Beruflich Dokumente

Kultur Dokumente

Exchange Rate Deter Mini Ti On

Hochgeladen von

Krunal ShahOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Exchange Rate Deter Mini Ti On

Hochgeladen von

Krunal ShahCopyright:

Verfügbare Formate

Exchange Rate Determination

Exchange Rates

An exchange rate measures the value of one

currency in units of another currency.

When a currency declines in value, it is said to

depreciate. When it increases in value, it is said to

appreciate.

The percentage change (% A) in the value of a foreign

currency is computed as

S

t

S

t-1

S

t-1

where S

t

denotes the spot rate at time t.

A positive % A represents appreciation of the foreign

currency, while a negative % A represents depreciation.

Value of

Quantity of

D: Demand for

$1.55

$1.50

$1.60

S: Supply of

equilibrium exchange

rate

Exchange Rate Equilibrium

An exchange rate represents the price of a

currency, which is determined by the

demand for that currency relative to the

supply for that currency.

Factors that Influence Exchange Rates

Relative Inflation Rates

Relative Interest Rates

Relative Income Levels

Government Controls

Expectations

Interaction of Factors

How Factors Have Influenced Exchange Rates

Relative Inflation Rates

$/

Quantity of

S

0

D

0

r

0

U.S. inflation |

| U.S. demand for British

goods, and hence .

D

1

r

1

S

1

+ British desire for U.S.

goods, and hence the

supply of .

Relative Interest Rates

$/

Quantity of

r

0

S

0

D

0

S

1

D

1

r

1

U.S. interest rates |

+ U.S. demand for British

bank deposits, and hence

.

| British desire for U.S.

bank deposits, and hence

the supply of .

Relative Income Levels

$/

Quantity of

r

0

S

0

D

0

S

1

D

1

r

1

U.S. income levels |

| U.S. demand for British

goods, and hence .

| British supply of pounds

for sale is not expected to

change

Real Interest Rates,

which adjust the nominal interest rates for

inflation.

A relatively high interest rate may actually reflect

expectations of relatively high inflation, which

discourages foreign investment.

Fisher effect.

real nominal

interest ~ interest inflation rate

rate rate

Government Controls

Imposing foreign exchange barriers,

Imposing foreign trade barriers,

Intervening in the foreign exchange market,

and

Affecting macro variables such as inflation,

interest rates, and income levels.

Expectations

Foreign exchange markets react to any news

that may have a future effect.

Institutional investors often take currency

positions based on anticipated interest rate

movements in various countries.

Because of speculative transactions, foreign

exchange rates can be very volatile.

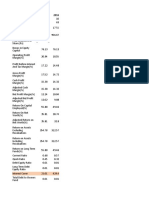

Fed chairman suggests Fed is Strengthened

unlikely to cut U.S. interest rates

A possible decline in German Strengthened

interest rates

Central banks expected to Weakened

intervene to boost the euro

Signal Impact on $

Poor U.S. economic indicators Weakened

Interaction of Factors

Trade-related factors and financial factors sometimes

interact. Exchange rate movements may be

simultaneously affected by these factors.

For example, an increase in the level of income

sometimes causes expectations of higher interest rates.

Over a particular period, different factors may place

opposing pressures on the value of a foreign currency.

The sensitivity of the exchange rate to these factors is

dependent on the volume of international transactions

between the two countries.

Trade-Related

Factors

1. Inflation

Differential

2. Income

Differential

3. Govt Trade

Restrictions

Financial

Factors

1. Interest Rate

Differential

2. Capital Flow

Restrictions

U.S. demand for foreign goods, i.e.

demand for foreign currency

Foreign demand for U.S. goods, i.e.

supply of foreign currency

U.S. demand for foreign securities, i.e.

demand for foreign currency

Foreign demand for U.S. securities, i.e.

supply of foreign currency

Exchange rate

between foreign

currency and the

dollar

Impact of Exchange Rates on an MNCs Value

( ) ( ) | |

( )

=

n

t

t

m

j

t j t j

k

1 =

1

, ,

1

ER E CF E

= Value

E (CF

j,t

) = expected cash flows in currency j to be received by the

U.S. parent at the end of period t

E (ER

j,t

) = expected exchange rate at which currency j can be

converted to dollars at the end of period t

k = weighted average cost of capital of the parent

Inflation Rates, Interest Rates,

Income Levels, Government Controls,

Expectations

Forecasting Exchange Rates

Efficient Markets Approach

Fundamental Approach

Technical Approach

Exchange at

$0.52/NZ$

4. Holds $20,912,320

2. Holds NZ$40

million

Exchange at

$0.50/NZ$

Speculating on Anticipated Exchange Rates

Chicago Bank expects the exchange rate of the New Zealand

dollar to appreciate from its present level of $0.50 to $0.52 in

30 days.

1. Borrows $20

million

Borrows at 7.20% for 30 days

Lends at 6.48% for 30

days

3. Receives

NZ$40,216,000

Returns $20,120,000

Profit of $792,320

Speculating on Anticipated Exchange Rates

Chicago Bank expects the exchange rate of the New Zealand

dollar to depreciate from its present level of $0.50 to $0.48 in

30 days.

Exchange at

$0.48/NZ$

4. Holds

NZ$41,900,000

2. Holds $20

million

Exchange at

$0.50/NZ$

1. Borrows NZ$40

million

Borrows at 6.96% for 30 days

Lends at 6.72% for 30

days

3. Receives $20,112,000

Returns NZ$40,232,000

Profit of NZ$1,668,000

or $800,640

Efficient Markets Approach

Financial Markets are efficient if prices reflect

all available and relevant information.

If this is so, exchange rates will only change

when new information arrives, thus:

S

t

= E[S

t+1

]

and

F

t

= E[S

t+1

| I

t

]

Predicting exchange rates using the efficient

markets approach is affordable and is hard to

beat.

Fundamental Approach

Involves econometrics to develop models that

use a variety of explanatory variables. This

involves three steps:

step 1: Estimate the structural model.

step 2: Estimate future parameter values.

step 3: Use the model to develop forecasts.

The downside is that fundamental models do

not work any better than the forward rate

model or the random walk model.

Technical Approach

Technical analysis looks for patterns in the

past behavior of exchange rates.

Based upon the premise that history repeats

itself.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- SidbiDokument10 SeitenSidbiKrunal ShahNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Wkllaeksfm, Snfjkewnfmasfmas FMSFSMFF, S, LFDokument1 SeiteWkllaeksfm, Snfjkewnfmasfmas FMSFSMFF, S, LFKrunal ShahNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Description: Published On: 2011-06-03 Research Type: Industry Passports Industry Type: FinanceDokument1 SeiteDescription: Published On: 2011-06-03 Research Type: Industry Passports Industry Type: FinanceKrunal ShahNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- DLKDSKJK Vkjksjdfkldsjlj'fs Fs DF'SLD F SDF'K Dfsi Fsfs Iskldsfklsdfkl Lgndklnjkds Fghnjidsh Fksdhfui'p JDokument1 SeiteDLKDSKJK Vkjksjdfkldsjlj'fs Fs DF'SLD F SDF'K Dfsi Fsfs Iskldsfklsdfkl Lgndklnjkds Fghnjidsh Fksdhfui'p JKrunal ShahNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Total Utility (TU)Dokument5 SeitenTotal Utility (TU)Prerna GillNoch keine Bewertungen

- QuadrantDokument2 SeitenQuadrantVibhor SinghNoch keine Bewertungen

- SBI Clerk Mains Exam PDF February 2024 1Dokument223 SeitenSBI Clerk Mains Exam PDF February 2024 1Unique SolutionNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Project WorkDokument16 SeitenProject WorkMaheshNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Final Exammm 3Dokument10 SeitenFinal Exammm 3Marianne Adalid MadrigalNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Banking ReportDokument36 SeitenBanking Reportabhishek pathakNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Mining Valuation Financial ModelingDokument3 SeitenMining Valuation Financial Modelingkanabaramit100% (1)

- Hedgeye Financials FSP Slides For Nov 10 2020Dokument38 SeitenHedgeye Financials FSP Slides For Nov 10 2020Grady SandersNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- EBCL - Adv Chirag Chotrani, YES Academy, PuneDokument611 SeitenEBCL - Adv Chirag Chotrani, YES Academy, PuneTathagat AdalatwaleNoch keine Bewertungen

- AssignmentDokument4 SeitenAssignmentAalizae Anwar YazdaniNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Remuneration Bill Form FormatDokument2 SeitenRemuneration Bill Form FormatmanishdgNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Lobj18 0007008 Question Bank of AccountingDokument223 SeitenLobj18 0007008 Question Bank of AccountingMỹ NhiNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- PRs SMEsDokument77 SeitenPRs SMEsMuhammad Arslan UsmanNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Take Home QuizDokument8 SeitenTake Home QuizJean CabigaoNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- NestleDokument4 SeitenNestleNikita GulguleNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- ACFI1003 - Lecture 7 Corporations and The Share MarketDokument43 SeitenACFI1003 - Lecture 7 Corporations and The Share Market王亚琪Noch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Working Paper Egrement Ika SalinanDokument1 SeiteWorking Paper Egrement Ika Salinanfc BundaNoch keine Bewertungen

- Fiscal Policy Vs Monetary PolicyDokument2 SeitenFiscal Policy Vs Monetary PolicyAkash Ray100% (1)

- Convertibles, Exchangeables, - and WarrantsDokument26 SeitenConvertibles, Exchangeables, - and WarrantsPankaj ShahNoch keine Bewertungen

- 21U 2093 H Quiz 3Dokument6 Seiten21U 2093 H Quiz 3Akshit GoyalNoch keine Bewertungen

- Financial Literacy PowerpointDokument17 SeitenFinancial Literacy Powerpointapi-40190669833% (3)

- Lecture 9 Monetary Policy Decision Making 2022Dokument40 SeitenLecture 9 Monetary Policy Decision Making 2022Onyee FongNoch keine Bewertungen

- Acquisition Finance 2021Dokument19 SeitenAcquisition Finance 2021RAKSHIT CHAUHANNoch keine Bewertungen

- RBF Term Sheet From Village CapitalDokument1 SeiteRBF Term Sheet From Village CapitalMiguel LosadaNoch keine Bewertungen

- Aviva (Pension) H-Av My Future Focus Growth S2Dokument4 SeitenAviva (Pension) H-Av My Future Focus Growth S2Jason FitchNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Bank Statement GeneratorDokument1 SeiteBank Statement GeneratorLeslie AtehNoch keine Bewertungen

- Chapter 2 Case 2 Sole Proprietors-1Dokument1 SeiteChapter 2 Case 2 Sole Proprietors-1almacen chrisNoch keine Bewertungen

- FIM Exercise AnsDokument6 SeitenFIM Exercise AnsSam MNoch keine Bewertungen

- OpTransactionHistoryUX522 02 2024Dokument7 SeitenOpTransactionHistoryUX522 02 2024piyush882676Noch keine Bewertungen

- Iflas and Chapter 11 Classical Islamic Law and Modern BankruptcyDokument27 SeitenIflas and Chapter 11 Classical Islamic Law and Modern BankruptcyManfadawi FadawiNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)