Beruflich Dokumente

Kultur Dokumente

Chapter 14 - Cash Flow Estimation and Capital Budgeting Decisions

Hochgeladen von

Jawad ButtOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 14 - Cash Flow Estimation and Capital Budgeting Decisions

Hochgeladen von

Jawad ButtCopyright:

Verfügbare Formate

Prepared by

Ken Hartviksen

INTRODUCTION TO

CORPORATE FINANCE

Laurence Booth W. Sean Cleary

Chapter 14 Cash Flow Estimation and

Capital Budgeting Decisions

CHAPTER 14

Cash Flow Estimation and

Capital Budgeting Decisions

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 3

Lecture Agenda

Learning Objectives

Important Terms

General Guidelines for Capital Project Analysis

Estimating and Discounting Cash Flows

Sensitivity to Inputs

Replacement Decisions

Inflation and Capital Budgeting Decisions

Summary and Conclusions

Concept Review Questions

Appendix 1 Company A

Appendix 2 Backus Distributing Limited

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 4

Learning Objectives

1. How to estimate the future cash flows associated with potential

investments

2. How to determine whether these investments are the result of

expansion or replacement decisions

3. How to conduct a sensitivity analysis to see how the value changes

as key inputs vary

4. Why real option valuation techniques have become an important

trend in project evaluation

5. How mistakes can easily be made in dealing with inflation

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 5

Important Chapter Terms

Capital cost (C

0

)

Decision tree

Ending (or terminal) after-

tax cash flow (ECF

n

)

Expansion projects

Expected annual after-tax

cash flows (CF

t

)

Externalities

Initial after-tax cash flow

(CF

0

)

Marginal or incremental

cash flows

NPV break-even point

Opportunity costs

Real option valuation (ROV)

Replacement projects

Salvage value (SV

n

)

Scenario analysis

Sensitivity analysis

Sunk costs

Relevant Cash Flows for Capital

Project Evaluation

Cash Flow Estimation and Capital

Budgeting Decisions

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 7

Cash Flows and Capital Budgeting

Introduction

Decisions are only as good as the information used

to make them.

This chapter focuses on approaches used to

estimate future cash flows associated with capital

project proposals

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 8

Project Evaluation Techniques

Required Information and Estimates

All evaluation approaches (NPV, IRR, Discounted Payback, and PI)

require the same data:

Estimate of initial cost (CF

0

)

Net incremental after-tax cash flows CFBT(1-T)

Cost of Capital (k)

Estimate of useful life (n)

Ending Cash flows (ECF

n

)

Corporate tax rate (T)

Capital Cost Allowance Rate (d)

This chapter provides you with guidelines for identifying relevant

information and testing the decisions sensitivities to variations in

those input variables.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 9

Cash Flows Estimation

General Guidelines

Cash flows should be:

1. After-tax

2. Incremental or marginal

3. Do not include interest or dividends

4. Adjust initial cash outlay and terminal cash flows for additional working

capital requirements

5. Treat sunk costs as irrelevant

6. Opportunity costs should be factored into the cash flow estimates

Determine the appropriate time horizon for the project

Ignore intangible considerations

Ignore externalities

Consider the effect of all project interdependencies on cash flow

estimates.

Treat inflation consistently

Undertake all social investments required by law.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 10

The Capital Budgeting Cash Flows

The Basic Cash Flow Pattern

The following slide graphically illustrates the basic

cash flow patterns involved in a capital project:

There is an initial investment at t = 0 (CF

0

)

There follows an annual stream of after-tax cash flow benefits

(CF

t

)

At the end of the useful life, ending cash flow benefits after tax

are received (ECF

n

)

) ( ) (

0

CF ECF PV CFs Annual PV NPV

n

+ = [ 14-5]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 11

The Capital Budgeting Cash Flows

The Basic Cash Flow Pattern

Initial After-

Tax Cash Flow

(CF

0

)

Expected Annual After-Tax Operating Cash Flows (CF

tt

)

t=1 2 3 n-1 n

CF

1

CF

2

CF

3

CF

N-1

CF

N

Terminal Cash

Flow (ECF

n

)

=

+

=

n

t

t

t

t

k

CF

CF of PV

1

) 1 (

If CF

0

< PV of

CF

t

, then

benefits

exceeds costs,

the NPV is

positive.

ACCEPT the

Project

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 12

The Capital Budgeting Cash Flows

Deconstructing the Basic Cash Flow Pattern

The basic cash flow pattern can be deconstructed

into:

Initial investment (CF

0

)

Annual stream of after-tax cash flows throughout the

project life (CF

t

)

Ending cash flows (ECF

n

)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 13

The Capital Budgeting Cash Flows

Deconstructing the Basic Cash Flow Pattern

CF

0

There is an initial investment at t = 0 (CF

0

) consists of:

C

0

the initial capital cost of the asset

NWC

0

the change in net working capital

OC the opportunity costs associated with the project

0 0 0

OC NWC C CF + A + =

[ 14-1]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 14

The Capital Budgeting Cash Flows

Deconstructing the Basic Cash Flow Pattern

CF

t

There follows an annual stream of after tax cash flow

benefits (CF

t

) consisting of:

Operating after-tax cash flow benefits (OCF

t

) = CFBT

t

(1 T)

Tax shield benefits from CCA

) ( ) 1 ( T CCA t CFBT CF

t t t

+ + =

[ 14-2]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 15

The Capital Budgeting Cash Flows

Deconstructing the Basic Cash Flow Pattern

ECF

n

At the end of the useful life, ending cash flow benefits received

(ECF

n

) in the absence of tax issues include:

SV

n

the estimated salvage value in year n for the asset purchased

NWC

n

the net working capital investment released at the end of

the project

NWC SV ECF

n n n

A + =

[ 14-4]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 16

The Capital Budgeting Cash Flows

Deconstructing the Basic Cash Flow Pattern

ECF

n

If there are tax issues the ECF

n

consists of:

SV

n

the estimated salvage value in year n for the asset purchased

NWC

n

the net working capital investment released at the end of

the project

Less any taxes payable on the salvage value (capital gains,

recapture of depreciation)

] ) -

T] 50 . 0 ) C - [( ns) Implicatio Tax With (

0

T UCC [(SV

SV NWC SV ECF

n n

n n n n

A + =

[ 14-3]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 17

The Capital Budgeting Cash Flows

Deconstructing the Basic Cash Flow Pattern

Putting It All Together

Once you have estimated the cash flows you must:

Determine their after-tax values

Discount them back to the present

Sum them in determining the NPV

(The following slide graphically illustrates the deconstructed cash flow pattern involved in a capital project)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 18

The Capital Budgeting Cash Flows

Deconstructing the Cash Flows

Initial After-

Tax Cash Flow

(CF

0

)

Expected Annual After-Tax Operating Cash Flows (excluding CCA Tax

Shield) (OCF

t

) = CFBT(1 T)

t=1 2 3 n-1 n

CF

1

CF

2

CF

3

CF

N-1

CF

N

Terminal Cash

Flow (ECF

n

)

CF

0

= C

0

+ NWC

0

+ OC

Expected Tax Shield Benefits from CCA deduction (CdT)

=

+

=

n

t

t

t

t

k

CF

CF of PV

1

) 1 (

Because the CCA

tax shield benefit

changes each year

in a predictable

fashion, we can

use a formula to

calculate their total

present value.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 19

Alternative Approaches to Finding the Tax

Shield Benefit on CCA

You will recall that there are two approaches to

determining cash flows.

We will use alternative (2) found on Table 14 1

This allows us to deconstruct the analysis,

separating operating cash flows from the tax shield

benefits of CCA.

(See the following slide)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 20

Determining Cash Flows after CCA

(1) Before-tax operating Income (OI) (2) Before-tax Operating Income (OI)

- CCA - Taxes payable on OI

Taxable Income After-tax OI

-Taxes Payable + CCA tax savings

After-tax Income Net Cash Flow

+ CCA (non-cash expense)

Net Cash Flow

Table 14 - 1 Two Ways to Determine Cash Flows After Capital Cost Allowance

Present Value of Tax Savings on

Capital Cost Allowance

Cash Flow Estimation and Capital

Budgeting Decisions

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 22

Separating Operating Cash Flows from

CCA Tax Shield Benefits

t=1 2 3 n-1 n

CF

1

CF

2

CF

3

CF

N-1

CF

N

Typically operating cash

flow benefits can be treated

as an annuity.

The CCA Tax Shield

benefits are a growing

perpetuity with a constant

negative growth rate.

The only exception to this

is the first cash flow. (This

is year rule effect.)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 23

Tax Shield Benefit of CCA

The tax shield benefit from CCA is equal to the corporate tax

rate (T) CCA amount.

As demonstrated in the following slide, assuming the firm will

have taxable operating income in the future, we can predict

the maximum amount of CCA the firm can claim from the year

of acquisition through to infinity.

You will note:

rule effect in the first year

We assume we claim the maximum CCA in each subsequent

year.

We forecast the tax shield benefit by: T CCA

t

Tax shield benefits will be a perpetual stream of cash flows that

are going a constant negative compound growth rate (d) where d

is the CCA rate

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 24

CCA Tax Shield Over Time

(Assume a corporate Tax Rate T of 40%)

Year UCC of pool Addition CCA @ 10% T(CCA)

1 0 100,000 5,000 2,000

2 95,000 0 9,500 3,800

3 85,500 0 8,550 3,420

4 76,950 0 7,695 3,078

5 69,255 0 6,926 2,770

6 62,330 0 6,233 2,493

7 56,097 0 5,610 2,244

8 50,487 0 5,049 2,019

9 45,438 0 4,544 1,818

$100,000 asset is acquired in year 1.

No asset pool disposals. CCA rate

(d) = 10%

Tax Shield = T(CCA)

Lets

graph

this

series of

tax

shield

benefits

the firm

is

forecast

to

receive.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 25

CCA Tax Shield Over Time

(A Graphical Representation)

0

500

1000

1500

2000

2500

3000

3500

4000

Tax Shield

1 3 5 7 9 11 13 15 17 19

Year

T(CCA) at 10% on $100,000

Asymptotic

Curve

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 26

Observations

In the foregoing you can now readily see:

CCA provides large tax shields in the early years of the

assets life

residual values remain in the pool long after the asset was

acquiredthis means that the firm will never fully recoup the

original cost of the asset as the firms asset base ages,

cash flows generated from CCA will not enable the firm to

replace the original asset.

Now we can learn how to find the present value of a perpetual

stream of forecast cash flows.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 27

Present Value of the CCA Tax Shield

(Assume a corporate Tax Rate T of 40% and Discount rate of 12%)

(1) (2) (3) (4) (5) (6) = (4) (5)

Year UCC of pool Addition CCA @ 10% T(CCA)

Present

Value

Factor at

12%

Present

Value

1 0 100,000 5,000 2,000 0.893 $1,786

2 95,000 0 9,500 3,800 0.797 3,029

3 85,500 0 8,550 3,420 0.712 2,434

4 76,950 0 7,695 3,078 0.636 1,956

5 69,255 0 6,926 2,770 0.567 1,572

6 62,330 0 6,233 2,493 0.507 1,263

7 56,097 0 5,610 2,244 0.452 1,015

8 50,487 0 5,049 2,019 0.404 816

Sum (1:8) = $13,871

This is the sum of the first 8 years of tax savingsit would be an infinitely

long process to find the actual sum of an infinite stream of cash flows.

We must develop a formula-based solution to this problem.

Multiplying T(CCA) by the PVIF we can estimate the present

value of the tax shield benefit for each year into the future.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 28

Present Value of the CCA Tax Shield

In Chapter 7 you learned about the constant growth DDM:

This model assumes the first dividend becomes the base

amount and all future cash flows grow at a constant

compound rate from t =1 through infinity:

g k

D

g k

g D

P

c c

=

+

=

1 0

0

) 1 (

[ 7-7]

o

o

) 1 (

) 1 (

...

) 1 (

) 1 (

) 1 (

) 1 (

0

2

2

0

1

1

0

0

c c c

k

g D

k

g D

k

g D

P

+

+

+ +

+

+

+

+

+

= [ 7-6]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 29

Present Value of the CCA Tax Shield

The constant growth DDM:

The Tax Shield benefit to CCA (ignoring the year rule for a

moment) is the same except:

Cash flow at time one is the CCA tax shield at t = 1 and is calculated as

(TdC

0

) this is the numerator

The growth is negative (declining balance) two negatives equal a

positive!

1

0

g k

D

P

c

=

) (

) )( )( (

) (

0 0

d k

dT C

d k

T d C

Shield Tax CCA PV

+

=

=

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 30

Present Value of Tax Savings Lost on

Salvage Value an ECF

We will use this version of the formula to calculate the

present value of tax savings lost on the salvage value of

the asset (when the net addition rule does not apply)

The PV of tax savings lost at time n =

) (

) )( )( (

d k

dT SV

d k

T d SV

Value Salvage on Lost Shield Tax CCA of PV

n n

n

+

=

=

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 31

Present Value of Tax Savings Lost on

Salvage Value an ECF

The PV of tax savings lost at time n =

The last step in finding the Present value of this amount is to

discount the value back to t = 0.

Sothe equation becomes:

) (

) )( )( (

1

d k

dT SV

d k

T d SV

Value Salvage on Lost Shield Tax CCA of PV

n n

n

+

=

=

k) (1

1

) 1 (

) (

) )( )( (

n 0

d k

dT SV

k

d k

T d SV

Value Salvage on Lost Shield Tax CCA of PV

n

n

n

+

+

=

+

=

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 32

Present Value of the Tax Savings on CCA

Assuming the Year Rule

Adjusting the Formula for the year Net Addition Rule

We multiply the first factor by (1+.5k) / (1+ k) to produce a formula

that will estimate the present value of tax savings from CCA (time 1

through infinity) assuming year net addition rule.

For a graphical depiction of this formula see the following slide.

1

5 0 1

) (

0

k

)k . (

d k

dT C

Shield Tax CCA PV

(

+

+

+

=

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 33

CCA Tax Shield Over Time

(A Graphical Representation)

0

500

1000

1500

2000

2500

3000

3500

4000

Tax Shield

1 3 5 7 9 11 13 15 17 19

Year

T(CCA) at 10% on $100,000

1

5 0 1

) (

0

k

)k . (

d k

dT C

Shield Tax CCA PV

(

+

+

+

=

This formula

calculations

the PV of tax

savings on

CCA from time

1 through

infinity

assuming the

year net

addition rule.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 34

Present Value of the Tax Savings on CCA

Adjusting for Year Rule An Example

We can now use the formula to solve for the present of the tax

savings on CCA for an asset that is never sold (no salvage value):

This formula assumes:

C

0

= $100,000 (Initial cost of a depreciable asset)

d = 10% (CCA rate)

k = 12% (Cost of capital or discount rate)

T = 40% (Corporate tax rate)

Notice the answer is greater than the spread sheet example ($13,871)

because the spreadsheet summed only the first 8 cash flows whereas the

formula finds the sum of the present values of the tax shield benefits for an

infinite stream.

27 . 207 , 17 $

12 . 1

06 . 1

22 .

000 , 4 $

12 . 1

) 12 (. 5 . 1

1 . 12 .

) 4 )(. 1 (. 000 , 100 $

1

5 0 1

) (

0

k

)k . (

d k

dT C

Shield Tax CCA PV = =

(

+

(

+

=

(

+

+

+

=

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 35

Formula for PV of Tax Savings on CCA

Assuming a Salvage Value at t = n

Finally we can incorporate planned disposal of the

asset we will acquire.

Disposal value is the salvage value (SV) at t = n

(See the following two slides for graphical depiction of the effect of a salvage value)

) 1 (

1

) (

) )( )( (

) 1 (

) 5 . 0 1 ( ) )( )( (

) (

0

k k d

T d SV

k

k

k d

T d C

Shield Tax CCA PV

n

n

+

+

+

+

=

[ 14-7]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 36

CCA Tax Shield Over Time

(A Graphical Representation)

0

500

1000

1500

2000

2500

3000

3500

4000

Tax Shield

1 3 5 7 9 11 13 15 17 19

Year

T(CCA) at 10% on $100,000 By selling the

asset after the end

of the 10

th

fiscal

year, we lose CCA

in years 11

through infinity.

( )

1

1

) (

0

k d k

dT SV

SV on Lost Savings Tax CCA PV

n

n

(

+

=

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 37

CCA Tax Shield Over Time

(A Graphical Representation)

0

500

1000

1500

2000

2500

3000

3500

4000

Tax Shield

1 3 5 7 9 11 13 15 17 19

Year

T(CCA) at 10% on $100,000

( )

1

1

) 1 (

) 5 . 1 (

) (

0

0

k d k

dT SV

k

k

d k

dT C

Savings Tax CCA PV

n

n

(

+

+

+

=

We subtract the

PV of tax savings

lost on the

Salvage Value

from the PV of tax

saving from t = 1

through infinity to

get the PV of tax

savings benefits

years 1 10.

Operating Cash Flows

Cash Flow Estimation and Capital

Budgeting Decisions

CFBT

t

(1-T)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 39

Expected Annual After-Tax Cash Flows

(CF

t

)

As illustrated in Equation 14 2 expected Annual

After-Tax Cash Flows are:

The cash flows that are estimated to occur as a result of the

investment decision, comprising

the associated expected incremental increase in after-tax

operating income and

Any incremental tax savings (or additional taxes paid) that result

from the initial investment outlay.

) ( ) 1 ( T CCA t CFBT CF

t t t

+ + =

[ 14-2]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 40

Forecasting Expected Annual After-Tax

Cash Flows (CF

t

)

Example 14 - 2 from your text

Approach 1

Year 1 Year 2 Year 3 Year 4 Year 5

Operating Income $125,000 $125,000 $125,000 $125,000 $125,000

- CCA Expense -97,500 -165,750 -116,025 -81,218 -56,852

Taxable Income $27,500 -$40,750 $8,975 $43,782 $68,148

- Taxes payable @ 45% 12,375 -18,338 4,039 19,702 30,667

After-tax income $15,125 -$22,413 $4,936 $24,080 $37,481

+ CCA expense $97,500 $165,750 $116,025 $81,218 $56,852

Net cash flow $112,625 $143,338 $120,961 $105,298 $94,333

Approach 2

Year 1 Year 2 Year 3 Year 4 Year 5

Operating Income $125,000 $125,000 $125,000 $125,000 $125,000

- Taxes Payable on Operating

income @ 45% 56250 56250 56250 56250 56250

After-tax Operating Income $68,750 $68,750 $68,750 $68,750 $68,750

+ CCA tax savings (CCA * T) 43,875 74,588 52,211 36,548 25,583

Net cash flow $112,625 $143,338 $120,961 $105,298 $94,333

Spreadsheets

can be useful in

making detailed

forecasts of the

incremental

operating cost

and benefits

associated with

the project.

Operating

cash flows are

an annuity

where as net

cash flow is

not.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 41

Decomposing Expected Annual After-Tax

Cash Flows (CF

t

)

We have already seen that since the CCA tax

shield (CCA

t

)(T) changes each year and potentially

involve an infinite series, we separately calculate

its present value using a formula.

) ( ) 1 ( T CCA t CFBT CF

t t t

+ + =

[ 14-2]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 42

Decomposing Expected Annual After-Tax

Cash Flows (CF

t

)

Since the operating cash flow benefits after-tax are

often equal each year, we can find their present

value simply using the Present Value Factor of an

Annuity:

) 1 (

1

1

) 1 ( ) (

k

k

T CFBT Flows Cash Operating PV

n

(

(

(

(

=

[ 14-6]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 43

Decomposing Expected Annual After-Tax Cash

Flows (CF

t

)

Example of the PV of the Operating Cash Flow Annuity

Using Example 14 2:

Operating income

excluding CCA before tax =

$125,000

Tax rate = 45%

Useful life = 5 years

Discount rate (k) = 10%

The present vale of the

operating income annuity =

616 , 260 $ 7908 . 3 750 , 68 $

.1

(1.1)

1

- 1

.45) - $125,000(1

) 1 (

1

1

) 1 ( ) (

5

= =

(

(

(

(

=

(

(

(

(

=

k

k

T CFBT Flows Cash Operating PV

n

Ending (or Terminal) Cash Flows

Cash Flow Estimation and Capital

Budgeting Decisions

ECF

n

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 45

Ending (or Terminal) After-Tax Cash

Flows (ECF

n

)

Ending cash flows include:

Salvage value of the asset (SV

n

)

Recovery of the net investment in working capital (NWC

n

)

Less any taxes payable in the event of a capital gain on the sale of the

asset or a recapture of depreciation.

] ) -

T] 50 . 0 ) C - [( ns) Implicatio Tax With (

0

T UCC [(SV

SV NWC SV ECF

n n

n n n n

A + =

[ 14-3]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 46

CCA Tax Shield with a Recapture of

Depreciation

Equation 14 -8 Is used when the salvage value of the asset is

greater than the UCC of the pool of assets at the time of disposal.

A recapture of depreciation must be included in income in the year it

occurs and is subject to tax at the firms tax rate (T )

) 1 (

) )( (

) 1 (

1

) (

) )( )( (

) 1 (

) 5 . 0 1 ( ) )( )( (

) (

0

k

T UCC SV

k k d

T d SV

k

k

k d

T d C

Shield Tax CCA PV

n

n n

n

n

+

+

+

+

=

[ 14-8]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 47

Capital Gain on Asset Disposal

Equation 14 9 is used when you expect to sell the asset for a price

that is greater than its original cost.

The difference between the SV and C

0

is the capital gain.

50% of a realized capital gain is subject to tax at the corporate tax

rate (T )

) 1 (

) )( 5 )(. (

) (

0

k

T C SV

Paid Taxes Gains Capital PV

n

n

+

=

[ 14-9]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 48

NPV Using the Decomposed

Components

Equation 14 10 show how the decomposed components are

recombined to determine the projects NPV.

Remember NPV =

+ Present value of after-tax operating cash flows

+ Present value of CCA tax shield

+ Present value of the salvage value (ECF)

+ Present value of the recovery of net working capital investment (ECF)

- Taxes payable on realized capital gain and/or recapture of depreciation (ECF)

- Initial investment in the asset (CF

0

)

- Initial investment in net working capital (CF

0

)

) (

) ( ) ( ) (

0

CF Paid Taxes Gains Capital PV

ECF PV Shield Tax CCA PV CFs Operating PV NPV

n

+ + =

[ 14-10]

Sensitivity of Decision to Input

Variables

Cash Flow Estimation and Capital

Budgeting Decisions

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 50

Sensitivity to Inputs

Sensitivity Analysis

Stress testing NPV models to determine the

sensitivity of the decision to input variables is an

important part of risk assessment.

There are two common approaches:

Sensitivity analysis

Scenario Analysis

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 51

Sensitivity to Inputs

Sensitivity Analysis

Sensitivity analysis is an examination of how an

investments NPV changes as the value of one input

at a time is changed.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 52

Sensitivity to Inputs

Scenario Analysis

Scenario analysis is an examination of how an investments

NPV changes in response to varying scenarios in terms of one

or more estimates, such as sales or costs.

Input variables are often given discrete forecast ranges:

Best case

Most likely

Worst case

The analyst will be interested in what the NPV might be in the

worst combination of cases for example:

Worst case operating cash flows (low)

Worst case initial cost (high)

Worst case new working capital investment (high)

Real Option Valuation (ROV)

Cash Flow Estimation and Capital

Budgeting Decisions

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 54

Sensitivity to Inputs

Real Option Valuation (ROV)

ROV and decision tree analysis have dramatically increased understanding of

corporate decision-making and the value of flexibility and strategic

considerations.

Decision trees are a schematic way to represent alternative decisions and the

possible outcomes.

Table 14 -2 (next slide) gives a real options example of three alternative ore-

price scenarios for a mine. (The most important variable in mining projects).

This table illustrates that the highest expected cash flows occur when ore

prices are most volatile (have the greatest range of prices).

This illustrates an option that is often overlooked in traditional project

analysisthe possibility of shutting down the mine when prices make it

uneconomic. (Remember, the mine can be returned to production when

economic conditions turn more favourable.)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 55

Real Option Valuation (ROV)

Comparing NPV and IRR

Scenario 1:

Ore Price

$12 or $8

Scenario 2:

Ore Price

$14 or $6

Scenario 2:

Ore Price

$14 or $6

Good price (=.5) $12 $14 $16

Cash Flow $400 $600 $800

Bad price (=.5) $8 $6 $4

Cash Flow $0 -$200 -$200

Expected cash flow $200 $200 $300

Table 14 - 2 Real Options Example

NPV Break-Even Analysis

Cash Flow Estimation and Capital

Budgeting Decisions

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 57

Sensitivity to Inputs

NPV Break-Even Analysis

Operating Cash Flow NPV Break-even Point

Solving for the annual operating after-tax cash

flows that cause NPV = 0.

PV (Operating CFs) is the source of value creation

The most important part of the viability analysis.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 58

Sensitivity to Inputs

Operating Cash Flow NPV Break-Even Point

Example:

CF

0

= $100,000

PV(CCA Tax Shield) = $20,453

PV(ECF

n

) = $12,834

Approach:

Set NPV = 0 and solve for the

PV of the operating CF

s

:

Now solve for the annual after-

tax CF

Conclusion:

The operating cash flows could

fall to $10,770 without

destroying value.

Now the decision makers can

assess the threats to this key

forecast and determine the

likelihood of this occurring.

713 , 66 $ ) (

000 , 100 $ 834 , 12 $ 453 , 20 $ ) ( 00 . 0 $

) ( ) ( ) (

0

=

+ + =

+ + =

CFs Operating PV

CFs Operating PV

CF ECF PV Shield Tax CCA PV CFs Operating PV NPV

n

770 , 10 $

) 194374 . 6 ( ] [ 713 , 66 $

12 . 0

) 12 . 1 (

1

1

] [ ) (

12

=

=

=

CF Operating even Break

CF Operating even Break

CF Operating even Break CFs Operating PV

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 59

Sensitivity to Inputs

Operating Cash Flow NPV Break-Even Point

NPV

$

$20,000

Operating Cash Flow

Break-even cash flow

0

$50,000 $40,000 $30,000 $20,000 $10,000 $0

It is possible to vary the cash

flow assumptions and test

the sensitivity of NPV to

those changes.

NPV is the dependent

variable.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 60

Sensitivity to Inputs

NPV Break-Even Discount Rate

Break Even Discount Rate

IRR of the project

NPV profile illustrates the range of discount rates

that produce a positive NPV.

(See the following two slides as a review of NPV profiles from Chapter 13)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 61

Sensitivity to Inputs

NPV Break-Even Discount Rate

NPV

$

$260,000

Discount Rate (%)

IRR = 55.8%

0

0% 5% 10% 20% 40% 50% 60%

Required rates of return

can change if:

The general level of

interest rates rise in

the economy, or

The risk of the project

increases.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 62

Sensitivity to Inputs

NPV Break-Even Discount Rate

NPV

$

$260,000

$146,684

Discount Rate (%)

IRR = 55.8%

0

0% 5% 10% 20% 40% 50% 60%

Even if your estimate of the

projects required return (RADR)

is wrong, the projects NPV

remains positive over a wide

range of values for k (from 0% to

55%)

Expansion and Replacement Decisions

Cash Flow Estimation and Capital

Budgeting Decisions

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 64

Expansion Decisions

Expansion projects add something extra to the firm in

terms of sales or cost savings.

Their new cash flows are incremental cash flows.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 65

Replacement Decisions

Involve the replacement of an existing asset (or

assets) with a new one.

In such cases we must clearly identify the

incremental cash flows paying particular attention to:

The effect on the incremental capital cost (C

0

)

The effect on the CCA tax shield

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 66

Replacement Decisions

Incremental Capital Cost

Incremental Capital Cost (C

0

) = the difference between

the purchase price of the new equipment and the

salvage price of the old machine.

The equipment to be replaced is normally sold. Normally there are

no tax consequences on disposal, except when assets are sold

at a price greater than their original cost (which triggers capital

gains taxes on the difference)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 67

Replacement Decisions

Effects on Capital Cost Allowance Tax Shield

When an asset is removed from the Capital Cost Allowance Class:

There is no CCA in the year of disposal

The UCC of the pool/class is reduced by the disposal value

When an asset is added to the Capital Cost Allowance Class:

There is of the normal CCA on the net additions to the pool in

that year

The UCC of the pool is increased by half of the net addition in the

first year, and half of the net additions in the second year.

In replacement decisions we must modify the PV of Tax Shield

formula to account for the change () in C

0

and () in SV

(See the following slide for the new formula)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 68

Replacement Decisions

Effects on Capital Cost Allowance Tax Shield

) 1 (

1

) (

) )( )( (

) 1 (

) 5 . 0 1 ( ) )( )( (

) (

0

k k d

T d SV

k

k

k d

T d C

Shield Tax CCA PV

n

n

(

+

A

+

+

+

A

= A

The replacement of old with new results in a change

in the tax shield and affects both the net cost of the

new as well as the salvage value.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 69

Replacement Decisions

Simple Example Ignoring CCA Formula Approach

Problem:

Cost of new machine =

$12,000

Disposal value of old

machine = $2,000

After-tax cash flow benefits:

Year 1 = $5,000

Year 2 = $5,000

Year 3 = $8,000

Discount rate (k) = 15% 389 , 3 $

000 , 10 $ 260 , 6 $ 781 , 3 $ 348 , 4 $

) 000 , 2 $ 000 , 12 ($

) 15 . 1 (

000 , 8 $

) 15 . 1 (

000 , 5 $

) 15 . 1 (

000 , 5 $

) 1 ( ) 1 ( ) 1 (

3 2 1

0

3

3

2

2

1

1

=

+ + =

+ + =

A

+

+

+

+

+

= C

k

CF

k

CF

k

CF

NPV

Incremental

capital cost is

the price of the

new machine

less the price of

the old.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 70

Replacement Decisions

Simple Example Ignoring CCA Formula Approach

Incremental Cost (new-old) = $10,000

Cost of Capital = 15.0%

Year Cashflow

After-tax

incremental CF PV Factor

Present

Value

0 Initial cost -$10,000 1 -$10,000

1 ATCF operating benefit 5,000 0.869565 $4,348

2 ATCF operating benefit 5,000 0.756144 $3,781

3 ATCF operating benefit 8,000 0.657516 $5,260

NPV = $3,389

Problem:

Cost of new machine = $12,000

Disposal value of old machine =

$2,000

After-tax cash flow benefits:

Year 1 = $5,000

Year 2 = $5,000

Year 3 = $8,000

Discount rate (k) = 15%

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 71

Replacement Decisions

The Formula Approach

The deconstructed NPV model can be used in

replacement decisions.

Again, in replacement decisions, the focus in on the net

change in operating cash flows, net change in CCA tax

shield, and net changes in ending and initial cash flows.

) ( ) ( ) (

0

CF ECF PV Shield Tax CCA PV CFs Operating PV NPV

n

A A + A + A =

Inflation and Capital Budgeting

Cash Flow Estimation and Capital

Budgeting Decisions

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 73

Inflation and Capital Budgeting Decisions

The Impact of Inflation

Even small rates of inflation over time can have considerable

effects on the economic viability of a project.

Although inflation is often measured by aggregate changes

in prices at the retail (CPI consumer price index) or

wholesale level, these measures often do not reflect price

changes specific to one company or one project.

Inflation MUST be treated consistently in our project

evaluation models (NPV, IRR, PI)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 74

Inflation and Capital Budgeting Decisions

Two Basic Approaches

Inflation can be consistently incorporated by:

1. Removing it from the nominal discount rate and

using nominal cash flow forecasts

2. Leaving the discount rate with an expected inflation

component and estimating real (inflation-adjusted)

cash flows

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 75

Inflation and Capital Budgeting Decisions

Removing Expected Inflation from the Discount Rate

As illustrated on the following slide, all discount rates used

have embedded into them, an expected rate of inflation.

If we use non-inflation adjusted cash flow forecasts, and

then discount using a nominal discount rate, we are over

discounting because we are using a higher ratebut not

using inflated forecast cash flows.

You can use the Fisher equation to estimate the embedded

inflationary expectations, and then reduce the nominal

discount rate by that amount.

Then you are free to discount nominal cash flows.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 76

Risk Adjusted Discount Rates

Using the CAPM

Market

= 1

Required

Return

RF

M

ER

M

Proj ect Proj ect

) ( | RF ER RF k

M

+ =

Project

=

1.5

ER

Project

Risk Premium

for project

systematic risk

Real rate of return

Premium for expected inflation

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 77

Required Rates of Return (RADR)

Components

The risk-free rate is

equal to the real rate of

return plus expected

inflation (Fisher

Equation)

The risk premium is

based on an estimate of

the risk associated with

the project.

Premium Risk RF+ = RADR

Beta of the

Project

Required

Return (%)

RF

Risk

Risk Adjusted

Discount

Rate

Risk

Premium

Real Return

Expected Inflation Rate

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 78

Inflation and Capital Budgeting Decisions

The Inflation Adjustment Process

The key thing to remember is:

If you use WACC unadjusted, then you must use

inflation-adjusted cash flow estimates for operating

cash flows

If you remove inflation from the discount rate

(WACC), you can use nominal cash flow estimates.

The key is consistency!

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 79

Summary and Conclusions

In this chapter you have learned:

Several approaches and guidelines for estimating future

cash flows associated with an investment

The equations used to estimate the present value of

future cash flows

How to differentiate between expansion and replacement

decisions

How to use sensitivity analysis, scenario analysis, what-if

decision tree analysis and NPV break-even analysis.

How to incorporate inflation into capital budgeting analysis.

Concept Review Questions

Cash Flow Estimation and Capital

Budgeting Decisions

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 81

Concept Review Question 1

Treatment of Taxes and Inflation

How should we treat taxes and inflation when

determining the present value of future cash flows?

Company A

An Example of NPV Decomposition, Capital Cost Allowance and

Taxation Issues on Ending Cash Flows (ECF

n

)

APPENDIX 1

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 83

Company A

The Given Information

Company A Limited is considering an investment with an initial cost of

$200,000 that will yield the following incremental before-tax and depreciation

operating cash flows benefits of:

Year Cash flows

1 $50,000

2 $60,000

3 $70,000

4 $80,000

5 $100,000

The firm will sell this depreciable asset at the beginning of year six for $20,000

and this asset is the only one in the undepreciated capital cost pool. The UCC

of the pool at the time of asset acquisition is $0.00. The company faces a tax

rate of 45%, its cost of capital is 12%, and the capital cost allowance rate for

this pool is 20%.

Calculate the project's NPV.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 84

Company A

Issues Arising from the Given Information

Uneven Operating Cash Flows

When the cash flow benefits are not equal over time they must

be discounted separately.

Terminal Loss Possibility

Whenever you sell the last asset in an asset class there is the

possibility of a terminal loss benefit to the firm.

Need to Forecast Ending UCC

You need to forecast ending UCC of the pool so that it can be

compared to the forecast salvage value to determine whether a

recapture or terminal loss is to occur.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 85

Company A

Issues Arising from the Given Information

Timing of Asset Disposal

Management usually has some control over the timing of the sale of an asset.

It does NOT make sense to sell the asset immediately BEFORE the firms

fiscal year end (ie. t = 5 )

Management would wait until the first day of t = 6 and then sell the asset so

that they can receive the tax shield benefit of the last year of CCA.

For analysis purposes, then we still would use t = 5, not t = 6, because the

first day of the 6

th

fiscal year is very close to the end of year 5.

Timing of Terminal Loss Benefit

The asset may be sold at the beginning of the 5

th

year, but the company wont

file its income tax return until the end of the year. It is at that time the

company would realize its tax shield benefit from the terminal loss.

This fact affects the discount rate we use to find the present value of the

Terminal Loss Tax Shield Benefit.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 86

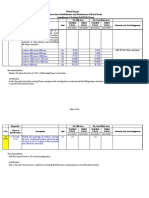

Company A

Present Value of Tax Savings on CCA Spreadsheet Approach

Capital Cost Allowance Schedule

CCA rate = 20.0%

Tax Savings PVIF @ Present Value

Year UCC CCA on CCA 12.0% Tax Savings

1 $200,000 $20,000 $9,000 0.892857 $8,036

2 180,000 36,000 16,200 0.797194 12,915

3 144,000 28,800 12,960 0.71178 9,225

4 115,200 23,040 10,368 0.635518 6,589

5 92,160 18,432 8,294 0.567427 4,706

6 73,728 PV of Tax Savings on CCA = $41,470

Terminal loss = $53,728

UCC

6

is the

forecast

undepreciated

capital cost at

the beginning

of the 6

th

year

when the asset

is likely to be

sold.

The estimated salvage value (SV) is only $20,000. When

subtracted from the $73,728 UCC of the pool, this leaves

$53,728 to be a non-cash deduction (written off for tax

purposes.) The after-tax benefit the company will receive

= terminal loss T .

The sum of the present value of

the tax savings on CCA (T

CCA

t

) = $41,470.

Later slides will confirm this

value by way of formula.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 87

Company A

Finding Ending UCC

You can always do a detailed table to finding ending UCC given

the assumption of maximum use of available CCA in each

year

However, you can also use a formula:

728 , 73 $

) 4096 )(. 9 (. 000 , 200 $

) 8 )(. 9 (. 000 , 200 $

) 2 . 1 )(

2

2 .

1 ( 000 , 200 $

) 1 )(

2

1 (

5

5

4

5

1 5

5

1

0

=

=

=

=

=

UCC

UCC

UCC

UCC

d

d

C UCC

n

n

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 88

Company A

Present Value of Tax Savings on CCA Formula Approach

When you dispose of the last asset, (you subtract the salvage value

from the UCC of the pool at the time of sale) if a balance remains in the

pool, this is called a terminal loss and can be used as a non-cash

deduction.

When calculating the PV of Tax Savings on CCA you must modify the

formula for this fact (the fact that the UCC of the pool will be reduced to

zero because of the terminal loss)

Please confirm that the formula results in the same answer found in the

spreadsheet approach:

| | | |

$41,470

61 . 765 , 11 $ 58 . 236 , 53 $

5674 . 0 736 , 20 $ 946428 .

.32

$18,000

) 12 . 1 (

1

.32

)(.45) $73,728(.2

-

12 . 1

06 . 1

.12 .2

(.2)(.45) ($200,000)

) 1 (

1

) (

) )( )( (

) 1 (

) 5 . 0 1 ( ) )( )( (

) (

5

0

=

=

(

+

=

+

+

+

+

=

n

n

k k d

T d UCC

k

k

k d

T d C

Shield Tax CCA PV

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 89

Company A

Present Value of Tax Savings on CCA Formula Approach

When you dispose of the last asset, (you subtract the salvage value

from the UCC of the pool at the time of sale) if a balance remains in the

pool, this is called a terminal loss and can be used as a non-cash

deduction.

When calculating the PV of Tax Savings on CCA you must modify the

formula for this fact (the fact that the UCC of the pool will be reduced to

zero because of the terminal loss)

Please confirm that the formula results in the same answer found in the

spreadsheet approach:

| |

58 . 236 , 53 $

946428 .

.32

$18,000

12 . 1

06 . 1

.12 .2

(.2)(.45) ($200,000)

) 1 (

) 5 . 0 1 ( ) )( )( (

) (

0

=

=

(

+

=

+

+

+

=

k

k

k d

T d C

Shield Tax CCA PV

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 90

Company A

Spreadsheet Solution

Company A

Corporate Tax Rate = 45.0%

Cost of Capital = 12.0%

CCA rate = 20.0%

PVIF @ Present

Year Type of Cash Flow BTCF ATCF 12.0% Value

0 Initial Cost -$200,000 1 -$200,000

1 Operating Cash Flow Benefits $50,000 27,500 0.892857 24,554

2 60,000 33,000 0.797194 26,307

3 70,000 38,500 0.71178 27,404

4 80,000 44,000 0.635518 27,963

5 100,000 55,000 0.567427 31,208

1-infinity Present Value of Tax Shield on CCA 53,237 41,470

5 Present Value of Tax Savings lost on disposal of asset -20,736 0.567427 -11,766

5 Salvage Value of the Asset 20,000 0.567427 11,349

6 Terminal Loss Benefit 24,178 0.506631 12,249

NPV = $2,504

| |

58 . 236 , 53 $

946428 .

.32

$18,000

12 . 1

06 . 1

.12 .2

(.2)(.45) ($200,000)

) 1 (

) 5 . 0 1 ( ) )( )( (

) infinity through 1 years Shield Tax CCA (

0

=

=

(

+

=

+

+

+

=

k

k

k d

T d C

PV

| |

61 . 765 , 11 $

5674 . 0 736 , 20 $

) 12 . 1 (

1

.32

)(.45) $73,728(.2

) 1 (

1

) (

) )( )( (

UCC use we so off written is class asset whole the :

) infinity through 6 years sale asset of because lost Shield Tax CCA (

5

pool

=

=

=

+

+

=

n

n

k k d

T d UCC

NOTE

PV

There are no tax implications for the

salvage value because the asset is sold

for a price less than its original cost (ie.

No capital gain) and less than the UCC

pool

(ie. No recapture of depreciation).

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 91

Company A

Summary

In this example you learned:

How to set up a spreadsheet model to solve for a decomposed

Net Present Value.

How to discount an uneven stream of operating cash flow

benefits before tax.

How to identify a terminal loss and how the terminal loss will

result in a tax shield benefit as part of the ECF

n

How to calculate the present value of tax savings on a finite

stream of CCA deductions.

How a terminal loss results in a complete write off the UCC in a

pool.

BACKUS DISTRIBUTING LIMITED

An Comprehensive Example of NPV Decomposition involving

Acquisition of Multiple Assets for a Project together with CCA,

Identification of relevant costs, Net Working Capital Investment and

Taxation Issues on Ending Cash Flows (ECF

n

) Inflation

Adjustment is Required in a Risk-Adjusted Discount Rate Setting

APPENDIX 2

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 93

Backus Distributing Limited

The Given Information

Backus Distributing Limited is considering an investment project that involves

the establishment of a new regional distribution warehouse in Saskatoon to

serve western Canada. The firm holds land in that city. This land was

purchased for $250,000 five years ago for a new retail outlet, but because of

economic factors and poor location that project never started. Today, the firm

could sell the land for $800,000.

The warehouse project would also require construction of a building and

installation of equipment for $300,000 and $120,000 respectively. The firm

expects that once the project is up and running, it will have to maintain a

greater investment in accounts receivable and inventories that will average

$75,000 throughout the projects life.

This project is riskier than the firm as a whole and management prefers to use

risk-adjusted discount rates when considering such projects.

Other data pertaining to this project is summarized in the table on the

following slide:

Calculate the project's NPV.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 94

Backus Distributing Limited

The Warehouse Project Information

Land Building Equipment

Net Working

Capital

Acquisition/Asset Data:

Initial Cost to be determined $300,000 $120,000 $75,000

CCA Class n/a 1 8 n/a

CCA Rate (d) 4.0% 20.0%

UCC

beginning

(before acquisition) n/a $3,533,230 $40,000 n/a

Number of assets in asset class 0 5 12 n/a

Estimated salvage value (SV) at the end of the useful life $1,200,000 $200,000 $100,000

Operating Cash Flow Data:

Annual net operating cash flow benefits before-tax = $850,000

Useful life of the project (years) = 10

Beta Coefficient for the project = 1.85

Overall Corporate Data:

Corporate Tax Rate (T) = 40.0%

Cost of Capital = 8.5%

Market Data:

Real rate of return demanded by investors = 2.6%

Current yield on 91-day Government of Canada Treasury Bills = 4.6%

Market premium for risk = 4.0%

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 95

Backus Distributing Limited

Issues Arising from the Given Information

Equal Annual Operating Cash Flows

Use an annuity formula to quickly determine the present value of the

after-tax cash flows (BTCF (1 T))

Treatment of Land

Land is not a depreciable asset for tax purposes.

Land often is expected to appreciate in value and can lead to capital

gains on disposal.

Initial Cost of the Land

An appropriate cost for the land is part of the initial cash flow for the

project (CF

0

).

The original cost of the land of $250,000 is a sunk cost and is

therefore not relevant.

The fact that the land can now be sold for $800,000 is an opportunity

cost (OC) and is relevant to this decision.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 96

Backus Distributing Limited

Issues Arising from the Given Information

Risk-Adjusted Discount Rate

The CAPM formula to determine investors required

rate of return given the risk-free rate (RF), the

market premium for risk and the project beta.

Inflation Adjustment

Operating cash flows are expressed in nominal

terms

It is necessary to remove the expected rate of

inflation from the RADR.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 97

Backus Distributing Limited

Issues Arising from the Given Information

Ending Cash Flow Issues

Recapture of depreciation might be expected in the case of the

equipment given the low balance in beginning UCC of the pool,

and the high CCA rate, and the 10 year life of the project.

No terminal losses should be expected because each

depreciable asset class has numerous other assets in the

class.

Recapture is unlikely in the building asset class because of the

high starting balance and the low rate of CCA.

Capital gains on sale of land will be the difference between

selling price and original cost (not selling price less opportunity

cost)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 98

Backus Distributing Limited

Issues Arising from the Given Information

Treatment of Net Working Capital Investment

Working capital is not a depreciable investment.

The cost of the working capital investment is an

initial cash flow (CF

0

) that will be recovered in

nominal terms at t = n = 10 years.

Risk Assessment

How strong is the NPV?

Looking at the decomposed costs and benefits for

this project, which factors are most critical in

ensuring a positive NPV?

As a manager how would you monitor / manage

these factors?

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 99

The Backus Distributing Limited

Challenge

This project is an excellent example of the

application of the principles covered in Chapter 14.

Use this as a challenge exercise or hand-in

assignment problem.

The following slides gives you a structure to start

with in solving this problem.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 100

Estimating the Required Return on the

Warehouse Project

Using the CAPM, the required rate of return on a project I is a

function of the risk-free rate of return (RF) and market premium for

risk (ER

M

RF) and the systematic risk of the project (Beta

Coefficient)

We use equation 9 to solve for k

i

:

Because the projects risk significantly different from that of the firm

as a whole (much greater) we will use the RADR rather than WACC.

% 0 . 12

% 4 . 7 % 6 . 4

85 . 1 %) 4 ( % 6 . 4

) (

=

+ =

+ =

+ =

i

i

i

i M i

k

k

k

RF ER RF k |

[9-9]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 101

Determining the Expected Rate of

Inflation

The Fisher Equation from Chapter 6 allows us to estimate the

expected inflation premium that is incorporated in the risk-free rate

of return (Yield on 91-day Treasury Bills)

The market information we have been given is that

the RF (yield on 91-day T-bills) is 4.6%

Real rate of return demanded by investors is 2.5%

The implicit rate of inflation embedded in these relationships is:

2.0% 2.6% - 4.6% inflation Expected

inflation Expected 2.6% 4.6%

inflation Expected rate Real RF

= =

+ =

+ =

[ 6-5]

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 102

Adjusting the Required Return for

Expected Inflation

With expected inflation at 2.0% and RADR = 12%

(determined in the previous slides) is the nominal

rate, our inflation-adjusted (relevant) discount rate

is:

10% 2% - 12%

inflation - RADR Rate Discount adjusted - Inflation

= =

=

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 103

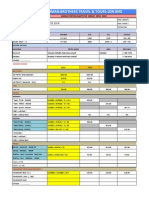

Backus Distributing Limited

Spreadsheet Solution Initial Cash Flows (CF

0

)

Backus Distributing Limited

Warehouse Project Proposal

Corporate Tax Rate = 40.0%

Inflation-adjusted risk-adjusted discount rate = 10.0%

CCA rate for Class 1 Asset (building) = 4.0%

CCA rate for Class 8 Asset (equipment) = 20.0%

Present

Value

Factor @ Present

Year Type of Cash Flow BTCF ATCF 10.0% Value

Initial Cash Flows (CF

0

)

0 Opportunity cost of the land -$800,000 1 -$800,000

0 Cost of Building -300,000 1 -300,000

0 Cost of Equipment -120,000 1 -120,000

0 Investment in Working Capital -75,000 1 -75,000

TOTAL CF

0

= -$1,295,000

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 104

Backus Distributing Limited

Spreadsheet Solution Operating Cash Flows (CF

n

)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 105

Backus Distributing Limited

Spreadsheet Solution Net CCA Tax Shield Cash Flow Benefits

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 106

Backus Distributing Limited

Spreadsheet Solution Ending Cash Flows (EF

n

)

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 107

Backus Distributing Limited

Spreadsheet Solution Net Present Value

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 108

Backus Distributing Limited

Summary

In this comprehensive example you learned:

How to set up a spreadsheet model to solve for a decomposed Net

Present Value.

How to discount an annuity of operating cash flow benefits before tax.

How to identify a recapture of depreciation and how the recapture will

result in a tax liability as part of the CF

n

How to calculate the present value of tax savings on a finite stream of

CCA deductions in two different asset classes and incorporate into the

NPV framework.

How to identify relevant costs.

How to estimate a risk-adjusted discount rate.

How to incorporate inflation into an NPV analysis.

How to incorporate net working capital investment into a NPV model.

CHAPTER 14 Cash Flow Estimation and Capital Budgeting

Decisions

14 - 109

Copyright

Copyright 2007 John Wiley & Sons

Canada, Ltd. All rights reserved.

Reproduction or translation of this work

beyond that permitted by Access

Copyright (the Canadian copyright

licensing agency) is unlawful. Requests

for further information should be

addressed to the Permissions

Department, John Wiley & Sons Canada,

Ltd. The purchaser may make back-up

copies for his or her own use only and

not for distribution or resale. The author

and the publisher assume no

responsibility for errors, omissions, or

damages caused by the use of these files

or programs or from the use of the

information contained herein.

Das könnte Ihnen auch gefallen

- AAC Plant OpEx and CapEx Rev2Dokument8 SeitenAAC Plant OpEx and CapEx Rev2Kevin CariñoNoch keine Bewertungen

- Construction ManualDokument278 SeitenConstruction ManualUnnikrishnan NairNoch keine Bewertungen

- Ca Final - Ama (Costing) Theory Notes: Amogh Ashtaputre @amoghashtaputre Amogh Ashtaputre Amogh AshtaputreDokument143 SeitenCa Final - Ama (Costing) Theory Notes: Amogh Ashtaputre @amoghashtaputre Amogh Ashtaputre Amogh AshtaputreB GANAPATHY100% (1)

- Rajiv Dua Bsc. (Eng), PMP: Managing Cost Overruns and Project ManagementDokument193 SeitenRajiv Dua Bsc. (Eng), PMP: Managing Cost Overruns and Project Managementfhsn84Noch keine Bewertungen

- Estimation - Construction Time ManagementDokument24 SeitenEstimation - Construction Time ManagementJuanaNoch keine Bewertungen

- Iia Global Internal Audit Standards Public Comment Draft English v2Dokument132 SeitenIia Global Internal Audit Standards Public Comment Draft English v2harshimadushaniNoch keine Bewertungen

- Elements of CostingDokument171 SeitenElements of Costingiisjaffer100% (1)

- 1-4-2 Scheduling Techniques For ConstructionDokument47 Seiten1-4-2 Scheduling Techniques For ConstructionVũ Thị Hà TrangNoch keine Bewertungen

- Survey Study of The RequirementDokument128 SeitenSurvey Study of The Requirementapi-3839680Noch keine Bewertungen

- Cost Estimation Manual Manual Number SM014Dokument0 SeitenCost Estimation Manual Manual Number SM014pankajmayNoch keine Bewertungen

- Manhour Rate INKADokument3 SeitenManhour Rate INKADeny ArifiantoNoch keine Bewertungen

- (PDF) Schedule of Rates For Civil Works Public Works DepartmentDokument407 Seiten(PDF) Schedule of Rates For Civil Works Public Works DepartmentRadha Vaibhav VaishNoch keine Bewertungen

- 10 Estimation Function PT Q2Dokument61 Seiten10 Estimation Function PT Q2Varundeep SinghalNoch keine Bewertungen

- UD06737B-A Baseline Fingerprint Time Attendance Termimal User Manual V1.1.1 20180502Dokument144 SeitenUD06737B-A Baseline Fingerprint Time Attendance Termimal User Manual V1.1.1 20180502davaasuren jargalsaihanNoch keine Bewertungen

- BI Course Ebook PDFDokument22 SeitenBI Course Ebook PDFQorina AzizahNoch keine Bewertungen

- 1 PMHB Complete PDFDokument357 Seiten1 PMHB Complete PDFTayyiba ImranNoch keine Bewertungen

- Construction Planning: Choosing Tech and Defining TasksDokument198 SeitenConstruction Planning: Choosing Tech and Defining TasksHajarath Prasad AbburuNoch keine Bewertungen

- Contractora Estimate Cost - Propelat RapDokument192 SeitenContractora Estimate Cost - Propelat RapMr. RudyNoch keine Bewertungen

- Task 1 BDokument159 SeitenTask 1 Bpentyala88Noch keine Bewertungen

- Overhead Guidance PDFDokument9 SeitenOverhead Guidance PDFanuarNoch keine Bewertungen

- Em - 1110 3 136Dokument203 SeitenEm - 1110 3 136Real VinchenzoNoch keine Bewertungen

- Acounting Atve Summarised NotesDokument118 SeitenAcounting Atve Summarised NotesFolegwe FolegweNoch keine Bewertungen

- S Telp RDB 5279259Dokument14 SeitenS Telp RDB 5279259Pablo NuñezNoch keine Bewertungen

- Project Execution Plan - TemplateDokument12 SeitenProject Execution Plan - TemplateTonny SuakNoch keine Bewertungen

- 2014 Handbook External Costs TransportDokument139 Seiten2014 Handbook External Costs TransportEdoardo CecereNoch keine Bewertungen

- Rig Weight NormsDokument1 SeiteRig Weight NormsDPSprojectsNoch keine Bewertungen

- Dissertation - Delay Analysis TechniqueDokument167 SeitenDissertation - Delay Analysis Techniqueparkjiho79Noch keine Bewertungen

- Engineer ContractingDokument114 SeitenEngineer ContractingAndrew ReidNoch keine Bewertungen

- Selection of Consultants: Request For Proposals Consulting ServicesDokument164 SeitenSelection of Consultants: Request For Proposals Consulting ServicesRani Arun ShakarNoch keine Bewertungen

- Manhour MastersDokument60 SeitenManhour MastersMeetNoch keine Bewertungen

- Construction Master ManualDokument108 SeitenConstruction Master ManualBrian leerNoch keine Bewertungen

- Work ManualDokument684 SeitenWork ManualshashiNoch keine Bewertungen

- Manhour SampleDokument4 SeitenManhour SampleAhmed SaidNoch keine Bewertungen

- Measuring Concrete Work 1Dokument19 SeitenMeasuring Concrete Work 1Akbar RafeekNoch keine Bewertungen

- EPC-2018.10.29-Amendment in Standard RFP - AE BILLINGDokument2 SeitenEPC-2018.10.29-Amendment in Standard RFP - AE BILLINGPremNoch keine Bewertungen

- Costing Materials TombstoneDokument2 SeitenCosting Materials TombstoneMark Anthony Carreon MalateNoch keine Bewertungen

- 2013 Actual Man HourDokument907 Seiten2013 Actual Man HourwessamalexNoch keine Bewertungen

- Open Version Cost Estimation ManualDokument252 SeitenOpen Version Cost Estimation ManualDennis MagajaNoch keine Bewertungen

- Strengthening 49 km of NH-2B in West BengalDokument102 SeitenStrengthening 49 km of NH-2B in West BengalOllie BhattNoch keine Bewertungen

- 4.mechanical (Qa)Dokument22 Seiten4.mechanical (Qa)Osama AzaiemNoch keine Bewertungen

- S ProjectDefinitionOnOffshore PetrofacDokument4 SeitenS ProjectDefinitionOnOffshore PetrofacDiego1980bNoch keine Bewertungen

- W3 - Week 3 Project ManagementDokument53 SeitenW3 - Week 3 Project ManagementEe Ling SawNoch keine Bewertungen

- Carl N. Anderson Bayard E. Bosserman Il Charles D. Morris Contri Butors Casi Cadrecha Joseph E. Lescovich Harvey W. Taylor John VuncannonDokument15 SeitenCarl N. Anderson Bayard E. Bosserman Il Charles D. Morris Contri Butors Casi Cadrecha Joseph E. Lescovich Harvey W. Taylor John Vuncannonshady mohamedNoch keine Bewertungen

- Description Brand U/M Item NO Unit Price (AED) Total Price (AED)Dokument9 SeitenDescription Brand U/M Item NO Unit Price (AED) Total Price (AED)rageshdinesh23Noch keine Bewertungen

- Delft Management of Engineering ProjectsDokument222 SeitenDelft Management of Engineering ProjectsEirinaios ChatzillariNoch keine Bewertungen

- 10 State Standards - Waste Water FacilitiesDokument178 Seiten10 State Standards - Waste Water Facilitiesblin254Noch keine Bewertungen

- Contract DocumentDokument109 SeitenContract DocumentEngineeri TadiyosNoch keine Bewertungen

- UPDATED New Cost Estimation Manual FinalDokument26 SeitenUPDATED New Cost Estimation Manual FinalBerihun AddisNoch keine Bewertungen

- Project WBS EstimateDokument6 SeitenProject WBS EstimateSatria PinanditaNoch keine Bewertungen

- Promineo Cost EPC Tips & Tricks Webinar HighlightsDokument37 SeitenPromineo Cost EPC Tips & Tricks Webinar Highlightspthakur234Noch keine Bewertungen

- Dolidar Norms AdendumDokument33 SeitenDolidar Norms AdendumKiran Kumar AcharyaNoch keine Bewertungen

- Productivity Analysis of EPC WorksDokument8 SeitenProductivity Analysis of EPC Workssimeonochiche3640Noch keine Bewertungen

- Rahman Brothers Travel Costing Sheet for 12D 10N Umrah PackageDokument16 SeitenRahman Brothers Travel Costing Sheet for 12D 10N Umrah PackagehanijibrilNoch keine Bewertungen

- Cordelia Project B2-105 Costing ScheduleDokument4 SeitenCordelia Project B2-105 Costing ScheduleMallikarjun PatilNoch keine Bewertungen

- Case-Based Cost Estimation PDFDokument160 SeitenCase-Based Cost Estimation PDFanshu_foruNoch keine Bewertungen

- Capital BudgetingDokument45 SeitenCapital BudgetingdawncpainNoch keine Bewertungen

- Capital Budgeting DecisionsDokument28 SeitenCapital Budgeting DecisionsMoshmi MazumdarNoch keine Bewertungen

- Capital Budgeting MaterialDokument64 SeitenCapital Budgeting Materialvarghees prabhu.sNoch keine Bewertungen

- VI. Capital Budgeting Under Certainty: Professors Simon Pak and John ZdanowiczDokument56 SeitenVI. Capital Budgeting Under Certainty: Professors Simon Pak and John ZdanowiczSonal Power UnlimitdNoch keine Bewertungen

- Statement of Cash Flows: Preparation, Presentation, and UseVon EverandStatement of Cash Flows: Preparation, Presentation, and UseNoch keine Bewertungen

- Term PlanDokument4 SeitenTerm PlanKaushaljm PatelNoch keine Bewertungen

- Macroeconomics Jargons: University of Caloocan CityDokument16 SeitenMacroeconomics Jargons: University of Caloocan CityMyriz AlvarezNoch keine Bewertungen

- Bab I Persamaan Dasar AkuntansiDokument8 SeitenBab I Persamaan Dasar Akuntansiakhmad fauzanNoch keine Bewertungen

- Public Sector Debt Statistical Bulletin No 43 1Dokument57 SeitenPublic Sector Debt Statistical Bulletin No 43 1getupfrontNoch keine Bewertungen

- Fundamental #28 Have A Bias For Structure and Rebar.Dokument9 SeitenFundamental #28 Have A Bias For Structure and Rebar.David FriedmanNoch keine Bewertungen

- RM - Mcom Sem 4Dokument37 SeitenRM - Mcom Sem 4Suryakant FulpagarNoch keine Bewertungen

- Global Construction Paints and Coatings PDFDokument384 SeitenGlobal Construction Paints and Coatings PDFSunny JoonNoch keine Bewertungen

- Investors Preference in Commodities MarketDokument8 SeitenInvestors Preference in Commodities MarketSundar RajNoch keine Bewertungen

- Three questions to grow your investment returnsDokument21 SeitenThree questions to grow your investment returnsMOVIES SHOPNoch keine Bewertungen

- DrewDokument2 SeitenDrewmusunna galibNoch keine Bewertungen

- Comparison of The Markowitz and Single Index Model Based On M-V Criterion in Optimal Portfolio FormationDokument6 SeitenComparison of The Markowitz and Single Index Model Based On M-V Criterion in Optimal Portfolio FormationPavan KumarNoch keine Bewertungen

- Original Proposal of Georgia Bank and Trust To Columbia County For Banking ServicesDokument20 SeitenOriginal Proposal of Georgia Bank and Trust To Columbia County For Banking ServicesAllie M GrayNoch keine Bewertungen

- C C 2021 Cfa® E: Ritical Oncepts For The XamDokument6 SeitenC C 2021 Cfa® E: Ritical Oncepts For The XamGonzaloNoch keine Bewertungen

- PU 4 YEARS BBA IV Semester SyllabusDokument15 SeitenPU 4 YEARS BBA IV Semester SyllabushimalayabanNoch keine Bewertungen

- Week 7 - Financial Management 23Dokument59 SeitenWeek 7 - Financial Management 23jeff28Noch keine Bewertungen

- Soal Latihan Penilaian SahamDokument6 SeitenSoal Latihan Penilaian SahamAchmad Syafi'iNoch keine Bewertungen

- Liken Vs ShafferDokument1 SeiteLiken Vs ShafferMikhail JavierNoch keine Bewertungen

- Fera and Fema: Submitted To: Prof. Anant AmdekarDokument40 SeitenFera and Fema: Submitted To: Prof. Anant AmdekarhasbicNoch keine Bewertungen

- The Yamuna Syndicate Limited: Ratings Upgraded Summary of Rating ActionDokument8 SeitenThe Yamuna Syndicate Limited: Ratings Upgraded Summary of Rating ActionSandy SanNoch keine Bewertungen

- Overconfidence Bias in ThirukkuralDokument3 SeitenOverconfidence Bias in ThirukkuralEditor IJTSRDNoch keine Bewertungen

- 17 PHD Directory F LRDokument16 Seiten17 PHD Directory F LRchetanaNoch keine Bewertungen

- Fiscal PolicyDokument13 SeitenFiscal PolicyAakash SaxenaNoch keine Bewertungen

- International Business & Trade Research Paper ReviewDokument3 SeitenInternational Business & Trade Research Paper ReviewKiyan YunNoch keine Bewertungen

- 2005 10 XBRL Progress ReportDokument18 Seiten2005 10 XBRL Progress ReportkjheiinNoch keine Bewertungen

- CFA1 (2011) Corporate FinanceDokument9 SeitenCFA1 (2011) Corporate FinancenilakashNoch keine Bewertungen

- Solution Past Paper Higher-Series4-08hkDokument16 SeitenSolution Past Paper Higher-Series4-08hkJoyce LimNoch keine Bewertungen

- Case Study Presentation-Consumer BehaviourDokument26 SeitenCase Study Presentation-Consumer BehaviourPravakar KumarNoch keine Bewertungen