Beruflich Dokumente

Kultur Dokumente

Understanding Your Payslip

Hochgeladen von

MohanKrishnaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Understanding Your Payslip

Hochgeladen von

MohanKrishnaCopyright:

Verfügbare Formate

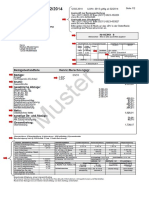

Understanding your payslip Bezügemitteilung

24.04.2017 Lfd.Nr. 001 Seite 1/1

Landesamt für Finanzen / Dienststelle Ansbach

Bescheinigung nach §108 Absatz 3 Satz 1 (GewO) Bezügestelle Arbeitnehmer

Brauhausstr. 18, 91522 Ansbach

Telefon: (0981) 888-5363 Vermittlung -01 Fax: -5451

Verkehrs- Bus: Linie 725 Brauhausstraße

verbindung Linie 753 Jüdtstraße

Description 1 Landesamt für Finanzen Bezügestelle PF 611 91511 Ansbach

52214 - 40052973 A

Current payroll period (month/year) 2 Geschäftszeichen - Bitte bei allen Zuschriften angeben!

Herrn A Your personnel number

B Steuermerkmale C

Pay grade and step 3 Dr. Max Mustermann Steuer- Kinder- Religion Familienstand

Steuerfrei-(F)/Hinzurechnungsbetrag (H)

monatlich jährlich

Your pay grade and step are determined in accordance Musterweg 2 G

klasse

F

freibetrag

0,0 E -- D ledig Steuertage: 30,00 SV-Tage: 30,00 B Tax features

with your qualifications and previous work experience.

Your step increases automatically after a number of years. 12345 Musterstadt H

Faktor

anteilige Bezüge Stufe Mitversteuerungsbetrag monatlich

I 1 weiterer Bezug Versorgungsbezug

Salary 4 K Geburtsdatum Besch. Beginn

12.05.1985 01.08.2016 J Versorgungsfreibetrag Altersentlastungsbetr.

C Tax exemption

monatlich monatlich

Salary according to the current schedule Available if your way to work is more than 40 km one way or

L Steuer IdNr.: 49102358072

if you have a severe disability.

agreed by the state and trade unions.

Total 5 1 M

Bezeichnung Berechnungsgrundlagen N

Betrag D Marital status

Gross salary (current month) 6

Religion (church membership)

2 Aktuelle Abrechnungsperiode E

Members of the Roman Catholic Church or the Protestant

After tax exemption 7 Abrechnungsmonat: 09/2016 3 Church pay church tax, which is deducted directly from the

salary and passed on to the respective Church organisation.

Gross for health/long-term care insurance 8 Bezüge: E13 / 1 3.517,36 Information about religious affiliation is voluntary and is

4 Tabellenentgelt LSGZ recorded when you register your residency at the municipal

government offices.

Gross for state pension insurance 9 Brutto:

5 Gesamtbrutto 3.517,36 F Child tax credit

Guarantees that a certain amount of your income is not taxed

Gross for unemployment insurance 10 Gesetzliche Abzüge: but available as living expenses for your child or children.

6 Steuerbrutto, lfd. 3.517,36 G Tax category

Employer’s contribution to 11 7 nach Frei-/Hinzu.-betrag 3.517,36 Depends on your marital status and/or on your spouse’s tax

extra pension insurance 8 KV/PV-Brutto, lfd. 3.669,69 category. Category I is for single persons, categories III/IV/V are

Extra pension insurance is available for employees of the available for married persons. Category VI should be avoided.

Free State of Bavaria. This amount shows the

9 RV-Brutto, lfd. 3.669,69

employer’s contribution. 10 AV-Brutto, lfd. 3.669,69 H Payment fraction

100% means that you are employed full-time, i.e. you work

Income tax (current month) 12 11 ZV SV-Hinz.-Betrag, lfd. 152,33 40.5 hours a week. For example, 75% means that you are

The percentage of income tax paid is linked to your gross 12 Lohnsteuer, lfd. 580,41 employed part-time, working 30 hours a week.

income, your tax category and other factors, and varies

between 11% and 50%. 13 Solidaritätszuschlag, lfd 31,92

14 Krankenversicherung, lfd. 308,26 I Salary step (subgroup of your pay grade)

Solidarity tax (current month) 13

15 Rentenversicherung, lfd. 343,12

Arbeitslosenvers., lfd. 55,05 J Start of employment contract

Health insurance (current month) 14 16

Health insurance is compulsory and is paid by the employer 17 Pflegeversicherung, lfd. 52,29 K Date of birth

and by you. This amount shows your contribution.

Netto:

Pension insurance (current month) 15 Gesetzliches Netto L Tax identification number

18 2.146,31 Not to be confused with the tax number, which is assigned by

Pension insurance is compulsory and is paid by the em- the local tax office when you hand in your first tax declara-

ployer and by you. This amount shows your contribution. 19 sonstige Be- und Abzüg(e): tion, the tax ID number is given to you after the first registra-

20 ZV-Uml. Regelentg. AN tion of residence in Germany (or after birth) and is for life.

Unemployment insurance (current month) 16 60,15-

Unemployment insurance is compulsory and is paid by the

employer and by you. This amount shows your contribution.

21 Gesamtbetrag: M Basis of calculation

Unemployment benefits are available if you are out of work, 22 Überweisung 2.086,16

depending on years of contribution and residence status. N Amount

23 Zahlungen:

Long-term care insurance (current month) 17 24 Überweisung 2.086,16 EUR

Long-term care insurance is compulsory and paid by the 25 Bankverbindung: IBAN: DE06 8205 1000 0000 0123 45

employer and by you. It is linked to your health insurance. Don’t let the German way of writing num-

26 Arbeitgeber: bers confuse you! The comma is the decimal

Statutory net salary 18 Freistaat Bayern / Universität Beispiel point, whereas the period is the thousand

Beispielstraße 1 separator.

Further earnings or deductions 19

95003 Beispielstadt

Employee’s contributions to 20

extra pension insurance Versicherungspflicht Krankenversicherung Rentenversicherung Arbeitslosenversich. Pflegeversicherung O Aufgelauf. Jahreswerte (Lohnkonto)

Shows the employee’s contribution to the extra pension (Beitragsgruppe) 1 1 1 1 gesamter steuerpflichtiger Bezug 3.517,36

insurance (only applicable if you have not opted out). Beitragssatz (AN) 8,40 % 9,35 % 1,5 % 1,4250 % - davon Lohnsteuer 580,41 O Cumulative totals (amounts accumulated

Krankenkasse / RV Nummer AOK Bayern 5815120585D002 - davon Solidaritätszuschlag 31,92

Sum total 21 Zuschl./Gleitz./Mehrfachb.Z/G/M Z - davon Kirchensteuer during the year up to the current month)

Kum. AN.-Beiträge SV 308,26 343,12 55,05 52,29 sonst. Bezug für mehrjährige Tätigkeit

Amount to be transferred 22 Aufgel. svpfl. Brutto, lfd. Kalj. 3.669,69 3.669,69 3.669,69 - davon Lohnsteuer

- davon Solidaritätszuschlag

Payments 23 Entgelt Zusatzversorgung von der Arbeitgeberleistung zur Zusatz-

versorgung sind im laufenden Monat

- davon Kirchensteuer

Stfr. belassen nach AN - Beiträge zur Solzialvers. 785,72

lfd. Monat lfd. Jahr

Amount to be transferred 24 § 3 Nr. 56

§ 3 Nr. 63 S.1

steuerpflichtig sozialvers.pfl. AG - Krankenversicherungszuschuss

343,12

3.517,36 3.517,36 152,33 AG - Anteil Rentenversicherung

Your bank account number 25 § 3 Nr. 63 S.3 Sachbezüge / sonst. Leist. lfd. Monat steuerpfl. Bezug davon steuerpfl.

AG - Pflegeversicherungszuschuss

AN - Anteil Zusatzversorgung

steuerpflichtig sozialvers. pfl. lfd. Monat Zeitzuschläge 60,15

Employer’s details 26 Z. MuschG / KUG / Aufstock. AtG

Fahrtkostenzuschuss

AG-Beitrag freiw. Zus. Vers.

Das könnte Ihnen auch gefallen

- Sage MusterabrechnungDokument1 SeiteSage MusterabrechnungtempNoch keine Bewertungen

- Lohn 12Dokument1 SeiteLohn 12Yunus BilirNoch keine Bewertungen

- Brutto Netto Abrechnung Februar 2022Dokument2 SeitenBrutto Netto Abrechnung Februar 2022HAMID CR7Noch keine Bewertungen

- Verdienstabrechnung 08.2021Dokument1 SeiteVerdienstabrechnung 08.2021Jan BoltNoch keine Bewertungen

- MusterDokument3 SeitenMusterAndreas Franke100% (1)

- Brutto Netto Abrechnung September 2022Dokument1 SeiteBrutto Netto Abrechnung September 2022HAMID CR7Noch keine Bewertungen

- Herrn Tomislav Martinek Langbürgener Strasse 2 81549 MünchenDokument2 SeitenHerrn Tomislav Martinek Langbürgener Strasse 2 81549 MünchenTomislavNoch keine Bewertungen

- Formular-zur-Gehaltsabrechnung-2018-mit-eigenem-Lohnkonto 2 PDFDokument3 SeitenFormular-zur-Gehaltsabrechnung-2018-mit-eigenem-Lohnkonto 2 PDFLuisa NorcoNoch keine Bewertungen

- E - Bescheid - L1 - 69 - 1507073 - 2018 - 2019 10 11 - 2019 10 11 16 08 35 336221Dokument4 SeitenE - Bescheid - L1 - 69 - 1507073 - 2018 - 2019 10 11 - 2019 10 11 16 08 35 336221Andreas SpeiserNoch keine Bewertungen

- 2023 11 Abr 00104 - 1 - 1 - Dumitrache Ioan - AfoDokument1 Seite2023 11 Abr 00104 - 1 - 1 - Dumitrache Ioan - Afodumitrachedaniel335Noch keine Bewertungen

- Jahresabrechnung 2021/2022: Kundennummer: 958268 Verbrauchsstellen-Nr.: 486606Dokument5 SeitenJahresabrechnung 2021/2022: Kundennummer: 958268 Verbrauchsstellen-Nr.: 486606mehmetNoch keine Bewertungen

- September 2014 v2Dokument2 SeitenSeptember 2014 v2ererererrrrrrNoch keine Bewertungen

- Rechnungserläuterung. Zeigt An, Dass Weitere Informationen Zum Verständis Hinterlegt Sind. 2. Oktober 2014 PDFDokument9 SeitenRechnungserläuterung. Zeigt An, Dass Weitere Informationen Zum Verständis Hinterlegt Sind. 2. Oktober 2014 PDFlososNoch keine Bewertungen

- Bav Self BD Rech KFZ 15897551 PDFDokument2 SeitenBav Self BD Rech KFZ 15897551 PDFOtpadNoch keine Bewertungen

- 01 Gehaltsscheine Formular2Dokument6 Seiten01 Gehaltsscheine Formular2Andreas Franke100% (1)

- Erklärung Zur StromrechnungDokument5 SeitenErklärung Zur Stromrechnungkukuz85Noch keine Bewertungen

- Akontorechnung Vom 01.10.2021 - 31.12.2021: Zu Bezahlender Betrag CHF 325.00Dokument3 SeitenAkontorechnung Vom 01.10.2021 - 31.12.2021: Zu Bezahlender Betrag CHF 325.00ChrigelNoch keine Bewertungen

- 4/3 Rechnung für Steuerfachangestellte in Ausbildung: Einnahmenüberschussrechnung Schritt für Schritt erklärt - für Unterricht, Selbststudium oder PrüfungsvorbereitungVon Everand4/3 Rechnung für Steuerfachangestellte in Ausbildung: Einnahmenüberschussrechnung Schritt für Schritt erklärt - für Unterricht, Selbststudium oder PrüfungsvorbereitungNoch keine Bewertungen

- Brutto Netto Abrechnung Oktober 2021Dokument1 SeiteBrutto Netto Abrechnung Oktober 2021HAMID CR7Noch keine Bewertungen

- Schr. v. 19.02.2024, Fragebogen 2Dokument6 SeitenSchr. v. 19.02.2024, Fragebogen 2eiscafe.ajetiNoch keine Bewertungen

- EON-Gas-Rechnung 24XXXX785351 2019 01 07Dokument6 SeitenEON-Gas-Rechnung 24XXXX785351 2019 01 07Iro100% (1)

- X 01 R01EG : Ihr Aktueller Stromtarif Natur12 Best StromDokument8 SeitenX 01 R01EG : Ihr Aktueller Stromtarif Natur12 Best StromSorin FlorinNoch keine Bewertungen

- 2020 12 Abr 00244 18 1 DR Ghici Constantin Cosmin - AfoDokument1 Seite2020 12 Abr 00244 18 1 DR Ghici Constantin Cosmin - AfoAlex DumiNoch keine Bewertungen

- Payslip SachsenDokument1 SeitePayslip Sachsenmr.laravelNoch keine Bewertungen

- Abrechnung Über Die Quellensteuern: WWW - Ar.ch/quellensteuer Quellensteuer@ar - CHDokument3 SeitenAbrechnung Über Die Quellensteuern: WWW - Ar.ch/quellensteuer Quellensteuer@ar - CHIgnat AdelinaNoch keine Bewertungen

- Lohn-/ Gehaltsabrechnung: Frau Ganna Sape InykovaDokument1 SeiteLohn-/ Gehaltsabrechnung: Frau Ganna Sape Inykovakatapolakova592Noch keine Bewertungen

- Abrechnung Der Brutto-Netto-Bezüge: Februar 2023Dokument2 SeitenAbrechnung Der Brutto-Netto-Bezüge: Februar 2023iosif dumitruNoch keine Bewertungen

- Informationen: Abrechnung Der Brutto-Netto-BezügeDokument4 SeitenInformationen: Abrechnung Der Brutto-Netto-BezügeSerevan HamoNoch keine Bewertungen

- Lohnausweis Schweiz E17Dokument2 SeitenLohnausweis Schweiz E17MJ MuellerNoch keine Bewertungen

- QS Abrechnung Ueber Abgezogene Quellensteuer 2021Dokument1 SeiteQS Abrechnung Ueber Abgezogene Quellensteuer 2021Maja ŠpoljarićNoch keine Bewertungen

- MusterDokument33 SeitenMusterEmrah TekinNoch keine Bewertungen

- 670 20001 000 050101 202202 20220302 145407 Formular+plusDokument1 Seite670 20001 000 050101 202202 20220302 145407 Formular+plusFlakron ImeriNoch keine Bewertungen

- Verdienstabrechnung 01.2024Dokument1 SeiteVerdienstabrechnung 01.2024husseinhawkar27Noch keine Bewertungen

- Lohnabrechnungen 06 - 2022!04!2023 GannaDokument10 SeitenLohnabrechnungen 06 - 2022!04!2023 Gannakatapolakova592Noch keine Bewertungen

- Dokumente Der Testabrechnung 2024 02Dokument1 SeiteDokumente Der Testabrechnung 2024 02nilix2005Noch keine Bewertungen

- Mandt 21 - 07Dokument1 SeiteMandt 21 - 07Pal PetrovicsNoch keine Bewertungen

- 2023-12 Abrechnungen Brutto-Netto (Verschoben)Dokument1 Seite2023-12 Abrechnungen Brutto-Netto (Verschoben)johnNoch keine Bewertungen

- 2024-03 AbrechnungenDokument1 Seite2024-03 Abrechnungenalihdry16Noch keine Bewertungen

- VV 1 Steuern Steuererklärung Fam. MusterDokument2 SeitenVV 1 Steuern Steuererklärung Fam. MusterJulia PanditaNoch keine Bewertungen

- 670 - 00026 - 000 - 260953 - 202210 - 20221110 - 091323 - Formular PlusDokument1 Seite670 - 00026 - 000 - 260953 - 202210 - 20221110 - 091323 - Formular Pluseverything for youNoch keine Bewertungen

- 670 - 15600 - 000 - 746190 - 202211 - 20221125 - 151622 - Formular PlusDokument2 Seiten670 - 15600 - 000 - 746190 - 202211 - 20221125 - 151622 - Formular Plusjdvfmpxx84Noch keine Bewertungen

- SNGPL BILL DocumentDokument1 SeiteSNGPL BILL DocumentMohammad Adeel BhattiNoch keine Bewertungen

- 01 Entgeltnachweis EntgDokument15 Seiten01 Entgeltnachweis EntgJohnNoch keine Bewertungen

- Brutto-Netto-Abrechnung 2023 10 OktoberDokument1 SeiteBrutto-Netto-Abrechnung 2023 10 Oktoberajmal.dielawariNoch keine Bewertungen

- Sozialkunde 11 - 1Dokument2 SeitenSozialkunde 11 - 1anna kleinNoch keine Bewertungen

- Muster BaulohnabrechnungDokument45 SeitenMuster BaulohnabrechnunghaydarschawarmaNoch keine Bewertungen

- 031099e7-0a5f-4da6-85c4-f3a162da1418Dokument2 Seiten031099e7-0a5f-4da6-85c4-f3a162da1418vatorioNoch keine Bewertungen

- LB01 23Dokument1 SeiteLB01 23Betania PeixotoNoch keine Bewertungen

- DokumentDokument3 SeitenDokumentRemzi KenarNoch keine Bewertungen

- DokumentDokument3 SeitenDokumentRemzi KenarNoch keine Bewertungen

- Brutto-Netto-Abrechnung 2023 12 DezemberDokument1 SeiteBrutto-Netto-Abrechnung 2023 12 Dezemberajmal.dielawariNoch keine Bewertungen

- Abs PlanaendDokument2 SeitenAbs Planaendjovan ivicatomaic123Noch keine Bewertungen

- Brutto-Netto-Abrechnung 2023 11 NovemberDokument1 SeiteBrutto-Netto-Abrechnung 2023 11 Novemberajmal.dielawariNoch keine Bewertungen

- Leistungsantrag 7 09Dokument2 SeitenLeistungsantrag 7 09polybios81Noch keine Bewertungen

- LOHI - Bayern - MitgliederInformationen - 2020 2Dokument6 SeitenLOHI - Bayern - MitgliederInformationen - 2020 2Andreas BohrerNoch keine Bewertungen

- Dev 000175658 3870Dokument2 SeitenDev 000175658 3870Fred GauthierNoch keine Bewertungen

- Brutto-Netto-Abrechnung 2023 08 AugustDokument1 SeiteBrutto-Netto-Abrechnung 2023 08 Augustajmal.dielawariNoch keine Bewertungen