Beruflich Dokumente

Kultur Dokumente

3CWEALTHPLANNINGANDMANAGEMENTLectureNo 5

Hochgeladen von

Marjan NaseriOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

3CWEALTHPLANNINGANDMANAGEMENTLectureNo 5

Hochgeladen von

Marjan NaseriCopyright:

Verfügbare Formate

WEALTH PLANNING AND

MANAGEMENT

LECTURE No. 5

WEALTH ALLOCATION PROCESS

(Part III)

CONTENTS

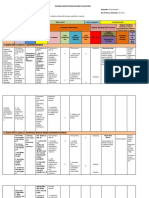

Identifying Risks and Constraints

Introduction to risk tools

Portfolio performance evaluation

Ways of measuring returns

Ways of adjusting returns for risks

Ways of reporting and presenting performance

Potential Investment Channel

Structured products

Summary

References

2

Identifying risks and constraints

Introduction to risk tools:

One of the key principles in building a portfolio of

investments (stocks, bonds, mutual funds, ETFs,

cash, etc) is managing the amount of risk you're

willing to take. Risk is a difficult thing to measure,

but, a number of tools are available to measure

risks.

The first modern risk measurement tool was

introduced decades ago, having developed

through the work of Markotwiz and Sharpe.

3

Identifying risks and constraints

(Contd)

Introduction to risk tools (Contd)

The Treynor measure considers the excess return

earned per unit of systematic risk

The Sharpe measure indicates the excess return per

unit of standard deviation

Jensen and Information ratio measures evaluate

performance in terms of the systematic risk involved.

Value at Risk (VAR) focuses on holdings currently in

the portfolio and has a way of decomposing risk

characteristics of complex securities such as

convertibles and derivatives

4

Portfolio Performance Evaluation

Portfolio managers are required to meet 3

major requirements in discharging their

duties:

1. Meet objectives spelled out in the clients

investment policy statement

2 Earn superior returns for each given risk

class

3 Achieve portfolio diversification to

eliminate unsystematic (diversifiable) risks

5

Portfolio Performance Evaluation

(Contd)

Historically, the focus in the asset management

industry has been on returns. Performance

evaluation should not focus on returns alone. It

should give due recognition to both returns and

the riskiness of the investments.

Superior performance can be achieved by either

superior security selection or superior timing.

From the perspective of asset allocation, this can

be thought of in terms of superior asset

allocation strategies, such as tactical asset

allocation.

6

Portfolio Performance Evaluation

(Contd)

Performance in terms of returns can be

thought of in two ways. First, it can be

thought of in absolute terms i.e., how much

money was made or lost. Second, it can be

measured in relative terms i.e., compared

against a bogey or benchmark, or against the

average returns for similar investment

products, or against a peer group or universe

comparison.

7

Portfolio Performance Evaluation

(Contd)

Ways of Measuring Returns

1. Dollar-Weighted Returns

This simple format takes the difference between the beginning and end

values of the portfolio and divides it by the beginning value. The answer

in decimal form is then converted into percentage form by multiplying it

by 100:

Dollar Weighted Return (%)= (End Value Beginning Value ) x100

Beginning Value

All dividends or other forms of distribution received in the interim period

are included in the end value of the portfolio.

8

Portfolio Performance Evaluation

(Contd)

2. Chain-Linked Returns

This step is necessary to establish the compound return for

an investment held over several investment periods during

which returns for each period were calculated using the

Dollar Weighted Returns method described above.

Chain-Linked Returns = [ (1+ PR

1

) x (1 + PR

2

) + (1 + PR

3

)

x x (1+PR

n

)] 1

Where PR is the decimal form return for the respective

periods 1, 2, 3,..n

The periods need not be of equal lengths of time. For

example, PR1 may be the return for a 1-month period and

PR2 in respect of period 2 may be for a period of 6 months.

9

10

Year Return Return

(Decimal)

Return

(%)

Cumulative return Formula Cumulative

Return

1 R1 0.1 10% R1 10.0%

2 R2 0.091 9.1% (1+R1) (1+R2) 1 20.0%

3 R2 0.034 3.4% (1+R1) (1+R2) (1+R3) 1 24.1%

4 R4 0.12 12.0% (1+R1) (1+R2) (1+R3) (1+R4) - 1 39.0%

5 R5 0.23 23.0% (1+R1) (1+R2) (1+R3) (1+R4) (1+R5) - 1 70.9%

3. Cumulative Returns

The cumulative return is simply specified by chain-linking the total

returns up to the previous period to the next periods return as

illustrated below (Table 3.12 and table 3.13):

Table 3.12

Portfolio Performance Evaluation

(Contd)

Portfolio Performance Evaluation

(Contd)

Applying the chain-linked returns concept allows

us to spell out the cumulative returns for an

investment. This information can be relayed to

the investor in 2 ways (Figure 3.13):

Actual growth in absolute Ringgit terms - use the

returns to show how one Ringgit in value of the

original investment would have grown over the period

reviewed

Displaying the cumulative percentage return over

time. By this means, we can display the end value

return expressed as a percentage of the initial

investment.

11

12

Table 3.13 Cumulative Returns Over a 5-Year Period

Portfolio Performance Evaluation

(Contd)

Year Return Return

(Decimal)

Return

(%)

Cumulative return Formula Cumulative

Return

$

Growth

1 R1 0.1 10% R1 10.0% .100

2 R2 0.091 9.1% (1+R1) (1+R2) 1 20.0% .200

3 R2 0.034 3.4% (1+R1) (1+R2) (1+R3) 1 24.1% .241

4 R4 0.12 12.0% (1+R1) (1+R2) (1+R3) (1+R4) - 1 39.0% .390

5 R5 0.23 23.0% (1+R1) (1+R2) (1+R3) (1+R4)

(1+R5) - 1

70.9% .709

13

MYR 1.00

MYR 1.10

MYR 1.20

MYR 1.30

MYR 1.40

MYR 1.50

MYR 1.60

MYR 1.70

MYR 1.80

0 1 2 3 4 5

D

o

l

l

a

r

G

r

o

w

t

h

Year

Cumulative Growth of MYR 1

Figure 3.13 Dollar Growth Presentation in Absolute Ringgit Terms

14

Cumulative Return Chart

0%

10%

20%

30%

40%

50%

60%

70%

80%

0 1 2 3 4 5

R

e

t

u

r

n

Year

Portfolio Performance Evaluation

(Contd)

4.Annualised Time-Weighted Returns

The returns for a period shorter than one year may be

expressed in annualized return form. Also, the absolute

return over a number of years may be averaged over the

period to arrive at annualised returns. Simply averaging

the cumulative returns over the number of years will yield

misleading results. Instead, the best results are yielded by

geometric average returns derived by taking the n

th

root of

the return relative in decimal form arrived at by dividing

the end of period portfolio value less interim cash inflows

by beginning value of the portfolio, then subtracting 1.00

from it, where n is the number of years the original

portfolio has been invested.

15

Portfolio Performance Evaluation

(Contd)

16

1 Return) Dollar Cumulative (1

n

+

Annualised Return =

Using the preceding numerical example of cumulative

dollar returns for 5 years expressed in decimal form and

computed on the original investment,

17

1 ) 709 . 0 (1

5

+

Annualised

Return

=

=

11.32%

Portfolio Performance Evaluation

(Contd)

Portfolio Performance Evaluation

(Contd)

5. Simple Cash-flow Adjusted Returns

Where there are interim cash-flows, cash- flow

adjusted Dollar weighted returns (CFADWR)

can be calculated

CFADWR = [End Market Value Beginning

Market Value Net Interim Cash Inflows]

[Beginning Market Value + Net Interim Cash

Inflows]

18

Portfolio Performance Evaluation

(Contd)

This method takes no cognisance of the timing

of the cash flows within the period invested.

As a result, it is more accurate only if the

interim cash flows occur in the early part of

the investment period. More accurate

formulae incorporating the timing of interim

cash flows are discussed below.

19

Portfolio Performance Evaluation

(Contd)

6. Time-Weighted Return Approach

The first form of the time-adjusted cash flow method

we look at is the Daily Valuation Approach to

determining the Time-Weighted Return. In this

approach, the portfolio is valued at the end of the

business day before each interim cash flow occurs and

accrued income is included in the value of the

portfolio. The return for the period between initial

investment and the day before the first interim cash

flow is derived. This process is repeated for the period

between the first interim cash flow and the day before

the second interim cash flow.

20

Portfolio Performance Evaluation

(Contd)

Time-Weighted Return

= [(1+R

1

) (1 + R

2

) ... (1 + R

n

)]

1/n

-1

However, where the interim cash flow is very large and

cannot be immediately invested in the underlying

securities, or if investment of a large sum without driving

up the prices of relatively illiquid securities is not possible,

or if the interim cash flows or payouts are fixed by

contractual agreements between the investment manager

and the investor (such that the investment manager is

forced to sell securities at the appointed but inopportune

point in time), valuing the portfolio on business days prior

to the interim cash flows under this approach may be

unfair.

21

Portfolio Performance Evaluation

(Contd)

The use of the Daily Valuation Method results in the exact

Time Weighted Returns but is extremely involved, requiring

calculating the value of the portfolio every time a cash flow

occurs, whether due to fresh funds received to be invested

or due to withdrawals. In the example tabulated below in

Table 3.14, beginning with a portfolio carried forward from

2004 valued at RM7,560.08, the portfolio receives RM100

approximately once a month from the investor, who

evidently uses the dollar cost averaging strategy. On 23

rd

March 2005, he makes a withdrawal of RM5, 000. At the

end of the period on 1

st

August 2005, the portfolio is valued

at RM5, 452.93 before the cash inflow of RM100

22

Portfolio Performance Evaluation

(Contd)

The beginning market value (MVB) is always

based on the number of shares immediately prior

to the inflow/outflow of cash in the current

period. The MVE is the number of shares owned

at the end of the previous period (which is the

same as the number at the end of the period

before purchases/sales resulting from cash flows)

multiplied by the price on the date of the

valuation (i.e., the date the fresh cash flows

occur). The cumulative return, derived from the

return relative in the extreme right column, is in

this example, 33.3%.

23

24

Date

Cash

flow

(RM) Reason

Price

of

Shares

(RM)

Number

of Shares

Owned

Value of

Portfolio

(RM)

MVB

(Beginning

Market

Value) (RM)

MVE (End

Market

Value) (RM)

MVE/M

VB

Cumulative

Return

Relative

1-Jan b/f 0.090 84,001 7,560.08 -

3-Jan 100.00 investment 0.090 85,112 7,660.08 7,560.08 7,560.08 1.0000

1-Feb 100.00 investment 0.095 86,165 8,185.64 7,660.08 8,085.64 1.0556 1.0556

1-Mar 100.00 investment 0.100 87,165 8,716.46 8,185.64 8,616.46 1.0526 1.1111

23-Mar

5,000.0

0 withdrawal 0.110 41,710 4,588.11 8,716.46 9,588.11 1.1000 1.2222

3-Apr 100.00 investment 0.105 42,662 4,479.56 4,588.11 4,379.56 0.9545 1.1667

1-May 100.00 investment 0.100 43,662 4,366.25 4,479.56 4,266.25 0.9524 1.1111

1-Jun 100.00 investment 0.110 44,572 4,902.87 4,366.25 4,802.87 1.1000 1.2222

1-Jul 100.00 investment 0.115 45,441 5,225.73 4,902.87 5,125.73 1.0455 1.2778

1-Aug 100.00 investment 0.120 46,274 5,552.93 5,225.73 5,452.93 1.0435 1.3333

Portfolio Performance Evaluation

(Contd)

An approximation that allows bypassing involved computations above is the Modified Dietz

approximation formula described below:

Modified Dietz = End Market Value Beginning Market Value Net Inflows

Beginning Market Value + ETime Weighted Cash flows

where each Time Weighted Cash flow = No. of Days Invested X Cash flow

Total No. of Days in the Period

In the example above, the returns estimated using the Modified Dietz formula are calculated

as follows:

End Market Value = 5,552.93

Beginning Market Value = 7,560.08

Total Inflows = 800.00

Total Outflows = 5,000.00

25

26

Time Weighted Cash Flows are calculated as follows

Cash flow Dated No of Days Invested Amount (RM) Time Weighted Cash flow

3-Jan 210 100.00 99.06

1-Feb 181 100.00 85.38

1-Mar 153 100.00 72.17

23-Mar 79 5,000.00 -1,863.21

3-Apr 120 100.00 56.60

1-May 92 100.00 43.40

1-Jun 61 100.00 28.77

1-Jul 31 100.00 14.62

1-Aug - 100.00 -

Total 212 -1,463.21

Table 3.15 Total No of Days During the Period: 212 days

27

Numerator

5,552.93 7,560.08 + 4,200 =

2,192.85

Denominator

7,560.08 - 1,463.21 =

6,096.87

Modified Dietz

Return = 2,192.85 / 6,096.87

= 35.97%

Table 3.16 Modified Dietz Return

Modified Dietz Return = 2,192.85 6,096.87 = 35.97%

The result of Modified Dietz Return in Table 3.16 is reasonably close

to the value of 33.33% obtained using the Daily Valuation Method.

If absolute accuracy is not required, this method allows a handy rule

of thumb computation to be made and the return estimated.

Ways of Adjusting Returns for Risks

We use the following Risk Tools

Sharpe ratio

Treynor measure

Jensens alpha

Modiglianis Square and Treynor Square

Information Ratio or Non-Systematic Risk ratio

Downside Deviation of Risk of Loss Measure

The Sortino Ratio

Value at Risk

28

Sharpe Ratio

The Sharpe ratio formula is:

SR = [E (r

p

) r

f

]/

p

Where

E (r

p

) = Expected portfolio return

r

f

= risk free rate

p

= portfolio standard

deviation

29

Sharpe Ratio (Contd)

What Does Sharpe Ratio Mean?

A ratio developed by Nobel laureate William F.

Sharpe to measure risk-adjusted

performance. The Sharpe ratio is calculated by

subtracting the risk-free rate - such as that of

the 10-year U.S. Treasury bond - from the rate of

return for a portfolio and dividing the result by

the standard deviation of the portfolio returns.

30

Sharpe Ratio (Contd)

The Sharpe ratio tells us whether a portfolio's returns are

due to smart investment decisions or a result of excess risk.

This measurement is very useful because although one

portfolio or fund can reap higher returns than its peers, it is

only a good investment if those higher returns do not come

with too much additional risk. The greater a portfolio's

Sharpe ratio, the better its risk-adjusted performance has

been. A negative Sharpe ratio indicates that a risk-less asset

would perform better than the security being analyzed.

A variation of the Sharpe ratio is the Sortino ratio, which

removes the effects of upward price movements on

standard deviation to measure only return against

downward price volatility.

31

Sharpe Ratio (Contd)

For example, if manager A generates a return of 15% while

manager B generates a return of 12%, it would appear that

manager A is a better performer. However, if manager A, who

produced the 15% return, took much larger risks than manager B, it

may actually be the case that manager B has a better risk-adjusted

return.

To continue with the example, say that the risk free-rate is 5%, and

manager A's portfolio has a standard deviation of 8%, while

manager B's portfolio has a standard deviation of 5%. The Sharpe

ratio for manager A would be 1.25 while manager B's ratio would

be 1.4, which is better than manager A. Based on these

calculations, manager B was able to generate a higher return on a

risk-adjusted basis.

32

Sharpe Ratio (Contd)

To give you some insight, a ratio of 1 or better is

considered good, 2 and better is very good, and 3 and

better is considered excellent.

The Sharpe ratio is quite simple, which lends to its

popularity. It's broken down into just three

components: asset return, risk-free return and

standard deviation of return. After calculating the

excess return, it's divided by the standard deviation of

the risky asset to get its Sharpe ratio. The idea of the

ratio is to see how much additional return you are

receiving for the additional volatility of holding the

risky asset over a risk-free asset - the higher the better.

33

SHARPE RATIO

34

Eg.

B generates a higher return than A on a risk

adjusted basis.

The Sharpe ratio is an appropriate measure of

performance for an overall portfolio particularly

when it is compared to another portfolio,

40 . 1

5

5 12 ) ( (

=

=

p

rf rp E

SRB

o

Treynor Measure

The Treynor ratio (sometimes called the reward-to-

volatility ratio or Treynor measure), named after Jack

L Treynor, is a measurement of the returns earned in

excess of that which could have been earned on an

investment that has no diversifiable risk (e.g., Treasury

Bills or a completely diversified portfolio), per each unit

of market risk assumed.

The Treynor ratio relates excess return over the risk-

free rate to the additional risk taken; however,

systematic risk is used instead of total risk. The higher

the Treynor ratio, the better the performance of the

portfolio under analysis.

35

Treynor Measure (Contd)

What Does Treynor Ratio Mean?

A ratio developed by Jack Treynor that measures

returns earned in excess of that which could have

been earned on a riskless investment per each

unit of market risk.

The Treynor ratio is calculated as:

(Average Return of the Portfolio - Average Return

of the Risk-Free Rate) / Beta of the Portfolio

36

Treynor Measure (Contd)

In other words, the Treynor ratio is a risk-adjusted measure of

return based on systematic risk. It is similar to the Sharpe

ratio, with the difference being that the Treynor ratio uses

beta as the measurement of volatility.

Also known as the "reward-to-volatility ratio".

Risk adjusted rate of return of Portfolio A = .043+ .09 = 13.3%

37

043 . 0

07 .

09 . 12 .

' =

=

B

=

p

Rmf Rp

s Treynor

a

Treynor Measure (Contd)

In other words, the Treynor ratio is a risk-adjusted measure of

return based on systematic risk. It is similar to the Sharpe

ratio, with the difference being that the Treynor ratio uses

beta as the measurement of volatility.

Also known as the "reward-to-volatility ratio".

Risk adjusted rate of return of Portfolio A = .04+ .09 = 13%

It measures the returns earned in excess of those that could

have been earned on a riskless investment per unit of market

risk assumed.

38

04 . 0

2 . 1

09 . 14 .

' =

=

B

=

p

Rmf Rp

s Treynor

b

Beta () of a Stock or Portfolio

In finance, the Beta ) of a stock or portfolio is a number describing the

relation of its returns with that of the financial market as a whole.

An asset has a Beta of zero if its returns change independently of changes

in the market's returns. A positive beta means that the asset's returns

generally follow the market's returns, in the sense that they both tend to

be above their respective averages together, or both tend to be below

their respective averages together. A negative beta means that the asset's

returns generally move opposite the market's returns: one will tend to be

above its average when the other is below its average.

The beta coefficient is a key parameter in the capital asset pricing model

(CAPM). It measures the part of the asset's statistical variance that cannot

be removed by the diversification provided by the portfolio of many risky

assets, because of the correlation of its returns with the returns of the

other assets that are in the portfolio. Beta can be estimated for individual

companies using regression analysis against a stock market index .

39

Beta () of a Stock or Portfolio

The formula for the beta of an asset within a portfolio is

a

= Cov (r

a

, r

p

)/ Var (r

p

)

where r

a

measures rate of return of the asset,

r

p

measures the rate of return of the portfolio, and

cov(r

a

, r

p

) is the covariance between the rates of return.

The portfolio of interest in the CAPM formulation is the market portfolio

that contains all risky assets, and so the r

p

terms in the formula are

replaced by r

m

, the rate of return of the market.

Beta is also referred to as financial elasticity or correlated relative volatility

and can be referred to as a measure of the sensitivity of the assets

returns to market returns, its non-diversifiable risk, its systematic risk, or

market risk. On an individual asset level, measuring beta can give clues to

volatility and liquidity in the marketplace. In fund management,

measuring beta is thought to separate a manager's skill from his or her

willingness to take risk.

40

Beta () of a Stock or Portfolio

The beta coefficient was born out of linear regression analysis. It is linked to a

regression analysis of the returns of a portfolio (such as a stock index) (x-axis) in a

specific period versus the returns of an individual asset (y-axis) in a specific year.

The regression line is then called the Security Characteristic Line (SCL)

a

is called the asset's alpha and

a

is called the asset's beta coefficient. Both

coefficients have an important role in Modern portfolio theory.

For an example, in a year where the broad market or benchmark index returns

25% above the risk free rate, suppose two managers gain 50% above the risk free

rate. Because this higher return is theoretically possible merely by taking a

leveraged position in the broad market to double the beta so it is exactly 2.0, we

would expect a skilled portfolio manager to have built the outperforming portfolio

with a beta somewhat less than 2, such that the excess return not explained by the

beta is positive. If one of the managers' portfolios has an average beta of 3.0, and

the other's has a beta of only 1.5, then the CAPM simply states that the extra

return of the first manager is not sufficient to compensate us for that manager's

risk, whereas the second manager has done more than expected given the risk.

Whether investors can expect the second manager to duplicate that performance

in future periods is of course a different question.

41

Jensens Ratio or Alpha

What Does Jensen's Measure Mean?

A risk-adjusted performance measure

that represents the average return on a portfolio

over and above that predicted by the capital

asset pricing model (CAPM), given the portfolio's

beta and the average market return. This is the

portfolio's alpha. In fact, the concept is

sometimes referred to as "Jensen's alpha."

42

Jensens Ratio or Alpha (Contd)

Jensens measure is calculated as

p

= E(r

p

) - [r

f

+

p

{E(r

m

) r

f

}]

where

E( r

p

) = expected total portfolio return

r

f

= risk free rate = 9%

p

= Beta of the portfolio=.07

E( r

m

) = expected market return = .12

43

% 1 01 . 0 11 . 12 . 0 '

11 . ) 09 . 12 (. 07 . 09 . 0 (

or s Jensen

Er Rm

R Rm R Er

p p

f p

p

f P

= = =

= + = + =

o

|

Jensens Ratio or Alpha (Contd)

If the definition above makes your head spin, don't worry: you

aren't alone! This is a very technical term that has its roots in

financial theory.

The basic idea is that to analyze the performance of an investment

manager you must look not only at the overall return of a portfolio,

but also at the risk of that portfolio. For example, if there are two

mutual funds that both have a 12% return, a rational investor will

want the fund that is less risky. Jensen's measure is one of the ways

to help determine if a portfolio is earning the proper return for its

level of risk. If the value is positive, then the portfolio is earning

excess returns. In other words, a positive value for Jensen's alpha

means a fund manager has "beat the market" with his or her stock

picking skills.

44

Modigliani-Square or M

2

Measure and the

TreynorSquare or T

2

Measure

The former measure is named after the authors of the

formula, Nobel laureate Franco Modigliani and his

niece, Leah Modigliani, a Morgan Stanley strategist.

Like the preceding approaches, the M

2

ratio attempts

to adjust the returns for risks. The M

2

approach is to

leverage/de-lever the portfolio until its volatility

matches that of its benchmark. This follows from the

CAPM methodology that assumes that the investor will

leverage (borrow or lend at the risk-free rate). The

effect is that the investor can mix one risky asset with a

risk-free asset to obtain the same standard deviation of

returns as the market portfolio.

45

Modigliani-Square or M

2

Measure and

the TreynorSquare or T

2

Measure

Suppose the market rate of return was 15.0%. If an

investor had just one risky asset A, which offered an

expected return of 25.0% and had a standard deviation of

returns of 51% compared to 33% for the market portfolio,

the investor must lower the standard deviation of his

portfolio of risky assets. He can do this by buying riskless

assets offering say for example, returns of 3.0% of such that

a 33/51 or 64.7% proportion is made up of A and a (1

0.647) or 35.3% is made up of riskless assets.

The expected return of the new portfolio is then (0.647 x

25.0%) + (0.353 x 3.0%) = 17.2%.

This is higher than the market rate of return of 15.0%,

leaving the M

2

measure at (17.2 15.0) = 2.2%.

46

Modigliani-Square or M

2

Measure and

the TreynorSquare or T

2

Measure

A similar operation can be made to adjust the beta of a

portfolio of risky assets to the market portfolio. This

approach is called the T

2

Ratio calculated as follows:

Suppose the market rate of return was again, 15.0%. If

an investor had the same one risky asset A, which

offered an expected return of 25.0% (hence an excess

return of 22% over the risk-free rate of 3.0% and had a

beta of 1.7 compared (the beta of the market portfolio

is always 1.0), the investor must lower the beta of his

portfolio of risky assets.

47

Modigliani-Square or M

2

Measure and

the TreynorSquare or T

2

Measure

He can do this by buying riskless assets which have a

beta of 0.0, offering excess returns over the risk-free

rate of 3.0% such that a 1.0/1.7 or 58.8% proportion is

made up of A and a (1 0.588) or 42.2% is made up of

riskless assets. The excess return of the portfolio made

up entirely of A, denoted as R

A

is 25% - 3% = 22% while

the excess return of the constructed portfolio R

P

= 22%

x 0.588 = 12.94%.

The T

2

measure of the constructed portfolio

= (R

P

excess return of market portfolio)

= 12.94% - (15%-3%) = 0.94%.

48

Information Ratio, also known as Excess Return

to Non-systematic Risk Ratio or Appraisal Ratio

The information ratio measures the investment

managers performance against a benchmark. It

measures the consistency by which a portfolio or fund

beats the benchmark. The ratio is therefore alpha

(measured by the average of a funds excess monthly

return over a benchmark), divided by the standard

deviation of the alpha. The formula is of the form

49

return monthly excess of deviation standard

return monthly excess mean

Ratio n Informatio =

Downside Deviation or Risk of Loss

Measure

The downside risk measures just one portion of

the area under the normal distribution curve that

is used to define the standard deviation of

returns. In Figure 3.14, it is represented by the

portion under the probability distribution curve

shaded in red lying to the left of the vertical line

NN that sets the frequency distribution or

probability of 0% return. The area measures the

cumulative probability of a loss and measures the

Downside Deviation Risk.

50

51

Probability

Figure 3.14

N

N

52

The associated formula is computed as follows:

Downside Deviation Risk =

N

Return Mean Return (Portfolio )

2

where N is the number of observations where the losses occurred or where the

portfolio underperformed the mean returns. Where the Downside Deviation Risk

is computed based on periods other than yearly (i.e., monthly or quarterly) data, an

adjustment is required if annualised results are to be obtained:

Annualised Downside Deviation Risk

= Downside Deviation Risk x \(No of periods required to make up one year)

For example, if quarterly data is used, the Downside Deviation Risk will be

multiplied by a factor of \4 = 2.

The Sortino Ratio

This ratio adopts the downside deviation risk as a measure of

portfolio risk. Unlike the Sharpe Ratio, the Sortino Ratio

measures the excess return not over the risk free rate but

over a target or expected rate and adjusts the annualised

portfolio excess return over the mean or annualised target

return by a factor represented by the Annualised Downside

Deviation Risk:

Sortino Ratio = Annualised Portfolio Return Annualised Target Return

Annualised Downside Deviation

53

The Sortino Ratio

A negative value indicates expected portfolio returns

lower than the target rate of return. Generally, the

higher the value the better the risk-adjusted return. A

large positive value for a numerator will be negated if

the denominator was large as well, leaving the risk-

adjusted return the same. The interpretation of this

ratio may lead to conclusions conflicting with that of

the Sharpe Ratio since focusing just on the standard

deviation of returns may result in the selection of a

portfolio for a client who may in fact be averse to

losses more than outright volatility of returns, in

which event, the Sortino Ratio may be a useful gauge

of which is the preferred portfolio.

54

Value At Risk (VAR)

VAR or sometimes (VaR) has been called the "new

science of risk management", but you do not need to

be a scientist to use VAR. Here, we look at the idea

behind VAR and the three basic methods of

calculating it

For investors, risk is about the odds of losing money,

and VAR is based on that common-sense fact. By

assuming investors care about the odds of a really big

loss, VAR answers the question, "What is my worst-

case scenario?" or "How much could I lose in a really

bad month?"

55

Value At Risk (VAR) (Contd)

The most popular and traditional measure of risk is

volatility. The main problem with volatility, however, is that

it does not care about the direction of an investment's

movement: a stock can be volatile because it suddenly

jumps higher. Of course, investors are not distressed by

gains!

For investors, risk is about the odds of losing money, and

VAR is based on that common-sense fact. By assuming

investors care about the odds of a really big loss, VAR

answers the question, "What is my worst-case scenario?"

or "How much could I lose in a really bad month?"

56

Value At Risk (VAR) (Contd)

Now let's get specific. A VAR statistic has three components: a time

period, a confidence level and a loss amount (or loss percentage).

Keep these three parts in mind as we give some examples of

variations of the question that VAR answers:

What is the most I can - with a 95% or 99% level of confidence -

expect to lose in dollars over the next month?

What is the maximum percentage I can - with 95% or 99%

confidence - expect to lose over the next year?

You can see how the "VAR question" has three elements: a

relatively high level of confidence (typically either 95% or 99%), a

time period (a day, a month or a year) and an estimate of

investment loss (expressed either in dollar or percentage terms).

57

Value At Risk (VAR) (Contd)

Methods of Calculating VAR

Institutional investors use VAR to evaluate portfolio

risk, but we will use it to evaluate the risk of a single

index that trades like a stock: the Nasdaq 100 Index,

which trades under the ticker QQQQ. The QQQQ is a

very popular index of the largest non-financial stocks

that trade on the Nasdaq exchange.

There are three methods of calculating VAR:

the historical method,

the variance-covariance method and

the Monte Carlo simulation

58

Value At Risk (VAR) (Contd)

1. Historical Method

The historical method simply re-organizes actual historical returns,

putting them in order from worst to best. It then assumes that

history will repeat itself, from a risk perspective.

The QQQ started trading in Mar 1999, and if we calculate each daily

return, we produce a rich data set of almost 1,400 points. Let's put

them in a histogram that compares the frequency of return

"buckets". For example, at the highest point of the histogram (the

highest bar), there were more than 250 days when the daily return

was between 0% and 1%. At the far right, you can barely see a tiny

bar at 13%; it represents the one single day (in Jan 2000) within a

period of five-plus years when the daily return for the QQQ was a

stunning 12.4%!

59

60

Value At Risk (VAR) (Contd)

Value At Risk (VAR) (Contd)

Notice the red bars that compose the "left tail" of the

histogram. These are the lowest 5% of daily returns (since

the returns are ordered from left to right, the worst are

always the "left tail"). The red bars run from daily losses of

4% to 8%. Because these are the worst 5% of all daily

returns, we can say with 95% confidence that the worst

daily loss will not exceed 4%. Put another way, we expect

with 95% confidence that our gain will exceed -4%. That is

VAR in a nutshell. Let's re-phrase the statistic into both

percentage and dollar terms:

With 95% confidence, we expect that our worst daily loss

will not exceed 4%.

If we invest $100, we are 95% confident that our worst

daily loss will not exceed $4 ($100 x -4%).

61

Value At Risk (VAR) (Contd)

You can see that VAR indeed allows for an outcome

that is worse than a return of -4%. It does not express

absolute certainty but instead makes a probabilistic

estimate. If we want to increase our confidence, we

need only to "move to the left" on the same histogram,

to where the first two red bars, at -8% and -7%

represent the worst 1% of daily returns:

With 99% confidence, we expect that the worst daily

loss will not exceed 7%.

Or, if we invest $100, we are 99% confident that our

worst daily loss will not exceed $7.

62

Value At Risk (VAR) (Contd)

2. The Variance-Covariance Method

This method assumes that stock returns are

normally distributed. In other words, it

requires that we estimate only two factors - an

expected (or average) return and a standard

deviation - which allow us to plot a normal

distribution curve. Here we plot the normal

curve against the same actual return data:

63

64

Value At Risk (VAR) (Contd)

Value At Risk (VAR) (Contd)

The idea behind the variance-covariance is similar to

the ideas behind the historical method - except that

we use the familiar normal curve instead of actual

data. The advantage of the normal curve is that we

automatically know where the worst 5% and 1% lie

on the curve. They are a function of our desired

confidence and the standard deviation ( ):

65

Value At Risk (VAR) (Contd)

The blue curve above is based on the actual daily

standard deviation of the QQQ, which is 2.64%. The

average daily return happened to be fairly close to zero,

so we will assume an average return of zero for

illustrative purposes. Here are the results of plugging the

actual standard deviation into the formulas above:

66

Value At Risk (VAR) (Contd)

3. Monte Carlo Simulation

The third method involves developing a model for future stock price

returns and running multiple hypothetical trials through the model. A

Monte Carlo simulation refers to any method that randomly generates

trials, but by itself does not tell us anything about the underlying

methodology.

For most users, a Monte Carlo simulation amounts to a "black box"

generator of random outcomes. Without going into further details, we

ran a Monte Carlo simulation on the QQQ based on its historical

trading pattern. In our simulation, 100 trials were conducted. If we ran

it again, we would get a different result--although it is highly likely that

the differences would be narrow. Here is the result arranged into a

histogram (please note that while the previous graphs have shown

daily returns, this graph displays monthly returns):

67

68

Value At Risk (VAR) (Contd)

Value At Risk (VAR) (Contd)

To summarize, we ran 100 hypothetical trials of monthly returns for

the QQQ. Among them, two outcomes were between -15% and -

20%; and three were between -20% and 25%. That means the worst

five outcomes (that is, the worst 5%) were less than -15%. The

Monte Carlo simulation therefore leads to the following VAR-type

conclusion: with 95% confidence, we do not expect to lose more

than 15% during any given month.

Summary

Value at Risk (VAR) calculates the maximum loss expected (or worst

case scenario) on an investment, over a given time period and given

a specified degree of confidence. We looked at three methods

commonly used to calculate VAR. But keep in mind that two of our

methods calculated a daily VAR and the third method calculated

monthly VAR

69

Potential Investment Channel

One of the more unusual developments in investment

in 2004 was the introduction of the first Shariah

compliant fund of hedge funds. The fund had been in

development for more than two years, tapped four

prominent Shariah scholars on three continents to

approve investment strategies whose methodologies

might differ from conventional short sales, derivatives,

and leverage but whose fiscal result would be similar.

The fund went to market late in the year and

reportedly set a goal of US$200 million on initial close.

70

Potential Investment Channel (Contd)

An Islamic fund of hedge funds is only the latest milestone in the

development of Islamic alternative investment, an opportunity lying

somewhere between US$200 billion to US$300 billion, depending

on the source. Historically, alternative investments have been

reserved for wealthier accredited investors. However, we are now

seeing more and more private-client advisers turning to alternative

investments: private markets (venture capital, leveraged buyouts,

private equity, mezzanine financing, and distressed debt), natural

resources (timberland, water, agriculture, oil, and gas), real estate,

and hedge funds. These investments are called alternative

because, unlike stock and bond investments, advisers actively

manage them and seek absolute rather than relative rates of return

(unambiguous, measurable, investable, specified-in-advance

benchmarks are difficult to devise).

71

Potential Investment Channel (Contd)

Strictly speaking, hedge funds are really more of an

alternative strategy than an alternative investment.

Though some hedge funds invest in alternative

investments, many invest in the same readily

marketable securities that are available to ordinary unit

trust funds. But unlike unit trust funds, hedge funds

can use myriad investing and trading strategies that

may or may not hedge risk.

Financial planner should note that the familiar tools

and methods for assessing portfolios of conventional

assets, such as using historical data and optimizations,

may not applicable for portfolios that combine

conventional and alternative investments.

72

Potential Investment Channel (Contd)

Financial planner should note that the familiar tools

and methods for assessing portfolios of conventional

assets, such as using historical data and optimizations,

may not applicable for portfolios that combine

conventional and alternative investments. Therefore,

investors will be better served by eschewing the

familiar approaches for identifying (or defining)

return and risk characteristics that reflect underlying

drivers of performance and replacing them with

simulations that are useful for identifying appropriate

policy mixes combining conventional and alternative

investments.

73

Structured Products

In the pioneering days of structured products,

customer demand revolved around two mutually

exclusive objectives of income or growth. Both

objectives were underpinned by a strong

common desire to maintain capital values or to

strictly limit loss.

Today, both practitioners and investors often

misinterpret structured products as guaranteed

or capital protected vehicles because of this

legacy.

74

Structured Products (Contd)

But more worryingly, investor expectation regarding

structured products would seem to be somewhat misplaced

as many look to structures as a means of achieving multiple

objectives from a single product. It is therefore important for

Islamic financial planners to have a good understanding of

structured products although some of the investment

approaches in these products may not be Shariah compliant.

Structured products can be defined as any investment

vehicle designed to fulfill a principal objective by combining a

range of techniques or elements, which individually could not

achieve the same result.

75

Structured Products (Contd)

Applying this definition helps to demonstrate the width and depth

of this sector. The usual suspects can be found such as capital

protected or enhanced growth and income vehicles. These are

typically underpinned by a zero coupon with a derivative overlay

and have struck a chord with private investors. For those who cant

afford their own structure the market is awash with new retail

issues and a secondary market, created by the product provider,

which can also be accessed.

Other areas of structured a product that is most commonly talked

about is the hedge fund, which comes in many shapes and sizes

from single to multiple strategies to well-diversified funds of hedge

funds while exchange-traded funds offer the structured alternative

to index tracking unit trusts.

76

Structured Products (Contd)

Investment and private banks, asset and fund

managers and the life companies are all offering some

form of structured product. They aim to differentiate

their offering through the wrapper in which the

structure is placed or the innovative concept

underpinning the structure.

In structured products, investors typically seek returns

comparable with equities over the long term but

without the same degree of associated risk. Structured

products can give investors access to a multi-asset,

multi-manager, multi-style, multi-currency structure,

which is, at its heart, a sophisticated neutral asset

allocation model.

77

Structured Products (Contd)

The advantages of this structure are five-fold:

Firstly, the multi-asset approach means that a

clients assets are invested equally across fixed

income, property, equities and hedge funds,

giving them excellent diversification across a full

range of asset classes. These typically have

different economic cycles ensuring that two asset

classes will always outperform the remaining

two. This will either act as a driver for growth or a

brake when certain markets fall.

78

Structured Products (Contd)

Secondly, the multi-manager approach allows the

selection of a range of managers who are particularly

skilled to manage the different assets classes. These

managers track records and skill place the clients

assets in the hands of individuals who are most likely

to add value to the portfolio.

Thirdly, using a multi-style approach means that within

each asset class, the investment team get to blend

investment styles and approaches. This adds further

diversification and reduces the possibility of

duplicating holdings, further reducing risk.

79

Structured Products (Contd)

Fourthly, the implementation of a multi-currency approach

led to the development where the underlying exposure is

kept to the base currency of the fund. This reduces

currency risk and is fundamental for conservative or

medium risk investors.

Finally, a neutral asset allocation means that the portfolio

is rebalanced on a monthly basis to ensure that investors

exposure to the four asset classes is virtually equal. This

means that customers are not exposed to a deliberate over

or underweight asset allocation strategy. This increases risk,

but remains neutral. This neutral position allows the fund

to take profit from rising asset classes and reinvest into

falling ones. In effect, it is continuous dollar cost averaging

and profit taking

80

Structured Products (Contd)

However, Islamic financial planners should

access structured products with due care

because such products normally involve short-

selling and securities borrowing and lending,

where many Shariah scholars are still divided

on the legitimacy of such practices since there

are no parallel in classical Fiqh al-mualamat.

81

Thank you

82

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Fidp ResearchDokument3 SeitenFidp ResearchIn SanityNoch keine Bewertungen

- Social Media Marketing Advice To Get You StartedmhogmDokument2 SeitenSocial Media Marketing Advice To Get You StartedmhogmSanchezCowan8Noch keine Bewertungen

- PC210 8M0Dokument8 SeitenPC210 8M0Vamshidhar Reddy KundurNoch keine Bewertungen

- Course Specifications: Fire Investigation and Failure Analysis (E901313)Dokument2 SeitenCourse Specifications: Fire Investigation and Failure Analysis (E901313)danateoNoch keine Bewertungen

- Hotel ManagementDokument34 SeitenHotel ManagementGurlagan Sher GillNoch keine Bewertungen

- Chapter 5Dokument3 SeitenChapter 5Showki WaniNoch keine Bewertungen

- Algorithmique Et Programmation en C: Cours Avec 200 Exercices CorrigésDokument298 SeitenAlgorithmique Et Programmation en C: Cours Avec 200 Exercices CorrigésSerges KeouNoch keine Bewertungen

- Hip NormDokument35 SeitenHip NormAiman ArifinNoch keine Bewertungen

- Notifier AMPS 24 AMPS 24E Addressable Power SupplyDokument44 SeitenNotifier AMPS 24 AMPS 24E Addressable Power SupplyMiguel Angel Guzman ReyesNoch keine Bewertungen

- Configuring Master Data Governance For Customer - SAP DocumentationDokument17 SeitenConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoNoch keine Bewertungen

- Fedex Service Guide: Everything You Need To Know Is OnlineDokument152 SeitenFedex Service Guide: Everything You Need To Know Is OnlineAlex RuizNoch keine Bewertungen

- Micron Interview Questions Summary # Question 1 Parsing The HTML WebpagesDokument2 SeitenMicron Interview Questions Summary # Question 1 Parsing The HTML WebpagesKartik SharmaNoch keine Bewertungen

- Condition Monitoring of Steam Turbines by Performance AnalysisDokument25 SeitenCondition Monitoring of Steam Turbines by Performance Analysisabuhurairaqazi100% (1)

- Wendi C. Lassiter, Raleigh NC ResumeDokument2 SeitenWendi C. Lassiter, Raleigh NC ResumewendilassiterNoch keine Bewertungen

- Historical Development of AccountingDokument25 SeitenHistorical Development of AccountingstrifehartNoch keine Bewertungen

- Engineering Management (Final Exam)Dokument2 SeitenEngineering Management (Final Exam)Efryl Ann de GuzmanNoch keine Bewertungen

- Unit 2Dokument97 SeitenUnit 2MOHAN RuttalaNoch keine Bewertungen

- MDOF (Multi Degre of FreedomDokument173 SeitenMDOF (Multi Degre of FreedomRicky Ariyanto100% (1)

- CoDokument80 SeitenCogdayanand4uNoch keine Bewertungen

- Lending OperationsDokument54 SeitenLending OperationsFaraz Ahmed FarooqiNoch keine Bewertungen

- Brochure Ref 670Dokument4 SeitenBrochure Ref 670veerabossNoch keine Bewertungen

- Prachi AgarwalDokument1 SeitePrachi AgarwalAnees ReddyNoch keine Bewertungen

- CHAPTER 3 Social Responsibility and EthicsDokument54 SeitenCHAPTER 3 Social Responsibility and EthicsSantiya Subramaniam100% (4)

- Peoria County Jail Booking Sheet For Oct. 7, 2016Dokument6 SeitenPeoria County Jail Booking Sheet For Oct. 7, 2016Journal Star police documents50% (2)

- Jerome4 Sample Chap08Dokument58 SeitenJerome4 Sample Chap08Basil Babym100% (7)

- Bajaj Allianz InsuranceDokument93 SeitenBajaj Allianz InsuranceswatiNoch keine Bewertungen

- Building Program Template AY02Dokument14 SeitenBuilding Program Template AY02Amy JaneNoch keine Bewertungen

- Termination LetterDokument2 SeitenTermination Letterultakam100% (1)

- 4109 CPC For ExamDokument380 Seiten4109 CPC For ExamMMM-2012Noch keine Bewertungen

- Cs8792 Cns Unit 1Dokument35 SeitenCs8792 Cns Unit 1Manikandan JNoch keine Bewertungen