Beruflich Dokumente

Kultur Dokumente

Wm. Wrigley Jr. Co.: Capital Structure, Valuation & Cost of Capital

Hochgeladen von

sotki4Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Wm. Wrigley Jr. Co.: Capital Structure, Valuation & Cost of Capital

Hochgeladen von

sotki4Copyright:

Verfügbare Formate

THE WM. WRIGLEY JR.

COMPANY:

CAPITAL STRUCTURE, VALUATION, AND COST OF CAPITAL

3/14/12

Cliquez pour modifier le style des Jordan Benchetrit Sotir Dimovski Fabrice Galan sous-titres du masque

Introduct ion

Interests are at their lowest rate for the past 50 years. Even though the crisis, corporate deleveraging has gone too far and CEOs are missing opportunities to create value. The Wm. Wrigley Jr. company is totally unleveraged. It used to be the worlds largest manufacturer and seller of 3/14/12 chewing gums and has several well

Overview : Effects of the recapitalization

Borrow $ 3 billion to pay dividend or to repurchase shares

Effects :

On Prices : outstanding shares and book value of equity On Earning Per Share and Price Earning Ratio On debt interest coverage ratio and financial flexibility On the voting control of the Wrigley family On the Cost of Capital

3/14/12

Effect of a Leveraged Recapitalization

Leverage has positive effect on the firm value. It is the benefit of debt tax shields. This savings derives from the deductibility of interest expense from the firms taxable income. According to Modigliani & Miller (M&M), the impact of those tax savings is seen in the second term of this equation:

3/14/12

Comparison dividends / shares repurchase

Dividends Effect on no Market Value Equity Effect on No outstanding Shares Cash change yes for the firm Cash for Yes Shareholders Effect on Share Negative Share repurchase no

Yes

yes No Positive

3/14/12

Effect on prices (1)

After After Recapitalizatio Recapitalizatio n - Dividend n - Repurchase Market Value 11.3 Billion 11.3 Billion Equity # of Outstanding 232.441 Million 183.677 Million Shares Add. Cash Received 3 Billion 0

3/14/12

Effect on prices (2)

MV Equity + PV Debt Tax Shield 13.1 Billion + (3 Billion x 40%) = $14.3 Billion 14.3 B/232.441 M = $61.52 per Share MV Equity + PV Debt Tax Shield 13.1 Billion + (3 Billion x 40%) = $14.3 Billion

Shares repurchased: 3 B/$61.52 = $ 48.764 M Price unchanged MV equity : (232 441 48 764)* 61.52 = $11,3B

Effect on the stock price: 14,3/232 441m 3B/232 441M = 61,52 12,91 = 48,61$ 3/14/12 per share

Impact on EPS & PER

Capitalization EPS Status

Before $1,36 Recapitalization

Why

(EBIT*0,6)/ 232 441M shares

+/- 10% change in EBIT

+/- 10% change in EPS +/- 38% change in EPS

After $0,35 (EBIT*0,6 - 0,13*3B)/ 232 Recapitalization 441M shares Dividends After $0,45 (EBIT*0,6 0,13*3B )/ 183 Recapitalization 684 M shares Repurchase Capitalization PER

+/- 38% change in EPS

Status

Why?

Before Recapitalization After Recapitalization Repurchase

$45,19 $137,1

MV equity/ Net earnings 13,1B/EBIT*0,6 Price/EPS 48,61/0,35

3/14/12

Impact on Debt Interest Coverage and Financial Flexibility

Before Interest Coverage Financial Flexibility n/a

After

1,35* (in line with BB/B rating) Good Poor (more than 26% drop of EBIT) company may not be able to meet its debt payments

3/14/12

Impact on Voting Control & Book Value

Before Change in Capital Wrigley Family Shares Voting outstandin rights g 39 858 247 318 287 176 189 800 42 641 232 441 641 232 441 After Dividend Wrigley Fmily Voting rights 39 858 247 318 287 176 141 036 After Share repurchase* Wrigley Family Voting rights Total Voting rights 189 800 426 410 616 210 Total Voting rights 189 800 426 410 616 210 Shares Total outstandi Wrigley Voting ng Shares rights 189 800 42 641 232 441 141 036 426 410 567 446

Shares outstanding

Wrigley Shares

Wrigley Shares 189 800 42

Class A

189 800

189 800

39 858

Class B

42 641

42 641

42 641

247 318

Total

232 441

232 441

183 677

287 176

Wrigley Voting Power

47%

47%

51%

Book Value of Equity Before Dividends

Share repurchase 3/14/12

Impact on Cost of Capital

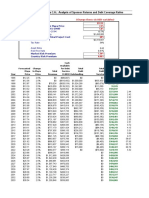

Before Recapitalization 100% * 0 n/a 0,75 7,15% 7,54% 10,9% 7,15% After Recapitalization 79%* 21%* 7,8% 0,87 7,98 % 8,38% 11,74% 8,26% 3/14/12

Weight of Equity Weight of Debt After-tax Cost of Debt Beta Cost of Equitya Cost of Equityb Cost of Equityc WACCa

Impact on Cost of Capital (calculation)

BetaL = ,75 (1+ ((1-40%)*(3 B/11,3 B)) = ,87 CAPM with Rf = 20Y US = 5,65% CAPM with Rf =20Y US = 5,65% REUL = 5,65% + .75 (7%) = 10,9% REL = 5,65% + .87(7%) = 11,74% REUL = 1,9% + .75 (7%) = REL = 1,9% + ,87(7%) =

CAPM with Rf = Average Short term US =1,9% 7,15% CAPM with Rf = Average Short term US =1,9% 7,98% CAPM with Rf = 20Y US 7,54%

- Maturity Spread = 2,29%

REUL = 2,29% + ,75 (7%) = = 2,29% + ,87(7%) = 8,38%

CAPM with Rf =20Y US Maturity Spread = 2,29% REL Excess Market Return = 7%

WACCBefore = 0 (1-40%) 13% + 100% (10.9%) = 10.9%* 3/14/12 WACCAfter = 0,21% (1-40%) 13% +0,79* (11.74%) = 10.9%*

Extraordinary Repurchase Dividend Stocks Financial Situation & WACC Same Same

Conclusi on

Conclusion

Same effect/ Possible Financial distress in case of adverse economic situation; WACC may worsen depending on risk-free rate hypothesis Higher EPS for share repurchase, possible positive effect if future earnings growth Same effect With Share repurchase Wrigley's family has the majority voting power Current Shareholders value is the same

EPS PER Wrigley's Voting Power Value to shareholders

0,35 137 47% $61.52

0,45 137 51% $61.52

If the company takes the debt, it may use if for re-purchasing shares which may be preferred by Wrigleys family. The company may be reluctant to take so much debt because its financial situation can severely deteriorate if earnings fall (but if the assumption of 3/14/12 continuous growth holds the restructuring will have a highly positive effect on the shareholders value).

Thank you for your attention

3/14/12

Das könnte Ihnen auch gefallen

- SFM Wrigley JR Case Solution HBRDokument17 SeitenSFM Wrigley JR Case Solution HBRHayat Omer Malik100% (1)

- Case 5Dokument15 SeitenCase 5Qiao LengNoch keine Bewertungen

- Wm. Wrigley Jr. Co. recapitalization analysisDokument8 SeitenWm. Wrigley Jr. Co. recapitalization analysisHussain AhmedNoch keine Bewertungen

- Wrigley Case AnswerDokument4 SeitenWrigley Case AnswerYehan MatuilanaNoch keine Bewertungen

- William WrigleyDokument8 SeitenWilliam WrigleyRajaram Iyengar100% (2)

- The History and Business of Wm. Wrigley Jr. CompanyDokument7 SeitenThe History and Business of Wm. Wrigley Jr. CompanySyed Ahmedullah Hashmi100% (1)

- The Wm. Wrigley Jr. Company:: Capital Structure, Valuation, and Cost of CapitalDokument10 SeitenThe Wm. Wrigley Jr. Company:: Capital Structure, Valuation, and Cost of CapitalSalil Kuwelkar100% (1)

- Case 30 The WM Wrigley J Company QuestionsDokument1 SeiteCase 30 The WM Wrigley J Company Questionsodie99Noch keine Bewertungen

- WrigleyDokument28 SeitenWrigleyKaran Rana100% (1)

- Wrigley CaseDokument15 SeitenWrigley CaseDwayne100% (4)

- Case 30: Efficient Financing DiscussionsDokument5 SeitenCase 30: Efficient Financing Discussionswaldek87Noch keine Bewertungen

- Wrigley Case GRP 5Dokument13 SeitenWrigley Case GRP 5Kobi Garbrah0% (1)

- Wrigley CaseDokument12 SeitenWrigley Caseresat gürNoch keine Bewertungen

- Paper Wrigley gr.4Dokument9 SeitenPaper Wrigley gr.4shaherikhkhanNoch keine Bewertungen

- Mars - Wrigley Case Study - SolutionDokument8 SeitenMars - Wrigley Case Study - SolutionSidhartha ModiNoch keine Bewertungen

- The WM Wringley JR CompanyDokument3 SeitenThe WM Wringley JR Companyavnish kumarNoch keine Bewertungen

- The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalDokument19 SeitenThe Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalMai Pham100% (1)

- LinearDokument6 SeitenLinearjackedup211Noch keine Bewertungen

- Wrigley CalculationDokument13 SeitenWrigley CalculationAnindito W WicaksonoNoch keine Bewertungen

- JetBlue Airways IPO ValuationDokument9 SeitenJetBlue Airways IPO ValuationMuyeedulIslamNoch keine Bewertungen

- Stone Container CorporationDokument5 SeitenStone Container Corporationalice123h21Noch keine Bewertungen

- Continental Carriers Debt vs EquityDokument10 SeitenContinental Carriers Debt vs Equitynipun9143Noch keine Bewertungen

- TN 34 The WM Wrigley JR Company Capital Structure Valuation and Cost of CapitalDokument108 SeitenTN 34 The WM Wrigley JR Company Capital Structure Valuation and Cost of CapitalStanisla Lee0% (2)

- Capital StructureDokument9 SeitenCapital Structurealokkuma050% (2)

- Revenue and expenses analysis of JetBlue Airways from 2002-2010Dokument2 SeitenRevenue and expenses analysis of JetBlue Airways from 2002-2010prtkshnkr50% (2)

- Jetblue Airways Ipo ValuationDokument6 SeitenJetblue Airways Ipo ValuationXing Liang HuangNoch keine Bewertungen

- Case Background: Kaustav Dey B18088Dokument9 SeitenCase Background: Kaustav Dey B18088Kaustav DeyNoch keine Bewertungen

- Analysis of Petrolera Zuata Petrozuata Debt CoverageDokument2 SeitenAnalysis of Petrolera Zuata Petrozuata Debt CoveragedewanibipinNoch keine Bewertungen

- Case 34 - The Wm. Wrigley Jr. CompanyDokument72 SeitenCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- Hbs Case - Ust Inc.Dokument4 SeitenHbs Case - Ust Inc.Lau See YangNoch keine Bewertungen

- The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalDokument4 SeitenThe Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalAditya Mukherjee100% (1)

- Arcadian Business CaseDokument20 SeitenArcadian Business CaseHeniNoch keine Bewertungen

- (Holy Balance Sheet) Jones Electrical DistributionDokument29 Seiten(Holy Balance Sheet) Jones Electrical DistributionVera Lúcia Batista SantosNoch keine Bewertungen

- Americanhomeproductscorporation Copy 120509004239 Phpapp02Dokument6 SeitenAmericanhomeproductscorporation Copy 120509004239 Phpapp02Tanmay Mehta100% (1)

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Dokument3 SeitenSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNoch keine Bewertungen

- Updated Stone Container PaperDokument6 SeitenUpdated Stone Container Paperonetime699100% (1)

- Finance Simulation: Estimated Equity Value of Bel Vino CorporationDokument4 SeitenFinance Simulation: Estimated Equity Value of Bel Vino Corporationvardhan73% (11)

- Landmark Facility Solutions - QuestionsDokument1 SeiteLandmark Facility Solutions - QuestionsFaig0% (1)

- Nike Inc. Case StudyDokument3 SeitenNike Inc. Case Studyshikhagupta3288Noch keine Bewertungen

- Boeing's New 7E7 AircraftDokument10 SeitenBoeing's New 7E7 AircraftTommy Suryo100% (1)

- Case Study - Linear Tech - Christopher Taylor - SampleDokument9 SeitenCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193Noch keine Bewertungen

- Mariott Wacc Cost of Capital DivisionalDokument6 SeitenMariott Wacc Cost of Capital DivisionalSuprabhat TiwariNoch keine Bewertungen

- Bank Merger Synergy Valuation and Accretion Dilution AnalysisDokument2 SeitenBank Merger Synergy Valuation and Accretion Dilution Analysisalok_samal_250% (2)

- China Fire Case AssignmentDokument3 SeitenChina Fire Case AssignmentTony LuNoch keine Bewertungen

- Kohler Co. (A)Dokument18 SeitenKohler Co. (A)Juan Manuel GonzalezNoch keine Bewertungen

- American Home Products CorporationDokument7 SeitenAmerican Home Products Corporationpancaspe100% (2)

- Lex Service PLC - Cost of Capital1Dokument4 SeitenLex Service PLC - Cost of Capital1Ravi VatsaNoch keine Bewertungen

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDokument5 SeitenCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashNoch keine Bewertungen

- AirThread Valuation MethodsDokument21 SeitenAirThread Valuation MethodsSon NguyenNoch keine Bewertungen

- UST IncDokument16 SeitenUST IncNur 'AtiqahNoch keine Bewertungen

- Group4 SectionA SampavideoDokument5 SeitenGroup4 SectionA Sampavideokarthikmaddula007_66Noch keine Bewertungen

- General Mills' acquisition of Pillsbury from DiageoDokument4 SeitenGeneral Mills' acquisition of Pillsbury from DiageoDigraj Mahanta100% (1)

- Tugas 3 CH 7 Dan 8 Up Date1Dokument5 SeitenTugas 3 CH 7 Dan 8 Up Date1Bayu SilvatikaNoch keine Bewertungen

- Corporate Restructuring: Max L. Heine Professor of Finance NYU Stern School of BusinessDokument34 SeitenCorporate Restructuring: Max L. Heine Professor of Finance NYU Stern School of BusinessAndrew Drummond-MurrayNoch keine Bewertungen

- Chapter 10 SolutionDokument13 SeitenChapter 10 SolutionPhước NgọcNoch keine Bewertungen

- Wrigley Gum 21Dokument18 SeitenWrigley Gum 21Fidelity RoadNoch keine Bewertungen

- American Vanguard Corporation (Security AnaylisisDokument18 SeitenAmerican Vanguard Corporation (Security AnaylisisMehmet SahinNoch keine Bewertungen

- Risk, Cost of Capital, and Capital BudgetingDokument23 SeitenRisk, Cost of Capital, and Capital BudgetingBussines LearnNoch keine Bewertungen

- Chapter3 ExercisesDokument6 SeitenChapter3 ExercisesNguyễn PhươngNoch keine Bewertungen

- Rider University PMBA 8020 Module 1 Solutions: ($ Millions)Dokument5 SeitenRider University PMBA 8020 Module 1 Solutions: ($ Millions)krunalparikhNoch keine Bewertungen

- DocumentDokument66 SeitenDocumentAkram AkhtarNoch keine Bewertungen

- 08 Chapter 2Dokument38 Seiten08 Chapter 2Bryan GonzalesNoch keine Bewertungen

- B2B E-Commerce: Supply Chain Management and Collaborative CommerceDokument54 SeitenB2B E-Commerce: Supply Chain Management and Collaborative CommerceAvinash PrajapatiNoch keine Bewertungen

- MISGP 2019 Handbook IC5757 659850 7Dokument24 SeitenMISGP 2019 Handbook IC5757 659850 7Anonymous 0HRTZSXSXNoch keine Bewertungen

- Capital Budgeting Techniques for Evaluating Investment ProjectsDokument15 SeitenCapital Budgeting Techniques for Evaluating Investment ProjectsSpencer Tañada100% (1)

- Marketing Sales Operations in Chicago IL Resume Curt PetersonDokument3 SeitenMarketing Sales Operations in Chicago IL Resume Curt PetersoncurtpetersonNoch keine Bewertungen

- Industrial Training Report on Knitting CompanyDokument18 SeitenIndustrial Training Report on Knitting CompanyVijay VijayNoch keine Bewertungen

- Carvel AnswerDokument7 SeitenCarvel AnswerlapbsNoch keine Bewertungen

- Tutor Marked Assignment Course Code: BCOC-131 Course Title: Assignment Code: BCOC-131/TMA/2020-2021 Coverage: All Blocks Maximum Marks: 100Dokument32 SeitenTutor Marked Assignment Course Code: BCOC-131 Course Title: Assignment Code: BCOC-131/TMA/2020-2021 Coverage: All Blocks Maximum Marks: 100Rajni KumariNoch keine Bewertungen

- Basics of Derivatives StrategiesDokument66 SeitenBasics of Derivatives Strategiesnikomaso tesNoch keine Bewertungen

- Igcse Economics QuestionsDokument99 SeitenIgcse Economics QuestionscarlotaNoch keine Bewertungen

- CH 11 SolDokument6 SeitenCH 11 SolEdson EdwardNoch keine Bewertungen

- Case 2 - KimuraDokument6 SeitenCase 2 - KimuraSara AbrantesNoch keine Bewertungen

- Market Mechanics PDFDokument14 SeitenMarket Mechanics PDFVeeken ChaglassianNoch keine Bewertungen

- Sebi Grade A 2020: Economics-Consumption & Investment FunctionDokument11 SeitenSebi Grade A 2020: Economics-Consumption & Investment FunctionThabarak ShaikhNoch keine Bewertungen

- LTA TCOC Underground Linkway 311018 PDFDokument96 SeitenLTA TCOC Underground Linkway 311018 PDFThaungMyintNoch keine Bewertungen

- Gitman Chapter 14 Divident PolicyDokument59 SeitenGitman Chapter 14 Divident PolicyArif SharifNoch keine Bewertungen

- Business Combination-Acquisition of Net AssetsDokument2 SeitenBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNoch keine Bewertungen

- ACCA FR D19 Notes PDFDokument152 SeitenACCA FR D19 Notes PDFMohammed DanishNoch keine Bewertungen

- AGRICULTUREDokument17 SeitenAGRICULTURESamantha JoseNoch keine Bewertungen

- Terranova Calendar Dec 2013Dokument5 SeitenTerranova Calendar Dec 2013B_U_C_KNoch keine Bewertungen

- The Cost of Living: The Consumer Price Index andDokument21 SeitenThe Cost of Living: The Consumer Price Index andWan Nursyafiqah Wan RusliNoch keine Bewertungen

- Centre Wise General Index - Labour Bureau ChandigarhDokument10 SeitenCentre Wise General Index - Labour Bureau ChandigarhEr navneet jassiNoch keine Bewertungen

- 1684057746781gmail - Your Trip Confirmation and ReceiptDokument4 Seiten1684057746781gmail - Your Trip Confirmation and ReceiptelcameroNoch keine Bewertungen

- Welcome To The Presentation ON Option StrategiesDokument13 SeitenWelcome To The Presentation ON Option StrategiesVarun BansalNoch keine Bewertungen

- Chapter 6 Price DeterminationDokument9 SeitenChapter 6 Price DeterminationNeelabh KumarNoch keine Bewertungen

- Assessment No. 3 MAS-03 Absorption and Variable Costing Part 1. Multiple Choice Theory: Choose The Letter of The Best AnswerDokument10 SeitenAssessment No. 3 MAS-03 Absorption and Variable Costing Part 1. Multiple Choice Theory: Choose The Letter of The Best AnswerPaupauNoch keine Bewertungen

- Agency Callable Primer 07mar07Dokument18 SeitenAgency Callable Primer 07mar07Neil SchofieldNoch keine Bewertungen

- Toyota Vitz - Manufacturer Set Option - Toyota Motor WEB SiteDokument5 SeitenToyota Vitz - Manufacturer Set Option - Toyota Motor WEB SiteThushianthan KandiahNoch keine Bewertungen

- Inventory Management in Reliance FreshDokument14 SeitenInventory Management in Reliance FreshSabhaya Chirag0% (1)