Beruflich Dokumente

Kultur Dokumente

Basel III and Impact Analysis

Hochgeladen von

geethyOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Basel III and Impact Analysis

Hochgeladen von

geethyCopyright:

Verfügbare Formate

Comprehensive set of reform measures, developed by the Basel Committee on Banking Supervision, to strengthen the regulation, supervision and

risk management of the banking sector. Aim:

Improve the banking sector's ability to absorb shocks from

financial and economic stress.

Improve risk management and governance Strengthen banks' transparency and disclosures.

Micro prudential regulation - Raise the resilience of individual banking institutions in periods of stress Macro prudential regulation ensure system wide resilience against risks/ shocks and counter procyclicality.

Strengthening the resilience of the banking sector International framework for liquidity risk measurement, standards and monitoring.

Strengthening the capital framework.

Redefining Capital and Minimum Capital Requirement.

Reducing Procyclicality & Promoting countercyclical buffers.

Capital Conservation & Countercyclical Buffers. Forward looking provisioning.

Enhancing Risk Coverage.

Enhancing counterparty Credit Risk Management Systems, incentives

for moving towards CCPs and Collateral Management.

Reducing reliance on ECAI ratings. Pillar-2 and 3 measures for better governance and disclosures.

Supplementing Risk Based Capital requirement with Leverage ratio. Introducing Global Liquidity standard.

LCR & NSFR.

Flaws in existing definition of capital Regulatory adjustment (deductions) not applied to common equity No harmonized list of regulatory adjustments/deductions. Weak transparency in disclosure of regulatory capital. Subordinated instruments turned out to be less loss absorbent during crisis.

Raising quality, consistency and transparency of capital base Improving/enhancing risk coverage on account of counterparty credit risk Supplementing risk based capital requirement with leverage ratio Reducing pro-cyclicality and introducing countercyclical capital buffer

Redefining Capital

Predominant form of Tier 1 capital must be the common

equity CE(common shares and retained earnings).

Increased minimum requirement for CE -from 2% to 3.5%

by Jan, 2013,4% by 2014 and 4.5% from Jan, 2015. period.

The Tier 1 capital - increased from 4% to 6% over the same Capital instruments that do not meet the criteria for

inclusion in common equity Tier 1 will be excluded from common equity Tier 1 as of 1 January 2013.

Abolished Tier III capital.

Countercyclical buffer & Capital Buffers

Countercyclical Buffer Range of 0% 2.5% of CE or other fully

loss absorbing capital (Influenced by national circumstances) linked with excessive credit growth (when credit to GDP ratio is above its long term trend by certain percentage) .

Capital conservation buffer2.5%, is designed to :

Ensure that banks build up capital buffers outside periods of

stress which can be drawn down as losses are incurred.

Invoke capital distribution constraints on a bank when capital

levels fall within the following ranges.

Minimum Required

Common Capital Ratio Capital Conservation Buffer CE Capital Ratio Plus Capital Buffer Phase-in deductions CET1 from

1st 1st 1st 1st 1st Jan, 1st, 1st Jan, Jan, Jan, Jan, Jan, 2018 Jan,20 19 2013 2014 2015 2016 2017 Equity 3.5% 4% 4.5% 4.5% 4.5% 4.5% 4.5%

0%

0%

0% 0.625 1.25% 1.875 2.5% % %

3.5% 4% 4.5% 5.125 5.75 6.375 7% % % % 20% 40% 60% 80% 100% 100%

(DTA, Significant Investments) subject to Thresholds)

Phasing out from CET1, T1 or T2 capital To be phased out by 10 years from 2013

Tier-1 capital 4.5% 5.5% 6% 6% 6% 6% 6% Total capital 8% 8% 8% 8% 8% 8% 8% Total capital Plus 8% 8% 8% 8.625 9.25% 9.875 10.5% conservation % % Buffer Discretionary 0% 0% 0% 0.625 1.25% 1.875 2.5% countercyclical % % buffer non-eligibleEquity) instruments (as per new definition ) (Common capital

Raise the capital buffers for counterparty credit exposures arising from derivatives, repo and securities financing transactions. Banks with large and illiquid derivative exposures to counterparty will have to apply longer margining periods for determining the regulatory capital. A stressed value-at-risk (VaR) capital requirement based on a 12-month period of significant financial stress & higher capital requirements for resecuritisations . Incentives to move OTC derivative contracts to central counterparties through relatively lower capital requirements. Incentives to strengthen the risk management of counterparty credit exposures & collateral management. Banks will be subject to a capital charge for MTM losses (ie credit valuation adjustment CVA risk) associated with deterioration in the credit worthiness of counterparty. Asset value correlation of 1.25 for Systemically important financial firms and unregulated financial firms

2011 Leverage Ratio

2012 Supervisory Monitoring

2013

2014

2015

2016 2017 2018

Parallel Run 1st Jan,2013- 1st Jan,2017. Disclosure from 1st Jan, 2015

1st Jan, 2019 Migration to Pillar 1

Liquidity Coverage Ratio

Observation Period

Introduce Minimum Standard

Net Stable Funding Ratio

Observation Period

Introduce Minimum Standard

Help in to mitigate the risk of high leverage & destabilizing deleveraging processes which can damage the financial system and the economy Additional safeguard against model risk and measurement error by supplementing the risk-based measure with a simple, transparent, independent measure of risk . Minimum should be 3%. Reinforce the risk based requirements with a simple, nonrisk based backstop measure Numerator Tier 1 capital Denominator On and off balance sheet exposure credit equivalent

Key characteristic of the financial crisis was inaccurate and ineffective management of liquidity risk Two standards/ratios proposed Liquidity coverage ratio (LCR) for short term (30 days) liquidity risk management Net Stable Funding Ratio (NSFR) for longer term structural liquidity mismatches

Ensuring enough liquid assets to survive an

acute stress scenario lasting for 30 days

Banks must hold unencumbered high quality liquid assets to cover total net cash outflows over a 30 day period under a stressed scenario Unencumbered means not pledged to secure, collateralize or credit enhance any transaction Assets are considered high quality liquid assets if they can be easily and immediately converted into cash at little or no loss of value High quality liquid assets should also ideally be eligible at central banks for intraday and overnight liquidity needs In certain jurisdictions where central bank eligibility is limited to a narrow list of assets, a supervisor may allow unencumbered, non-central bank eligible assets to be used 2 categories of assets Level 1 and Level 2 asset

cash Central bank reserves; Marketable securities representing claims on/ claims guaranteed by sovereigns, central banks, non-central government PSEs, BIS, IMF, EC or multilateral development banks which have a 0% risk weight under Basel 2 Standardized Approach; have a deep and active repo or cash markets; is a proven source of liquidity in markets; and is not a financial obligation Non-0% risk-weighted sovereigns/ central bank debt securities issued in domestic currency or foreign currency; AA- and better

Subject to a minimum 15% haircut and capped at 40% (post haircut) marketable securities representing claims on/ claims guaranteed by sovereigns, central banks, non-central government PSEs, or multilateral development banks. The conditions are the same as Level 1 except these will have a 20% risk weight under Basel 2 Standardized Approach corporate bonds and covered bonds satisfying the following conditions:i) not issued by a financial institution/ its affiliates (for corp. bonds) ii) not issued by bank itself/ its affiliates (for covered bonds) iii) have a credit rating from a recognized credit institution of at least AArating iv) traded in large, deep and active cash or repo markets v) proven record as a reliable source of liquidity (max. decline of price/ increase in haircut over 30 day period does not exceed 10%)

Run-off of a proportion of retail deposits; Partial loss of unsecured wholesale funding capacity; Additional contract outflows that arises from a banks downgrade in its public credit rating by up to and including 3 notches, including collateral posting requirements; Increase in market volatilities that impact quality of collateral/ potential future derivatives exposure that may require larger collateral haircuts/additional collateral or leads to other liquidity needs; Unscheduled draws on committed but unused credit and liquidity facilities that a bank provides to its clients; Potential need for a bank to buy back debt/ honor noncontractual obligations to mitigate reputational risk

To promote medium to long term structural funding of assets and activities Available amount of stable funding Defined as the total amount of a banks: a) Capital b) Preferred stock with a maturity of equal or >1 yr c) Liabilities with effective maturity equal or >1 year d) Portion of non-maturity and/or term deposits with maturities of <1 year e) Portion of wholesale funding with maturities <1 yr

Amount of stable funding measured using supervisory assumptions on the liquidity profiles of an institutions assets, off-balance sheet exposures etc. Required amount of stable funding = Sum of the value of the assets held multiplied by the relevant RSF factor, added to the amount of offbalance sheet activity multiplied by its associated RSF factor. Assets that are more liquid and more readily available as a source of extended liquidity in the stressed environment, receive a lower RSF

Estimated Shortfalls by 2019

(Source McKinsey Report, Nov, 2010)

Shortfall in capital = Almost 60 % of Tier 1 capital outstanding, Liquidity gap = Approx 50 % of all O/s short-term liquidity. Estimated Decline in ROE -4% Europe -3% US

Retail banks - Affected least, unless with very low capital ratios. Corporate banks Increase in cost for specialized lending, trade finance and capital market exposures & OTC Derivatives. Investment banks - Core businesses profoundly affected, particularly trading, OTC derivatives and securitization businesses.

Cutting costs ,adjusting prices, Balance-sheet restructuring Improve the quality of capital and Business-model adjustments

Create capital/ RWA light- and liquidity-efficient business

models and products.

Rethink the scope and even the viability of specific business

lines and exit certain lines ,if found unviable through above

Lending between financial institutions & LCs- An essential element of trade finance & Basel III Increases RW for financial institutions by some 20 % to 30 %. Leverage ratio -Trade finance now count in full Vs 20%-50% now, a fivefold increase over todays capital ratio requirements. Liquidity rules More reserves against off-balance-sheet liquidity lines such as LCs and trade guarantees. Increase in Product Costs - Structured finance, unsecured loans, specialized lending. Estimated increase of about 60 basis points. OTC derivatives - Stressed value at risk, incremental risk charge (IRC), credit valuation adjustments (CVAs) increase capital for counterparty credit risk and market risk, along with increased liquidity costs and reduced liquidity benefits trades. Trades with lower-rated counterparties /trades with counterparties with limited netting ability- to be more costly Eg: sales of risk-management products to corporates

SOME EXAMPLES

Offering transaction a/cs with investment capabilities. For NSFR, such a/cs have beneficial treatment of stable funding. Ensure all short-term investment funds are held in accounts classified as stable. Attract more stable funding - Retail and small and midsize enterprise (SME) deposits. Substitute factoring for receivables financing which reduce RWAs by nearly half. Convert corporate lending into corporate bond issuance for large, highquality clients,. Substitute RWA-free fee income for RWA heavy net interest income. Increase the proportion of short-maturity lending to reduce funding costs. Use risk-adjusted pricing to accurately account for costs for risk, capital, and liquidity.

REDESIGNING CUSTOMER MIX & ACQUISITION STRATEGIES

Exit customers with big share of the banks RWAs without returning the

BIS, Macroeconomic Assessment Group (MAG)- April ,2011 study released in Oct, 10,2011.

Fall in GDP by 0.34% from baseline forecast, followed by a recovery.

Due to Higher capital requirements on the top 30 potential G-

SIBs (globally systemically important banks) over 8 yrs.

Roughly 0.04 % reduction from annual growth, while lending

spreads rise by around 0.31%.

Benefits Outweigh Costs

Estimated = The degree to which reduction in the benefits the exposure of the financial of Basel III system to systemic crises reduces the annual probability of a systemic crisis. Estimate of overall cost of a typical crisis in terms of lost output

Estimated annual benefit -Up to 2.5% of GDP. Benefits many times the costs of the reforms by temporarily slower

Risk Governance Balancing Growth with capital. Pillar-2 enhancements for risk coverage. Risk Based pricing and remuneration. Strengthening Liquidity management & reporting. Enhancing counterparty credit risk and collateral management standards. Infrastructure- Addressing Gaps in MIS & Skillsets for Basel-II & III compliance.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Business Mathematics Exercise Sheet - InterestDokument1 SeiteBusiness Mathematics Exercise Sheet - InterestAnna Patricia F. MaltoNoch keine Bewertungen

- Memorandum and Articles of Association - PDF JockeyDokument47 SeitenMemorandum and Articles of Association - PDF JockeytaufiqNoch keine Bewertungen

- Operations Management in BankingDokument12 SeitenOperations Management in Bankinggmurali_17956883% (12)

- 03 Elgin Natl. Bank v. GoeckeDokument2 Seiten03 Elgin Natl. Bank v. GoeckeJanelleNoch keine Bewertungen

- ICICI Bank PPT - Internship 2021-2022 DMII SDokument26 SeitenICICI Bank PPT - Internship 2021-2022 DMII Srohitsf22 olypmNoch keine Bewertungen

- Account StatementDokument3 SeitenAccount StatementJobz ForuNoch keine Bewertungen

- Republic Act No. 3765 Truth in Lending ActDokument6 SeitenRepublic Act No. 3765 Truth in Lending ActMarc Geoffrey HababNoch keine Bewertungen

- Practice of Banking I Law and PracticeDokument171 SeitenPractice of Banking I Law and Practicecarltawia100% (1)

- SA's Best Value For You and Your FamilyDokument38 SeitenSA's Best Value For You and Your FamilyKosie SmithNoch keine Bewertungen

- Co Opbanksfinal PDFDokument13 SeitenCo Opbanksfinal PDFAJAY SHAHNoch keine Bewertungen

- Blackcard Forms March 2010Dokument173 SeitenBlackcard Forms March 2010Bruce Mayor96% (27)

- Deutsche Bank Ag - 2023 02 21Dokument6 SeitenDeutsche Bank Ag - 2023 02 21Nuria PuenteNoch keine Bewertungen

- Namita Mams ResumeDokument33 SeitenNamita Mams Resumesachin11hahaNoch keine Bewertungen

- Depository Institutions FMDokument37 SeitenDepository Institutions FMEricNoch keine Bewertungen

- LL b2020-21 pdf202106055205Dokument206 SeitenLL b2020-21 pdf202106055205dishu kumar100% (1)

- Summer Internship Project Report: Submitted ToDokument89 SeitenSummer Internship Project Report: Submitted Tonipa100% (1)

- Dpwh-Infr-10-2016 Form of Bid Security Bank GuaranteeDokument1 SeiteDpwh-Infr-10-2016 Form of Bid Security Bank Guaranteeeugene jaralbaNoch keine Bewertungen

- Role & Importance of Financial Management in The Banking SectorDokument18 SeitenRole & Importance of Financial Management in The Banking SectorAjit DasNoch keine Bewertungen

- Bank Account EnglishDokument6 SeitenBank Account EnglishNgang Wei HanNoch keine Bewertungen

- 2.19 FNB Relocation PolicyDokument5 Seiten2.19 FNB Relocation PolicyXbox FlashingNoch keine Bewertungen

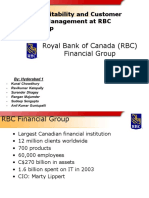

- RBC Case StudyDokument20 SeitenRBC Case StudyIshmeet SinghNoch keine Bewertungen

- FBL (Final)Dokument88 SeitenFBL (Final)Muhammad Rizwan KhanNoch keine Bewertungen

- Guidance On AML CFT Controls in Trade Finance and Correspondent Banking PDFDokument29 SeitenGuidance On AML CFT Controls in Trade Finance and Correspondent Banking PDFTodwe Na MurradaNoch keine Bewertungen

- Central BankDokument5 SeitenCentral BankMohammad JamilNoch keine Bewertungen

- The Money Masters - ReportDokument59 SeitenThe Money Masters - ReportSamiyaIllias100% (2)

- TD Business Premier Checking: Account SummaryDokument3 SeitenTD Business Premier Checking: Account SummaryJohn Bean75% (4)

- MobiVi VietnamDokument10 SeitenMobiVi VietnamMiguel Angel GarciaNoch keine Bewertungen

- Statement of Account: PT 632 Desa Darul Naim Pasir Tumboh 16150 Kota Bharu, KelantanDokument6 SeitenStatement of Account: PT 632 Desa Darul Naim Pasir Tumboh 16150 Kota Bharu, KelantanFadzianNoch keine Bewertungen

- Bank of Commerce Pos Merchant Agreement MDR 2022Dokument12 SeitenBank of Commerce Pos Merchant Agreement MDR 2022Mat Santos Angiwan IIINoch keine Bewertungen

- Application Form Post 11. Tailor (Bs-07)Dokument4 SeitenApplication Form Post 11. Tailor (Bs-07)Azhar MehmoodNoch keine Bewertungen