Beruflich Dokumente

Kultur Dokumente

Working Capital Financing

Hochgeladen von

mshereef103292Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Working Capital Financing

Hochgeladen von

mshereef103292Copyright:

Verfügbare Formate

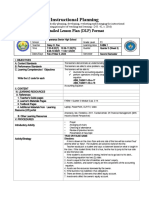

Prepared By: Muhammed Saheer PV

What is working capital?

Working capital typically means the firms holding

of current or short-term assets such as cash, receivables, inventory and marketable securities. management of CA as well as CL.

Management of Working capital refers to

Working capital financing discusses the source of finance that are used to support current assets It is divided into ten sections:

Accruals Trade credit Working capital advance by commercial banks Regulation of bank finance Public deposits Inter corporate deposit Short term loans from financial institutions Rights debentures for working capital Commercial paper Factoring

Accruals

Major accruals are wages and taxes. These are simply what the amounts that the firm

owes to its employees and is not yet paid is shown as accrued wages.

Accruals vary with the level of activity of the firm.

Trade Credit

It represents the credit extended by the supplier of

goods and services.

The cost of trade credit depends on the terms of

credit offered by the supplier.

Working capital advance by commercial banks

It is the most important source for financing current

assets.

It includes the following aspects of finance:

Application and processing Sanction and terms condition Forms of bank finance Nature of security Margin amount

Regulation of bank finance

Industrial borrowers enjoyed a relatively easy The RBI has been trying to bring a measure of

access to bank finance for meeting their working capital needs. discipline among industrial borrowers and issues guidelines and directives to the banking sector.

Public deposits

Many firms large and small have solicited

unsecured deposits from the public in recent years, mainly to finance their working capital requirements.

Inter corporate deposits

A deposit made by one company with another,

normally for a period up to six months if referred to as an inter corporate deposits.

Short term loans from financial institutions

It is the method of taking loans from short term

financial institutions.

The Life Insurance Corporation of India, the General

Insurance Corporation of India, and the Unit Trust of India provide short term loans to manufacturing companies.

Rights debentures for working capital

Public limited companies can issue rights

debentures for the long term resources of the company for working capital requirements.

Its is provided only on the basis of some guidelines.

Commercial paper

It represents short term unsecured promissory notes

issued by the firms which enjoy a fairly high credit rating. able to issue commercial paper.

Large firms with considerable financial strength are

factoring

A factor is a financial institution which offers

services relating to management and financing of debts arising from credit sales.

THANKS

Das könnte Ihnen auch gefallen

- Synopsis: A Study On Labour Welfare Mesures in Parvin PardhaDokument12 SeitenSynopsis: A Study On Labour Welfare Mesures in Parvin Pardhamshereef103292Noch keine Bewertungen

- DEFINITIONS On Labour WelfareDokument1 SeiteDEFINITIONS On Labour Welfaremshereef103292Noch keine Bewertungen

- SwapDokument8 SeitenSwapmshereef103292Noch keine Bewertungen

- Recipe Eeeeeee eDokument10 SeitenRecipe Eeeeeee emshereef103292Noch keine Bewertungen

- Quality of Work LifeDokument14 SeitenQuality of Work LifeRiyas ParakkattilNoch keine Bewertungen

- Review of LiteratureDokument6 SeitenReview of Literaturemshereef103292Noch keine Bewertungen

- Finance Seminar Differnce Btween Developed and Developing CountriesDokument6 SeitenFinance Seminar Differnce Btween Developed and Developing Countriesmshereef103292Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Basics of AppraisalsDokument20 SeitenBasics of AppraisalssymenNoch keine Bewertungen

- Time Table CS Exams December 2023Dokument1 SeiteTime Table CS Exams December 2023Himanshu UpadhyayNoch keine Bewertungen

- Ass6 10Dokument1 SeiteAss6 10Kath LeynesNoch keine Bewertungen

- Financial Accessibility of Women Entrepreneurs: (W S R T W P W E)Dokument5 SeitenFinancial Accessibility of Women Entrepreneurs: (W S R T W P W E)Vivi OktaviaNoch keine Bewertungen

- SEPO Policy Brief - Maharlika Investment Fund - FinalDokument15 SeitenSEPO Policy Brief - Maharlika Investment Fund - FinalDaryl AngelesNoch keine Bewertungen

- NAQDOWN PowerpointDokument55 SeitenNAQDOWN PowerpointsarahbeeNoch keine Bewertungen

- The Customer and Car Rental Service RelationshipDokument3 SeitenThe Customer and Car Rental Service RelationshipAbhimanyu GuptaNoch keine Bewertungen

- Strategic Plan 2016-2019: A Place for People to ProsperDokument20 SeitenStrategic Plan 2016-2019: A Place for People to ProsperKushaal SainNoch keine Bewertungen

- Topic 3 Long-Term Construction Contracts ModuleDokument20 SeitenTopic 3 Long-Term Construction Contracts ModuleMaricel Ann BaccayNoch keine Bewertungen

- Ub23m03 561476Dokument1 SeiteUb23m03 561476Ratul KochNoch keine Bewertungen

- OECD HRM Profile - BrazilDokument4 SeitenOECD HRM Profile - BrazilRaymond LullyNoch keine Bewertungen

- How Affiliate Marketing Impacts E-CommerceDokument13 SeitenHow Affiliate Marketing Impacts E-CommercePrecieux MuntyNoch keine Bewertungen

- (Marketing Management ENEMBA-KESDM) Finaltest - MUHAMAD FUDOLAHDokument6 Seiten(Marketing Management ENEMBA-KESDM) Finaltest - MUHAMAD FUDOLAHMuhamad FudolahNoch keine Bewertungen

- DLP Fundamentals of Accounting 1 - Q3 - W3Dokument5 SeitenDLP Fundamentals of Accounting 1 - Q3 - W3Daisy PaoNoch keine Bewertungen

- Standard ISO Response Codes PDFDokument3 SeitenStandard ISO Response Codes PDFwattylaaNoch keine Bewertungen

- First workshop unit overviewDokument2 SeitenFirst workshop unit overviewSachin Avishka PereraNoch keine Bewertungen

- Top Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersDokument8 SeitenTop Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersBassignotNoch keine Bewertungen

- Ds 3 ZJG PFA8 VV 0 Uhb Itzm K2 ARl EGBc 82 SQB 9 ZHC 4 PDokument1 SeiteDs 3 ZJG PFA8 VV 0 Uhb Itzm K2 ARl EGBc 82 SQB 9 ZHC 4 PprabindraNoch keine Bewertungen

- Risk and Return 2Dokument2 SeitenRisk and Return 2Nitya BhakriNoch keine Bewertungen

- Marketing Plan For Ready-Made Canned Foo PDFDokument10 SeitenMarketing Plan For Ready-Made Canned Foo PDFHussain0% (1)

- The Benefits of Free TradeDokument30 SeitenThe Benefits of Free TradeBiway RegalaNoch keine Bewertungen

- Advanced Performance Management (APM) : Strategic Professional - OptionsDokument11 SeitenAdvanced Performance Management (APM) : Strategic Professional - OptionsNghĩa VõNoch keine Bewertungen

- Taxation: Far Eastern University - ManilaDokument4 SeitenTaxation: Far Eastern University - ManilacamilleNoch keine Bewertungen

- Govt ch3Dokument21 SeitenGovt ch3Belay MekonenNoch keine Bewertungen

- HR SopDokument7 SeitenHR SopDen PamatianNoch keine Bewertungen

- Options Exposed PlayBookDokument118 SeitenOptions Exposed PlayBookMartin Jp100% (4)

- Chapter 7 Process ApproachDokument12 SeitenChapter 7 Process Approachloyd smithNoch keine Bewertungen

- Sip ReportDokument72 SeitenSip ReporthemanthreddyNoch keine Bewertungen

- Government of Karnataka's Chief Minister's Self-Employment Program DetailsDokument4 SeitenGovernment of Karnataka's Chief Minister's Self-Employment Program DetailsHajaratali AGNoch keine Bewertungen

- Foreign Exchange Risk: Types of ExposureDokument2 SeitenForeign Exchange Risk: Types of ExposurepilotNoch keine Bewertungen