Beruflich Dokumente

Kultur Dokumente

20111101121111PPT Chap04

Hochgeladen von

batraz79Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

20111101121111PPT Chap04

Hochgeladen von

batraz79Copyright:

Verfügbare Formate

Chapter 4

Reporting and Analyzing Merchandising Operations

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

Conceptual Learning Objectives

C1: Describe merchandising activities and identify income components for a merchandising company C2: Identify and explain the inventory asset of a merchandising company C3: Describe both perpetual and periodic inventory systems C4: Analyze and interpret cost flows and operating activities of a merchandising company

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

Analytical Learning Objectives

A1: Compute the acid-test ratio and explain its use to assess liquidity A2: Compute the gross margin ratio and explain its use to assess profitability

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

Procedural Learning Objectives

P1: Analyze and record transactions for merchandise purchases using a perpetual system P2: Analyze and record transactions for merchandise sales using a perpetual system P3: Prepare adjustments and close accounts for a merchandising company P4: Define and prepare multiple-step and single-step income statements P5: Appendix 4A: Record and compare merchandising transactions using both periodic and perpetual inventory systems

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2010

C1

Merchandising Activities

Service organizations sell time to earn revenue.

Examples: Accounting firms, law firms and plumbing services

Revenues

Minus

Expenses

Equals

Net income

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

C1

Merchandising Activities

Merchandising Companies

Manufacturer Wholesaler Retailer Customer

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

C1

Reporting Income of a Merchandiser

Merchandising companies sell products to earn revenue. Examples: sporting goods, clothing, and auto parts stores

Net Sales

Minus

Cost of Equals Goods Sold

Gross Profit

Minus

Expenses

Equals

Net Income

Merchandising Company Income Statement For Year Ended December 31, 2010 Net sales Cost of goods sold Gross profit Operating expenses Net income

McGraw-Hill/Irwin

$ 150,000 80,000 $ 70,000 46,500 $ 23,500

The McGraw-Hill Companies, Inc., 2010

C2

Operating Cycle for a Merchandiser

Begins with the purchase of merchandise and ends with the collection of cash from the sale of merchandise. Cash Sale

Purchases

Credit Sale

Cash collection Purchases

Cash sales

Account receivable

Merchandise inventory

Merchandise inventory

McGraw-Hill/Irwin

Credit sales

The McGraw-Hill Companies, Inc., 2010

C3

Inventory Systems

Beginning inventory Net cost of purchases

+

available for sale

= Merchandise

Ending inventory

McGraw-Hill/Irwin

Cost of goods sold

The McGraw-Hill Companies, Inc., 2010

P1

Merchandise Purchases

On June 20, Jason, Inc. purchased $14,000 of Merchandise Inventory paying cash.

Dr. Jun. 20 Merchandise Inventory Cash Purchase merchandise for cash 14,000 14,000 Cr.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Trade Discounts

Used by manufacturers and wholesalers to offer better prices for greater quantities purchased.

Example

Matrix, Inc. offers a 30% trade discount on orders of 1,000 units or more of their popular product Racer. Each Racer has a list price of $5.25.

McGraw-Hill/Irwin

Quantity sold Price per unit Total Less 30% discount Invoice price

1,000 $ 5.25 5,250 (1,575) $ 3,675

The McGraw-Hill Companies, Inc., 2010

P1

Invoice

Main Source, Inc.

614 Tech Avenue Nashville, TN 37651

S o l d T o

Invoice

Date 5/4/10 Number 358-BI

Name: Barbee, Inc. Attn: Tom Bell Address: One Willow Plaza Cookeville, Tennessee 38501 Ship: FedEx Prepaid Quanity Price 500 $ 54.00 $

P.O. 167 Item AC417

Sales: 25 Terms 2/10,n/30 Description 250 Backup System

Seller Invoice date Purchaser Order number Credit terms Freight terms Goods Amount Invoice amount

27,000

We appreciate your business!

Sub Total Ship Chg. Tax Total $

27,000 27,000

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Purchase Discounts

A deduction from the invoice price granted to induce early payment of the amount due.

Terms Time Due

Discount Period

Credit Period

Due: Invoice price minus discount

Due: Full Invoice Price

Date of Invoice McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Purchase Discounts

2/10,n/30

Discount Percent

McGraw-Hill/Irwin

Number of Days Discount Is Available

Otherwise, Net (or All) Is Due in 30 Days

Credit Period

The McGraw-Hill Companies, Inc., 2010

P1

Purchase Discounts

On May 7, Jason, Inc. purchased $27,000 of merchandise inventory on account, credit terms are 2/10, n/30.

Merchandise Inventory Accounts Payable

Dr. 27,000

Cr. 27,000

Purchase merchandise on a ccount

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Purchase Discounts

On May 15, Jason, Inc. paid the amount due on the purchase of May 7.

May 15 Accounts Payable Cash Merchandise Inventory* Dr. 27,000 Cr. 26,460 540

Pa id a ccounts payabl e in ful l

*$27,000 2% = $540 discount

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2010

P1

Purchase Discounts

After we post these entries, the accounts involved look like this:

Merchandise Inventory

5/7 27,000 5/15 540 Bal. 26,460

Accounts Payable

5/15 27,000 5/7 27,000 Bal. 0

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

When Discount is Not Taken

If we fail to take a 2/10, n/30 discount, is it really expensive?

365 days 20 days 2% = 36.5% annual rate

Number of additional days before payment Percent paid to keep money

Days in a year

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Purchase Returns and Allowances

Purchase Return . . . Merchandise returned by the purchaser to the supplier. Purchase Allowance . . . A reduction in the cost of defective merchandise received by a purchaser from a supplier.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Purchase Returns and Allowances

On May 9, Matrix, Inc. purchased $20,000 of merchandise inventory on account, credit terms are 2/10, n/30.

May 9 Merchandise Inventory Accounts Payable 20,000 20,000

Purchased merchandise on account

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Purchase Returns and Allowances

On May 10, Matrix, Inc. returned $500 of defective merchandise to the supplier.

May 10 Accounts Payable Merchandise Inventory

Dr. 500

Cr. 500

Returned defective merchandise

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Purchase Returns and Allowances

On May 18, Matrix, Inc. paid the amount owed for the purchase of May 9.

Dr. 19,500 Cr. 19,110 390

May 18

Accounts Payable Cash Merchandise Inventory

Pa i d a ccount i n ful l

Purchase Returns Amount Due Discount Cash Paid

McGraw-Hill/Irwin

$ 20,000 (500) 19,500 (390) $ 19,110

The McGraw-Hill Companies, Inc., 2010

P1

Transportation Costs

Seller Buyer

FOB shipping point (buyer pays)

Merchandise

Ownership transfers to buyer when goods are passed to

FOB destination (seller pays)

Terms

Transportation costs paid by

FOB shipping point FOB destination

McGraw-Hill/Irwin

Carrier Buyer

Buyer Seller

The McGraw-Hill Companies, Inc., 2010

P1

Transportation Costs

On May 12, Jason, Inc. purchased $8,000 of merchandise inventory for cash and also paid $100 transportation costs.

May 12 Merchandise Inventory Cash Dr. 8,100 Cr. 8,100

Paid for merchandise and transportation

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P1

Quick Check

On July 6, 2010, Seller Co. sold $7,500 of merchandise to Buyer, Co. on account; terms of 2/10,n/30. The shipping terms were FOB shipping point. The shipping cost was $100. Which of the following will be part of Buyers July 6 journal entry? a. Credit Sales $7,500 b. Credit Purchase Discounts $150 c. Debit Merchandise Inventory $7,600 d. Debit Accounts Payable $7,450

FOB shipping point indicates the buyer ultimately pays the freight. This is recorded with a debit to Merchandise Inventory.

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2010

P1

Cost of Merchandise Purchased

Matrix, Inc. Total Cost of Merchandise Purchases For Year Ended May 31, 2011 Invoice cost of merchandise purchases $ 692,500 Less: Purchase discounts (10,388) Purchase returns and allowances (4,275) Add: Cost of transportation-in 4,895 Total cost of merchandise purchases $ 682,732

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Accounting for Merchandise Sales

Matrix, Inc. Computation of Gross Profit For Year Ended May 31, 2011 Sales Less: Sales discounts Sales returns and allowances Net sales Cost of goods sold Gross profit $ 2,451,000 $ 29,412 18,500

47,912 $ 2,403,088 (1,928,600) $ 474,488

Sales discounts and returns and allowances are Contra Revenue accounts.

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2010

P2

Sales of Merchandise

On March 18, Diamond Store sold $25,000 of merchandise on account. The merchandise was carried in inventory at a cost of $18,000.

Mar. 18 Accounts Receivable Sales Dr. 25,000 Cr. 25,000

Sa l es of mercha ndi se on cr edi t

Cost of Goods Sold 18,000 Merchandise Inventory

To r ecord cost of sal es

18,000

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Sales Discounts

On June 8, Barton Co. sold merchandise costing $3,500 for $6,000 on account. Credit terms were 2/10, n/30. Lets prepare the journal entries.

Jun. 8

Accounts Receivable Sales

Dr. 6,000

Cr. 6,000

Sales of merchandise on credit

Cost of Goods Sold Merchandise Inventory

To record cost of sales

McGraw-Hill/Irwin

3,500 3,500

The McGraw-Hill Companies, Inc., 2010

P2

Sales Discounts

On June 17, Barton Co. received a check for $5,880 in full payment of the June 8 sale.

Cash Sales Discount Accounts Receivable

5,880 120 6,000

Received payment less discount

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Sales Returns and Allowances

On June 12, Barton Co. sold merchandise costing $4,000 for $7,500 on account. The credit terms were 2/10, n/30.

Dr. 7,500 Cr. 7,500

Jun. 12 Accounts Receivable Sales

Sales of merchandise on credit

Cost of Goods Sold Merchandise Inventory

To record cost of sales

4,000 4,000

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Sales Returns and Allowances

On June 14, merchandise with a sales price of $800 and a cost of $470 was returned to Barton. The return is related to the June 12 sale.

Dr. 800 Cr. 800

Jun. 14 Sales Returns and Allowances Accounts Receivable

Customer returned merchandise

Merchandise Inventory Cost of Goods Sold

470 470

Returned goods placed in inventory

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P2

Sales Returns and Allowances

On June 20, Barton received the amount owed to it from the sale of June 12.

Jun. 20

Cash Sales Discount Accounts Receivable

Dr. 6,566 134

Cr.

6,700

Recei ved pa yment l ess di scount

Sale Return Amount due Discount Cash received

McGraw-Hill/Irwin

$ 7,500 (800) $ 6,700 (134) $ 6,566

The McGraw-Hill Companies, Inc., 2010

C4

Barton Company Adjusted Trial Balance December 31, 2011 Cash Accounts receivable Merchandise inventory Supplies Equipment Accum. depr.- Equip. Accounts payable Salaries payable Common Stock Retained Earnings Dividends Sales Sales discounts Sales returns Cost of goods sold Admin. salaries expense Sales salaries expense Insurance expense Rent expense Supplies expense Advertising expense $ 7,700 11,200 14,300 1,300 41,200 $ 7,000 16,400 1,000 42,400

Lets complete the accounting cycle by preparing the closing entries for Barton.

4,000 323,800 4,300 2,000 233,200 18,200 29,600 1,200 8,100 1,000 13,300 390,600

390,600

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P3

Step 1: Close Credit Balances in Temporary Accounts to Income Summary.

Dec. 31 Sales Income summary

To close credit balances in temporary accounts

Barton Company Adjusted Trial Balance December 31, 2011

Dr. 323,800

Cr. 323,800

Salaries payable Owner's Capital Withdrawals Sales Sales discounts Sales returns Cost of goods sold Admin. salaries expense Sales salaries expense Insurance expense Rent expense Supplies expense McGraw-Hill/Irwin Advertising expense

1,000 42,400 4,000 323,800 4,300 2,000 233,200 18,200 29,600 1,200 8,100 1,000 13,300

Income Summary 323,800

The McGraw-Hill Companies, Inc., 2010

P3

Step 2: Close Debit Balances in Temporary Accounts to Income Summary.

Dr. Cr. 4,300 2,000 233,200 18,200 29,600 1,200 8,100 1,000 13,300 Incom e Sum m ary Sale s Dis counts Sale s Re turns Cos t of Goods Sold Adm . Salarie s Expe ns e Sale s Salarie s Expe ns e Ins urance Expe ns e Re nt Expe ns e Supplie s Expe ns e Adve rtis ing Expe ns e 310,900

De c. 31

To cl ose debi t ba l a nces i n tempora ry a ccounts

McGraw-Hill/Irwin

Income Summary 310,900 323,800 12,900 McGraw-Hill Companies, Inc., 2010 The

P3

Step 3: Close Income Summary to Owners Capital

Dr. 12,900 Cr. 12,900

Dec. 31 Income Summary Owner's Capital

To close Income Summary account

Income S ummary 310,900 323,800 12,900 -0McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2010

P3

Step 4: Close Withdrawals to Owners Capital

Dec. 31 Owner's Capital Withdrawals

Dr. 4,000

Cr. 4,000

To cl ose the wi thdra wa l s account

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P4

Income Statement Formats

MultipleMultiple-Step SingleSingle-Step

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P4

Multiple-Step Income Statement

Barton Company Income Statement For Year Ended December 31, 2011 Sales Less: Sales discounts Sales returns Net sales Cost of Goods Sold Gross profit from sales Operating expenses: Selling expenses: Salaries expense $ 29,600 Advertising expense 13,300 General and administrative expenses: Adm. salaries expense $ 18,200 Insurance expense 1,200 Rent expense 8,100 Supplies expense 1,000 Total operating expenses Net income $ 323,800 $ 4,300 2,000 6,300 $ 317,500 233,200 $ 84,300

$ 42,900

28,500 71,400 $ 12,900

The McGraw-Hill Companies, Inc., 2010

McGraw-Hill/Irwin

P4

Single-Step Income Statement

Barton Company Income Statement For Year Ended December 31, 2011 Net sales Cost of goods sold Operating expenses Total expense Net income $ 317,500 $ 233,200 71,400 304,600 $ 12,900

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

P4

Balance Sheet

Merchandising Company Balance Sheet December 31, 2011 Assets Cash Merchandise Inventory Equipment $ 10,200 1,200 16,000 Liabilities Accounts payable $ 1,200 Notes payable 4,000 Total liabilities 5,200 Equity Owner's Capital 22,200 Total liabilities and equity $ 27,400

Total assets

$ 27,400

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

A1

Acid-Test Ratio

AcidAcid-Test = Ratio Quick Assets Current Liabilities

AcidAcid-Test Cash + S-T Investments + Receivables S= Ratio Current Liabilities A common rule of thumb is the acid-test ratio should have a value of at least 1.0 to conclude a company is unlikely to face liquidity problems in the near future.

McGraw-Hill/Irwin The McGraw-Hill Companies, Inc., 2010

A2

Gross Margin Ratio

Gross Margin = Ratio Net Sales - Cost of Goods Sold Net Sales

31.0% 30.0% Year 2005 2004 29.0% 2003 2002 28.0% 2001 27.0% 26.0% 2005 2004 2003 2002 2001 Percent 30.2% 28.8% 27.7% 29.8% 30.7%

Percentage of dollar sales available to cover expenses and provide a profit.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

End of Chapter 4

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 2010

Das könnte Ihnen auch gefallen

- Chap 004Dokument45 SeitenChap 004Yuti XianNoch keine Bewertungen

- Chapter 5 - Accounting For Merchandising OperationsDokument42 SeitenChapter 5 - Accounting For Merchandising OperationsmaziahesaNoch keine Bewertungen

- Reporting and Analyzing Inventories: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinDokument61 SeitenReporting and Analyzing Inventories: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinYvonne Teo Yee VoonNoch keine Bewertungen

- Importance of AccountingDokument52 SeitenImportance of AccountingLalithaNoch keine Bewertungen

- Chap 006 NotesDokument69 SeitenChap 006 Notesflower104Noch keine Bewertungen

- Ch05-Accounting PrincipleDokument9 SeitenCh05-Accounting PrincipleEthanAhamed100% (2)

- Taller Cinco Acco 111Dokument41 SeitenTaller Cinco Acco 111api-274120622Noch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- Ch06 12edDokument52 SeitenCh06 12edAhmed Mahmoud AbouzaidNoch keine Bewertungen

- Incomplete RecordsDokument13 SeitenIncomplete RecordsSylvan Muzumbwe MakondoNoch keine Bewertungen

- Periodic Methods of AccountingDokument40 SeitenPeriodic Methods of AccountingKiasatina Amalia MustafaNoch keine Bewertungen

- Chapter 4,5,6 QuizzesDokument22 SeitenChapter 4,5,6 QuizzesAnonymous aPQWrwo3iiNoch keine Bewertungen

- A Presentation On: Accounting For Merchandising OperationDokument26 SeitenA Presentation On: Accounting For Merchandising OperationKayesCjNoch keine Bewertungen

- Lecture 6 Accounting For Inventory (I)Dokument33 SeitenLecture 6 Accounting For Inventory (I)chestervale1Noch keine Bewertungen

- WRD 27e SG Solutions CH 06Dokument22 SeitenWRD 27e SG Solutions CH 06Ellii YouTube channelNoch keine Bewertungen

- Reporting and Interpreting Sales Revenue, Receivables, and CashDokument53 SeitenReporting and Interpreting Sales Revenue, Receivables, and CashEbenezer Amoah-KyeiNoch keine Bewertungen

- Chapter 5 Inventory AccountingDokument57 SeitenChapter 5 Inventory Accountinghosie.oqbe100% (1)

- Chapter 3Dokument31 SeitenChapter 3EricKHLeawNoch keine Bewertungen

- ACCT Midterm 2Dokument26 SeitenACCT Midterm 2Gene'sNoch keine Bewertungen

- 11 Edition: Mcgraw-Hill/IrwinDokument52 Seiten11 Edition: Mcgraw-Hill/IrwinfaisalNoch keine Bewertungen

- Accounting For Merchandising OperationsDokument31 SeitenAccounting For Merchandising OperationsBülent Kılıç100% (1)

- Bis Second Term Sheet 1Dokument11 SeitenBis Second Term Sheet 1magdy kamelNoch keine Bewertungen

- Acc. QuestionsDokument5 SeitenAcc. QuestionsFaryal MughalNoch keine Bewertungen

- FUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT PPP 1Dokument185 SeitenFUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT PPP 1Janelle Dela Cruz100% (1)

- 02 Accounting For A Merchandising BusinessDokument54 Seiten02 Accounting For A Merchandising BusinessApril SasamNoch keine Bewertungen

- Nature of Merchandising BusinessDokument12 SeitenNature of Merchandising BusinessJessica ManahanNoch keine Bewertungen

- Cost of Goods SoldDokument23 SeitenCost of Goods SoldCrizylen Mae Pepito LahoylahoyNoch keine Bewertungen

- Merchadising MOCK QUIZDokument5 SeitenMerchadising MOCK QUIZCarl Dhaniel Garcia SalenNoch keine Bewertungen

- Accounting For Merchandising ActivitiesDokument45 SeitenAccounting For Merchandising ActivitiessaadashfaqNoch keine Bewertungen

- Module 9 Accounting For A Merchandiser Dec 2021 (20231122130953)Dokument34 SeitenModule 9 Accounting For A Merchandiser Dec 2021 (20231122130953)Antonette LaurioNoch keine Bewertungen

- Chapter 9 Profit Planning PDFDokument86 SeitenChapter 9 Profit Planning PDFAisyahlathifawahyudiNoch keine Bewertungen

- Accounting For Merchandising BusinessesDokument73 SeitenAccounting For Merchandising BusinessesYustamar Ramatsuy100% (1)

- Chapter 13Dokument59 SeitenChapter 13Asad AbbasNoch keine Bewertungen

- Accounting Cycle of A Merchandising BusinessDokument25 SeitenAccounting Cycle of A Merchandising BusinessMichelle Vinoray Pascual100% (2)

- Accounting For MerchandisingDokument45 SeitenAccounting For MerchandisingJane OfendaNoch keine Bewertungen

- Entrep Week4 Q2Dokument28 SeitenEntrep Week4 Q2Aisa CrisologoNoch keine Bewertungen

- Reporting and Analyzing Receivables: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinDokument52 SeitenReporting and Analyzing Receivables: © The Mcgraw-Hill Companies, Inc., 2010 Mcgraw-Hill/IrwinYvonne Teo Yee VoonNoch keine Bewertungen

- Chapter 5Dokument14 SeitenChapter 5RB100% (3)

- InventoriesDokument47 SeitenInventoriesMarjorie NepomucenoNoch keine Bewertungen

- CombinepdfDokument226 SeitenCombinepdfjed rolluque decena100% (1)

- Chapter-5: Accounting For Merchandising OperationsDokument39 SeitenChapter-5: Accounting For Merchandising OperationsNoel Buenafe JrNoch keine Bewertungen

- Chapter 4 5 6Dokument4 SeitenChapter 4 5 6nguyen2190Noch keine Bewertungen

- Accounting For Merchandising Business ACG 2021 Module 5Dokument45 SeitenAccounting For Merchandising Business ACG 2021 Module 5Janine Joy Orpilla50% (2)

- Accounting 211 Chapter 5Dokument46 SeitenAccounting 211 Chapter 5Darwin QuintosNoch keine Bewertungen

- Lecture Notes Chapters 1-4Dokument28 SeitenLecture Notes Chapters 1-4BlueFireOblivionNoch keine Bewertungen

- Accounting ChapterDokument13 SeitenAccounting ChapterMamaru SewalemNoch keine Bewertungen

- Cash Discounts & Trade Discounts I. DrillDokument3 SeitenCash Discounts & Trade Discounts I. DrillArny MaynigoNoch keine Bewertungen

- Accounting Online Test With AnswersDokument10 SeitenAccounting Online Test With AnswersAuroraNoch keine Bewertungen

- ACTG 101-101a Topic 4 Processing Transactions of A Merchandising BusinessDokument67 SeitenACTG 101-101a Topic 4 Processing Transactions of A Merchandising BusinessEdmar Lerin100% (1)

- Intro To Financial Analysis AssignmentDokument4 SeitenIntro To Financial Analysis AssignmentAshar AlamNoch keine Bewertungen

- Accounting Textbook Solutions - 19Dokument19 SeitenAccounting Textbook Solutions - 19acc-expertNoch keine Bewertungen

- Chapter 7Dokument26 SeitenChapter 7EricKHLeawNoch keine Bewertungen

- 10 Bbfa1103 T6Dokument31 Seiten10 Bbfa1103 T6djaljdNoch keine Bewertungen

- 2010-06-23 203304 Financialaccounting 2Dokument6 Seiten2010-06-23 203304 Financialaccounting 2pi!Noch keine Bewertungen

- Acctg 11-1 Gbs For Week 11Dokument5 SeitenAcctg 11-1 Gbs For Week 11Ynna Gesite0% (1)

- Module 05-06-07 ProblemsDokument14 SeitenModule 05-06-07 ProblemsmaxzNoch keine Bewertungen

- Acct Lesson 9Dokument9 SeitenAcct Lesson 9Gracielle EspirituNoch keine Bewertungen

- Amazon Business: A Comprehensive Guide for B2B ProcurementVon EverandAmazon Business: A Comprehensive Guide for B2B ProcurementNoch keine Bewertungen

- Soalan Test Mid Term BiologyDokument4 SeitenSoalan Test Mid Term Biologybatraz79Noch keine Bewertungen

- What Current Is Flowing If 0.67 C of Charge Pass A Point in 0.30s?Dokument4 SeitenWhat Current Is Flowing If 0.67 C of Charge Pass A Point in 0.30s?batraz79Noch keine Bewertungen

- Business Comm Ppb3043 Ri Sem2 Year 2013 - 2014Dokument15 SeitenBusiness Comm Ppb3043 Ri Sem2 Year 2013 - 2014batraz79Noch keine Bewertungen

- Work Schedule Preliminaries: Sub StructureDokument4 SeitenWork Schedule Preliminaries: Sub Structurebatraz79Noch keine Bewertungen

- Upgrade Electrolytic Capacitors To Rubycon BrandDokument6 SeitenUpgrade Electrolytic Capacitors To Rubycon Brandbatraz79Noch keine Bewertungen

- 20150227080233Chp 1 Electric Charge and Electric FieldDokument37 Seiten20150227080233Chp 1 Electric Charge and Electric Fieldbatraz79Noch keine Bewertungen

- Common Ions ListingDokument2 SeitenCommon Ions Listingbatraz79Noch keine Bewertungen

- 20150316140353TUTORIAL 4 (Topik 5&6)Dokument4 Seiten20150316140353TUTORIAL 4 (Topik 5&6)batraz79Noch keine Bewertungen

- 20150316140314tutorial 2 (Topik 3)Dokument1 Seite20150316140314tutorial 2 (Topik 3)batraz79Noch keine Bewertungen

- Chapter 5Dokument25 SeitenChapter 5batraz79Noch keine Bewertungen

- The Production Cycle: Accounting Information Systems, 9/e, Romney/SteinbartDokument48 SeitenThe Production Cycle: Accounting Information Systems, 9/e, Romney/Steinbartbatraz79Noch keine Bewertungen

- 20150227080251Chp 4 MagnetismDokument30 Seiten20150227080251Chp 4 Magnetismbatraz79Noch keine Bewertungen

- Review of LiteratureDokument12 SeitenReview of Literaturebatraz79Noch keine Bewertungen

- The Basics of Educational ResearchDokument13 SeitenThe Basics of Educational Researchbatraz79Noch keine Bewertungen

- Tutorial 6 (Chapter 9 and 10)Dokument3 SeitenTutorial 6 (Chapter 9 and 10)batraz79Noch keine Bewertungen

- Module 4: The Human Resource Management Cycle: Accounting Information Systems: Essential Concepts and ApplicationsDokument20 SeitenModule 4: The Human Resource Management Cycle: Accounting Information Systems: Essential Concepts and Applicationsbatraz79Noch keine Bewertungen

- 20150218130206kuliah6 IntrumentDokument44 Seiten20150218130206kuliah6 Intrumentbatraz79Noch keine Bewertungen

- 20141008131049chapter 7cDokument52 Seiten20141008131049chapter 7cbatraz79Noch keine Bewertungen

- 20150218130208kuliah7 ValidrelibleDokument43 Seiten20150218130208kuliah7 Validreliblebatraz79Noch keine Bewertungen

- Business Communication Foundations: Student Slides CH 1 - 1Dokument14 SeitenBusiness Communication Foundations: Student Slides CH 1 - 1batraz79Noch keine Bewertungen

- Hapter 15: Pearson Education, IncDokument36 SeitenHapter 15: Pearson Education, Incbatraz79Noch keine Bewertungen

- Topic 7 Prokaryotes and VirusesDokument50 SeitenTopic 7 Prokaryotes and Virusesbatraz79Noch keine Bewertungen

- 20150227080211Chp 5 InductionDokument17 Seiten20150227080211Chp 5 Inductionbatraz79Noch keine Bewertungen

- Sickle Cell enDokument9 SeitenSickle Cell enbatraz79Noch keine Bewertungen

- Premiums and WarrantiesDokument17 SeitenPremiums and WarrantiesKaye Choraine NadumaNoch keine Bewertungen

- Assignment 1558529720 SmsDokument43 SeitenAssignment 1558529720 SmsSmit JariwalaNoch keine Bewertungen

- BUS13401n14099 10 09Dokument2 SeitenBUS13401n14099 10 09jc199707Noch keine Bewertungen

- The Capital Expenditure Decisions Have The Following FeaturesDokument3 SeitenThe Capital Expenditure Decisions Have The Following FeaturesYosephine KurniatyNoch keine Bewertungen

- FIN 254 (SEC: 19) Assignment: Project: Ratio AnalysisDokument42 SeitenFIN 254 (SEC: 19) Assignment: Project: Ratio AnalysisMuntasir Sizan100% (1)

- Computerised Accounting With MYOB 2Dokument126 SeitenComputerised Accounting With MYOB 2AzwirNoch keine Bewertungen

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Dokument17 SeitenMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoNoch keine Bewertungen

- REXEL SA - Research Report - FinalDokument6 SeitenREXEL SA - Research Report - FinalGlen BorgNoch keine Bewertungen

- Central Plaza: Project Report For Development ofDokument18 SeitenCentral Plaza: Project Report For Development ofHemant BalodiNoch keine Bewertungen

- Sample Tax ComputationEXDokument2 SeitenSample Tax ComputationEXAngelica RubiosNoch keine Bewertungen

- Can You Capitalize It As PPE or Not - IfRSboxDokument63 SeitenCan You Capitalize It As PPE or Not - IfRSboxMarkie GrabilloNoch keine Bewertungen

- Accounting MS1 2022Dokument18 SeitenAccounting MS1 2022Faaz SheriffdeenNoch keine Bewertungen

- Accounting Process. Part 3Dokument18 SeitenAccounting Process. Part 3Karl Alvin Reyes HipolitoNoch keine Bewertungen

- Preparing Financial StatementsDokument6 SeitenPreparing Financial StatementsAUDITOR97Noch keine Bewertungen

- HARD ROCK COMPANY Statement of Financial PositionDokument3 SeitenHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoNoch keine Bewertungen

- Chapter 13 - Relevant Costs For Decision Making PDFDokument34 SeitenChapter 13 - Relevant Costs For Decision Making PDFnafin ayub ArilNoch keine Bewertungen

- Software Associates-Variance Analysis and Flexible BudgetingDokument4 SeitenSoftware Associates-Variance Analysis and Flexible Budgetingk_Dashy846550% (2)

- Finacial Decision CaseDokument7 SeitenFinacial Decision Caseayeshaali20Noch keine Bewertungen

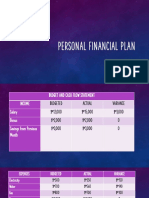

- Personal Financial PlanDokument6 SeitenPersonal Financial PlanThomgie TilaNoch keine Bewertungen

- GT BankDokument1 SeiteGT BankFuaad DodooNoch keine Bewertungen

- Cfas - Reviewer PDFDokument21 SeitenCfas - Reviewer PDFMira Monica D. VillacastinNoch keine Bewertungen

- Value Added Tax (IPCC) 2013-14: Complete Information Relating VATDokument24 SeitenValue Added Tax (IPCC) 2013-14: Complete Information Relating VATTekumani Naveen KumarNoch keine Bewertungen

- Butler Excel Sheets (Group 2)Dokument11 SeitenButler Excel Sheets (Group 2)Nathan ClarkinNoch keine Bewertungen

- Trend AnalysisDokument1 SeiteTrend Analysisangel caoNoch keine Bewertungen

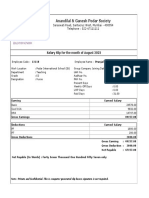

- Anandilal & Ganesh Podar Society: Salary Slip For The Month of August 2022Dokument1 SeiteAnandilal & Ganesh Podar Society: Salary Slip For The Month of August 2022Pradnyesh GuramNoch keine Bewertungen

- Prelim - PART 2Dokument6 SeitenPrelim - PART 2Dan RyanNoch keine Bewertungen

- BusinessFinance12 Q2 Mod6 Managing-Personal-Finance V5Dokument20 SeitenBusinessFinance12 Q2 Mod6 Managing-Personal-Finance V5Emsccy AbeciaNoch keine Bewertungen

- Marketing Plan Banana ChipsDokument34 SeitenMarketing Plan Banana Chipseahpot82% (61)

- Quiz DepletionDokument5 SeitenQuiz Depletionhoneyjoy salapantanNoch keine Bewertungen

- Bata Shoe Company Swot Analysis PDF FreeDokument33 SeitenBata Shoe Company Swot Analysis PDF FreeMB ManyauNoch keine Bewertungen