Beruflich Dokumente

Kultur Dokumente

Cuses of Rise in Intrest Rate

Hochgeladen von

Khuram ShahzadOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cuses of Rise in Intrest Rate

Hochgeladen von

Khuram ShahzadCopyright:

Verfügbare Formate

PRESENTED BY JAFFAR NAQVI AMNA JAVED KHURRAM SHAHZAD

The general economic picture of a society is one of the more important causes of rate increases. If the economy is not doing well for whatever reason, business loans become that much more risky. Therefore, banks will be more reluctant to lend. This is reflected in the increasing rate of interest.

Many governments worry about inflation. Therefore, if an economy is growing "too fast," the central bank, influenced by the government, might raise rates. EXAMPLE:

Supply and demand make up a large part of determining interest rates. If rates go up, money will go into the bond, or loan market, since that money might do well under the higher rates.

When the national savings are low then the level of interest rises in the country.

The demand for the country's currency can also cause a hike in interest rates. Large trade deficits can be an important cause for this. Dollars are being shipped out of the country to pay for foreign imports over and above the society's exports. Since there are now fewer dollars in circulation, their price will increase. The larger the deficit, the more upward pressure on rates.

In order to raise the level of F.D.I state raises the rate of interest. EXAMPLE

In order to raise the domestic level of investment state bank lowers the rate of intrest.

State bank also use this tool to increase the money supply in the country.

In order to raise the employment level in the country state bank lowers the interest rate.

If the economy overheats and inflation is high, interest rates will have to be really high just to reduce inflation. This was the case in the 1980's, when Paul Volker was the chief of the US Central Bank. If the economy is slow, and deflation is possible, interest rates will have to be really low just to prevent a deflationary economic depression. This is the case in Japan for the past decade, and in the rest of the Western World starting late 2008.

Interest rates rise when things are going well in the economy. If prices of goods and services are high because of high demand, interest rates may increase to help push prices back down and slow down growth.

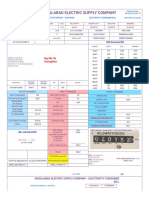

The benchmark interest rate in Pakistan was last reported at 12 percent. In Pakistan, interest rates decisions are taken by the State Bank of Pakistan. The official interest rate is the discount rate. From 1992 until 2010, Pakistan's average interest rate was 12.78 percent reaching an historical high of 20.00 percent in October of 1996 and a record low of 7.50 percent in November of 2002. This page includes: Pakistan Interest Rate chart, historical data and news

Das könnte Ihnen auch gefallen

- Indian Inflation Problem and Simulation Using IS-LM Model EdharmeshDokument7 SeitenIndian Inflation Problem and Simulation Using IS-LM Model EdharmeshPhilip LeonardNoch keine Bewertungen

- Japan Liquidity Trap - Economics ExplainedDokument2 SeitenJapan Liquidity Trap - Economics ExplainedSiddhartha Sekhar SarkarNoch keine Bewertungen

- Diploma in Accounting Diploma in Finance: Student Name Course Student IdDokument22 SeitenDiploma in Accounting Diploma in Finance: Student Name Course Student Idng shiminNoch keine Bewertungen

- Growing Worries About InflationDokument3 SeitenGrowing Worries About InflationAsad AfridiNoch keine Bewertungen

- Inflation in Pakistan3Dokument31 SeitenInflation in Pakistan3Rajput Ahmed MujahidNoch keine Bewertungen

- Artlicles On InflationDokument5 SeitenArtlicles On Inflationsrinivasan9Noch keine Bewertungen

- Money in AssigmentDokument6 SeitenMoney in AssigmentMussa AthanasNoch keine Bewertungen

- National Income of PhilippinesDokument10 SeitenNational Income of PhilippinesCyrel Jake Magadan AbapoNoch keine Bewertungen

- Inflation & Its Impact On Pakistan EconomyDokument25 SeitenInflation & Its Impact On Pakistan EconomyMuhammadHammadNoch keine Bewertungen

- Objectives of ProposalDokument3 SeitenObjectives of ProposalBurairNoch keine Bewertungen

- Thailand-An Imbalance of PaymentsDokument7 SeitenThailand-An Imbalance of PaymentsN MNoch keine Bewertungen

- Turkey Monetary PolicyDokument3 SeitenTurkey Monetary PolicyEmmanuella N.MNoch keine Bewertungen

- Vietnam Outlook 5-17-2011Dokument5 SeitenVietnam Outlook 5-17-2011Thao Nhu HoNoch keine Bewertungen

- The Effects of Currency Fluctuations On The Economy: Forex Economics Forex Fundamentals Forex TheoryDokument6 SeitenThe Effects of Currency Fluctuations On The Economy: Forex Economics Forex Fundamentals Forex TheoryPuja YadavNoch keine Bewertungen

- Case Studies To Solve at HomeDokument6 SeitenCase Studies To Solve at HomeShuvro RahmanNoch keine Bewertungen

- Chetana S Bachelor of Management Studies: Opic Name: Nadar Karthik Soundararajan. Roll NO.: 2138Dokument5 SeitenChetana S Bachelor of Management Studies: Opic Name: Nadar Karthik Soundararajan. Roll NO.: 2138Karthik SoundarajanNoch keine Bewertungen

- US Interest Rate HikeDokument10 SeitenUS Interest Rate HikeThavam RatnaNoch keine Bewertungen

- AssignmentDokument5 SeitenAssignmentNg ChunyeNoch keine Bewertungen

- IMF Intervention: Debt Relief For Poor CountriesDokument4 SeitenIMF Intervention: Debt Relief For Poor CountrieschaitrasuhasNoch keine Bewertungen

- Depreciating Exchange Rate - January 12 - 2010Dokument2 SeitenDepreciating Exchange Rate - January 12 - 2010Usama MubeenNoch keine Bewertungen

- Currency WarsDokument9 SeitenCurrency WarsAnkit BindalNoch keine Bewertungen

- Malaysia Current Inflation SituationDokument10 SeitenMalaysia Current Inflation SituationIdris_Ahad_2009100% (2)

- 1997 Asian Financial Crisis: Made byDokument12 Seiten1997 Asian Financial Crisis: Made byHitesh GuptaNoch keine Bewertungen

- Analysis of Monetary Policy in PakistanDokument3 SeitenAnalysis of Monetary Policy in PakistanAmna JamilNoch keine Bewertungen

- Indicators of Successful EconomyDokument9 SeitenIndicators of Successful EconomyAli Zafar0% (1)

- The Why's of Economics: How Governments and Central Banks run the economyVon EverandThe Why's of Economics: How Governments and Central Banks run the economyNoch keine Bewertungen

- Connecting Each Macro-Economic IndicatorsDokument7 SeitenConnecting Each Macro-Economic IndicatorsMedha SinghNoch keine Bewertungen

- Essay On InflationDokument2 SeitenEssay On InflationAlyani Korner100% (6)

- Azrul Ikhwan Bin Azmi (2020414356) - Self ReflectionDokument8 SeitenAzrul Ikhwan Bin Azmi (2020414356) - Self ReflectionAZRUL IKHWAN AZMINoch keine Bewertungen

- Newsid 3013 (Baht Opinion)Dokument4 SeitenNewsid 3013 (Baht Opinion)Ashish Raj PandeyNoch keine Bewertungen

- Economics 9Dokument39 SeitenEconomics 9Padlah Riyadi. SE., Ak., CA., MM.Noch keine Bewertungen

- Fara Dina R.A Tugas 1 Bahasa Inggris NiagaDokument3 SeitenFara Dina R.A Tugas 1 Bahasa Inggris NiagaFaradina channelNoch keine Bewertungen

- MohammedDokument7 SeitenMohammedZANGINA Nicholas NaaniNoch keine Bewertungen

- WB EAP Econ Seminar - EngDokument6 SeitenWB EAP Econ Seminar - Engvica3_Noch keine Bewertungen

- IEPBM Assignment Prateek Srivastava 1714047 1Dokument2 SeitenIEPBM Assignment Prateek Srivastava 1714047 1Prateek SrivastavaNoch keine Bewertungen

- Economic Analysis: 1.0 - Developed Country - United States of America (GDP)Dokument170 SeitenEconomic Analysis: 1.0 - Developed Country - United States of America (GDP)azizi akmalNoch keine Bewertungen

- Scientific Research About InflationDokument7 SeitenScientific Research About InflationLanNoch keine Bewertungen

- Global PerpectiveDokument3 SeitenGlobal Perpectivessharma_895257Noch keine Bewertungen

- What Is Inflation?Dokument14 SeitenWhat Is Inflation?Ankit NandawatNoch keine Bewertungen

- Monetary Policy in Africa Has Become More Orthodox - The Winding RoadDokument2 SeitenMonetary Policy in Africa Has Become More Orthodox - The Winding RoadFaustinNoch keine Bewertungen

- Bab 1Dokument10 SeitenBab 1Abhijeet kumarNoch keine Bewertungen

- The Butterfly Effect of Interest Rate in PakistanDokument7 SeitenThe Butterfly Effect of Interest Rate in PakistanScrew Soft (Screw Soft Channel)Noch keine Bewertungen

- Inflation: Measuring Inflation: Inflation Is Measured by Observing The Change in TheDokument4 SeitenInflation: Measuring Inflation: Inflation Is Measured by Observing The Change in TheShoaib KhanNoch keine Bewertungen

- A Component of The Economy Is The Capital MarketDokument5 SeitenA Component of The Economy Is The Capital MarketFlora bhandariNoch keine Bewertungen

- Inflation Impact On EconmyDokument4 SeitenInflation Impact On EconmyRashid HussainNoch keine Bewertungen

- FIN444 Part2 (Final)Dokument22 SeitenFIN444 Part2 (Final)A ChowdhuryNoch keine Bewertungen

- D DDD DD DD DD DD DD DD DD DD DD DDDokument3 SeitenD DDD DD DD DD DD DD DD DD DD DD DDHamza ShafiqueNoch keine Bewertungen

- Impact of Inflation IndianDokument3 SeitenImpact of Inflation IndiankautiNoch keine Bewertungen

- In The Thai Financial Crisis Case StudyDokument7 SeitenIn The Thai Financial Crisis Case StudyMamush JWNoch keine Bewertungen

- What Kinds of Events Can Cause Fluctuations in Currency Values?Dokument4 SeitenWhat Kinds of Events Can Cause Fluctuations in Currency Values?Paris CiciuNoch keine Bewertungen

- Mundul Global Financial CrisisDokument3 SeitenMundul Global Financial CrisisBrijesh SharmaNoch keine Bewertungen

- How Would You Characterize The International Monetary System Since Collapse of Bretton WoodsDokument6 SeitenHow Would You Characterize The International Monetary System Since Collapse of Bretton Woodsmario32323243Noch keine Bewertungen

- What Is Inflation-FinalDokument2 SeitenWhat Is Inflation-FinalArif Mahmud MuktaNoch keine Bewertungen

- Eco ResearchDokument5 SeitenEco ResearchArdays BalagtasNoch keine Bewertungen

- Thesis Topics Monetary PolicyDokument7 SeitenThesis Topics Monetary Policyashleyfishererie100% (1)

- Nflation and Its Impact On The Pakistan EconomyDokument6 SeitenNflation and Its Impact On The Pakistan EconomyYaseen AyazNoch keine Bewertungen

- What Factors Determine and Intervene in Foreign Exchange Rates - EditedDokument11 SeitenWhat Factors Determine and Intervene in Foreign Exchange Rates - EditedDavid JumaNoch keine Bewertungen

- Global FinancesDokument31 SeitenGlobal Financesdtq1953401010044Noch keine Bewertungen

- What Is The Asian Financial Crisis - IB Unit 4Dokument2 SeitenWhat Is The Asian Financial Crisis - IB Unit 4ApurvaNoch keine Bewertungen

- Fesco Online BillDokument2 SeitenFesco Online BillSaqLain AliNoch keine Bewertungen

- International Economics 12Th Edition Full ChapterDokument41 SeitenInternational Economics 12Th Edition Full Chaptertyler.brady625100% (24)

- Inb 372Dokument5 SeitenInb 372Md Shahiduzzaman Tamim 1811770630Noch keine Bewertungen

- Mama TheoDokument17 SeitenMama TheophantomhabzicNoch keine Bewertungen

- Canara Revecco ManufacturingDokument7 SeitenCanara Revecco ManufacturingRanjan Sharma100% (1)

- Delhi Veneers CompleteDokument6 SeitenDelhi Veneers CompleteMbok JamuNoch keine Bewertungen

- Lima91g ONU SalariesDokument14 SeitenLima91g ONU SalariesChris Ian RaulNoch keine Bewertungen

- 894411921500234RPOSDokument2 Seiten894411921500234RPOSÃtúl GàñgwäřNoch keine Bewertungen

- Reliance InfrastructureDokument15 SeitenReliance InfrastructurePrasannaKumar93Noch keine Bewertungen

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDokument1 SeiteAhmedabad Municipal Corporation Mahanagar Sewa SadanJohn FernendiceNoch keine Bewertungen

- MSI-20-006 Mask InvoiceDokument1 SeiteMSI-20-006 Mask Invoicetranshind overseasNoch keine Bewertungen

- User Id 012439461813 - DSL Telephonenumber 01244823150Dokument6 SeitenUser Id 012439461813 - DSL Telephonenumber 01244823150NAVEEN SLNoch keine Bewertungen

- Economic Systems in EthiopiaDokument1 SeiteEconomic Systems in EthiopiaMeti GudaNoch keine Bewertungen

- Pestel Analysis of Banking Industry: BY: Nancy TatwaniDokument2 SeitenPestel Analysis of Banking Industry: BY: Nancy TatwaninancyNoch keine Bewertungen

- WACC EthiopiaDokument4 SeitenWACC EthiopiaPandS BoiNoch keine Bewertungen

- Global Finance3Dokument11 SeitenGlobal Finance3kbogdanoviccNoch keine Bewertungen

- Rupee Appreciation - Its Impact On Indian EconomyDokument60 SeitenRupee Appreciation - Its Impact On Indian Economynikhil100% (1)

- Rajiv Kumar S O Late Moti Prasad Sah C O Vivek Vishal Indraprasi Colony Ratu Road Ranchi Yamaha Service Cen RanchiDokument15 SeitenRajiv Kumar S O Late Moti Prasad Sah C O Vivek Vishal Indraprasi Colony Ratu Road Ranchi Yamaha Service Cen RanchiNikhil KumarNoch keine Bewertungen

- MOGSS International (Autosaved)Dokument9 SeitenMOGSS International (Autosaved)Ken TunNoch keine Bewertungen

- Important Bin For CCDokument2 SeitenImportant Bin For CCRozanawati Shanty100% (4)

- Acct Statement - XX6419 - 08112022Dokument26 SeitenAcct Statement - XX6419 - 08112022AartiNoch keine Bewertungen

- Important Points On International TaxationDokument3 SeitenImportant Points On International TaxationPadma Charan SahuNoch keine Bewertungen

- Financial Ratios of BankDokument4 SeitenFinancial Ratios of BankSasidharan Ravi KumarNoch keine Bewertungen

- Statement of Account Central Bank of India: Vasna Branch, Ahmedabad Branch Code: 281463Dokument2 SeitenStatement of Account Central Bank of India: Vasna Branch, Ahmedabad Branch Code: 281463jainam100% (2)

- T2 - Economía Internacional - Lopez Cayao Liz EvelynDokument5 SeitenT2 - Economía Internacional - Lopez Cayao Liz EvelynBrany George Marquez OrdoñezNoch keine Bewertungen

- Bill FaisalabadDokument2 SeitenBill FaisalabadTech With UsNoch keine Bewertungen

- Error Exercise - Sentence CompletionDokument3 SeitenError Exercise - Sentence CompletionsmnxwxNoch keine Bewertungen

- Europe Economics OverviewDokument4 SeitenEurope Economics Overviewapi-291877361Noch keine Bewertungen

- Bonds: CHF NOK PLN USD GBP TRY RUB CAD AUD MXN BRL SGD ILS INR CNH ZARDokument6 SeitenBonds: CHF NOK PLN USD GBP TRY RUB CAD AUD MXN BRL SGD ILS INR CNH ZARRobert StewartNoch keine Bewertungen

- Rob Peluso Running For Jefferson County LegislatureDokument1 SeiteRob Peluso Running For Jefferson County LegislatureNewzjunkyNoch keine Bewertungen