Beruflich Dokumente

Kultur Dokumente

Capital Fund

Hochgeladen von

sher_azmatOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Capital Fund

Hochgeladen von

sher_azmatCopyright:

Verfügbare Formate

Capital Fund

Sher Jahan Khan

The capital fund constitutes one of the sources of funds for the commercial banks. It represents owned resources, and includes the share capital subscribed by its shareholders as well as reserve built up by the banks by ploughing back a part of its business earnings.

Funtions Of Capital Funds In Commercial Banks

Bank Capital acts as loss absorber. Bank Capital supplies working tools of banks. Bank Capital acts as source of loan funds.

Genesis Of Adequacy Of Capital Fund

To bring about solidarity, scope and the ultimate strength of the bank. To cover the normal hazards inherent in its operations. To cover the costs of expansion. To finance growing industry and trade.

Standards of measuring capital adequacy

Ratio of paid-up capital to reserve Capital - Deposit ratio Risk - Assets ratio Adjusted Risk Assets ratio

Capital Adequacy Norms In Indian Commercial Banks

The balance sheet assets, non-funded items and other off balance sheet exposures are assigned weight according to the prescribed risk. Capital has been divided into two tiers

Tier 1 Tier 2

Capital Adequacy Norms In Indian Commercial Banks

Tier 1 capital means

Paid up capital Statutory reserves Other disclosed free reserves Capital reserves Equity investment

Capital Adequacy Norms In Indian Commercial Banks

Tier 2 capital means

Undisclosed reserves Revaluation of reserves General provisions and loss reserves Hybrid debt capital instruments

Capital Adequacy Norms In Indian Commercial Banks

For those banks having branches abroad, the risk weighted assets ratio of 8% was to be achieved as early as possible and in any case by 31st March, 1995. Other banks were to achieve a capital adequacy norm of 8% by 31st March, 1996 Foreign banks were to achieve the norm of 8% by 31st March, 1993

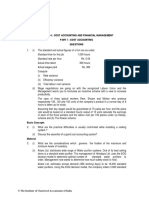

Weights of Funded Assets

Assets Weight 0

Cash, balance with RBI, balances with other banks, money at call and short-notice and investment in government and other trustee securities

Claims on commercial banks, such as certificate of deposits Other investments Investments in bonds issued by banks of financial institutions for Tier 2 capital Loans guaranteed by govt. of India, loans to staff Loans guaranteed by state government Others Other assets

20 100 20 0 100 100 100

Weights of Non-Funded Items

Assets Conversion factor for LC Weight 20

Acceptances and endorsements

100

Direct credit substitutes of financial guarantees

Sales and repurchase agreements where the credit risk remains with the banks

100

100

Forward asset purchase, forward deposits and partly paid up shares

Foreign exchange contracts original maturity of 14 days or less

100

20

Capital Adequacy Ratio Of Public Sector Indian Commercial Banks

Name of the Bank Allahabad bank Andhra bank Bank of Baroda Bank of India Canara bank Indian overseas bank 2009-2010 11.51 13.36 12.10 10.57 9.64 9.15 10.31 11.49

Punjab national bank State bank of India

Capital Adequacy Ratio Of Private Sector Indian Commercial Banks

Name of the Bank Jammu and Kashmir bank ltd HDFC Bank ltd IDBI Bank Ltd ICICI 2009-2010 24.48 11.86 11.26 11.06 12.01 15.56

Axis Bank

IndusInd Bank Ltd Bank of Rajasthan Karur Vysya bank

10.68

15.34

Thank You For Your kind attention

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- CEO COO General Counsel in Bermuda Resume William FawcettDokument3 SeitenCEO COO General Counsel in Bermuda Resume William FawcettWilliamFawcett100% (1)

- Assignment 01: Audit of Property, Plant and Equipment Problem SolvingDokument2 SeitenAssignment 01: Audit of Property, Plant and Equipment Problem SolvingDan Andrei BongoNoch keine Bewertungen

- Dimensional Fund Advisors 2002 Case SoluDokument3 SeitenDimensional Fund Advisors 2002 Case SoluPawan PoollaNoch keine Bewertungen

- ch12 Principles of AccountingDokument49 Seitench12 Principles of AccountingAdam Rivera100% (2)

- NG Cho Cio V NG Diong-Case DigestDokument2 SeitenNG Cho Cio V NG Diong-Case DigestAngelette BulacanNoch keine Bewertungen

- GTB Statement For The Month of May 2013Dokument3 SeitenGTB Statement For The Month of May 2013shomama100% (2)

- Banking: Loan Function of BanksDokument4 SeitenBanking: Loan Function of BanksmelfabianNoch keine Bewertungen

- List Bibliography PDFDokument5 SeitenList Bibliography PDFInes SantosNoch keine Bewertungen

- Inancial Arkets: Learning ObjectivesDokument24 SeitenInancial Arkets: Learning Objectivessourav goyalNoch keine Bewertungen

- Abba Application FormDokument1 SeiteAbba Application FormAbbaNoch keine Bewertungen

- 5 TH Sem Advanced Accounting PPT - 2.pdf382Dokument21 Seiten5 TH Sem Advanced Accounting PPT - 2.pdf382Azhar Ali100% (3)

- Double Entry Worksheets PDSTDokument2 SeitenDouble Entry Worksheets PDSTChit Manzon CruzNoch keine Bewertungen

- Financial Planning and Forecasting QuestionDokument10 SeitenFinancial Planning and Forecasting QuestionRonmaty VixNoch keine Bewertungen

- RA 7653, As Amended by RA 11211: I. Operations A. Section 25, Supervision and ExaminationDokument25 SeitenRA 7653, As Amended by RA 11211: I. Operations A. Section 25, Supervision and ExaminationJay TabuzoNoch keine Bewertungen

- Free Online Calculators - Math, Fitness, Finance, ScienceDokument3 SeitenFree Online Calculators - Math, Fitness, Finance, SciencejNoch keine Bewertungen

- Sub: FIMMDA CBRICS Corporate Bond Reporting Platform Participant Application AgreementDokument4 SeitenSub: FIMMDA CBRICS Corporate Bond Reporting Platform Participant Application AgreementharikrishnanmscphysicsNoch keine Bewertungen

- Brochure PGDM Exe PDFDokument39 SeitenBrochure PGDM Exe PDFtrishajainmanyajainNoch keine Bewertungen

- ASE20091 Bank Recon - 2017-04 - P53212A0120Dokument2 SeitenASE20091 Bank Recon - 2017-04 - P53212A0120Thooi Joo Wong0% (1)

- Economy India EnglishDokument76 SeitenEconomy India EnglishSudama Kumar BarailyNoch keine Bewertungen

- FAR.2850 - Interim Financial Reporting.Dokument4 SeitenFAR.2850 - Interim Financial Reporting.Ashley LegaspiNoch keine Bewertungen

- A Study On Fundamental Analysis of Top IT Companies in IndiaDokument14 SeitenA Study On Fundamental Analysis of Top IT Companies in IndiaMuttavva mudenagudiNoch keine Bewertungen

- All I KnowDokument305 SeitenAll I Knowhitesh_21Noch keine Bewertungen

- Paper 4Dokument44 SeitenPaper 4Mayuri KolheNoch keine Bewertungen

- RA 7721 As Amended by RA 10641Dokument3 SeitenRA 7721 As Amended by RA 10641Anonymous 4IOzjRIB1Noch keine Bewertungen

- Olamic Healthcare GST Invoice: Sri Krishna PharmaDokument2 SeitenOlamic Healthcare GST Invoice: Sri Krishna PharmaYours PharmacyNoch keine Bewertungen

- 5Dokument2 Seiten5ABDUL WAHABNoch keine Bewertungen

- Pfrs For Smes - Acpapp WebsiteDokument56 SeitenPfrs For Smes - Acpapp WebsiteThessaloe B. Fernandez100% (2)

- 2 Notes Lecture Audit of Cash 2021Dokument1 Seite2 Notes Lecture Audit of Cash 2021JoyluxxiNoch keine Bewertungen

- Financial DimensionDokument13 SeitenFinancial DimensionParitosh JainNoch keine Bewertungen

- ACCT 251 Practice SetDokument27 SeitenACCT 251 Practice SetrubayahconradNoch keine Bewertungen