costloq opptoocb

tbot osslqos tesootce costs to cost objects socb os

ptoJocts setvlces ot costomets boseJ oo

octlvltles petfotmeJ fot tbe cost objects

ln oLher words lL ls concerned wlLh cost otttlbotloo

to cost oolts oo tbe bosls of beoeflt tecelveJ ftom

Jltect octlvltles eq OtJetloq setop ossotloq

poollty (aplan Cooper)

ACC 512: Cost Accounting Systems 15

A8C Anu CosL urlvers

W 1he A8C approach ls Lo llnk overheads cosLs Lo

producLs or servlces LhaL causes Lhem by

absorblng overheads cosL on Lhe basls of

octivities LhaL 'drive' cosL (cost drivers) raLher

Lhan on Lhe basls of producLlon volume

ACC 512: Cost Accounting Systems 16

W Cver head expenses lncurred

W Step 1 overheads allocaLed Lo

cosL pools uslng sulLable bases

W CosL pools (usually

acLlvlLles)

W Step 2 Cverheads

absorbed lnLo unlLs of

producLlon uslng cosL

drlvers

Cverheads

x ? Z

roducLlon ouLpuL

ACC 512: Cost Accounting Systems 17

W A cost poo/ ls an acLlvlLy LhaL consumes resources

for whlch overhead cosLs are ldenLlfled and

allocaLed lor each cosL pool Lhere should be a

drlver

W A cost driver ls a unlL of acLlvlLy LhaL consumes

resources An alLernaLlve deflnlLlon of a cosL

drlver ls a facLor lnfluenclng Lhe level of cosL

W An octivity ls a speclflc Lask or acLlon of work

done

W A resource |s an ecn|c e|eent needed r

cnsed |n perfr|ng act|v|t|es

ACC 512: Cost Accounting Systems 18

ConcepLs or AssumpLlons underlylng

A8C

1) ln Lhe long run all overheads cosL are varlable

Some overheads are varlable ln Lhe shorL run

Powever overhead cosL do noL necessarlly vary

wlLh producLlon volume or servlce level

2) AcLlvlLles consumes resources

3) 1he consumpLlon of resources drlves cosL

4) roducLs lncur overhead cosLs because of Lhe

acLlvlLles LhaL go lnLo provldlng Lhe producLs or

servlce Lhese acLlvlLles are noL necessarlly

relaLed Lo Lhe volumes of Lhe producL LhaL are

manufacLured

ACC 512: Cost Accounting Systems 19

ConcepLs or AssumpLlons underlylng

A8C

3) ulrecL labour hours and machlne hours are noL

Lhe drlvers of cosL ln many modern buslness

envlronmenLs

AbsorpLlon of overheads lnLo unlL cosL on a

volume basls may be mlsleadlng parLlcularly ln a

modern manufacLurlng envlronmenL where

overhead cosLs are lnfluenced by dlverslLy and

complexlLy of ouLpuL raLher Lhan Lhan volume

ACC 512: Cost Accounting Systems 20

lllusLraLlon A8C

M8A C2 company manufacLures Lwo producLs x and ? M8A C2 uses

absorpLlon cosLlng and flxeJ ptoJoctloo costs ote obsotbeJ loto

ptoJoctloo cost oo o Jltect loboot boots bosls1he budgeLed lnformaLlon

for Lhe nexL flnanclal year ls as follows

dL x dL ? 1oLal

roducLlon Sales 2000unlLs 3000unlLs

u hrs/unlL 3hrs 2hrs

8udgeL u hrs 6000hrs 10000hrs 16000hrs

llxed producLlon cosL 48000

ACC 512: Cost Accounting Systems 21

DS1kA1- ConL

uslng A8C a revlew of Lhe lncldence cosLs has esLabllshed LhaL Lhe

number of

seLups ls Lhe drlver of Lhe flxed producLlon cosL uslng A8C Lhe flxed

producLlon cosLs would be allocaLed as follows

dL x dL ? 1oLal

no of seLups per 1000unlLs 8 16

8udgeLed seLups 16 8 24

llxed producLlon cosL 48000

ACC 512: Cost Accounting Systems 22

1rad|t|na| Methd

Ca|c|at|n f Absrpt|n rate

48000/16000hrs 3/uP

llxed C/P absorbed

roducL x 6000hrs x 3/uP 18000

roducL ? 10000hrs x 3/uP 30000

A8C Methd

llxed C/P allocaLed

48000/24seLups 2000/seLup

roducL x 16 x 2000 32000

roducL ? 8 x 2000 16000

1he dlfference ln cosLlng could have slgnlflcanL lmpllcaLlons for

prlclng especlally lf a cosLbased approach ls used for proflL

calculaLlon

ACC 512: Cost Accounting Systems 23

AcLlvlLybased cosLlng could provlde much

meanlngful lnformaLlon abouL producL cosLs and

proflLs when

W lndlrecL cosL are hlgh relaLlve Lo dlrecL cosL

W roducLs or servlces are complex

W roducLs and servlces are Lallored Lo cusLomer

speclflcaLlons

W Some producLs are sold ln large numbers and

oLhers ln small numbers

ACC 512: Cost Accounting Systems 24

ldenLlfylng approprlaLe cosL drlver

under A8C

W under A8C cosL are drlven by acLlvlLles and noL

producLlon volume

Lxamples of overheads whlch are nC1 drlven by

producLlon lnclude Lhe followlng

SeLup cosLdrlven by no of manufacLurlng seLups

Crderlng processlng cosL drlven by no of orders

acklng depL cosLs no of packlng orders

Lnglneerlng depL cosL no of producLlon orders

Alr condlLlonlng malnLenance no of AC unlLs

ACC 512: Cost Accounting Systems 25

1esL our undersLandlng

Act|v|ty Cst | Act|v|ty Cst dr|ver

AdverLlslng

CuallLy conLrol

urchaslng

SeLup cosLs

SLores

uespaLch

LqulpmenL preparaLlon

aLlenL preparaLlon

aLlenL afLercare

lllm processlng

lllm reporLlng

ACC 512: Cost Accounting Systems 26

1esL our undersLandlng

Act|v|ty Cst | Act|v|ty Cst dr|ver

AdverLlslng 1he value of sales ln each sales area

CuallLy conLrol 1he number of quallLy LesLs

urchaslng 1he number of purchase orders

SeLup cosLs 1he number of seLups/prdLn runs

SLores 1he number of maLerlal requlslLlons

uespaLch 1he number of despaLch orders

LqulpmenL preparaLlon 1lme Laken or number of seLups

aLlenL preparaLlon 1lme Laken or number of paLlenLs

aLlenL afLercare 1lme Laken or number of paLlenLs

lllm processlng 1he number of lmages

lllm reporLlng 1he number of lmages

ACC 512: Cost Accounting Systems 27

CalculaLlon of cosLs per drlver and per

unlL uslng A8C

llve (3) 8aslc sLeps

1 ldenLlfy acLlvlLles LhaL consume resources and

lncur overhead cosLs

2 AllocaLed overhead cosLs Lo Lhe acLlvlLles LhaL

lncur overhead cosLs

3 ueLermlne Lhe cosL drlver for each acLlvlLy or

cosL pool

ln Lhls way each acLlvlLy becomes a cosL pool for overhead cosLs lL ls

lmporLanL LhaL overhead cosLs should be dlrecLly allocaLed Lo a cosL

pool 1here should noL be any arblLrary apporLlonmenL of overhead

cosLs

ACC 512: Cost Accounting Systems 28

CalculaLlon of cosLs per drlver and per

unlL uslng A8C

4 CollecL daLa abouL acLual acLlvlLy for Lhe cosL

drlver ln each pool

3 CalculaLe Lhe overhead cosL of producLs or

servlces 1hls ls done by calculaLlng an

overhead cosL per unlL of Lhe cosL drlver

Cverhead cosLs are Lhen charged Lo

producLs or servlces on Lhe basls of acLlvlLles

used for each producL or servlce

ACC 512: Cost Accounting Systems 29

lllusLraLlon A8C

M8A C2 manufacLures Lwo parLs A and 8 MonLhly relaLlng Lo

producLlon and sales are as follows

roducL A roducL 8

ulrecL MaLerlal CosL/unlL() 13 20

ulrecL abour Pour/unlL 1hr 2hrs

ulrecL abour CosL/unlL() 20 40

Sales demand 100unlLs 930unlLs

roducLlon overheads are 200000 each monLh and are

absorbed on a dlrecL labour hours basls CA8 ls 100/uP

1he managemenL accounLanL of M8A C2 company Ld has

produced a reporL of poLenLlal value of A8C as a preferred alLernaLlve

Lo Lhe LradlLlonal absorpLlon cosLlng sysLem and has found LhaL Lhere

are flve maln areas of acLlvlLy LhaL can be sald Lo consume overhead

cosLs 1he managemenL accounLanL has gaLhered Lhe followlng

monLhly lnformaLlon

ACC 512: Cost Accounting Systems 30

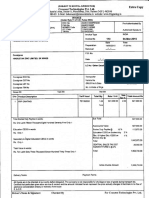

CalculaLe Lhe cosLs ln LoLal and per unlL for roducL A

and 8 uslng A8C

Act|v|ty 1C Cst dr|ver 1ta| - dt rdt

A 8

SeLLlng up 20000 no of seLups 4 1 3

Machlnlng 80000 Machlne hours 2000 100 1900

Crder handllng 20000 no of orders 4 1 3

CuallLy conLrol 20000 no of lnspecLlons 3 1 4

Lnglneerlng 60000 Lnglneerlng hours 1000 300 300

200000

ACC 512: Cost Accounting Systems 31

Worklngs

Cst per dr|ver

W SeL up/unlL 20000/4seLups 3000/seLup

W Machlnlng 80000/2000hrs 40/hr

W Crder 20000/4orders 3000/order

W CC 20000/3lnspecLlons 4000/lnspecLlon

W Lnglneerlng 60000/1000hrs 60/hr

Ds|ng A8C

W SeLLlng up allocaLlon

roducL A 1 seLup x 3000/seLup3000

roducL 8 3seLup x 3000/seLup 13000

W Machlnlng

roducL A 100hrs x 40/hr 4000

roducL 8 1900 hrs x 40 /hr 76000

ACC 512: Cost Accounting Systems 32

Worklngs

Cst per dr|ver

W SeL up/unlL 20000/4seLups 3000/seLup

W Machlnlng 80000/2000hrs 40/hr

W Crder 20000/4orders 3000/order

W CC 20000/3lnspecLlons 4000/lnspecLlon

W Lnglneerlng 60000/1000hrs 60/hr

Ds|ng A8C

W Crder handllng

dL A 1 order x 3000/order 3000

dL 8 3 order x 3000/order 13000

W CuallLy ConLrol

dL A 1 lnspecLlon x 4000/lnspecLlon 4000

dL 8 4 lnspecLlon x 4000/lnspecLlon 16000

W Lnglneerlng

dL A 300 hours x 60/hr 30000

dL 8 300 hours x 60/hr 30000

ACC 512: Cost Accounting Systems 33

soluLlon

Act|v|ty 1C Cst dr|ver 1ta| - dt rdt

A 8

SeLLlng up 20000 CosL per seLup 3000 3000 13000

Machlnlng 80000 CosL per Machlne hour 40 4000 76000

Crder handllng 20000 CosL per order 3000 3000 13000

CuallLy conLrol 20000 CosL per of lnspecLlon 4000 4000 16000

Lnglneerlng 60000 CosL per Lng hour 60 30000 30000

200000 48000 132000

ACC 512: Cost Accounting Systems 34

dt A () rdt 8 ()

ulrecL MaLerlals 1300 19000

ulrecL abour 2000 38000

Cverheads 48000 132000

1oLal CosL 31300 209000

number unlLs (31300/100) 100 930

CosL per unlL (209000/930) 313 220

Advantages f A8C

W 8etter prf|tab|||ty easres

A8C provldes more accuraLe and lnformaLlve producL cosLs leadlng Lo

more producL and accuraLe producL and cusLomer proflLablllLy

measuremenLs and Lo beLLerlnformed sLraLeglc declslons abouL

prlclng producL llnes and markeL segmenLs

W 8etter dec|s|n ak|ng

A8C provldes more accuraLe measuremenLs of acLlvlLydrlvlng cosLs

helplng managers Lo lmprove producL and process value by maklng

beLLer producL declslons beLLer cusLomer supporL declslons and

fosLerlng value enhancemenL pro[ecLs

W rcess |prveent

1he A8C sysLem provldes Lhe lnformaLlon Lo ldenLlfy areas where

process lmprovemenL ls needed

W Cst est|at|n

lmproved producL cosLs lead Lo beLLer esLlmaLes of [ob cosLs for prlclng

declslons budgeLlng and plannlng

ACC 512: Cost Accounting Systems 35

AdvanLages of A8C

W lL provlde much beLLer lnslghL lnLo whaL drlves

overhead cosLs

W A8C recognlses LhaL overhead cosLs are noL

relaLed Lo producLlon and sales volume

W ln many buslnesses overhead cosL are slgnlflcanL

proporLlon of LoLal cosLs and managemenL needs

Lo undersLand Lhe drlvers of overhead cosLs ln

order Lo manage Lhe buslness properly Cverhead

cosLs can be conLrolled by cosL drlvers

ACC 512: Cost Accounting Systems 36

CrlLlclsms of A8C

W A||cat|n

noL all cosL have approprlaLe acLlvlLy cosL drlvers Some cosLs requlre

allocaLlons Lo deparLmenLs and producLs based on arblLrary volumes

measures because flndlng Lhe

acLlvlLy LhaL causes Lhe cosL ls lmpracLlcal Lxamples are faclllLy susLalnlng

cosLs such as Lhe cosLs of lnformaLlon sysLem facLory manger's salary facLory

lnsurance and properLy Laxes for Lhe facLory 1hus lL ls lmposslble Lo allocaLe

all overhead cosLs Lo speclflc acLlvlLles

W pense and 1|e

An A8C sysLem ls noL free and ls Llmeconsumlng Lo develop and lmplemenL

lor flrms uslng volumebased cosLlng meLhod sysLem lnsLalllng a new A8C

sysLem ls llkely Lo be very expenses lurLhermore llke mosL lnnovaLlve

managemenL or accounLlng sysLems A8C usually requlres a year or longer

for successful developmenL and lmplemenLaLlon

ACC 512: Cost Accounting Systems 37

CrlLlclsms of A8C

W A8C cosL are based on assumpLlons and slmpllflcaLlon 1he

cholce of boLh acLlvlLles and cosL drlvers mlghL be

lnapproprlaLe

W A8C can be more complex Lo explaln Lo sLakeholders of

cosLlng exerclse

W 1he beneflLs obLalned from A8C mlghL noL [usLlfy Lhe cosL

ACC 512: Cost Accounting Systems 38

1he lmpllcaLlon of swlLchlng Lo A8C

1he use of A8C has poLenLlally slgnlflcanL

commerclal lmpllcaLlons

W rlclng can be based on more reallsLlc cosL

daLa

W Sales sLraLegy can be more soundly based

W erformance managemenL and declslon

maklng can be lmproved

ACC 512: Cost Accounting Systems 39

8ecap

W 1radlLlonal producL cosLlng measures accuraLely

volumerelaLed resources eg dlrecL cosLs buL fall

Lo measure Lhe way producLs consume non

volume relaLed acLlvlLles such as seLup cosLs

maLerlal handllng lnspecLlon

W A8C ls a meLhod of deLermlnlng accuraLe cosLs

W A8C ls a recenL lnnovaLlon ln cosL accounLlng and

lLs been rapldly adopLed by companles across

many lndusLrles and wlLhln governmenL and

nCCS

ACC 512: Cost Accounting Systems 40

AcLlvlLles consumes resources and Lhe

consumpLlon of resources drlves cosL

1herefore overhead cosL ls falrly or equally

allocaLed among producLs or servlces when

lL ls based on Lhe acLlvlLles LhaL consumes

resource whlch subsequenLly drlves cosL

ACC 512: Cost Accounting Systems 41

CuoLe

8eware of llLLle expenses A small leak wlll slnk

a greaL shlp" 8en[amln lranklln

ACC 512: Cost Accounting Systems 42

Croup 1wo Members

W AugusLlne Cwusu Applah

W uorcas uanladl

W lrederlck lorkuo ?eboah

W nehemlah 1eLLeh

W lrank wadwo 8onsu

W 8ev lr lsaac Cpoku1wumasl

ACC 512: Cost Accounting Systems 43

1PAn ?Cu

Lnu

ACC 512: Cost Accounting Systems 44

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- 3 Sem EcoDokument10 Seiten3 Sem EcoKushagra SrivastavaNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- 8C PDFDokument16 Seiten8C PDFReinaNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Solution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th EditionDokument36 SeitenSolution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th Editionsaxonic.hamose0p9698% (49)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- VademecumDokument131 SeitenVademecumElizabeth DavidNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Betma Cluster RevisedDokument5 SeitenBetma Cluster RevisedSanjay KaithwasNoch keine Bewertungen

- Cost Analysis of NestleDokument8 SeitenCost Analysis of NestleKiran Virk75% (4)

- Answer Scheme Question 1 (30 Marks) A.: Bkam3023 Management Accounting IiDokument14 SeitenAnswer Scheme Question 1 (30 Marks) A.: Bkam3023 Management Accounting IiTeh Chu LeongNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Groen BPP-40E Tilt SkilletDokument2 SeitenGroen BPP-40E Tilt Skilletwsfc-ebayNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Managenet AC - Question Bank SSDokument18 SeitenManagenet AC - Question Bank SSDharshanNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Ficci Ey M and e Report 2019 Era of Consumer Art PDFDokument309 SeitenFicci Ey M and e Report 2019 Era of Consumer Art PDFAbhishek VyasNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Variable & Absorption CostingDokument23 SeitenVariable & Absorption CostingRobin DasNoch keine Bewertungen

- Fashion and StatusDokument11 SeitenFashion and StatusDiana ScoriciNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Project Budget WBSDokument4 SeitenProject Budget WBSpooliglotaNoch keine Bewertungen

- (84650977) Variance Accounting Case Study - PD1Dokument24 Seiten(84650977) Variance Accounting Case Study - PD1Mukesh ManwaniNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Adult Ticket GuideDokument22 SeitenAdult Ticket GuideB.i. ShahedNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Types of Sewing MachinesDokument12 SeitenTypes of Sewing MachinesShireen KhanNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Accounting For Income Tax-NotesDokument4 SeitenAccounting For Income Tax-NotesMaureen Derial PantaNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- ReshapeDokument4 SeitenReshapearnab1988ghoshNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- About Feathers Fashion (1st Emirates Brand)Dokument15 SeitenAbout Feathers Fashion (1st Emirates Brand)MufeezRanaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDokument2 SeitenInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundGaurangNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Cows and ChickensDokument9 SeitenCows and Chickensapi-298565250Noch keine Bewertungen

- Chp14 StudentDokument72 SeitenChp14 StudentChan ChanNoch keine Bewertungen

- Barwani PDFDokument13 SeitenBarwani PDFvishvarNoch keine Bewertungen

- B1342 SavantICDokument3 SeitenB1342 SavantICSveto SlNoch keine Bewertungen

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDokument1 SeiteIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagecachandhiranNoch keine Bewertungen

- HZL 4100070676 Inv Pay Slip PDFDokument12 SeitenHZL 4100070676 Inv Pay Slip PDFRakshit KeswaniNoch keine Bewertungen

- AEON SWOT Analysis & MatricDokument6 SeitenAEON SWOT Analysis & MatricJanet1403Noch keine Bewertungen

- Fundamentals of AccountingDokument5 SeitenFundamentals of AccountingJayelleNoch keine Bewertungen

- Valeant Case SummaryDokument2 SeitenValeant Case Summaryvidhi100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- mgm3180 1328088793Dokument12 Seitenmgm3180 1328088793epymaliNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)