Beruflich Dokumente

Kultur Dokumente

Bonds 2011

Hochgeladen von

sanishmsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bonds 2011

Hochgeladen von

sanishmsCopyright:

Verfügbare Formate

llnanclal ManagemenL l

S S S kumar

lndlan lnsLlLuLe of ManagemenL kozhlkode

CallcuL 673 370

ond valuaLlon

bond ls a

W securlLy LhaL obllgaLes Lhe lssuer Lo make

speclfled lnLeresL and prlnclpal paymenLs Lo

Lhe holder on speclfled daLes

W onds are someLlmes called flxed lncome

securlLles

Financial Management I 3

lssuers

W CovernmenL sLaLe as well as cenLral govLs

W CorporaLes

Financial Management I 4

@he bond Lermlnology

1 ar value lace amounL pald aL maLurlLy

2 Coupon lnLeresL raLe SLaLed lnLeresL raLe MulLlply by par value Lo

geL lnLeresL ln rupee Lerms Cenerally flxed

3 MaLurlLy Llme Lo reLurn Lhe prlnclpal as Llme elapses Lhls decllnes

4 lssue daLe uaLe when bond was lssued

3 uefaulL rlsk 8lsk LhaL lssuer wlll noL make lnLeresL or prlnclpal

paymenLs

Financial Management I 5

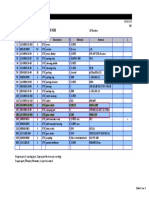

ond markeL reporLlng

Financial Management I 6

@rade uaLe lSln

LasL @rade

rlce (ln

8s)

LasL @rade

value (8s

ln lacs)

@oLal

@rade

value (8s

ln lacs)

LasL @rade

?leld

(?@M)

(nnuallz

ed) ()

WelghLed

verage

rlce

(8s)

WelghLed

verage

?leld

(?@M) ()

11nov11lnL134L0888 974127 1300 1300 93 974127 93

11nov11lnL11307v1 994974 300 1000 99969 994974 99969

11nov11lnL12107uS9 989626 230 230 108939 989626 108939

11nov11lnL02008391 9837 10 12010 97237 980307 97763

11nov11lnL134L08u84 971837 300 300 97988 971837 97988

11nov11lnL134L08uS2 972608 300 300 9799 972608 9799

11nov11lnL24308034 1036623 120 130 110627 10393 110163

11nov11lnL337l09336 330944 2300 2300 89438 330944 89438

11nov11lnL732L07ln3 992899 300 300 94887 992899 94887

11nov11lnL02008633 100 13000 20000 92373 100 92373

11nov11lnL043u08C81 969004 4300 4300 98781 969004 98781

11nov11lnL043u07740 100 3000 3000 90248 100 90248

11nov11lnL314L084 100 13000 13000 93833 100 93833

asls polnL deflned

W basls polnL (bp) ls 1 of 001 or 00001

W @he dlfference beLween a raLe of 300 and

301 ls one basls polnL

Financial Management I 7

Common feaLures

W Senlor versus subordlnaLed bonds

W ConverLlble bonds

W Callable bonds

W uLable bonds

W Slnklng funds

Financial Management I 8

aslc valuaLlon premlse

@he (markeL) value of any lnvesLmenL asseL ls

slmply Lhe presenL value of expecLed cash

flows

ln a coupon paylng bond

1herefore value of a bond

v of all expecLed lnLeresL and prlnclpal paymenLs

Financial Management I 9

ZC#s value

ln Lhe case of a zero coupon bond Lhe value of Lhe bond ls glven as

v lv/(1+ k)

n

where lv ls Lhe prlce aL whlch Lhe bond wlll be redeemed

k ls Lhe requlred raLe of reLurn

n ls Lhe number of years Lo maLurlLy

Financial Management I 10

ond valuaLlon conLd

Where

v

0

value of Lhe asseL aL Llme zero

Cl

L

cash flow expecLed aL Lhe end of year L

k approprlaLe requlred reLurn (dlscounL raLe)

n relevanL Llme perlod

Financial Management I 11

V

0

= CF

1

+ CF

2

+ . + CF

n

(1 + k)

1

(1 + k)

2

(1 + k)

n

aslc componenLs of Lhe dlscounL raLe

@he dlscounL raLe (k

l

) ls Lhe opporLunlLy cosL of funds le Lhe raLe

LhaL could be earned on alLernaLlve lnvesLmenLs of equal rlsk

ln general made up of some or all of Lhe followlng componenLs

Financial Management I 12

k

l

88 + l + M8 + u8 + L

lnflaLlon and reLurns

@he relaLlonshlp beLween real and nomlnal reLurns ls descrlbed by Lhe llsher LffecL

LeL

8 Lhe nomlnal reLurn

r Lhe real reLurn

h Lhe lnflaLlon raLe

ccordlng Lo Lhe llsher LffecL

1 + 8 (1 + r) x (1 + h)

lor example Lhe real reLurn ls 476 Lhe nomlnal reLurn ls 10 and Lhe lnflaLlon raLe

ls

W (1 + 8) 110

W (1 + r) x (1 + h) 110 and h 3

Financial Management I 13

Corp ond Spreads (bps) as on 10 nov 2011

Financial Management I 14

1enor AAA AA+ AA

1 8300 9800 12300

3 10100 12300 14800

ond valuaLlon conLd

ssume a company's bonds have a 8s1000 face value

W @he promlsed annual coupon ls 8s100

W @he bonds maLure ln 10 years

W @he markeL's requlred reLurn on slmllar bonds ls 10

Financial Management I 15

ond valuaLlon conLd

1 CalculaLe Lhe presenL value of Lhe face value

8s1000 x 1/110

10

8s1000 x 03833 8s38330

2 CalculaLe Lhe presenL value of Lhe coupon paymenLs

8s100 x 1 (1/110

10

)/10 8s100 x 61446

8s 61446

3 @he value of each bond 8s 1000 (barrlng roundlng off errors)

Financial Management I 16

racLlce quesLlon

company proposes Lo sell 10 yr debenLures of 8s 10000 each

@he co would repay 8s 1000 aL Lhe end of every year and wlll

pay lnLeresL annually aL 13 on Lhe ouLsLandlng amounL

ueLermlne Lhe presenL value of Lhe debenLure aL 16

caplLallzaLlon raLe

Financial Management I 17

MicrosoL Oice

Fxcel WorksheeL

LeL#s go a llLLle deeper

Suppose you purchase Lhe C Sec descrlbed earller and

lmmedlaLely LhereafLer expecLed lnflaLlon rose by

3 causlng k 13?

!' of annuity 543.315

!' of principal 295.85

Bond value 839.165

Financial Management I 18

When the interest

rute goes up the

bond price wiII

uIwuys go down,

ConLd

W WhaL would happen lf lnflaLlon fell and k

decllned Lo 7?

Financial Management I 19

!' of annuity 702.4

!' of principal 508.0

Bond value 1210.

4

When inferesf rofes

go down, bond

prices wiII oIwoys

go up.

ConLd

ond prlces are lnversely relaLed Lo lnLeresL raLes (or ylelds)

bond sells aL par only lf lLs coupon raLe equals Lhe requlred

reLurn

bond sells aL a premlum lf lLs coupon ls above Lhe requlred

reLurn

bond sells aL a dlscounL lf lLs coupon ls below Lhe requlred

reLurn

Financial Management I 20

rlce Converges Lo ar aL MaLurlLy

Financial Management I 21

It is also important to note that a bonds price will

approach par value as it approaches the maturity date,

regardless of the interest rate and regardless of the

coupon rate.

nferesf Price Price

Pofe Z0 Yeors I Yeor

07 3,000 $ I,I00 $

I07 I,000 $ I,000 $

Z07 bI3 $ 9I7 $

I07 Coupon 8ond

ulled Lo par

Financial Management I 22

Maturity

Bond price

1000

Premium bond

Discount bond

llnanclal ManagemenL l 23

?lelds

@he CurrenL ?leld measures Lhe annual reLurn Lo an lnvesLor based

on Lhe currenL prlce

CurrenL nnual Coupon lnLeresL

?leld CurrenL MarkeL rlce

lor example a 10 coupon bond whlch ls currenLly selllng aL 8s 1130 would have a

currenL yleld of

CurrenL 100 87

?leld 1130

@he ?@M sLory

We have seen how Lo value a bond can we reverse Lhe dynamlcs??

le leLs flnd ouL reLurn on a bond glven lLs prlce

llnanclal ManagemenL l 24

v Cl

1

+ Cl

2

+ + (Cl

n

+

n

)

(1+l)

1

(1+l)

2

(1+l)

n

@hls ls Lhe same equaLlon we saw earller when we solved for prlce ln

Lhls case we know Lhe markeL prlce buL are solvlng for reLurn

llnanclal ManagemenL l 23

?lelds

@he yleld Lo maLurlLy measures Lhe compound annual reLurn Lo an

lnvesLor and conslders all bond cash flows lL ls slmllar Lo Lhe l88 ln

caplLal budgeLlng conLexL (we wlll see whaL l88 means ln due course of

Llme)

ln oLher words lL ls Lhe slngle raLe LhaL when used Lo dlscounL a bond#s

Cashflows produces Lhe bond#s markeL prlce

CompuLlng ?@M

?@M compuLaLlon lnvolves one of Lhe followlng meLhods

(1) lnLerpolaLlon Lechnlque (Lrlal and error by yourself)

(2) llnanclal calculaLor (may be llke Lxcel)

llnanclal ManagemenL l 26

Cf course you have Lo use solver from Lhe @ools menu on Lxcel Lo

deLermlne ?@M or you may use l88 funcLlon also

?@M an approxlmaLlon

Financial Management I 27

0.6P 0.4M

P)/n (M C

C coupon M maLurlLy value

currenL prlce n no of years

Financial Management I 28

@he 8elnvesLmenL 8aLe ssumpLlon

lL ls lmporLanL Lo noLe LhaL Lhe compuLaLlon of Lhe ?@M lmpllclLly assumes LhaL

lnLeresL raLes are relnvesLed aL Lhe ?@M

ln oLher words lf Lhe bond pays a 8s 100 coupon and Lhe ?@M ls 8 Lhe

calculaLlon assumes LhaL all of Lhe 8s 100 coupons are lnvesLed aL LhaL raLe

lf markeL lnLeresL raLes fall however Lhe lnvesLor may be forced Lo relnvesL aL

someLhlng less Lhan 8 resulLlng a reallzed reLurn whlch ls less Lhan

promlsed

Cf course lf raLes rlse coupons may be relnvesLed aL a hlgher raLe resulLlng ln

a hlgher reallzed reLurn

8elnvesLmenL raLe

3year 10 bond Lrades aL 8s 9319634 lmplylng a ?@M of 12

. 11 1 404 . 1

1.634

1337.44

realized Return

3 1

Financial Management I 29

1.634 100 100 1100

1337.44

12.44

12 Ior 2 years

112

12 Ior 1year

Malklel#s Lheorems

1 ond prlces move lnversely wlLh lnLeresL raLes

2 lor a glven bond Lhe absoluLe rupee prlce lncrease caused by a fall ln ylelds

wlll exceed Lhe prlce decrease caused by an lncrease ln ylelds of Lhe same

magnlLude

3 onds wlLh lower coupon raLes experlence more changes for a glven

change ln lnLeresL raLes

4 onds wlLh longer maLurlLy experlence greaLer percenLage change for a glven

change ln lnLeresL raLes

3 @he prlce senslLlvlLy of bonds lncreases wlLh maLurlLy buL lL lncreases aL a

decreaslng raLe

Financial Management I 30

Malklel#s Lheorems

1 ond prlces move lnversely wlLh lnLeresL raLes

a) lor very small changes ln ?@M Lhe change ln bond prlce ls roughly equal

wheLher Lhe ?@M lncreases or decreases

b) lor large changes Lhe prlce lncrease ls greaLer Lhan Lhe prlce decrease

Financial Management I 31

Malklel#s Lheorems conLd

2 Coupon LffecL lor a glven Lerm Lo maLurlLy and lnlLlal ?@M

Lhe prlce volaLlllLy of a bond ls greaLer Lhe lower Lhe coupon

raLe

Financial Management I 32

Malklel#s Lheorems conLd

3 MaLurlLy LffecL lor a glven coupon raLe and lnlLlal ?@M Lhe

longer Lhe Lerm Lo maLurlLy Lhe greaLer Lhe prlce volaLlllLy

Financial Management I 33

DndersLandlng Malklel#s Lheorems

lour bonds prlced lnlLlally Lo yleld 9

9 coupon 3 years Lo maLurlLy lnlLlal prlce 100

9 coupon 20 years Lo maLurlLy lnlLlal prlce 100

3 coupon 3 years Lo maLurlLy lnlLlal prlce 841746

3 coupon 20 years Lo maLurlLy lnlLlal prlce 631968

Financial Management I 34

Coupon LffecL

Financial Management I 35

MicrosoL Oice

Fxcel WorksheeL

MaLurlLy LffecL

Financial Management I 36

MicrosoL Oice

Fxcel WorksheeL

lnferences

Financial Management I 37

rlce change ls greaLer Lhe lower Lhe coupon

raLe

rlce change ls greaLer Lhe longer Lhe Lerm Lo

maLurlLy

pplylng Malklel#s @heorems

W LeLs assume lnLeresL raLes are llkely Lo go down and

you are bond fund manager wlLh a long poslLlon

W wlll galn more by shlfLlng from hlgh coupon

bonds Lo low coupon bonds

Financial Management I 38

pplylng Malklel#s @heorems

W LeLs assume lnLeresL raLes are llkely Lo go up and you are bond

fund manager speclallzlng ln a shorL porLfollo

W @he sLraLegy you adopL wlll

Financial Management I 39

lmpllcaLlons of Malklel#s Lheorems

W bond buyer ln order Lo recelve Lhe maxlmum prlce lmpacL of

an expecLed change ln lnLeresL raLes should purchase low

coupon long maLurlLy bonds

W lf an lncrease ln lnLeresL raLes ls expecLed an lnvesLor

conLemplaLlng Lhelr purchase should conslder Lhose bonds wlLh

large coupons or shorL maLurlLles or boLh

Financial Management I 40

lrom Malklel#s Lheorems Lo

Conslder Lwo bonds

93 8 yr bond and

11 9 yr bond

Whlch one ls more lnLeresL raLe senslLlve?

@o address such quesLlons Malklel#s Lheorems may noL be sufflclenL

Financial Management I 41

uuraLlon

Comblnes Lhe effecLs of dlfferences ln coupon raLes and

dlfferences ln maLurlLy

Financial Management I 42

Macaulay#s duraLlon

P

y) (1

.

y) (1

t.c

Duration

1 t

n t

3

3

Financial Management I 43

Where

t = number of periods to the receipt of cashflow

C = cash flow to be delivered in t periods

n= term-to-maturity

y = yield to maturity

! = price of the bond

uuraLlon

Financial Management I 44

Weighted sum of the number of periods in the

future of each cash flow, (weighted by

respective fraction of the !' of the bond as a

whole).

For a zero coupon bond, duration equals

maturity since 100% of its present value is

generated by the payment of the face value,

at maturity.

uuraLlon conLd

W uuraLlon ls shorLer Lhan maLurlLy for all bonds excepL zero coupon

bonds

W uuraLlon of a zerocoupon bond ls equal Lo lLs maLurlLy

Financial Management I 45

CompuLaLlon of duraLlon

Financial Management I 46

MicrosoL Oice

Fxcel WorksheeL

DndersLandlng duraLlon

Financial Management I 47

Nicrosoft Office

Excel Worksheet

WhaL ls Lhe use of uuraLlon?

W no Dse????

Financial Management I 48

@radlng SLraLegles Dslng uuraLlon

W LongesLduraLlon securlLy provldes Lhe maxlmum prlce varlaLlon

W lf you expecL a decllne ln lnLeresL raLes lncrease Lhe average duraLlon of

your bond porLfollo Lo experlence maxlmum prlce volaLlllLy

W lf you expecL an lncrease ln lnLeresL raLes reduce Lhe average duraLlon Lo

mlnlmlze your prlce decllne

W noLe LhaL Lhe duraLlon of your porLfollo ls Lhe markeLvaluewelghLed

average of Lhe duraLlon of Lhe lndlvldual bonds ln Lhe porLfollo

Financial Management I 49

Modlfled duraLlon

Dur Mac

1

1 1

c

c

5 /

/5

Financial Management I 50

ModiIied duration

MD can be interpreted as the approximate change in price

Ior a 100 bp change in yield

uollar duraLlon

/ ! /5

5 /

/5

) 1 (

duration Macaulay

MD

duration Mac

1

1 1

c

Financial Management I 51

Dollar duration

Modlfled duraLlon (Mu)

ulrecL measure of prlce senslLlvlLy Lo lnLeresL raLe changes

Can be used Lo esLlmaLe petceotoqe ptlce volotlllty of a bond

/

!

/5

L

Financial Management I 52

,.:,,

1

Lxample

W Modlfled duraLlon of Lhe earller bond

W lf ylelds lncrease Lo 1010 how much

does Lhe bond prlce change?

W @he percenLage prlce change of Lhls bond ls

glven by

37907 x 01 037907

Financial Management I 53

707 . 3

10 . 1

16 . 4

W WhaL ls Lhe predlcLed change ln rupee Lerms?

new predlcLed prlce 100 037909 9962091

cLual dollar prlce (uslng v equaLlon)996219

3707 . 0

1 . 0 100 707 . 3

1

.

/ ! /5

5 /

/5

Financial Management I 54

Reasonable

approximation!

redlcLlng prlce change

W SLep 1 llnd Macaulay duraLlon of bond

W SLep 2 llnd modlfled duraLlon of bond

W SLep 3 8ecall LhaL when lnLeresL raLes change Lhe change ln a bond#s prlce can

be relaLed Lo Lhe change ln yleld accordlng Lo Lhe rule

100 100 L L L /

!

/5

Financial Management I 55

an approxlmaLe measure

W uuraLlon and lLs dlfferenL avaLars ls only

approxlmaLe measures

W LeLs go back Lo Lhe flve year bond example

W lf raLes change Lo 11 whaL wlll be Lhe

expecLed change ln bond prlce uslng

duraLlon?

Financial Management I 56

W WlLh an Mu of 37908 we can expecL a prlce

dep Lo 8s 962092

W nd Lhe acLual prlce decllned Lo 8s 963041

W So duraLlon overesLlmaLed Lhe prlce decllne

and Lhls ls due Lo

Financial Management I 57

uuraLlon and ConvexlLy

Financial Management I 58

Yield

!rice

Duration

!ricing Error from

convexity

ConvexlLy

@he convexlLy ls Lhe measure of Lhe curvaLure

and ls Lhe second derlvaLlve of prlce wlLh

respecL Lo yleld (

2

9$y

2

)

2

n

1 t

2

2

2

) 1 (

1

dy

p d

or Convexity

9 9

9

Financial Management I 59

ConvexlLy measure

!

/

! /

2

2

measure Convexity

Financial Management I 60

ConvexlLy d[usLmenL

2

) ( measure convexity

2

1

/ /

!

/!

L L L

Financial Management I 61

Cne lasL Llme Lo Lhe 3 year bond

W ConvexlLy measure of Lhe bond 1937

W @aklng ln Lo conslderaLlon Lhe convexlLy ad[usLmenL Lhe exp change ln

Lhe bond prlce ls

0364 . 0

100

1

100

1

37 . 1

2

1

100

1

70 . 3 L L L L

Financial Management I 62

Or -3.694% works out to a new bond price of Rs 96.3060

away by an epsilon!!!

Das könnte Ihnen auch gefallen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Course On Quantum ComputingDokument235 SeitenCourse On Quantum ComputingAram ShojaeiNoch keine Bewertungen

- The Western and Eastern Concepts of SelfDokument3 SeitenThe Western and Eastern Concepts of SelfTakumi Shawn Hinata100% (3)

- Air System Sizing Summary For NIVEL PB - Zona 1Dokument1 SeiteAir System Sizing Summary For NIVEL PB - Zona 1Roger PandoNoch keine Bewertungen

- Uav Based Plant Disease Detection SystemDokument14 SeitenUav Based Plant Disease Detection SystemTakudzwa MatangiraNoch keine Bewertungen

- Library: Astrology and WisdomDokument13 SeitenLibrary: Astrology and Wisdomalimuhammedkhan2115Noch keine Bewertungen

- 1704 Broschuere Metal-Coating en EinzelseitenDokument8 Seiten1704 Broschuere Metal-Coating en EinzelseiteninterponNoch keine Bewertungen

- Safety Procedures For Vertical Formwork PDFDokument17 SeitenSafety Procedures For Vertical Formwork PDFbalya7Noch keine Bewertungen

- A Study On Customer Satisfaction With After Sales Services at BLUE STAR Air ConditionerDokument99 SeitenA Study On Customer Satisfaction With After Sales Services at BLUE STAR Air ConditionerVinay KashyapNoch keine Bewertungen

- XYZprint User Manual en V1 1003Dokument25 SeitenXYZprint User Manual en V1 1003reza rizaldiNoch keine Bewertungen

- ESM-4810A1 Energy Storage Module User ManualDokument31 SeitenESM-4810A1 Energy Storage Module User ManualOscar SosaNoch keine Bewertungen

- Cho Gsas - Harvard 0084L 11462Dokument503 SeitenCho Gsas - Harvard 0084L 11462Claudemiro costaNoch keine Bewertungen

- Setting Times of ConcreteDokument3 SeitenSetting Times of ConcreteP DhanunjayaNoch keine Bewertungen

- Ae 2 PerformanceDokument4 SeitenAe 2 PerformanceankitNoch keine Bewertungen

- B.Pharm - Semester - III-10.07.2018Dokument16 SeitenB.Pharm - Semester - III-10.07.2018SAYAN BOSENoch keine Bewertungen

- Thermobaric Effects Formed by Aluminum Foils Enveloping Cylindrical ChargesDokument10 SeitenThermobaric Effects Formed by Aluminum Foils Enveloping Cylindrical ChargesAnonymous QFUEsUAnNoch keine Bewertungen

- Hydraulics Course FileDokument81 SeitenHydraulics Course FileSwarna LathaNoch keine Bewertungen

- International Travel Insurance Policy: PreambleDokument20 SeitenInternational Travel Insurance Policy: Preamblethakurankit212Noch keine Bewertungen

- Logarithmic Functions Week 7Dokument20 SeitenLogarithmic Functions Week 7gadraNoch keine Bewertungen

- Etl 213-1208.10 enDokument1 SeiteEtl 213-1208.10 enhossamNoch keine Bewertungen

- Temposonics: Absolute, Non-Contact Position SensorsDokument23 SeitenTemposonics: Absolute, Non-Contact Position Sensorssorangel_123Noch keine Bewertungen

- Practical 3.1 Determining The Specific Heat CapacityDokument3 SeitenPractical 3.1 Determining The Specific Heat CapacityiAlex11Noch keine Bewertungen

- Module 02 Connect Hardware Peripherals EndaleDokument49 SeitenModule 02 Connect Hardware Peripherals EndaleSoli Mondo100% (1)

- QIAGEN Price List 2017Dokument62 SeitenQIAGEN Price List 2017Dayakar Padmavathi Boddupally80% (5)

- Medical CodingDokument5 SeitenMedical CodingBernard Paul GuintoNoch keine Bewertungen

- Bomber JacketDokument3 SeitenBomber JacketLaura Carrascosa FusterNoch keine Bewertungen

- Boundary ScanDokument61 SeitenBoundary ScanGéza HorváthNoch keine Bewertungen

- Chapter 1 - Part 1 Introduction To Organic ChemistryDokument43 SeitenChapter 1 - Part 1 Introduction To Organic ChemistryqilahmazlanNoch keine Bewertungen

- Assignment 1 - Statistics ProbabilityDokument3 SeitenAssignment 1 - Statistics ProbabilityAzel Fume100% (1)

- Foundation Design LectureDokument59 SeitenFoundation Design LectureJamaica MarambaNoch keine Bewertungen

- Pertanyaan TK PDBDokument4 SeitenPertanyaan TK PDBHardenNoch keine Bewertungen