Beruflich Dokumente

Kultur Dokumente

Is-LM Revisited D

Hochgeladen von

sidrakhan098111Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Is-LM Revisited D

Hochgeladen von

sidrakhan098111Copyright:

Verfügbare Formate

IS-LM Revisited

Simple Income Determination

Properties of IS & LM Curves

Equilibrium Output & Interest Rates

Economic Policy

(1) Simple Income Determination

* Eco 1002

* Goods Market (IS)

* Exogenous Interest Rate & Prices

* Endogenous Income (GDP)

(2) IS-LM Model

* Eco 2101 (Keynesian Short-Run)

* (1) + Money Market

* Endogenous Income & Interest Rate (Fixed P)

Endogenous Policy

Simple Income Determination

(Eco 1001)

Behavioral Assumptions:

Consumption = C (y, r)

y = disposable income = Y T

r = interest rate

MPC = where 0 < C

y

< 1

Investment = I(r)

Government Purchases = G

Exogenous: r, P, Fiscal Policy: G, T

Endogenous: Y

Linear Examples

y

C y C = c c /

0 / < = c c

r

I r I

Equilibrium:

Some Basic Results:

(interest rates and GDP)

(Gov. Spending Multiplier)

(Tax Multiplier)

E G r I r y C Y + + = ) ( ) , (

1

1

1

/ >

=

y

C

dG dY

0

1

/ <

+

=

y

r r

C

I C

dr dY

0

1

/ <

=

y

y

C

C

dT dY

IS-LM Model (Eco 2101)

Goods & Money Market Equilibrium

IS-LM Model

Exogenous: P, Fiscal Policy: G, T

Monetary Policy: M

s

Endogenous: Y and r

IS and the Goods Market

Goods Market Equilibrium:

Y = C(y,r) + I(r) + G (IS equation)

where y = Y T = disposable income

0< C

y

< 1

I

r

< 0

G and T are exogenous policy

variables

Properties of IS curve:

Slope*:

Government spending multiplier:

(shifts right)

Tax Multiplier:

(shifts left)

0

1

<

+

=

y

r r

IS

C

I C

dr

dY

1

1

1

>

=

y

C dG

dY

0

1

<

=

y

y

C

C

dT

dY

LM and the Money Market

Real Money Demand = L(Y,r)

Money Market Equilibrium:

M

s

= P*L(Y,r) (LM equation)

M

s

is an exogenous policy variable.

0 / > = c c

Y

L Y L

0 / < = c c

r

L r L

Properties of LM curve

Slope*:

Real Money Supply:

(shifts right)

0 > =

Y

r

LM

L

L

dr

dY

0

1

) (

< =

r

s

PL M d

dr

The Simple IS-LM Model - (Y,r) which

solves:

(IS)

(LM)

G r I r y C Y + + = ) ( ) , (

) , ( * r Y L P M

s

=

Policy in IS-LM Model

Exogenous: P

Endogenous: Y, r

Policy Variables: G, Ms, T

Fiscal Policy

(1) Government Expenditures (dG)

but less than 1/(1-C

y

)!

0

) / )( ( ) 1 (

1

) ( ) 1 (

*

>

+ +

=

+ +

=

r Y r r y r r Y r y

r

L L I C C I C L L C

L

dG

dY

Crowding-out effect!

Effectiveness of G:

If (IS Flat)

or (LM verticle)

then . (Complete crowding-out!)

(2) Taxes (dT): dY/dT = ?, dr/dT = ?

0

) ( ) 1 (

*

>

+ +

=

r r Y r y

Y

I C L L C

L

dG

dr

r r

C I ,

0

r

L

0

dG

dY

Monetary Policy (dM

s

):

0

) ( ) 1 (

*

>

+ +

+

=

r r Y r y

r r

s

I C PL PL C

C I

dM

dY

0

) ( ) 1 (

1

*

<

+ +

=

r r Y r y

y

s

I C PL PL C

C

dM

dr

Effectiveness of monetary policy:

If (IS vertical)

or (LM flat)

Then

(Ineffective Monetary Policy)

0 ,

r r

C I

r

L

0

s

dM

dY

Liquidity Trap and Interest Rate

Insensitivity

Great Depression

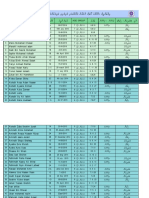

Year UR i t r = i - t

1930 8.9 3.6 -2.6 6.2

1931 16.3 2.6 -10.1 12.7

1932 24.1 2.7 -9.3 12.0

1933 25.2 1.7 -2.2 3.4

1934 22.0 1.0 7.4 -6.6

1935 20.3 0.8 0.9 -0.1

1936 17.0 0.8 0.2 0.6

2008-09 Recession

Jan 2007 Jan 2010, Federal funds rate

cut from 6% to 1%.

i UR

Jan 2007 5.25% 4.6%

Jan 2008 3.94% 5%

Jan 2009 0.15% 7.7%

Jan 2010 0.12% 10%

Business Cycles in IS-LM

Shocks to Consumer confidence ():

C = C(Y,r,) where C

> 0

dY*/d > 0

dr*/d > 0

Shocks to money demand (o):

L = L(y,r,o) where L

o

> 0

dY*/do < 0

dr*/do > 0

Endogenous Policy

Monetary/Fiscal Policy responds to economic

conditions to achieve goal.

Objective: dY = 0 (output stability) OR

dr = 0 (interest rate stability)

Exogenous: Policies - M

s

or G, or T

Shocks or o

Endogenous: Policies - M

s

or G, or T

Example: An increase in G and Feds objective

is to keep r constant (prevent crowding out).

Step 1: Set dr = 0

Step 2: Treat dY and dM

s

as endogenous, dG

as exogenous.

Step 3: Use Cramers Rule to solve for

dY/dG and dM

s

/dG.

Suppose instead Fed wanted to keep output

stable (dY = 0). Find dr/dG and dM

s

/dG.

Evaluation of Simple Keynesian IS-

LM Models

Provided reasonable explanation of

business cycles.

Guides policymakers on stabilizing

economic fluctuations.

Can be applied easily to think about

current events.

Shortcomings

Criticisms of IS-LM Model:

(1) Emphasis on aggregate demand.

(2) Static Model.

(3) Lack of solid microeconomic

foundations.

Lucas Critique on Policy Evaluation

Examples: Consumption, Phillips Curve

Modern Macro

Dynamics

Expectations (rational)

Microeconomic Foundations

Most modern macro models (New Classical

and New Keynesian) have these features.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Financial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDokument3 SeitenFinancial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDominic MuliNoch keine Bewertungen

- Sharmeen Obaid ChinoyDokument5 SeitenSharmeen Obaid ChinoyFarhan AliNoch keine Bewertungen

- "Working Capital Management": Master of CommerceDokument4 Seiten"Working Capital Management": Master of Commercekunal bankheleNoch keine Bewertungen

- Times Leader 03-16-2013Dokument61 SeitenTimes Leader 03-16-2013The Times LeaderNoch keine Bewertungen

- Depreciated Replacement CostDokument7 SeitenDepreciated Replacement CostOdetteDormanNoch keine Bewertungen

- Script PDFDokument1 SeiteScript PDFWahid KhanNoch keine Bewertungen

- CH 09Dokument31 SeitenCH 09Ammar YasserNoch keine Bewertungen

- Report WritingDokument3 SeitenReport WritingSeema SinghNoch keine Bewertungen

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDokument1 SeitePrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsRISHABH YADAVNoch keine Bewertungen

- Civil Law 2 Module 1 Case #008 - Andamo vs. IAC, 191 SCRA 195Dokument6 SeitenCivil Law 2 Module 1 Case #008 - Andamo vs. IAC, 191 SCRA 195Ronald MedinaNoch keine Bewertungen

- Shipping - Documents - Lpg01Dokument30 SeitenShipping - Documents - Lpg01Romandon RomandonNoch keine Bewertungen

- The Engraves of Macau by A. Borget and L. Benett in Stella Blandy's Les Épreuves de Norbert en Chine' (1883)Dokument8 SeitenThe Engraves of Macau by A. Borget and L. Benett in Stella Blandy's Les Épreuves de Norbert en Chine' (1883)Ivo CarneiroNoch keine Bewertungen

- Relative Clauses: A. I Didn't Know You Only Had OnecousinDokument3 SeitenRelative Clauses: A. I Didn't Know You Only Had OnecousinShanti AyudianaNoch keine Bewertungen

- Power of Attorney UpdatedDokument1 SeitePower of Attorney UpdatedHitalo MariottoNoch keine Bewertungen

- TDS Rate Chart For Financial Year 2022 23 Assessment Year 2023 24Dokument9 SeitenTDS Rate Chart For Financial Year 2022 23 Assessment Year 2023 24Sumukh TemkarNoch keine Bewertungen

- Nuclear Power Plants PDFDokument64 SeitenNuclear Power Plants PDFmvlxlxNoch keine Bewertungen

- GOUP GO of 8 May 2013 For EM SchoolsDokument8 SeitenGOUP GO of 8 May 2013 For EM SchoolsDevendra DamleNoch keine Bewertungen

- Adobe Scan 03-May-2021Dokument22 SeitenAdobe Scan 03-May-2021Mohit RanaNoch keine Bewertungen

- AJWS Response To July 17 NoticeDokument3 SeitenAJWS Response To July 17 NoticeInterActionNoch keine Bewertungen

- The Key To The Magic of The Psalms by Pater Amadeus 2.0Dokument16 SeitenThe Key To The Magic of The Psalms by Pater Amadeus 2.0evitaveigasNoch keine Bewertungen

- Turtle Walk WaiverDokument1 SeiteTurtle Walk Waiverrebecca mott0% (1)

- SiswaDokument5 SeitenSiswaNurkholis MajidNoch keine Bewertungen

- Reading Comprehension TextDokument2 SeitenReading Comprehension TextMelanie Valeria Gualotuña GancinoNoch keine Bewertungen

- 05 Vision IAS CSP21 Test 5Q HIS AM ACDokument17 Seiten05 Vision IAS CSP21 Test 5Q HIS AM ACAvanishNoch keine Bewertungen

- Open Quruan 2023 ListDokument6 SeitenOpen Quruan 2023 ListMohamed LaamirNoch keine Bewertungen

- Archbishop Averky Taushev - Stand Fast in The TruthDokument14 SeitenArchbishop Averky Taushev - Stand Fast in The Truthdorin_jambaNoch keine Bewertungen

- Student Guidelines The School PoliciesDokument5 SeitenStudent Guidelines The School PoliciesMaritessNoch keine Bewertungen

- Metaphors of GlobalizationDokument3 SeitenMetaphors of GlobalizationShara Christile ColanggoNoch keine Bewertungen

- TRB - HSK NC IiiDokument7 SeitenTRB - HSK NC IiiBlessy AlinaNoch keine Bewertungen