Beruflich Dokumente

Kultur Dokumente

Introduction To Time Value of Money

Hochgeladen von

mubashir_mm4uOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Introduction To Time Value of Money

Hochgeladen von

mubashir_mm4uCopyright:

Verfügbare Formate

FINANCIAL MANAGEMENT

Title: Financial Management

Objective

In todays dynamic world engineers along with taking technical decisions

also have to take financial decisions. So they need to understand,

analyze and interpret financial data and financial issues. This course

will help them in understanding the concepts and principles of

accounting and finance with the support of software packages so that

they can make quick informed financial decisions.

Learning Outcomes

At the end of the course the students will be able to understand:

- basic accounting principles.

- how to measure the performance of a business.

- how to make and evaluate the impact of business decisions at all levels.

Methodology

The course will be taught with the aid of lectures, case studies, and use of

computer spreadsheet programs. The students will self-learn the usage

of accounting packages available in the industry.

Text Book

Financial Management by M.Y. Khan, and P.K. Jain, Tata McGraw

Hill.

Financial Management by Prasanna Chandra, Tata McGraw Hill.

Books for Reference

Principles of corporate finance by Brealey, Richard A. and Myers,

Stewart C. Tata McGraw-Hill Publishing Delhi.

Fundamentals of financial management by Brigham, Eugene

F,Houston, Joel F. Thomson Asia Pte Ltd.

Financial management by I.M. Pandey, Vikas Publishing House Pvt

Ltd.

Course Contents

Topic-

Introduction

Basic Financial Concepts

Long Term Sources of Finance

Capital Budgeting: Principle Techniques

Concept and measurement of cost of capital

Cash Flows for Capital Budgeting

Financial statements & analysis

Leverages and Capital structure decision

Working capital management

Dividend Policy

Evaluation (Lecture Course)

Exam % of Marks Duration of

Examination

Coverage / Scope

(i) TEST-1

(T-1)

20 1 Hour

Syllabus covered upto test 1

(ii) TEST -2

(T-2)

25 1 Hour 15

Minutes

Mainly syllabus covered after

Test-1, plus some questions from

portions covered upto test 1

(iii)TEST-3

(T-3)

30 1 Hour 30

Minutes

Mainly syllabus covered after

Test-2, and upto Test-3 Plus some

questions from portions covered

Test-1 and Test-2.

(iv)

Assignments,

Quizzes, home

work &

Regularity in

attendance.

25

Quizzes: 5

Attendance: 5

Assignment: 5

Project work:

10

Entire

Semester

As decided and announced by the

teacher concerned in the class at

the beginning of the course

AN OVERVIEW

DEFINITION

Financial Management is broadly

concerned with the acquisition

(investment), financing and

management of assets by a

business firm

GOALS OF THE FIRM

Maximizing owners/shareholders wealth

Maximizing the price per share

Market price of a share serves as a barometer for

business performance

It indicates how well management is doing on behalf

of its shareholders

OBJECTIVES OF FINANCIAL

MANAGEMENT

Maximize owners' wealth

Market value of equity

SCOPE OF FINANCIAL MANAGEMENT

What should be the composition of the firms

assets?

What should be the mix of the firms

financing?

How should the firm analyse, plan and control

its financial affairs?

Financial Analysis, Planning and Control

Balance Sheet

Long Term

Financing

Short Term

Financing

Fixed Assets

Current

Assets

Management

of the

Firms Asset

Structure

Management

of

the Firms

Financial

Structure

KEY ACTIVITIES OF FINANCIAL

MANAGEMENT

Capital Budgeting

Decisions

Capital Structure

Decisions

Dividend

Decisions

Working Capital

Decisions

Return

Risk

Market Value of

the Firm

RISK RETURN TRADE OFF

FINANCE AND ECONOMICS

Macro Economics

Necessary for understanding the environment in

which the firm operates

Growth rate of economy, tax environment,

availability of funds, rate of inflation, terms on which

the firm can raise finances

Micro Economics

Helpful in sharpening the tools of decision making

Principle of marginal analysis is applicable to

decision making

FINANCE AND ACCOUNTING

Value Maximising vs. Score Keeping

Cash Flow Method vs. Accrual Method

Uncertainty vs. Certainty

Time Value of

Money

Obviously, Rs10,000 today.

You already recognize that there is

TIME VALUE TO MONEY!!

The Interest Rate

Which would you prefer Rs10,000

today or Rs10,000 in 5 years?

TIME allows you the opportunity to postpone

consumption and earn INTEREST

A rupee today represents a greater real

purchasing power than a rupee a year hence

Receiving a rupee a year hence is uncertain so

risk is involved

Why TIME?

Why is TIME such an important element

in your decision?

Time Value Adjustment

Two most common methods of

adjusting cash flows for time value of

money:

Compoundingthe process of

calculating future values of cash

flows and

Discountingthe process of

calculating present values of cash

flows.

Types of Interest

Compound Interest

Interest paid (earned) on any previous

interest earned, as well as on the

principal borrowed (lent).

Simple Interest

Interest paid (earned) on only the original

amount, or principal borrowed (lent).

Simple Interest Formula

Formula SI = P

0

(i)(n)

SI: Simple Interest

P

0

: Deposit today (t=0)

i: Interest Rate per Period

n: Number of Time Periods

SI = P

0

(i)(n)

= Rs1,000(.07)(2)

= Rs140

Simple Interest Example

Assume that you deposit Rs1,000 in an

account earning 7% simple interest for

2 years. What is the accumulated

interest at the end of the 2nd year?

FV = P

0

+ SI

= Rs1,000 + Rs140

= Rs 1,140

Future Value is the value at some future

time of a present amount of money, or a

series of payments, evaluated at a given

interest rate.

Simple Interest (FV)

What is the Future Value (FV) of the

deposit?

The Present Value is simply the

Rs 1,000 you originally deposited.

That is the value today!

Present Value is the current value of a

future amount of money, or a series of

payments, evaluated at a given interest

rate.

Simple Interest (PV)

What is the Present Value (PV) of the

previous problem?

Assume that you deposit Rs 1,000

at a compound interest rate of 7%

for 2 years.

Future Value

Single Deposit (Graphic)

0 1 2

Rs 1,000

FV

2

7%

FV

1

= P

0

(1+i)

1

= Rs 1,000 (1.07)

= Rs 1,070

FV

2

= FV

1

(1+i)

1

= P

0

(1+i)(1+i) = Rs1,000(1.07)(1.07)

= P

0

(1+i)

2

= Rs1,000(1.07)

2

= Rs1,144.90

You earned an EXTRA Rs 4.90 in Year 2 with

compound over simple interest.

Future Value

Single Deposit (Formula)

FV

1

= P

0

(1+i)

1

FV

2

= P

0

(1+i)

2

General Future Value Formula:

FV

n

= P

0

(1+i)

n

or FV

n

= P

0

(FVIF

i,n

)

General Future

Value Formula

etc.

Reena wants to know how large her deposit of

Rs 10,000 today will become at a compound

annual interest rate of 10% for 5 years.

Problem

0 1 2 3 4 5

Rs10,000

FV

5

10%

Solution

Calculation based on general formula:

FV

n

= P

0

(1+i)

n

FV

5

= Rs10,000 (1+ 0.10)

5

= Rs 16,105.10

We will use the Rule-of-72.

Double Your Money!!!

Quick! How long does it take to double

Rs 5,000 at a compound rate of 12%

per year (approx.)?

Doubling Period = 72 / Interest Rate

6 years

For accuracy use the Rule-of-69.

Doubling Period

=0.35 +(69 / Interest Rate)

6.1 years

Assume that you need Rs 1,000 in 2 years.

Lets examine the process to determine

how much you need to deposit today at a

discount rate of 7% compounded annually.

0 1 2

Rs 1,000

7%

PV

1

PV

0

Present Value

Single Deposit (Graphic)

PV

0

= FV

2

/ (1+i)

2

= Rs 1,000 / (1.07)

2

= FV

2

/ (1+i)

2

= Rs 873.44

Present Value

Single Deposit (Formula)

0 1 2

Rs 1,000

7%

PV

0

PV

0

= FV

1

/ (1+i)

1

PV

0

= FV

2

/ (1+i)

2

General Present Value Formula:

PV

0

= FV

n

/ (1+i)

n

or PV

0

= FV

n

(PVIF

i,n

)

General Present

Value Formula

etc.

Reena wants to know how large of a

deposit to make so that the money will

grow to Rs 10,000 in 5 years at a discount

rate of 10%.

Problem

0 1 2 3 4 5

Rs 10,000

PV

0

10%

Calculation based on general formula:

PV

0

= FV

n

/ (1+i)

n

PV

0

= Rs 10,000 / (1+ 0.10)

5

= Rs 6,209.21

Problem Solution

Types of Annuities

Ordinary Annuity: Payments or receipts

occur at the end of each period.

Annuity Due: Payments or receipts

occur at the beginning of each period.

An Annuity represents a series of equal

payments (or receipts) occurring over a

specified number of equidistant periods.

Examples of Annuities

Student Loan Payments

Car Loan Payments

Insurance Premiums

Retirement Savings

Parts of an Annuity

0 1 2 3

Rs 100 Rs 100 Rs 100

(Ordinary Annuity)

End of

Period 1

End of

Period 2

Today

Equal Cash Flows

Each 1 Period Apart

End of

Period 3

Parts of an Annuity

0 1 2 3

Rs 100 Rs 100 Rs 100

(Annuity Due)

Beginning of

Period 1

Beginning of

Period 2

Today

Equal Cash Flows

Each 1 Period Apart

Beginning of

Period 3

FVA

n

= A(1+i)

n-1

+ A(1+i)

n-2

+

... + A(1+i)

1

+ A(1+i)

0

Ordinary Annuity -- FVA

A A A

0 1 2 n n+1

FVA

n

A = Periodic

Cash Flow

Cash flows occur at the end of the period

i%

. . .

Example of an

Ordinary Annuity -- FVA

Rs1,000 Rs1,000 Rs1,000

0 1 2 3 4

7%

Cash flows occur at the end of the period

FVA

3

= 1,000(1.07)

2

+

1,000(1.07)

1

+ 1,000(1.07)

0

= 1,145 + 1,070 + 1,000

= Rs 3,215

Example of an

Ordinary Annuity -- FVA

Rs1,000 Rs1,000 Rs1,000

0 1 2 3 4

Rs3,215 =

FVA

3

7%

Rs1,070

Rs1,145

Cash flows occur at the end of the period

General Formula for Calculating

Future Value of an Ordinary

Annuity

A i A i A FVAn

n n

... ) 1 ( ) 1 (

2 1

+ + + + =

(

+

=

i

i

A

n

1 ) 1 (

FVAD

n

= R(1+i)

n

+ R(1+i)

n-1

+

... + R(1+i)

2

+ R(1+i)

1

= FVA

n

(1+i)

Annuity Due -- FVAD

R R R R R

0 1 2 3 n-1 n

FVAD

n

i%

. . .

Cash flows occur at the beginning of the period

FVAD

3

= 1,000(1.07)

3

+

1,000(1.07)

2

+ 1,000(1.07)

1

= 1,225 + 1,145 + 1,070

= Rs 3,440

Example of an

Annuity Due -- FVAD

1,000 1,000 1,000 1,070

0 1 2 3 4

Rs 3,440 =

FVAD

3

7%

Rs1,225

Rs1,145

Cash flows occur at the beginning of the period

PVA

n

= R/(1+i)

1

+ R/(1+i)

2

+ ... + R/(1+i)

n

Ordinary Annuity -- PVA

R R R

0 1 2 n n+1

PVA

n

R = Periodic

Cash Flow

i%

. . .

Cash flows occur at the end of the period

Example of an

Ordinary Annuity -- PVA

Rs1,000 Rs1,000 Rs1,000

0 1 2 3 4

7%

Cash flows occur at the end of the period

PVA

3

= 1,000/(1.07)

1

+

1,000/(1.07)

2

+

1,000/(1.07)

3

= 934.58 + 873.44 + 816.30

= 2,624.32

Example of an

Ordinary Annuity -- PVA

Rs1,000 Rs1,000 Rs1,000

0 1 2 3 4

Rs 2,624.32 = PVA

3

7%

934.58

873.44

816.30

Cash flows occur at the end of the period

n

n

i

A

i

A

i

A

PVA

) 1 (

...

) 1 ( ) 1 (

2

+

+ +

+

+

+

=

(

+

+

=

n

n

i i

i

A

) 1 (

1 ) 1 (

General Formula for Calculating

Present Value of an Ordinary

Annuity

PVAD

n

= R/(1+i)

0

+ R/(1+i)

1

+ ... + R/(1+i)

n-1

= PVA

n

(1+i)

Annuity Due -- PVAD

R R R R

0 1 2 n-1 n

PVAD

n

R: Periodic

Cash Flow

i%

. . .

Cash flows occur at the beginning of the period

PVAD

n

= 1,000/(1.07)

0

+ 1,000/(1.07)

1

+

1,000/(1.07)

2

= Rs 2,808.02

Example of an

Annuity Due -- PVAD

1,000.00 1,000 1,000

0 1 2 3 4

2,808.02 = PVAD

n

7%

934.58

873.44

Cash flows occur at the beginning of the period

Reena will receive the set of cash

flows below. What is the Present

Value at a discount rate of 10%?

Mixed Flows Example

0 1 2 3 4 5

600 600 400 400 100

PV

0

10%

Solution

0 1 2 3 4 5

600 600 400 400 100

10%

545.45

495.87

300.53

273.21

62.09

Rs 1677.15 = PV

0

of the Mixed Flow

General Formula:

FV

n

= PV

0

(1 + [i/m])

mn

Or

= PV

0

* PVIF

i/m,m*n

n: Number of Years

m: Compounding Periods per Year

i: Annual Interest Rate

FV

n,m

: FV at the end of Year n

PV

0

: PV of the Cash Flow today

Shorter Discounting Periods

Reena has Rs1,000 to invest for 1 year

at an annual interest rate of 12%.

Example

Annual FV = 1,000(1+ [.12/1])

(1)(1)

= 1,120

Semi FV = 1,000(1+ [.12/2])

(2)(1)

= 1,123.6

Effective vs. Nominal Rate of

Interest

Rs. 1000 Rs.1123.6

So,

Rs. 1000 grows @ 12.36% annually

Effective Rate of Interest

r = 1 + i/m

m

- 1

Basket Wonders (BW) has a Rs1,000 CD

at the bank. The interest rate is 6%

compounded quarterly for 1 year.

What is the Effective Annual Interest

Rate (EAR)?

Problem

EAR = ( 1 + 6% / 4 )

4

- 1

= 1.0614 - 1 = .0614 or

6.14%!

Perpetuity

A perpetuity is an annuity with an

infinite number of cash flows.

The present value of cash flows

occurring in the distant future is very

close to zero.

At 10% interest, the PV of Rs 100

cash flow occurring 50 years from

today is Rs 0.85!

Present Value of a

Perpetuity

n

n

i

A

i

A

i

A

PVA

) 1 (

...

) 1 ( ) 1 (

2

+

+ +

+

+

+

=

When n=

PV

perpetuity

= [A/(1+i)]

[1-1/(1+i)]

= A(1/i) = A/i

Present Value of a

Perpetuity

What is the present value of a perpetuity

of Rs270 per year if the interest rate is

12% per year?

PV

A

i

perpetuity

=

=

=

Rs270

0.12

Rs 2250

1. Calculate the payment per period.

2. Determine the interest in Period t.

Loan balance at (t-1) x (i%)

3. Compute principal payment in Period t.

(Payment - interest from Step 2)

4. Determine ending balance in Period t.

(Balance - principal payment from Step 3)

5. Start again at Step 2 and repeat.

Steps to Amortizing a Loan

Reena is borrowing Rs10,000 at a compound

annual interest rate of 12%. Amortize the loan

if annual payments are made for 5 years.

Amortizing a Loan Example

Step 1: Payment

PV

0

= A(PVIFA

i%,n

)

Rs10,000 = A(PVIFA

12%,5

)

Rs10,000 = A(3.605)

A = Rs10,000 / 3.605 = Rs2,774

Amortizing a Loan Example

End of

Year

Payment Interest Principal Ending

Balance

0

1

2

3

4

5

Amortizing a Loan Example

End of

Year

Payment Interest Principal Ending

Balance

0 --- --- --- Rs10,000

1 Rs2,774 Rs1,200 Rs1,574 8,426

2

3

4

5

[Last Payment Slightly Higher Due to Rounding]

Amortizing a Loan Example

End of

Year

Payment Interest Principal Ending

Balance

0 --- --- --- Rs10,000

1 Rs2,774 Rs1,200 Rs1,574 8,426

2 2,774 1,011 1,763 6,663

3 2,774 800 1,974 4,689

4 2,774 563 2,211 2,478

5 2,775 297 2,478 0

Rs13,871 Rs3,871 Rs10,000

[Last Payment Slightly Higher Due to Rounding]

Usefulness of Amortization

2. Calculate Debt Outstanding -- The

quantity of outstanding debt

may be used in financing the

day-to-day activities of the firm.

1. Determine Interest Expense --

Interest expenses may reduce

taxable income of the firm.

EXERCISE

Ashish recently obtained a

Rs.50,000 loan. The loan carries

an 8% annual interest. Amortize

the loan if annual payments are

made for 5 years.

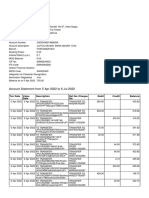

SOLUTION

50000 5 0.08

12523

TIME PAYMENT INTERESTPRINCIPAL AMOUNT

OUTSTANDING

0 50000

1 12523 4000 8523 41477

2 12523 3318 9205 32272

3 12523 2582 9941 22331

4 12523 1786 10737 11594

5 12522 928 11594 0

EXERCISE

Compute the present value of the

following future cash inflows,

assuming a required rate of 10%:

Rs. 100 a year for years 1

through 3, and Rs. 200 a year

from years 6 through 15.

ANS: 1011.75

Solution

100 100 100 200 200 200

0 1 2 3 6 7 15

248.70

i%

. . .

Cash flows occur at the end of the period

. . .

1228.9

763.05

1011.75

Till 5

th

year

Das könnte Ihnen auch gefallen

- Financial Management Course OutlineDokument61 SeitenFinancial Management Course OutlineVishal PathakNoch keine Bewertungen

- Financial ManagementDokument70 SeitenFinancial Managementrachit guptaNoch keine Bewertungen

- Financial Management FundamentalsDokument61 SeitenFinancial Management FundamentalsAyush JaggiNoch keine Bewertungen

- Time Value of MoneyDokument54 SeitenTime Value of MoneyBibhudatta SinghSamantNoch keine Bewertungen

- Fin1Dokument43 SeitenFin1afif12Noch keine Bewertungen

- Time Value of MoneyDokument76 SeitenTime Value of Moneyrhea agnesNoch keine Bewertungen

- Lec2 TVMDokument58 SeitenLec2 TVMvivek patelNoch keine Bewertungen

- Financial Management Lecture 04 ObjectivesDokument34 SeitenFinancial Management Lecture 04 ObjectivesMansour NiaziNoch keine Bewertungen

- Time Value of MoneyDokument54 SeitenTime Value of MoneyEyael ShimleasNoch keine Bewertungen

- 04 Present Value of MoneyDokument50 Seiten04 Present Value of MoneyAJINKYANoch keine Bewertungen

- Fin 1Dokument43 SeitenFin 1Aman AnshuNoch keine Bewertungen

- Time Value of MoneyDokument38 SeitenTime Value of MoneyPooja TripathiNoch keine Bewertungen

- Financial Management FM 1: Introduction & Time Value of MoneyDokument20 SeitenFinancial Management FM 1: Introduction & Time Value of MoneyharryworldNoch keine Bewertungen

- Module 1 - Time Value of Money Handout For LMS 2020Dokument8 SeitenModule 1 - Time Value of Money Handout For LMS 2020sandeshNoch keine Bewertungen

- Time ValueDokument19 SeitenTime ValuetaufiqNoch keine Bewertungen

- FM FinalDokument87 SeitenFM FinalGaurav S JadhavNoch keine Bewertungen

- LONG TERM INVESTMENT DECISIONS: TIME VALUE OF MONEY (TVM) REPORTDokument7 SeitenLONG TERM INVESTMENT DECISIONS: TIME VALUE OF MONEY (TVM) REPORTMary Ann MarianoNoch keine Bewertungen

- Manage corporate finance objectives and maximize firm valueDokument15 SeitenManage corporate finance objectives and maximize firm valueAjay AjayNoch keine Bewertungen

- Time Value of MoneyDokument71 SeitenTime Value of MoneyHaider ShahNoch keine Bewertungen

- The Time Value of Money ExplainedDokument61 SeitenThe Time Value of Money ExplainedAlex AlexNoch keine Bewertungen

- 3b5a3lecture 3 Time Value of MoneyDokument34 Seiten3b5a3lecture 3 Time Value of MoneyApril MartinezNoch keine Bewertungen

- Time Value of Money ExplainedDokument37 SeitenTime Value of Money Explainedansary75Noch keine Bewertungen

- Lecture 3rd Time Value of MoneyDokument26 SeitenLecture 3rd Time Value of MoneyBahrawar saidNoch keine Bewertungen

- Financial Management Ii: Chapter 5 (Fundamental of Corporate Finance) Introduction To Valuation: The Time Value of MoneyDokument33 SeitenFinancial Management Ii: Chapter 5 (Fundamental of Corporate Finance) Introduction To Valuation: The Time Value of MoneyEldi JanuariNoch keine Bewertungen

- Introduction To Business Finance (Fin201) : Time Value of MoneyDokument55 SeitenIntroduction To Business Finance (Fin201) : Time Value of MoneyAhsan KamranNoch keine Bewertungen

- Intuition Behind The Present Value RuleDokument34 SeitenIntuition Behind The Present Value RuleAbhishek MishraNoch keine Bewertungen

- A212 - Topic 3 - FV PV - Part I (Narration)Dokument31 SeitenA212 - Topic 3 - FV PV - Part I (Narration)Teo ShengNoch keine Bewertungen

- Topic 1 - TVMDokument61 SeitenTopic 1 - TVMBaby KhorNoch keine Bewertungen

- Time Value of Money: DR. Mohamed SamehDokument22 SeitenTime Value of Money: DR. Mohamed SamehRamadan IbrahemNoch keine Bewertungen

- Lec 3 - Chapter 03 - 2016Dokument48 SeitenLec 3 - Chapter 03 - 2016Dhanuka NadeeraNoch keine Bewertungen

- Financial Management - PPT - 2011Dokument134 SeitenFinancial Management - PPT - 2011Bhanu Prakash100% (1)

- 2.lecture TVMDokument60 Seiten2.lecture TVMfurqankhalid1218Noch keine Bewertungen

- Time Value of Money Notes Loan ArmotisationDokument12 SeitenTime Value of Money Notes Loan ArmotisationVimbai ChituraNoch keine Bewertungen

- BF Lecture Notes Topic 2 Part 1-1Dokument33 SeitenBF Lecture Notes Topic 2 Part 1-1yvonnepangestuNoch keine Bewertungen

- Time Value of MoneyDokument54 SeitenTime Value of Moneyayomi6515Noch keine Bewertungen

- Solutions For All Modules of FMDokument125 SeitenSolutions For All Modules of FMAtul KashyapNoch keine Bewertungen

- Lecture 11 02052020 105219pm 25012022 103841am 1 18062022 052423pm 18062022 052541pmDokument41 SeitenLecture 11 02052020 105219pm 25012022 103841am 1 18062022 052423pm 18062022 052541pmSyeda Maira BatoolNoch keine Bewertungen

- Financial Management - PPT - 2011Dokument183 SeitenFinancial Management - PPT - 2011ashpika100% (1)

- Chapter 3 - The Time Value of MoneyDokument60 SeitenChapter 3 - The Time Value of MoneyNiazi MustafaNoch keine Bewertungen

- Time Value of Money Ahmed HassanDokument41 SeitenTime Value of Money Ahmed HassanKamrul HasanNoch keine Bewertungen

- Term Paper On Financial ManagementDokument26 SeitenTerm Paper On Financial ManagementHaris MunirNoch keine Bewertungen

- Time Value of Money ExplainedDokument8 SeitenTime Value of Money ExplainedAngelo DomingoNoch keine Bewertungen

- FM Midterm NotesDokument9 SeitenFM Midterm NotesMj NuarinNoch keine Bewertungen

- Unit 2Dokument13 SeitenUnit 2anas khanNoch keine Bewertungen

- TVM Concepts for Business FinanceDokument12 SeitenTVM Concepts for Business FinanceMuhammad Saad IqbalNoch keine Bewertungen

- Sri Krishna College of TechnologyDokument62 SeitenSri Krishna College of TechnologyMohanNoch keine Bewertungen

- Chapter 4Dokument50 SeitenChapter 422GayeonNoch keine Bewertungen

- Module 5 Part 1Dokument36 SeitenModule 5 Part 1Papeterie 18Noch keine Bewertungen

- Time Value of Money LectureDokument43 SeitenTime Value of Money LectureShamsuddin SoomroNoch keine Bewertungen

- TVM Chapter SummaryDokument72 SeitenTVM Chapter SummaryCesyl Patricia BallesterosNoch keine Bewertungen

- TVM: The Time Value of MoneyDokument42 SeitenTVM: The Time Value of MoneyUsman KhanNoch keine Bewertungen

- The Time Value of Money: Money NOW Is Worth More Than Money LATER!Dokument37 SeitenThe Time Value of Money: Money NOW Is Worth More Than Money LATER!Meghashyam AddepalliNoch keine Bewertungen

- Corporate Finance: DR C.Sivashanmugam. Dept. of Management Studies (PG) Sivashanmugam@pes - EduDokument64 SeitenCorporate Finance: DR C.Sivashanmugam. Dept. of Management Studies (PG) Sivashanmugam@pes - EduRU ShenoyNoch keine Bewertungen

- Time Value of MoneyDokument3 SeitenTime Value of MoneyMcQueen 18Noch keine Bewertungen

- Time Value of MoneyDokument17 SeitenTime Value of Moneyyolanda monikaNoch keine Bewertungen

- CH 03Dokument86 SeitenCH 03Ahsan AliNoch keine Bewertungen

- Time Value of MoneyDokument25 SeitenTime Value of MoneyJeffrey YoungNoch keine Bewertungen

- High-Q Financial Basics. Skills & Knowlwdge for Today's manVon EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manNoch keine Bewertungen

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!Von EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!Noch keine Bewertungen

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- SA-BU Launch Report FinalDokument30 SeitenSA-BU Launch Report FinalSerenityNoch keine Bewertungen

- Annual Report 2003 UKDokument32 SeitenAnnual Report 2003 UKmubashir_mm4uNoch keine Bewertungen

- Case Study IodineDokument3 SeitenCase Study Iodinemubashir_mm4uNoch keine Bewertungen

- Iodine DeficiencyDokument2 SeitenIodine Deficiencymubashir_mm4uNoch keine Bewertungen

- Negotiable Instruments Act, 1881Dokument25 SeitenNegotiable Instruments Act, 1881Deepak PatilNoch keine Bewertungen

- April JuneDokument15 SeitenApril JuneSanjivNoch keine Bewertungen

- International BankingDokument21 SeitenInternational BankingVarun Rauthan50% (2)

- Métodos Cuantitativos: Alex Contreras MirandaDokument23 SeitenMétodos Cuantitativos: Alex Contreras MirandaRafael BustamanteNoch keine Bewertungen

- High Tire PerformanceDokument8 SeitenHigh Tire PerformanceSofía MargaritaNoch keine Bewertungen

- Asian Private Banker, Edelweiss Wealth Management ProfilingDokument1 SeiteAsian Private Banker, Edelweiss Wealth Management Profilingrohith surukutlaNoch keine Bewertungen

- Chapter 04 Test Bank - StaticDokument13 SeitenChapter 04 Test Bank - StaticCaioGamaNoch keine Bewertungen

- Piggy Bank Primer Saving and Budgeting ActivityDokument36 SeitenPiggy Bank Primer Saving and Budgeting ActivityyeimyNoch keine Bewertungen

- CT1 QP 0506Dokument4 SeitenCT1 QP 0506Subhash KumarNoch keine Bewertungen

- CHAPTER-15 - Bank Reconciliation System Practical QuestionsDokument49 SeitenCHAPTER-15 - Bank Reconciliation System Practical QuestionsBHARAT MAHAN RAI 22BBA10031Noch keine Bewertungen

- Axis Triple Advantage Fund Application FormDokument8 SeitenAxis Triple Advantage Fund Application Formrkdgr87880Noch keine Bewertungen

- Damodaran - Trapped CashDokument5 SeitenDamodaran - Trapped CashAparajita SharmaNoch keine Bewertungen

- Financial Accounting Fundamentals 6th Edition Wild Solutions ManualDokument6 SeitenFinancial Accounting Fundamentals 6th Edition Wild Solutions ManualJeremyMitchellkgaxp100% (56)

- Joy 1Dokument27 SeitenJoy 1rp63337651Noch keine Bewertungen

- Financial Management PPT PresentationDokument52 SeitenFinancial Management PPT PresentationJadez Dela CruzNoch keine Bewertungen

- Feb 23 To Jan 24Dokument40 SeitenFeb 23 To Jan 24Next Media UKNoch keine Bewertungen

- TCS Rating Downgrade to BuyDokument12 SeitenTCS Rating Downgrade to BuyDinesh ChoudharyNoch keine Bewertungen

- P5 Formulae SheetDokument2 SeitenP5 Formulae Sheet21000021Noch keine Bewertungen

- 4.3 Q MiniCase Turkish Kriz (A)Dokument6 Seiten4.3 Q MiniCase Turkish Kriz (A)SanaFatimaNoch keine Bewertungen

- Form OC-10 Appl 4 FRNDokument51 SeitenForm OC-10 Appl 4 FRNBenne James100% (4)

- Attachments 71b8d55c 2019 June Statement PDFDokument5 SeitenAttachments 71b8d55c 2019 June Statement PDFMarianaNoch keine Bewertungen

- Asset RevaluationDokument6 SeitenAsset RevaluationAbdul Sameeu MohamedNoch keine Bewertungen

- Economics P1 Nov 2020 Memo EngDokument21 SeitenEconomics P1 Nov 2020 Memo EngBurning PhenomNoch keine Bewertungen

- Report Format - FFMDokument6 SeitenReport Format - FFMMuhammad MansoorNoch keine Bewertungen

- Preliminary ProspectusDokument229 SeitenPreliminary ProspectusSteve LadurantayeNoch keine Bewertungen

- Operating System of ICB Unit FundDokument58 SeitenOperating System of ICB Unit FundShahriar Zaman HridoyNoch keine Bewertungen

- PNB v. CA and Ramon LopezDokument2 SeitenPNB v. CA and Ramon LopezRebecca ChanNoch keine Bewertungen

- Structure and Mechanism of Corporate Governance in The Indian Banking SectorDokument7 SeitenStructure and Mechanism of Corporate Governance in The Indian Banking SectorIJAR JOURNALNoch keine Bewertungen

- Study Note 3, Page 148-196Dokument49 SeitenStudy Note 3, Page 148-196samstarmoonNoch keine Bewertungen

- Accounts.31.12.17.FinalDokument7 SeitenAccounts.31.12.17.FinalMileticoNoch keine Bewertungen